Understanding Apportionment in Veterans Benefits

The concept of apportionment in veterans benefits involves the direct payment of a dependent's portion of VA benefits to a spouse, child, or dependent parent when certain conditions are met. This process ensures that dependents receive their entitled share of the benefits. However, there are specifi

0 views • 9 slides

Comprehensive Guide to CRA Activity Statement Reports

This comprehensive guide provides detailed information on Consolidated Revolving Accounts (CRA) activity statement reports, including balance summaries, transaction histories, and interest apportionment. Learn how to navigate through different sections and ensure accuracy in financial records.

0 views • 9 slides

State Taxation of Partnerships - Issues and Implications

The project work group outlines a comprehensive approach to addressing various issues related to state taxation of partnerships. Key topics include operating income, nexus, federal conformity, sale of partnership interests, administrative and enforcement issues, and conformity implications for multi

0 views • 18 slides

Understanding Contributory Negligence in Legal Context

Contributory Negligence (CN) refers to negligence that materially contributes to an injury, not just a breach of duty. It involves a person failing to take reasonable care of themselves, leading to their own injury. Legal cases like Ong Ah Long v Dr. S. Underwood [1983] and Kek Kee Leng v Teresa Bon

0 views • 15 slides

Cost Allocation, Apportionment, and Absorption in Accounting

Cost allocation involves charging identifiable costs to specific cost centers or units, while cost apportionment distributes costs that cannot be directly identified among various departments. This process is crucial for managing overheads effectively in accounting practices. Dr. B. N. Shinde discus

1 views • 16 slides

Tips & Tricks for CRA Activity Statement Reports in Florida PALM

Explore consolidated revolving accounts (CRA) activity statements, including balance details, transaction history, interest apportionment, and more. Learn about CRA balance summaries, fund balances, and how to match totals. Dive into itemized lists of bank and GL transactions for reconciliation. Dis

0 views • 9 slides

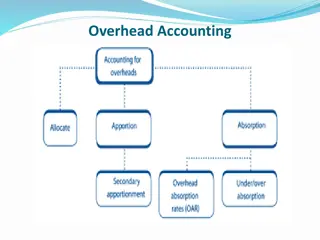

Understanding Overhead Accounting and Allocation Process

Overhead accounting involves allocating and apportioning overhead costs to different departments or cost centers in a company. This process includes dividing cost centers into production and service departments, assigning overhead costs accurately, and distributing common overhead costs proportionat

0 views • 18 slides

Understanding FTES Calculation in California Community Colleges

California Community Colleges use Full-Time Equivalent Students (FTES) to allocate apportionment revenue based on student attendance. FTES calculation involves factors like clock hours, class hours, passing time/breaks, and multiple-hour classes. Understanding these components is essential for educa

0 views • 35 slides

Tips & Tricks: Consolidated Revolving Accounts (CRA) Activity Statement Report Overview

Providing insights into the CRA Activity Statement Report for Consolidated Revolving Accounts in Florida PALM, this presentation covers details such as report functionality, user roles, search parameters, balance summaries, transaction histories, and interest apportionment. The report ensures accura

0 views • 9 slides

Understanding Offshore Profit Shifting and Tax Incentives

Offshore profit shifting by multinational companies to low-tax countries can lead to understatement of U.S. profits, GDP, net exports, and productivity. Tax incentives, shifting mechanisms, measurement challenges, and apportionment logic are key aspects discussed in the content.

0 views • 13 slides

Woodland School District 2024-2025 Budget Summary

Stacy Brown, Executive Director of Business Services, presented the budget summary for the Woodland School District's 2024-2025 fiscal year. The summary includes enrollment history, fund balance as a percentage of expenditures, revenue sources, apportionment changes, and funding allocations for vari

3 views • 24 slides

Woodland School District 2023-24 Budget Summary

Woodland School District's 2023-24 budget summary was presented by Stacy Brown, Executive Director of Business Services. The budget highlights changes in enrollment history, fund balance as a percentage of expenditures, general fund revenues by source, and apportionment history. The district anticip

0 views • 24 slides

Understanding Overhead Costs in Accounting

Overhead costs are supplementary expenses that cannot be easily allocated to specific cost objects. This includes indirect materials, labor, and expenses. Accounting and control of overheads involve steps like classification, codification, collection, allocation, apportionment, absorption, under/ove

1 views • 17 slides

Understanding Overhead Allocation in Financial Accounting

Overhead in accounting refers to expenses incurred in production or providing services that cannot be directly traced to specific products or departments. This involves classifying overhead based on function, element, and behavior, as well as allocating, apportioning, and absorbing overhead costs in

0 views • 13 slides

Overview of 2020 Census and Redistricting Workshop in Madison

Presented at a local redistricting workshop in Madison, this content highlights the importance and process of the 2020 Census, redistricting data, and key dates. It covers the role of the Applied Population Laboratory in demographic data and products, as well as the significance of the Decennial Cen

0 views • 31 slides

Understanding Regulations on Course Repetition in Educational Institutions

Exploring the regulations governing credit course repetition in educational institutions, with insights on past rules, current changes, and guidelines to address repetition issues effectively. Topics covered include enrollment limits, apportionment rules, and the importance of adhering to regulation

0 views • 64 slides

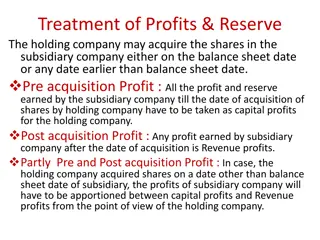

Understanding Treatment of Profits and Reserves in Holding Companies

The treatment of profits and reserves in holding companies when acquiring shares in subsidiary companies is essential for understanding the apportionment of pre-acquisition and post-acquisition profits. This involves distinguishing between capital profits and revenue profits, calculating the cost of

0 views • 8 slides

Understanding Input Tax Credit (ITC) Law: Provisions and Issues

Dive into the world of Input Tax Credit (ITC) with a focus on basic provisions, eligibility criteria, conditions, apportionment of credit, and blocked credit as outlined in Sec-16, Sec 17 (1) to (4), and Sec 17 (5) of tax laws. Gain insights into how businesses can effectively utilize ITC while navi

0 views • 109 slides

City of Bethlehem Department of Water and Sewer - 2024 Proposed Sewer Rate Increase and Fund Overview

Bethlehem's Sewer System, managed by the City's Department of Water and Sewer, includes a Wastewater Treatment Plant, collection systems, and agreements with tributary municipalities. Sewer billing is done directly for City and Hanover Township customers, with rates set by ordinance. Tributaries are

0 views • 10 slides

Woodland School District 2024-2025 Budget Summary

This budget summary for the Woodland School District covers various aspects including enrollment history, fund balance as a percentage of expenditures, revenue and expenditure details, sources and uses sheet, apportionment changes, and more for the 2024-2025 academic year. The document provides insi

0 views • 24 slides

Understanding UK Commercial Service Charges: RICS Code of Practice and Proposed Solutions

This presentation delves into the compliance of the RICS Code of Practice for Commercial Service Charges in the UK. It covers key issues, such as confusion over service definitions and the ideal scenario for service charge management. The document highlights the importance of transparency, communica

0 views • 13 slides

Engaging Activities in Math for Social Justice Classes

Explore a variety of thought-provoking activities centered around math and social justice, ranging from voting theory to game theory. Dive into topics like apportionment, measures of inequality, statistics, and more, all designed to spark critical thinking and discussions in your math classes.

0 views • 23 slides

Principles of ADS-B Cost Apportionment and Service Arrangements

Understanding the principles of cost apportionment in ADS-B systems is crucial for effective service arrangements. The general user-pay principle dictates that the owner ANSP bears the installation and maintenance costs if the ADS-B ground station serves their needs solely. However, when providing s

0 views • 21 slides

Understanding Factory Overheads and Allocation Methods

Explore the concept of factory overheads, treatment of special items, absorption methods, allocation, apportionment, and more. Learn about the classification of overheads, steps in distribution, computation of absorption rates, and practical application in cost accounting. Discover different methods

0 views • 11 slides

Understanding Congress: The Legislative Branch in Action

The legislative branch is embodied in Congress, where representatives elected by the people translate popular will into law. With the House of Representatives and the Senate comprising Congress, discussions explore the dynamics of representation, member demographics, apportionment, and the distinct

0 views • 11 slides