Overview of Enforcement Initiatives and Outcomes at National Conference of Enforcement Officers

Delve into the insights shared at the National Conference of Enforcement Officers on 4th March 2024, focusing on enforcement initiatives such as National Special Drive, actions by the Centre and State, technology interventions, and policy changes. Uncover details on fake billing structures, motives

3 views • 32 slides

Climate Action Strategy for Decarbonising Inland Transport by 2050

The Inland Transport Committee (ITC) has adopted a strategy to reduce greenhouse gas emissions from inland transport, aligning with the goal of achieving net-zero emissions by 2050. This strategy includes a focus on reducing GHG emissions, setting strategic objectives, implementing climate actions,

1 views • 19 slides

Changes in ITC for 2025: Exam Structure, Competency Framework, and More

Exciting changes are coming to the Initial Test of Competence (ITC) in 2025, including adjustments to the exam structure, mark allocation, number of papers, competency framework, and more. The new competency framework emphasizes six competency areas, with a focus on an even spread over three papers.

18 views • 4 slides

Know Your Mutual Fund Advisor_ Your Money Guide

let\u2019s talk about mutual funds. Imagine you have a huge pot of money that you have accumulated from many people like me. These funds are then used to purchase a variety of products such as stocks (which are small companies), bonds (which are similar to debt from companies or governments), and so

0 views • 2 slides

Validity of Section 16(2)(c) and 16(4) of CGST Act determined in HC Judgement

The Kerala High Court upheld Sections 16(2)(c) and 16(4) of the CGST Act, affirming their constitutional validity. The court ruled that Input Tax Credit (ITC) is a conditional entitlement, not an absolute right. The judgement emphasized the importance of the statutory scheme, rejecting challenges to

1 views • 3 slides

Notifications & Circulars - In light of 53rd GST Council Meeting Recommendation

Explore the key updates from the 53rd GST Council Meeting, including Circulars 224\/18\/2024 GST, 225\/19\/2024-GST, and 226\/20\/2024-GST. Understand the amendments from Notification No. 12\/2024-Central Tax affecting corporate guarantees, ITC distr

0 views • 11 slides

School Weekly Highlights: Achievements, Events, and Points Update

This week at school, students in different classes have shown excellent behavior and attendance. Various house points have been accumulated, with 9V leading with the highest total. The students have been busy with activities like Christmas films, ice skating trips, and a Christmas concert. Check out

0 views • 12 slides

Understanding Compound Interest and Simple Interest Formulas

Interest rates play a crucial role in financial transactions. Compound interest is earned on both the principal and accumulated interest, while simple interest is earned solely on the principal amount. Different compounding frequencies affect the overall interest earned. Learn how to calculate simpl

1 views • 14 slides

Understanding Accumulation Problems and Definite Integrals in Applied Calculus

Explore the interpretation of definite integrals in accumulation problems, where rates of change are accumulated over time. Learn how to solve accumulation problems using definite integrals and avoid common mistakes by understanding when to use initial conditions. Discover the relation between deriv

0 views • 9 slides

Experimental Lightning Flash Prediction Based on Real-Time Forecast

This PowerPoint presentation provides real-time experimental lightning flash prediction based on initial conditions data from GFS and WRF models. The forecast covers Day 1 and Day 2 with detailed insights on 24-hour accumulated total lightning flash counts and 3-hourly accumulated total lightning fl

0 views • 8 slides

Cold Storage Nutan Rajumani Transport (P) Ltd - Logistics Service Provider Since 1965

Cold Storage Nutan Rajumani Transport (P) Ltd has been a leading logistics service provider in India since 1965, celebrating 50 glorious years. Their motto is to create opportunities and their vision is to be the best in India. With a strong clientele including ITC Ltd, Asian Paints, and others, NRT

0 views • 12 slides

Real-Time Experimental Lightning Flash Prediction and Analysis

Cutting-edge real-time lightning flash prediction model output for Day1 with 24-hour accumulated total lightning flash counts and 3-hourly accumulated total lightning flash counts overlaid with max reflectivity data. Stay tuned for Day2 forecast updates. Prepared by experts at the Indian Institute o

0 views • 8 slides

Experimental Lightning Flash Prediction and Verification Study

This presentation contains real-time lightning flash prediction data based on various initial conditions and model observations. It showcases forecasts for lightning activity on specific dates, including accumulated total lightning flash counts and lightning threat assessments. The study also includ

0 views • 10 slides

Real-time Experimental Lightning Flash Prediction Report

This Real-time Experimental Lightning Flash Prediction Report presents a detailed analysis of lightning flash forecasts based on initial conditions. Prepared by a team at the Indian Institute of Tropical Meteorology, Ministry of Earth Sciences, India, the report includes data on accumulated total li

0 views • 6 slides

Real-time Experimental Lightning Flash Prediction Based on Initial Conditions

This presentation provides real-time experimental lightning flash prediction based on initial conditions for a specific period. The forecast includes accumulated total lightning flash counts and hourly variations along with maximum reflectivity overlaid. Prepared by a team of researchers, this data

0 views • 8 slides

Real-time Lightning Flash Prediction Research Update

Experimental lightning flash prediction based on initial conditions for Day 1, including total lightning flash counts and hourly accumulated data with maximum reflectivity overlays. Day 2 forecast updates coming soon. Prepared by the Indian Institute of Tropical Meteorology.

0 views • 8 slides

Contract Farming in India: A Case Study of Potato Cultivation

Value addition in Indian agriculture is low due to poor processing levels. Contract farming is being considered to integrate agriculture production into the global value chain, but concerns about unequal bargaining power between farmers and corporations exist. Various forms of contract farming exist

0 views • 26 slides

Understanding GST Returns: Types, Benefits, and Mechanisms

GST returns play a crucial role in the tax system by providing necessary information to the government in a specific format. They include details of outward and inward supplies, ITC availed, tax payable, and more. Filing returns ensures timely transfer of information, aids in tax liability determina

4 views • 38 slides

Experimental Lightning Flash Prediction Report

Real-time lightning flash prediction report based on initial conditions. Prepared by a team at the Indian Institute of Tropical Meteorology, Ministry of Earth Sciences, India. Includes 24-hour accumulated total lightning flash counts data for Day1, along with 3-hourly accumulated total lightning fla

0 views • 6 slides

Understanding Income Tax Issues in the Ratemaking Process

This content explores various aspects related to income tax issues in the ratemaking process, including Accumulated Deferred Income Taxes (ADIT), Net Operating Losses (NOLs), Tax Normalization, Repair Deductions, and more. It provides insights on how ADIT is calculated, the significance of NOLs, dif

0 views • 24 slides

Introduction of RCM Liability - ITC statement

The GST portal now features a new RCM liability\/ITC statement, effective August 2024. Taxpayers must declare their opening balance by October 31, 2024, with three opportunities to correct errors by November 30, 2024. This update aims to enhance accu

5 views • 1 slides

Introduction of Invoice Management System (IMS) on GSTN portal

The new Invoice Management System (IMS) on the GSTN portal, launching in October 2024, aims to streamline the GSTR-2B invoice matching process. This update simplifies claiming Input Tax Credit (ITC) by allowing businesses to easily match, accept, or

0 views • 2 slides

International Trade Centre: Empowering Small Businesses Through Trade

The International Trade Centre, a joint agency of the United Nations and World Trade Organization, supports small businesses globally in engaging in international trade. With a vision of creating inclusive, sustainable economies, ITC focuses on areas like regional integration, resilient value chains

0 views • 16 slides

Understanding Asymmetrical Delay in Networking

The content discusses the impact of asymmetrical delay in networking scenarios, focusing on how it can affect different applications such as audio, video, and industrial machinery. Through examples and diagrams, the potential issues of accumulated delays and closed gates in protocols like 802.1Qbv a

0 views • 16 slides

Understanding How Your Brain Works: Memory, Attention, and Processing

Delve into the intricate workings of memory, attention, and cognitive processing in the brain as explored by Prof. Jan Schnupp. Discover the various types of memory, including short-term and long-term, procedural, declarative, and more. Explore the concept of working memory and its neuronal mediatio

0 views • 66 slides

Introduction to Different Methods of Costing

Costing is a crucial technique for businesses to ascertain their costs, regardless of being in manufacturing, merchandizing, or service provision. This article explores various methods of costing such as job order costing, batch costing, contract costing, process costing, and service costing. Job or

0 views • 53 slides

Classroom Expectations and Student Behaviors with Mrs. Ivani: Srednja trgovska ola Ljubljana

Explore the classroom expectations for English class with Mrs. Ivani at Srednja trgovska ola Ljubljana, focusing on student behaviors, respect, responsibility for coursework, promoting lifelong learning, policies, and grading criteria. Ensure punctuality, preparedness, respect for others, responsibi

0 views • 8 slides

Understanding Interest Rates and Time Value of Money

This chapter delves into interest rate measurement, defining the force of interest, simple interest, and variable force of interest, along with the concept of time value of money. It explains amount functions, compound interest, effective rate of interest, and includes examples to illustrate calcula

0 views • 20 slides

IEEE Internet Technical Committee Meeting 2013 Summary

The IEEE Internet Technical Committee (ITC) met in December 2013 in Atlanta, USA. The meeting included various agenda items such as introductions, award announcements, conference updates, and discussions on roles and recertification. It highlighted the officers, community members, and past chairs of

0 views • 42 slides

Corporate Briefing Session for FY 2021-22 at Crescent Jute Products Limited

Crescent Jute Products Limited conducted a corporate briefing session for the year ended June 30, 2022. The session highlighted the company's vision to lead the global market in producing quality jute products and its mission to enhance quality, productivity, and community support. However, challeng

0 views • 13 slides

Contract Farming in India: Enhancing Agricultural Value Chain Through Partnerships

Value addition in Indian agriculture has been low due to limited processing levels. Contract farming is emerging as a viable solution to integrate agriculture production into the global value chain, albeit with concerns about unequal bargaining power. Various forms of contract farming exist, with ex

0 views • 26 slides

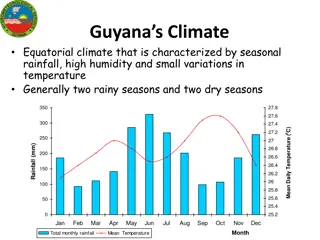

Guyana's Equatorial Climate: Rainfall Patterns and Weather Events

The equatorial climate in Guyana is characterized by seasonal rainfall, high humidity, and minimal temperature fluctuations. The region experiences two rainy seasons and two dry seasons throughout the year. In 2008, events like the Inter-Tropical Convergence Zone and La Niña led to intense rainfall

0 views • 7 slides

Understanding Input Tax Credit (ITC) Law: Provisions and Issues

Dive into the world of Input Tax Credit (ITC) with a focus on basic provisions, eligibility criteria, conditions, apportionment of credit, and blocked credit as outlined in Sec-16, Sec 17 (1) to (4), and Sec 17 (5) of tax laws. Gain insights into how businesses can effectively utilize ITC while navi

0 views • 109 slides

Computation for Real Estate Sector in Bangalore Branch of ICAI

Practical overview of GST computation for real estate transactions in Bangalore, with details on old rates with ITC and new rate regime effective from April 1, 2019. The content discusses different transactions, conditions for new rates without ITC, and provides insights on the 80:20 computation met

0 views • 39 slides

Real-time Experimental Lightning Flash Prediction for Lightning/TS Forecast

Real-time experimental lightning flash prediction based on initial conditions, including 24-hour accumulated total lightning flash counts and 3-hourly accumulated total lightning flash counts with max reflectivity overlaid. Presentation prepared by the Indian Institute of Tropical Meteorology for sc

0 views • 8 slides

Understanding Input Tax Credit Provisions in Taxation

This content provides a comprehensive overview of Input Tax Credit (ITC) provisions in taxation, covering eligibility criteria, conditions for claiming ITC, issues related to excess or wrong tax charged by vendors, receipt of goods/services, blocked credits, apportioned credits, and more. It discuss

0 views • 16 slides

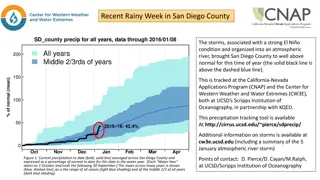

Impressive Impact of Recent El Niño-Fueled Storms in San Diego County

El Niño-driven storms in San Diego County led to above-average winter precipitation, with areas receiving over 5 inches of rain in just 3 days. This sudden increase has significantly boosted accumulated precipitation levels for the winter, especially in Southern California. The rapid rise in precip

1 views • 5 slides

GST Refund Procedure and Guidelines

Introduction to GST refunds focusing on refund of accumulated credit under GST for zero-rated supplies, the procedure for claiming refund of accumulated ITC, and filing and obtaining GST refund. It covers the eligibility criteria, required documents, formula for calculating refund amount, and step-b

0 views • 7 slides

Understanding U.S. Antidumping and Countervailing Duty Laws

Explore the rationale behind the existence of antidumping and countervailing duty laws in the U.S., the roles of Commerce and the ITC in enforcing these laws, definitions of dumping and antidumping duty, and the nuances of fair comparison in determining unfair trade practices. Learn how these laws a

0 views • 58 slides

Financial Policy Recommendations for Accumulated Surplus Management

The council policy recommends retaining an accumulated surplus up to 4% of operating expenditures, with any excess transferred to the Capital Works Reserve. The rationale behind this policy includes ensuring cash flow, setting aside funds for future expenditures, maintaining a rainy day fund, and pr

0 views • 14 slides