Lecture 7-Exercises and Concept for Analysis (Conceptual Frmework)

Explore qualitative characteristics in accounting with exercises on verifiability, comparability, understandability, and timeliness. Recognize accounting assumptions used by Marks and Spencer, such as accrual basis and full disclosure.

0 views • 9 slides

Understanding New Jersey's Earned Sick Leave Law

NJ's paid sick leave law, who it covers, accrual rules, usage, employer obligations, and more. Ensure compliance and access resources. Visit my.sickdays.nj.gov for details. Popular

1 views • 33 slides

Understanding Income and Expenditure Account in Accounting

Income and Expenditure Account, similar to the Profit and Loss Account, records revenue items on the credit side and expenses on the debit side. It follows the accrual concept and reflects only the current period's incomes and expenses. Surplus or deficit is shown based on the excess of income over

0 views • 4 slides

Understanding Basic Accounting Concepts and Budget Management at USF

This content provides valuable insights into basic accounting concepts such as budgeting, journal entries, accrual accounting, and budget management processes at USF. It covers essential topics like budget checking initiation, expense incurring methods, and budget impact on different financial trans

2 views • 45 slides

Understanding Student Loans: Options, Interest Calculation, Daily Interest Formula

Explore the various options available for student loans, learn how to calculate interest in different loan scenarios, and apply the simplified daily interest formula. Discover key terms like FAFSA, EFC, federal loans, private loans, and more. Dive into examples of interest accrual during school and

0 views • 19 slides

Year End Journal Entries

Explore the significance of year-end journal entries, their various categories like expense accruals, revenue deferrals, prepaid expenses, and revenue receivable. Understand the process for submission, key dates, and the difference between accrual and deferral entries. Discover how to handle entries

0 views • 14 slides

Computation of Machine Hour Rate: Understanding MHR and Overhead Rates

Computation of Machine Hour Rate (MHR) involves determining the overhead cost of running a machine for one hour. The process includes dividing overheads into fixed and variable categories, calculating fixed overhead hourly rates, computing variable overhead rates, and summing up both for the final M

4 views • 18 slides

New Mexico Graduation Rates 2018-2019 Analysis

The New Mexico Public Education Department utilizes a Shared Accountability Model to calculate graduation rates, considering students' time enrolled at each school. Graduation rates are calculated after a two-step verification process, with on-time graduates in focus. Historical data shows a positiv

0 views • 13 slides

Accounting Entries for Hire Purchase Transactions

Different hire purchase transactions are recorded in the books of both the hire vendor/seller and hire purchaser through various accounting methods like the Asset Accrual Method. This method involves gradual capitalization and recording installment payments towards the cash price of the asset. Depre

0 views • 11 slides

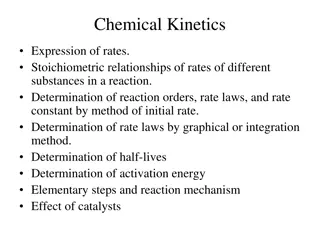

Understanding Chemical Kinetics: Rates, Reactions, and Mechanisms

Chemical kinetics involves studying reaction rates, rate laws, stoichiometry, and factors affecting reaction speed. This branch of chemistry delves into determining reaction orders, rate constants, and activation energies using various methods. Different types of rates, such as initial, instantaneou

2 views • 68 slides

Employee Time Tracking Guide for Cleveland State University Hourly Workers

This guide provides step-by-step instructions for hourly employees at Cleveland State University to clock in using Kronos Workforce Timekeeper and access their time records through myTime. It explains how to record timestamps, punch in or out for single or multiple jobs, view timecards, and check ac

0 views • 5 slides

Understanding New Jersey Paid Sick Leave Law

New Jersey Paid Sick Leave Law, effective since October 29, 2018, requires employers of all sizes in New Jersey to provide up to 40 hours of paid sick leave per year to covered employees. Employers must comply with accrual and use regulations and allow employees to utilize sick time for various reas

0 views • 27 slides

TCP Manager Module Orientation Overview

The TCP Manager Module Orientation provides an in-depth look at the TimeClock Plus (TCP) system, including employee setup, time tracking, leave requests, and clocking rules. The system allows for seamless management of staff time and schedules, with features such as automatic time adjustments, accru

0 views • 14 slides

Financial Accounting IFRS Learning Objectives

This educational material covers Chapter 3 of the Financial Accounting IFRS 3rd Edition by Weygandt, Kimmel, and Kieso. It delves into topics such as adjusting the accounts, time period assumption, accrual basis of accounting, fiscal and calendar years, accrual versus cash-basis accounting, and more

0 views • 20 slides

Accounting Basis Diagnostic Tool for NPOs and Funders

This diagnostic tool focuses on cash, modified cash, and accrual basis accounting for Non-Profit Organizations (NPOs) and funders. It explains the impact of accounting basis decisions and how to utilize the tool effectively. Designed for NPOs and funders, it helps in understanding, negotiating, and

0 views • 39 slides

Understanding Chemical Kinetics: Reaction Rates and Mechanisms

Chemical kinetics is a branch of chemistry focused on studying reaction rates and mechanisms. Unlike thermodynamics, which deals with feasibility, kinetics explores the speed at which reactions occur. Factors such as temperature, pressure, and catalysts influence reaction rates. Understanding the ra

3 views • 72 slides

Cancer Survival Rates in Europe: Trends and Disparities

Cancer survival rates in Europe have shown variations across different types of cancer and countries. While overall cancer mortality has increased over the years, some countries have experienced declines in mortality rates. Survival rates for breast cancer between 1995-2014 ranged from 74% to 89%, w

0 views • 17 slides

Understanding Income and Expenditure Account for Non-Trading Organizations

Income and Expenditure Account is crucial for non-trading organizations to monitor revenues, expenses, and financial position. It helps in determining surplus or deficit, providing insights for strategic decisions, and fulfilling reporting requirements for investors and stakeholders. The account is

0 views • 10 slides

Understanding Financial Accounting Principles in IFRS

Explore key concepts in financial accounting such as time period assumption, accrual basis, adjusting entries, and types of accounting methods. Learn about fiscal vs. calendar years and accrual versus cash-basis accounting in the context of International Financial Reporting Standards (IFRS).

1 views • 20 slides

NCI-MATCH Trial Interim Analysis Results and Status Update

NCI-MATCH is a groundbreaking clinical trial aiming to match tumor gene alterations with targeted therapies. The interim analysis results revealed impressive patient enrollment and site participation exceeding expectations. Despite challenges with pausing new patient registrations for the analysis,

0 views • 26 slides

Thyroid Cancer Survival Trends in Europe: Eurocare-5 Study

A population-based study on thyroid cancer survival rates in Europe over 25 years reveals insights by sex, country, age, period, and histological type. The study shows increased incidence but stable mortality trends, with varying survival rates based on region, gender, and histology types like papil

0 views • 14 slides

Year-End Journal Entry Accrual Process Overview

Gain insights into the year-end journal entry accrual process in Workday. Understand the submission and approval processes, find journals, review checklists, and learn how to create reversing accrual entries for the upcoming fiscal year.

0 views • 13 slides

Impact of Number of Contact Attempts on Response Rates in Multimode Surveys

This meta-analysis investigates the effects of the number of contact attempts on response rates and web completion rates in multimode surveys. Benefits of multimode surveys include improving coverage, increasing response rates, reducing costs, and enhancing measurement accuracy by utilizing multiple

0 views • 27 slides

Understanding Unit Rates in Mathematics

Explore the concept of unit rates in mathematics, where you will learn how to determine unit rates of given quantities and solve word problems involving unit rates. Discover key vocabulary, such as ratio, rate, and terms, and understand the difference between ratio and rates. Delve into examples and

0 views • 22 slides

Understanding Exchange Rate Behavior with Negative Interest Rates: Early Observations by Andrew K. Rose

In this study, Andrew K. Rose examines the exchange rate behavior in economies with negative nominal interest rates, focusing on the impact and implications of such rates on exchange rates. The findings suggest limited observable consequences on exchange rate behavior, with similarities in shocks dr

0 views • 42 slides

Airline Industry Work Regulations and Benefits Overview

This data provides insights into various aspects of the airline industry, including flight attendant pay increments, duty day restrictions, days off, duty period credits, vacation accrual, and sick leave accrual. Details cover different carriers such as Southwest, Alaska, US Airways, Virgin, America

0 views • 9 slides

Understanding the Firefighters Pension Scheme 2015

Explore the details of the Firefighters Pension Scheme 2015, including how you may be affected, membership categories, levels of protection, and the main elements of the scheme design. Learn about contribution rates, access to pensions, and benefits for ill health, death, and survivors. Discover if

0 views • 36 slides

Understanding Age Adjustment in Disability Statistics

Explore the significance of age adjustment in disability statistics for creating comparable figures across countries. Learn about crude versus age-adjusted prevalence estimates and the importance of standardized rates for accurate comparisons in different populations. Discover the anatomy of rates,

0 views • 22 slides

Accrual Recording of Property Income in Pension Management

The accrual recording of property income in the context of liabilities between a pension manager and a defined benefit pension fund involves accounting for differences in investment income and pension entitlements. This process aims to reflect the actual property income earned by the pension fund, c

0 views • 17 slides

Analysis of Prepaid Pension Assets in Oregon Regulatory Settings

The article delves into the complexities of Prepaid Pension Asset (PPA) inclusion in utility rates in Oregon. Issues such as incomplete records, inconsistent policies, and customer implications are discussed. The challenges faced by companies in shifting to accrual accounting and the varying treatme

0 views • 10 slides

Impact of Negative Nominal Interest Rates on Bank Performance: Cross-Country Insights

Examining the effects of negative nominal interest rates on bank performance reveals challenges in maintaining profitability, with concerns around reduced interest rate margins and disruptions to monetary transmission mechanisms. Empirical evidence suggests a reluctance among banks to impose negativ

0 views • 43 slides

FY21 Fringe Rates and Benefits Analysis for Research Grants

Explore the newly negotiated FY21 fringe rates for grants, historical comparisons, and the treatment of fringe benefits on grants per Uniform Guidance. The comprehensive analysis includes details on the increase in rates to recover deficits, benefits included in the fringe rates, and the process of

0 views • 14 slides

Paid Sick Leave Policy Overview under Healthy Workplace Healthy Families Act (AB 1522)

This overview provides details on the Paid Sick Leave policy effective from 07/01/15 under the Healthy Workplace Healthy Families Act (AB 1522). It covers eligibility criteria, accrual rates, usage limits, allowable reasons for leave, and prohibitions against employer actions that infringe on this b

0 views • 11 slides

Understanding NYC's Paid Sick Leave Law

NYC's Paid Sick Leave Law ensures employees have access to sick leave for themselves or family members, impacting businesses and customers positively. Learn about law overview, compliance, accrual rates, and more. Employers must provide paid or unpaid sick leave based on the number of employees. Cal

0 views • 49 slides

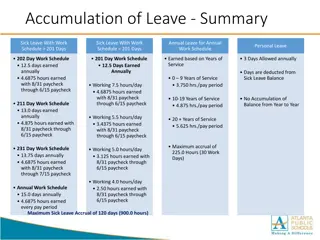

Leave Accumulation Summary for Employees

Detailed information on the accumulation of various types of leave (sick, annual, personal) based on different work schedules and years of service. The summary covers accrual rates, maximum accrual limits, days earned annually, and deductions from leave balances.

0 views • 6 slides

Understanding Federal Leave Programs Overview

This overview provides insight into various federal leave programs, including annual, sick, and family leave, as well as programs like FMLA and LWOP. It discusses accrual rates, approval processes, usage limits, and requirements for sick leave. The overview aims to enhance understanding and complian

0 views • 18 slides

Impact of Negative Nominal Interest Rates on Bank Performance

Negative nominal interest rates, implemented following the financial crisis, have had a limited effect on bank performance globally. While low rates reduce profitability, banks have shown resilience through adjustments in funding allocations and non-interest income sources. Studies suggest that resp

0 views • 34 slides

Analyzing Success Rates and Disproportionate Impact in Academic Courses

The analysis delves into courses with low success rates, examining factors contributing to outliers and equity implications. Courses like XXXXB1A and XXXXB36 show historically poor success rates. Additionally, disproportionate impacts are observed among Black, Asian, Hispanic, and White students. Th

0 views • 8 slides

Comparison of Graduation Rates in Federal and VFA Community Colleges

The comparison between Federal and VFA Community College graduation rates reveals differences in success percentages among different cohorts of students. Federal rates focus on first-time, full-time students after 3 years, while VFA rates consider all students after 6 years. The data highlights vary

0 views • 9 slides

Understanding Interest Rates: A Comprehensive Guide

Explore the terminology, calculation, and importance of various interest rates in our lives and the economy. Learn about measuring interest rates, real versus nominal rates, and the distinction between rates and returns. Dive into finance fields, debt concepts, time value of money, and investment va

0 views • 48 slides