Understanding NYC's Paid Sick Leave Law

NYC's Paid Sick Leave Law ensures employees have access to sick leave for themselves or family members, impacting businesses and customers positively. Learn about law overview, compliance, accrual rates, and more. Employers must provide paid or unpaid sick leave based on the number of employees. Calculation of employees includes full-time, part-time, and temporary workers who work over 80 hours in NYC. Protect your health and welfare by understanding this important law.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

The benefits of paid sick leave extend far beyond the positive impact on individual families. It's also about making our businesses run better, and protecting the health and welfare of their customers. - Mayor Bill de Blasio

WHAT WE WILL COVER Overview of the law Which employers must comply with the law Which employees are covered/not covered by the law Notice of Employee Rights Accrual and rate of pay for sick leave Use of sick leave Compliance Q & A

NYCS PAID SICK LEAVE LAW NYC was the 7th jurisdiction to guarantee access to sick leave for employees under the Earned Sick Time Act (Paid Sick Leave Law). To date, more than 30 jurisdictions have adopted paid sick leave laws. More than 1 million NYC employees now have the right to sick leave.

NYCS PAID SICK LEAVE LAW Under the law, covered employees have the right to use sick leave for the care and treatment of themselves or a family member.

WHICH EMPLOYERS MUST COMPLY WITH THE LAW

WHICH EMPLOYERS MUST PROVIDE SICK LEAVE? All employers must provide some type of sick leave. Employers with 5 or more employees or 1 or more domestic workers must provide paid sick leave. Employers with fewer than 5 employees must provide unpaid sick leave.

HOW SHOULD EMPLOYERS CALCULATE NUMBER OF EMPLOYEES? Employers should count full-time, part-time, and temporary employees who work more than 80 hours in a calendar year in NYC. If the number of employees changes every week, count the average number of employees paid per week during the 80 days immediately preceding the date the employee used sick leave.

WHICH EMPLOYEES ARE COVERED/NOT COVERED BY THE LAW

WHICH EMPLOYEES ARE COVERED? Employees who work more than 80 hours in NYC in a calendar year are covered. Includes: Undocumented employees Employees who are family members but not owners Employees who live outside of NYC but work in NYC Full-time employees Part-time employees Temporary employees Per diem and on call employees Transitional jobs program employees

WHICH EMPLOYEES ARE NOT COVERED UNDER THE LAW? Employees who work 80 hours or less a calendar year in NYC. Students in federal work study programs. Employees whose work is compensated by qualified scholarship programs. Employees of government agencies. Participants in Work Experience Programs (WEP).

WHICH EMPLOYEES ARE NOT COVERED UNDER THE LAW? Certain employees subject to a collective bargaining agreement. The law does not apply to employees subject to a collective bargaining agreement that has been in effect since April 1, 2014. For all other agreements, the agreement must expressly waive the law s provisions and, unless the employee is in the grocery or construction industry, the agreement must provide comparable benefit.

WHICH EMPLOYEES ARE NOT COVERED UNDER THE LAW? Physical Therapists, Occupational Therapists, Speech Language Pathologists, Audiologists licensed by NYS Department of Education. Not covered if: Call in for work at will. Determine own schedule and assignments. Paid average hourly wage 4x the federal minimum wage.

WHICH EMPLOYEES ARE NOT COVERED UNDER THE LAW? Independent contractors. Not covered if they do not meet definition of an employee under NYS Labor Law. Factors include how much supervision, direction, and control employer has over services being provided.

WHAT IS A CALENDAR YEAR? Means any consecutive 12-month period of time determined by employer. Employers must provide employees up to 40 hours of sick leave every calendar year. Employers must include their calendar year in the required written Notice of Employee Rights.

NOTICE OF EMPLOYEE RIGHTS Employers must give covered employees the Notice of Employee Rights created by DCA on the first day of their employment. The Notice is available in English and 25 additional languages at nyc.gov/PaidSickLeave.

NOTICE OF EMPLOYEE RIGHTS Employers are required to keep records that show the date the Notice was provided to each employee and proof that the Notice was received by each employee. Employers can give employees the Notice in person, by regular mail, or by email. Save email receipts.

WHAT IS IN NOTICE OF EMPLOYEE RIGHTS? Accrual rate and information on how to use sick leave. Employer s calendar year. Right to be free from retaliation. Right to file a complaint.

ACCRUAL AND RATE OF PAY FOR SICK LEAVE

HOW DOES ACCRUAL WORK FOR EMPLOYEES? An employee earns 1 hour of sick leave for every 30 hours worked. An employee can accrue up to 40 hours of sick leave per calendar year. Date Accrued Sick Leave Available for Use July 30, 2014 120 days after first day of employment Existing employee New employee

WHAT IS THE RATE OF PAID SICK LEAVE? Employers with 5 or more employees pay employees at their regular hourly rate but no less than the minimum wage. This includes employees whose salary is based on tips or gratuity.

RECAP: EMPLOYEES Number of Employees Amount of Sick Leave per Calendar Year Paid or Unpaid Sick Leave Rate of Pay 5 or more Up to 40 hours Paid Regular hourly rate but no less than the minimum wage 1- 4 Up to 40 hours Unpaid Not Applicable

OVERVIEW: DOMESTIC WORKERS Number of Employees Amount of Sick Leave per Calendar Year Paid or Unpaid Sick Leave Rate of Pay 1 or more domestic workers 2 days after one year working for same employer Paid Regular hourly rate but no less than the minimum wage City leave is in addition to the 3 days of paid rest under NYS Labor Law. Accrual and use of sick leave follow NYS Labor Law.

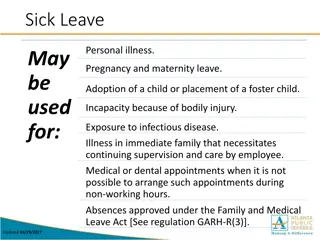

WHAT ARE ACCEPTABLE REASONS TO USE SICK LEAVE? Employees can use leave for themselves or a family member for: Mental or physical illness, injury, or health condition. Medical diagnosis, care, or treatment of above. Preventive medical care. Business closes due to a public health emergency. Care of child whose school or child care provider closed due to a public health emergency.

WHO IS A FAMILY MEMBER UNDER THE LAW? The law recognizes the following as a family member: Child (biological, adopted, or foster child; legal ward; child of an employee standing in loco parentis) Grandchild Spouse Domestic Partner Parent Grandparent Child or parent of an employee s spouse or domestic partner Sibling (including a half, adopted, or step sibling)

WHAT HAPPENS TO UNUSED SICK LEAVE? Employees can carry over up to 40 hours of unused sick leave to the next calendar year. Employees continue to accrue up to 40 hours of sick leave in addition to the sick leave carried over from the previous year. Employers are only required to allow employees to use up to 40 hours of sick leave per calendar year.

CAN EMPLOYER PAY AN EMPLOYEE FOR UNUSED SICK LEAVE? An employer can pay an employee for unused sick leave at the end of the calendar year. This is not required. An employer is not required to allow an employee to carry over sick leave if: The employer pays employee for the unused sick leave. AND The employer gives employee 40 hours of sick leave on the first day of the new calendar year.

WHAT HAPPENS TO UNUSED SICK LEAVE FOR REHIRES? If an employee is rehired within 6 months, the employer must reinstate previously accrued sick leave. Exception: Employer paid employee for unused sick leave when employee left.

MUST EMPLOYEE GIVE ADVANCE NOTICE TO USE SICK LEAVE? If the need is foreseeable, employers can require up to 7 days advance notice before employee uses sick leave. Example: scheduled doctor s appointment If the need is unforeseeable, employer may require employee to give notice as soon as practicable (reasonable). Example: accident The employer s requirements for giving notice of the need to use sick leave must be included in a written sick leave policy.

CAN EMPLOYER SET MINIMUM INCREMENTS FOR SICK LEAVE? An employer can set reasonable minimum increments for the use of sick leave, but the minimum cannot be more than 4 hours per day unless otherwise permitted by state or federal law. The employer s minimum increment must be included in a written sick leave policy. An employer may set fixed periods of 30 minutes or less for the use of leave beyond the minimum daily increment.

DOES EMPLOYEE NEED A DOCTOR S NOTE? Employers can require documentation from a licensed health care provider if employee uses more than 3 consecutive workdays as sick leave. Employers cannot require provider to specify the medical reason for sick leave. Note: A workday does not need to be a full day if the employee works part time. Employers may require employee to provide written verification that employee used sick leave for sick leave purposes. Form located at nyc.gov/PaidSickLeave Employers must include these requirements in their written policy.

WHAT ABOUT AN EMPLOYERS EXISTING LEAVE POLICIES? The Paid Sick Leave Law sets the minimumrequirements for sick leave. An employer s existing leave policies may already meet or exceed the requirements of the law.

WHAT DOES RIGHT TO BE FREE FROM RETALIATION MEAN? An employer cannot retaliate against employees for requesting or using sick leave. Retaliation is any act that is reasonably likely to deter an employee from exercising their rights under the paid sick leave law. Retaliation includes any threat, discipline, discharge, demotion, suspension, or reduction in hours, or any other adverse employment action against employee.

WHAT RECORDS ABOUT SICK LEAVE MUST EMPLOYER KEEP? Employers must keep and maintain records documenting compliance with the law for at least 3 years. Employers must keep any health-related information confidential.

WHAT RECORDS ABOUT SICK LEAVE MUST EMPLOYER KEEP? Employers must maintain records that show: Each employee s name, address, phone number, dates of employment, pay rate, whether employee is exempt from overtime. Hours worked by each employee. Date and time of each instance of sick leave used by each employee and the amount paid for each instance. Any change in the material terms of employment of an employee. AND Date the Notice was provided to each employee.

HOW DOES THE COMPLAINT PROCESS WORK? Employees have 2 years to file a complaint with DCA. DCA will keep the employee s identity confidential unless disclosure is necessary to investigate, settle, proceed to hearing, or is required by law. DCA will contact employer by mail for written response. Employers must respond to DCA within 30 days, sometimes less based on the nature of the complaint.

HOW DOES THE COMPLAINT PROCESS WORK? DCA will conduct a fair investigation of the complaint. If there is a violation, DCA will work with the employer and the employee to try to settle the complaint.

WHAT HAPPENS WHEN DCA AND THE EMPLOYER DON T SETTLE? If the employer receives a Notice of Violation, the employer has the opportunity to: Settle the violation without a hearing. OR Appear before an impartial judge at the City s Tribunal. The judge will hear testimony from DCA, the employer, and any witnesses.

WHAT RELIEF DO EMPLOYEES HAVE UNDER THE LAW? Under the law, a judge may order the following relief: Full compensation, including lost wages and benefits, $500 and appropriate equitable relief for each time employer punished employee for taking sick leave (not including termination). Full compensation, including lost wages and benefits, $2,500 and appropriate equitable relief (including reinstatement) for each time employer fires employee for taking sick leave. 3x the wages employee should have been paid for each time employee took sick leave but wasn t paid or $250, whichever is greater. $500 for each time employee was denied sick leave or was required to find replacement worker, or each time employee was required to work additional hours without mutual consent.

WHAT ARE MAXIMUM PENALTIES UNDER THE LAW? The law outlines the following maximum penalties: $500 for each affected employee for the first violation. Up to $750 for each affected employee for a second violation within 2 years of a prior violation. Up to $1,000 for each affected employee for subsequent violations that occur within 2 years of any previous violation. Up to $50 for each employee who was not given the required written Notice.

RULES DCA has published rules that are available at nyc.gov/PaidSickLeave. Rules clarify provisions in the Paid Sick Leave Law, establish requirements to implement the Act and meet its goals, and provide guidance to covered employers and protected employees.

DCA IS HERE TO HELP: PAID SICK LEAVE To file a complaint, get information, speak with a DCA representative, schedule a training: Visit nyc.gov/PaidSickLeave. Call 311 (212-NEW-YORK outside NYC) and ask for information about Paid Sick Leave. Email PaidSickLeave@dca.nyc.gov. Use online Live Chat at nyc.gov/BusinessToolbox (Businesses only). Visit 42 Broadway, 11th Floor, New York, NY 10004. Office hours are 9 a.m. to 5 p.m. Monday through Friday.

DCA IS HERE TO HELP: GENERAL/FINANCIAL EMPOWERMENT Visit nyc.gov/consumers. Search Financial Empowerment for free one-on-one professional financial counseling and safe banking products. Contact 311 (212-NEW-YORK outside NYC). Ask for Financial Empowerment Center, NYC SafeStart Account. Use online Live Chat at nyc.gov/BusinessToolbox (Businesses only).

nyc.gov/PaidSickLeave PaidSickLeave@dca.nyc.gov CONTACT 311 (212-NEW-YORK) Updated 07/2016