Year-End Journal Entry Accrual Process Overview

Gain insights into the year-end journal entry accrual process in Workday. Understand the submission and approval processes, find journals, review checklists, and learn how to create reversing accrual entries for the upcoming fiscal year.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Workday Training for Year-End Journal Entry Accruals March 9th & 10th, 2022

Agenda 1. Overview of Year End Journal Entries 2. Process for Submission of Year End Journal Entries in Workday 3. Approval Process in Workday 4. Find Journals 5. Review Checklist 6. Demo 2

Year End Journal Entries what are they and how are they different? Accrual and deferral entries that will reverse out the following month Must be >$5,000 unless contract related Submitted directly in Workday Approvals in Workday 3

Summary Table Ledger Account and Worktags for Year End Accrual Entries Journal Entry Category Worktag (if needed) Line Item text Entry Debit and Credit Appropriate Backup Invoice copy Confirmation that good / service was received in fiscal year but not yet recorded in ledger Amount of invoice clearly indicated including portion of non-refundable HST at 3.41% Dr. Expense (Cost Centre and Spend Category) Cr. Accrued Liabilities ledger account 2080 To accrue 2021-22 expense for Expense Accrual No Worktag Needed Deferred Revenue Other Deferred Rev MTCU Contracts Deferred Revenue - Contracts Fin Rpt report showing revenue booked and amount to be deferred Excerpt of agreement indicating amount may be deferred (ie. Contract period extending into next fiscal year, Ministry approval etc.) Dr. Revenue (Cost Centre and Revenue Category) Cr. Deferred Revenue ledger account 2500 To defer revenue to next fiscal year for Revenue Deferral Same invoice details as listed above for expense accruals with indication of period of time covered GL detail of amount in expense Details of the calculation of the prepaid amount To set up 2021-22 prepaid expense for Dr. Prepaid Expenses Operating ledger account 1500 Cr. Expense (Cost Centre and Spend Category) Prepaid Expense No Worktag Needed To set up 2021-22 receivable for revenue earned for Dr. A/R MTCU ledger account 1230 or Other AR ledger account 1370 Cr. Revenue (Cost Centre and Revenue Category) Excerpt of agreement indicating amount of funding to be received in current fiscal year Fin Rpt report showing total expenses incurred Revenue Receivable No Worktag Needed 4

Submission Process for Year End Reversing Accrual Journal Entries 5

Submission Process for Year End Reversing Accrual Journal Entries The journal entry will now be entered and submitted directly in Workday where it will follow the approval process The only changes: 1. Accounting Date = March 31 2022 2. Select Accrual Journal source 3. Click on Create Reversal 6

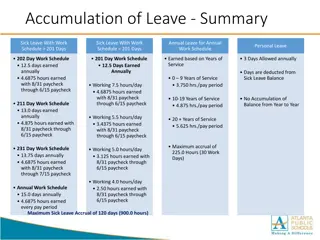

Approval Process in Workday Accounting Manager (Finance) Review and/or Final Approval if >$25K but <$100k Accrual Journal Approver (Finance) Review and/or final approval if <$25K VP Finance Final Approval & Posting > $100K Accountant CCH Approver (Finance) Review CostCenter Manager Approval Field Accountant CreateJournal Controller Approval > $100K 7

How to Find your Journal Entries Workday Inbox Archive 8

How to Find your Journal Entries FIN RPT Find Journal Lines with Sequence Generator or FIN RPT Find Journals with Sequence Generator 9

How to Find your Journal Entries Search box in Workday if you have the journal number 10

Review Checklist Accounting Date = 2022-03-31 Journal Source = Accrual Journal Create Reversal = Reversal Date = 2022-04-01 Line Memo is required (copy & paste the Header Memo) on the line of the journal with the balance sheet account No Cost Center, Revenue or Spend Category, or Region required on the Balance Sheet Line Deferred Revenue Worktag if required Check your Workday inbox daily in case a journal is sent back 11

DEMO 12