Insights into Kazakhstan's Retail Lending Market Dynamics

First Credit Bureau (FCB) in Kazakhstan was established in 2004 to centralize credit information. The National Bank of Kazakhstan imposed restrictions on unsecured lending in 2014. The retail lending market review reflects higher growth rates in retail loans compared to corporate lending. Non-performing loans (NPL) increased in most regions of Kazakhstan, with Almaty city and region showing the highest growth.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

About First Credit Bureau First Credit Bureau (FCB) was established in September 2, 2004 by seven Kazakh banks, one financial group and CreditInfo Group. FCB performs centralized collection, storage and processing of information, as well as formation and issuance of credit reports. FCB information providers include more than seventy organizations in Kazakhstan, which enables to form a significant database, boasting more than 6 million credit histories and containing information on more than 21.4 million credit contracts. From November 2012 FCB is lead by new management with new vision on product diversification and provision of more value added services. 2

Retail Lending Market Review As a reaction to increase of unsecured (without collateral) lending National Bank of Kazakhstan introduced legal restrictions on unsecured lending, which entered into force from April 1, 2014. According to new legislation banks have a right to disburse unsecured loan only if borrowers average monthly installments on all loans will not exceed 50% of the borrower's monthly income. The Debt Ratio must be calculated only for borrowers with incomes less than two times the average income. The NBK has also taken steps to limit the growth rate on unsecured loans by setting limits of a maximum of 30% per year for each bank. FCB felt that there must have been done a publicly available research and analysis of the dynamics behind unsecured lending boom, so we prepared the analysis and got some surprising findings. 3

Kazakhstan Retail Lending Market Review 4 April 2014

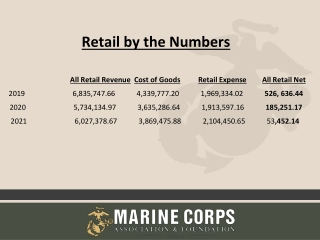

Retail Lending Market Review Retail and corporate lending dynamics 35% 14 12 33% 32.3% 32.1% 10 31.4% 31.3% trln tenge 30.5% 31% 8 29.3% 6 28.7% 29% 28.3% 27.3% 4 26.6% 27% 2 25% 0 1q 2012 2q 2012 3q 2012 4q 2012 1q 2013 2q 2013 3q 2013 4q 2013 01 2014 02 2014 retail loans corporate loans % of retail loans : Retail lending growth rates are higher than in corporate lending, which is reflected by growth of retail loans proportion in total loan book. 5

Retail Lending Market Review NPL by regions 45% 43% 43% 40% 37% march 2014 35% 30% march 2012 29% 30% 25% 38% 34% 33% 24% 25% 23% 21% 20% 26% 27% 20% 18% 25% 24% 17% 17% 16% 16% 16% 16% 15% 21% 15% 23% 18% 17% 18% 15% 16% 14% 10% 16% 13% 12% 5% 0% : In comparison to 2012 NPL increased almost in all regions of Kazakhstan, highest growth is observed in Almaty city and Almaty region 42,9% and 42,5%, respectively. Aggregate Kazakhstan NPL reached 29,8% as of March 2014. 6

Labor force average outstanding loan amount 1000% 1,300 900% Both average outstanding loan amount, and debt to average monthly salary ratio increased over last two years. Average outstanding loan amount figure is calculated by dividing total outstanding loan amount to labor force. 800% 1,100 700% 900 600% 000 tenge 700 500% 400% 500 300% 300 200% 100 100% : Average Outstanding Amount 03.2014 Average Outstanding/salary 03.2014 Average Outstanding Amount 03.2012 Average Outstanding/salary 03.2012 7

Retail borrowers average outstanding loan amount In contrast to previous slide, average outstanding loan amount, calculated by division of total outstanding loan amount to number of borrowers, decreased over all regions in comparison to 2012. This trend my be explained by quick growth of new borrowers number, and decrease size of disbursed loans. 2,200 1800% 2,000 1600% 1,800 1400% 1,600 1200% 1,400 000 tenge 1000% 1,200 800% 1,000 600% 800 400% 600 200% 400 200 0% : Average Outstanding Amount 03.2014 Average Outstanding 03.2012 8 Average Outstanding/salary 03.2014 Average Outstanding/salary 03.2012

Retail Lending Market Review 1,200 Total outstanding retail loans 1,000 800 Billion tenge march 2014 march 2012 600 400 200 0 : For the last two years outstanding retail loan amount increased by 34% on country level, highest growth is observed in Almaty region (+51%). 9

Retail Lending Market Review Borrowers as percentage of labor force 100% 91% 90% 84% 81% 81% march 2014 march 2012 80% 75% 75% 71% 71% 69% 70% 65% 64% 60% 52% 52% 51% 48% 48% 50% 57% 53% 41% 52% 50% 49% 48% 40% 44% 43% 40% 38% 30% 35% 31% 30% 30% 30% 20% 27% 21% 10% 0% : , Number of retail borrowers increased by 69% and average outstanding amount decreased by 21%. The highest increase of borrowers number is observed in Astana city (91% of total labor force have credits as of march 2014). 10

Summary 2014 vs 2012 4,500 1,400 800 6,500 10 1,000 6,500 14 1,300 14 6,000 14 6,000 9 700 12 14 4,000 900 1,200 5,500 5,500 14 14 1,100 8 12 600 800 3,500 5,000 5,000 -33% 1,000 +71% -21% 7 +69% +109% 14 +54% +34% 500 900 4,500 700 4,500 12 3,000 6 14 12 14 800 4,000 4,000 12 400 12 600 700 5 12 12 3,500 12 3,500 12 2,500 600 300 500 4 3,000 3,000 500 2,000 200 400 3 2,500 400 2,500 Outstanding Amount), billion tenge NPL >90 (Outstanding Amount), billion NPL >90 (number of subjects), Average Outstanding Amount, 000 Average Total Lenders, 000 Total contract, 000 Outstanding/sala ry : , Number of borrower with NPL increased by 109%, NPL outstanding amount increased by 54%. Number of contracts increased by 71%, number of borrowers by 69%. Average outstanding amount decreased by 21%, outstanding amount to monthly salary decreased by 33% 11

Retail Lending Market Review Debt to annual household income Country Kazakhstan* Russia* EU (17 countries)**, incl. Lithuania Poland Czech Republic Hungary Italy France Germany UK DTI, % 52,1 68 98,3 37,7 53,9 57,3 54,0 65,8 83,3 84,5 131,9 4 3,8 53% 3,3 52.1% 3 2,8 Trln tenge 2,6 51% 50.4% 49.9% 2 49% 1 47% 47.2% 45% March 2011 March 2012 Outstanding amount, trln tenge March 2013 March 2014 : , , Assumption: DTI is calculated as ratio of total outstnading retail loans amount to disposable income of all households. * Data for 2013. Household in Kazakhstan consist of 3,5 individuals, in Russia - 2,7 individuals. ** Data for EU countries for 2012. Debt-to-households income : , In Kazakhstan debt to annual household income is lower than in Europe or Russia. 12

Retail Loans Growth Fundamental Driver in 2013 Borrowers who s age now is below 30 years were born at the moment of demographic wave of 1980-th (around 3,8 mln people were born). Fundamental demand for retail lending increases at the age of 25 30 years, due to marital status changes. Generation Y phenomenon, generation right here, right now . Newborn number 450,000 400,000 350,000 Generation Y 300,000 250,000 200,000 Age breakdown of proportion of borrowers 40% Within 2009 - 2013, proportion of borrowers aged below 30 years increased from 29% to 34%, while proportion of others either decreased or changed insignificantly. 30% 20% 10% 0% 2009 2010 2011 2012 2013 13 30 31 - 40 41 - 50 51 - 60 60

Conclusions and further research questions Were there high retail lending growth rates in 2013? Definitely yes What were the causes of the growth? Irresponsible lending (borrowers overleveraging) by the banks? Deferred demand from inactive post-crises period of 2008 2010? Fundamental demand by generation Y? Additional research in needs to be done!!! 14

DTI and borrower default relationship research 15 April 2014

Research Methodology Research purpose assess how effectively DTI predicts default of a borrower For the assessment purposes indexes Gini and KS are used Default a borrower has 90+ days past due on any loan at least once during debt service period From FCB credit stories databases extract of random samples of borrowers, who got unsecured loans: 1) during period from 01.03.2012 to 01.03.2013 Sample 1 or Full sample 2) during February 2013 Sample 2 or Feb sample 3) during period from 01.03.2012 to 01.03.2013 and with monthly income < 210 000 tenge Sample 3 or Not reach sample Information on individuals all loans, active at disbursement date of unsecured loan. 16

Research Methodology DTI calculation strictly according to NBRK requirements is not possible, becauseFCB databases architecture does not contain field sum of interest payments . proxy indicators for average monthly payment are used: Proxy a) for installment loans: monthly installment amount, according loan repayment schedule for credit cards: repayment amount equals 5% from credit limit Proxy b) for installment loans : monthly installment amount, according loan repayment schedule for credit cards: repayment amount equals 10% from credit limit Proxy c) for installment loans : outstanding amount / loan term (months) for credit cards: credit limit / loan term (months) 17

Research Results Sample 1 (Full sample) Sample 2 (Feb sample) 45% 45% 40% 40% 35% 35% Bad Rate Bad Rate 30% 30% 25% 25% 20% 20% 15% 15% 10% 10% 5% 5% 0% 0% 10% 15% 20% 25% 30% 35% 40% 45% 50% 55% 60% 65% 70% 75% 80% 85% 90% 95% 10% 15% 20% 25% 30% 35% 40% 45% 50% 55% 60% 65% 70% 75% 80% 85% 90% 95% 100% 100% 0% 5% 0% 5% DTI DTI ) Proxy a) ) Proxy b) ) Proxy c) ) Proxy a) ) Proxy b) ) Proxy c) Behavior score Sample 3 (Not reach sample) 40% 100% 35% 80% 30% Bad Rate 25% 60% Bad Rate 20% 15% 40% 10% 20% 5% 0% 0% 10% 15% 20% 25% 30% 35% 40% 45% 50% 55% 60% 65% 70% 75% 80% 85% 90% 95% 100% 0% 5% A1 A2 A3 B1 B2 B3 C1 C2 C3 D1 D2 D3 E1 E2 18 E3 DTI 1) Sample 1) 2) Sample 2) 3) Sample 3) ) Proxy a) ) Proxy b) ) Proxy c)

Research Results Proxy a) Proxy b) Proxy c) Behavior score Sample 1 (Full sample) GINI = 31,32 KS = 22,25 GINI = 27,55 KS = 19,91 GINI = 34,61 KS = 24,53 GINI = 76,98 KS = 68,75 Sample 2 (Full sample) GINI = 31,24 KS = 23,97 GINI = 27,59 KS = 21,73 GINI = 35,90 KS = 27,93 GINI = 72,45 KS = 62,21 Sample 3 (Not reach sample) GINI = 26,16 KS = 18,43 GINI = 22,15 KS = 15,81 GINI = 28,38 KS = 19,08 GINI = 77,66 KS = 60,22 Conclusions: 1. Gini = 22,15 - 35,90 & KS = 15,81 27,93 => DTI does not have strong discriminatory power, however potentially useful 2. Sample 2 indicators are different from Sample 1 => DTI is subject to seasonality 3. Sample 3 indicators are lower than in Sample 1 => income limitation must be reviewed 4. Behavior score has a very high discriminatory power to identify default of a borrower 19

Research Results DTI specificity: takes into account only formally agreed relationships between bank and borrower, without considering other circumstances that arise in borrowers life. Air bag that is provided by DTI is not always enough to cover unforeseen costs. Behavior scoring specificity: in case borrower is facing some life difficulties, this will be reflected on the credit discipline and accordingly will be reflected on behavior score. Additionally, behavior scoring uses information for a long period of time on each individual, and takes into account each individual s aptitude to unforeseeable events. 20

Research Results Hypothesis: Except for loans borrower have other more prioritized obligations, that can lead to loan repayment past due: for example child s university tuition fees, health care expenditures, car accidents, aggregate price level increase while holding salary fixed etc. Recommendations: if available, better to use tools based on the behavior of the borrower when servicing a loan, rather than DTI; better to use annual household DTI, than personal monthly DTI (Appendix 1); additionally, use annual household DTI will let make international comparison; FCB will introduce periodic retail lending market analytical reports so that the stakeholders will have the opportunity to monitor market trends to enable consistency in DTI calculation FCB can provide central bank and banks with sound service on DTI calculation 21

Appendix 1 EuroStat Recommendations on the Use of Annual Household DTI Household level measurements instead of individual level, because de facto income and expenses of different individuals composing one household are combined. Indicators must take into account all financial obligations of a household: mortgage, retail loans, rent, utility bills etc. and must not be limited by only one type of obligations. Over indebtedness indicators must reflect long-run, instead of month-on- month, ability to pay. If in order to repay existing debts households have to shrink current consumption this will also be an indicator of over indebtedness. : . . , 11/2013; www.cbr.ru/publ/MoneyAndCredit/kuzina_11_13.pdf 22

Thank you for your time and attention!