Insights into Editorial Responsibilities and Avoiding Desk Rejection in Academic Publishing

Editors play a crucial role in setting the tone of academic discourse, enforcing ethical standards, and advancing technical standards in publishing. Avoiding desk rejection in academic publishing can significantly impact the acceptance of a paper, with an emphasis on the importance of writing quality over multiple rounds of review. Copy editing is essential to enhance poorly written papers and reduce the burden on external reviewers, ultimately improving the chances of publication.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

7th Sustainable & Impact Investments International Conference Title: Research in International Business and Finance: Trend topics and Tips By: Samuel Vigne, LUISS Business School Editor: Finance Research Letters Associate Editor: Research in International Business and Finance (Elsevier)

What does an editor do? Too many words on this slide! But editors do a lot more than look at papers! Set the tone and direction of debate for the discipline Weed out poor submissions, fast and early (desk reject) Determine what will get revised and published, under what conditions and when Communicate with academia, and increasingly with the public, about the discipline and the trends therein Enforces ethical standards on authors and reviewers Administer, along with the publisher, the journal (layout, paper order, special issues, fee structure, supplementary material etc.) Advance the technical standards of the field and of publishing, by showcasing new and emerging approaches and techniques, and by moving along what is after all a 300y old model of scientific dissemination Liaise with authors, reviewers, editorial board, outside rating agencies, conference organizers, the production and administration portions of the publisher Reflect considerably on journal impact, breadth Direct and evaluate strategy of the journal, such as linkage with conferences and associations Screen and solicit for good papers, editor selected papers are typically more cited than randoms Perpetuate the journal via the editorial board Certify and signal quality in a very noisy market, both by personal reputation and by the journal reputation Whew! Be nice please to editors!

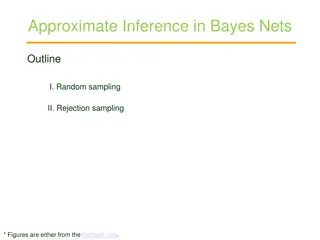

Avoiding desk rejection Since desk rejection is 70%; avoiding desk rejection gets a paper well on the way to acceptance The following slides address how to avoid desk rejection (some factors likely more known than others!)

Avoiding desk rejection: writing quality is way more important than many people think Rounds of review will address empirical methods etc. But rounds of review may not ever sufficiently improve the writing Copy edit receipts sometimes accompany papers that are still insufficiently written Poorly written papers burden external reviewers Copy edit costs not practical for many authors in emerging and frontier markets Academicword.com is about 400 USD A paper might be very suitable for desk rejection. But if on an interesting topic and particularly well written will be boosted to external review RIBAF is a commercial product. Not just a vehicle for science! Copy editing is more than a grammar check. Something equally important to native and non-native speakers

Avoiding desk rejection: understanding copy and paste checks Plagiarism checks 20% or less considered normal. A lot of false hits. But above 20% and then closer scrutiny About 20% does not in itself imply a problem. But implies more editor work Self plagiarism Traditional publishing houses do not use term self plagiarism ( a term widely used in US) but rather copy and paste . Not on offense necessarily. But diminishes contribution. Address in cover letter!

Avoiding desk rejection: pay more attention to keywords Keywords are basis of reviewer finder tool Reviewer finder tool much more efficient than journal references Example of not so good: "Dynamic common correlated effects";" panel-error correction modeling";" cross-sectional dependence";" unobserved common factors";" slope heterogeneity";" capital mobility. Only last one describes paper Keywords that are econometric techniques suggest to me a lack of contribution

Avoiding desk rejection: author disputes and the cover letter Author disputes worst thing for editor and publisher!! Working paper with 3 authors now 2? Where did third author go?? PhD supervisor dropped? This is where the cover letter is CRITICAL. It must address such things or you will get desk rejected and may not know why Reprints are horrible for publishers (and editors) And our production people in Chennai hate them! Addendums not that popular either! Reprints mess up statistics for everybody!

Avoiding author disputes cont. (avoiding desk rejection cont.) Solo authored and institutional Email v Gmail Chinese authors often like Gmail for good reasons. Big problem for solo authored works. Address in cover letter why using a Gmail and validate affiliation. Create a Google Scholar site for yourself Especially important if you have a name that is shared with other prolific researchers---Publish or Perish then too inconvenient)

Avoiding desk rejection: TOPIC Topic, topic, topic (location, location, location) good topics are citable! We take chances on topics We look at cites of author for his/her past papers

Avoiding desk rejection: Acknowledgements and cover letter Acknowledgements add credibility Cover letter: Almost all cover letters not useful. Why not make yours useful? Cover letters should be used to deal with potential authorship confusions that our checking systems will uncover For instance: A working paper of your article has 3 authors, but your submission only has 2. You might get desk rejected. But if you address this in cover letter, makes a big difference.

Avoid desk rejection: Sharp communication of contribution v impressing with methodological etc. Very sharp communication of contribution Avoid usually methodological details in abstract! This extends to not listing methodology or empirical tests as keywords OLS does not get you desk rejected. But bad writing does!

Regional diversity important to Elsevier Regional diversity sought RIBAF is going to give a very small edge or advantage to papers from regions underrepresented Why?

Targeting of acceptance rates? Targeting of acceptance rates?? Not really Certainly not the case that the lower the better with Elsevier. 15%-25% good (else not attracting good papers or attracting wrong papers) RIBAF s acceptance rate at times has actually been too low

Cites are not the main concern of publishers (but maybe of editors) Cites not the only concern of publishers From publisher s perspective cites lead submissions but submission growth is #1 Elsevier likes to see submissions (and acceptances ) grow Editors like citations though: They check the citation counts of submitting authors on Publish or Perish Reflects in part how good you are at getting your work cited An enormously cited co-author will help you avoid desk rejection

Reject with offer of transfer Keeps papers within Elsevier Convenience for authors Transfer letters often are worded with regard to goodness of fit of topic. Sometimes not the case. Can simply be moving paper downstream to a slightly lesser journal But reject and transfer often places papers better. RIBAF processes papers on periphery of aims and scopes. But they have to be a little better. If they fail on this then they might be a good fit for an economics journal etc. Bad writing will knock out any chance of being transferred!

Papers that get treated badly by the system Out of 1400 new submissions, a certain % get screwed up It is unfortunate. Monitoring can only do so much We have a team that will do very fast reviewing for papers massively delayed in processing.

Reviewing Does reviewing help avoid desk rejection? Sort of Depends on if I remember then yes Vast number of manuscripts. Often reviewers assigned by AEs Wish system was better at informing me Which is better: a long review or an on-time review? Usually the latter. Short reviews can be fine Long reviews are usually not result of forcing. But when people naturally have a lot to say. Then it doesn t take long.

When to ask for an extension Asking for an extension is NOT a bad signal When to ask for extension WELL BEFORE due date Editors get massive volume of Emails. Often travel. Not hearing from an editor is not likely a signal. If you don t hear back. Email again!

EVISE notices cause confusion Notices to authors and confusion For instance: if one reviewer is enough and one reviewer has accepted: if system is not toggled to one reviewer required rather than two, it will still say with editor

Authors disputing reviewers RIBAF is journal where needs of many and needs of system outweigh needs of the one. Author assessments of reviewers are interesting but there is limited capacity for editor to deal with these Reviews will naturally range in quality On any given day have a choice of spending 15 minutes on an author disputing a reviewer or alternatively attending to 25 new submissions etc Solution: a reasonable author dispute can lead to a reject and resubmit. Allowing a new submission. Clock reset etc. New reviewers.

Avoid long titles! The title communicates contribution Long title suggest a narrow contribution Awkward for publishers.

7th Sustainable & Impact Investments International Conference Title: Focus on Research in International Business and Finance

Area Editors and Associate Editors at RIBAF Associate editors (AE) for RIBAF either review papers or are assigned papers When an AE is assigned a paper, the AE then invites reviewers (or recommends desk reject) Area Editors are like Associate Editors. However, they handle much more volume and also have a role in coordinating other activities. Nevertheless, Editor-in-Chief handles majority of papers

RIBAF: Some numbers RIBAF has evolved across the finance discipline with increased submissions from across the globe, ranking it 10 out of 111 in Business, Finance Destribution of articles and citations 3500 3213 Acceptance rate about 16% 3000 Clarivate (SSCI) impact factor: 6.5 2280 2500 2163 1880 2000 1738 Cite Score: 9.1 1290 1500 ABS 2 10351073 1000 680 659585661551434503 Submission to acceptance: 263 days 435412 500 263 20 22 23 27 26 27 25 27 26 2751 55142254142132203162109 75 0 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 No. of Publicatioin Number of Citation

RIBAF: Some numbers Description Main information about data Timespan Sources (Journals, Books, etc.) Documents Average years from publication Average citations per documents Average citations per year per doc References Document types article review Document contents Keywords Plus (ID) Author's Keywords (DE) Results 2004:2022 1 1604 5.18 13.29 2.315 1 1455 55 0 4305 Authors Authors 2910 3610 307 2436 Author Appearances Authors of single-authored documents Authors of multi-authored documents Authors collaboration Single-authored documents Documents per Author Authors per Document Co-Authors per Documents Collaboration Index 312 0.554 1.81 2.41 2.05

RIBAF: Trending Articles Rank Authors Title YEAR Total Citations TC per Year 1 Ashraf B.N. Stock markets reaction to COVID-19: Cases or fatalities? 2020 443 222 Pasiouras F., Kosmidou K. Factors influencing the profitability of domestic and foreign commercial banks in the European Union 2007 371 25 2 3 Tully E., Lucey B.M. A power GARCH examination of the gold market 2007 222 15 Naceur S.B., Ghazouani S. Stock markets, banks, and economic growth: Empirical evidence from the MENA region 2007 188 13 4 5 Conlon T., Corbet S., McGee R.J. Are cryptocurrencies a safe haven for equity markets? An international perspective from the COVID-19 pandemic 2020 185 93 Sufian F. Determinants of bank efficiency during unstable macroeconomic environment: Empirical evidence from Malaysia 2009 168 13 6 7 Kim D.-W., Yu J.-S., Hassan M.K. Financial inclusion and economic growth in OIC countries 2018 163 41 Chaibi H., Ftiti Z. Credit risk determinants: Evidence from a cross-country study 2015 151 22 8 9 Pasiouras F. Estimating the technical and scale efficiency of Greek commercial banks: The impact of credit risk, off-balance sheet activities, and international operations 2008 150 11 Zhao H. Dynamic relationship between exchange rate and stock price: Evidence from China 2010 141 12 10

RIBAF: Research Streams current research trends: big data, COVID-19, Cryptocurrency bitcoin, oil prices, financial crisis, economic policy uncertainty.

RIBAF: Future Research Directions No. Stream Research Question 1. Corporate Can Fintech improve corporate investment efficiency? Industry 4.0 and Islamic banking, where we are? 2. Emerging markets Factors determining the investment in emerging markets. 3. Financial Comparative analysis of different form of digital financing methods. Developing blockchain based stock trading platform. 4. Does financial sector stock volatility react asymmetrically to COVID-19 pandemic? Sukuk, green bond and other financial assets: asymmetric time frequency risk transmission. Examining the asymmetric impact of COVID-19 panic on GCC/MENA/BRICS/OECD stock markets using quantile-based method. Volatility shocks and investors behaviour 5. Cryptocurrency Current trends in terrorism financing and role of cryptocurrency. Reference (Almaskati et al., 2020). Corporate social performance, ownership structure and corporate governance: evidence from Islamic and non-Islamic economies. The ESG and religious screening of business risk. What role can Fintech play in CSR and corporate performance? governance (Smaoui & Nechi, 2017) (Wang et al., 2021). Author s perspective (Hassan et al., 2019; Hassan et al., 2021) (Bhatia & Gulati, 2021). (Kantakji, 2019) (Atif et al., 2022; Dharani et al., 2022) Determinants of dividend pay-out in emerging markets. Volatility and risk transmission between emerging and developed markets. Do Implied Volatilities of Stock and Commodities Markets Affect Bonds, Shariah and Conventional Indices Differently in different markets? Evidence by OVX, GVZ and VIX Does environmental regulation improve corporate financial performance for green technological innovation? (Nerger et al., 2021) COVID-19, corporate resilience and corporate ESG disclosure. Can Fintech predict the financial crisis? Has COVID-19 paved way for the digital entrepreneurship? (Paltrinieri et al., 2020). Author s perspective (Adomako et al., 2020; H. H. Nguyen et al., 2021). Author s perspective Author s perspective (Haniff & Pok, 2010) (Zaman, 2019). (Smaoui & Nechi, 2017) crisis Risk and return relationship between future and spot markets: global evidence. Volatility Author s perspective Author s perspective (Ali & Hasan, 2019) Quantifying the safe-haven properties of green bond, and Islamic equity for Cryptocurrency indices. Cryptocurrency and ESG perspective: empirical evidence. Cryptocurrency and its sharia compliance. Event study from Islamic economies. Exploring the interdependence among the main cryptocurrencies and its return. (Bitcoin) (Abdelbaki, 2017) (Ali & Hasan, 2019). (Khaled & Khandker, 2015). (Iatridis, 2012)

SPECIAL ISSUE RIBAF: Sustainability: Impact and Double Materiality Sustainable Finance Landscape Financial intermediaries disseminating shared value and double materiality Increasing regulatory focus on non-financial disclosure Pursuit of dynamic equilibrium among impact, risk, and return in sustainable investments Regulatory Objectives and Requirements: Twofold regulatory objectives: Mitigating greenwashing and increasing ESG disclosure Emphasis on controlling ESG-related risks over spurring non-financial performance Challenges for financial players in meeting regulatory requirements

SPECIAL ISSUE: Challenges and Objectives in Sustainable Finance Academic Insights Scholars' decade-long examination of sustainability's effects on financial intermediaries Analysis of regulatory frameworks, risks, profitability, and stability Identification of potential risks, challenges, and the need for standardized metrics Academic Challenges Financial players face a range of principles, indicators, and standards Materiality-based approaches leading to non-comparable and sometimes irrelevant disclosures Notable challenges in implementing growing regulatory requirements

SI - Sustainability: Impact and Double Materiality. Outcomes beyond risk Aim and CFP Exploration of sustainable finance dimensions, incorporating new risk drivers and orientating investment decisions Adoption of a double-lens approach, emphasizing outcomes beyond risks Contribution to RIBAF's debate on ESG regulation, disclosure, and integrated reporting Suggested Topics Sustainable finance regulation: investigating effectiveness in enforcing financial stability and promoting impact-oriented investment decisions Non-financial information by financial intermediaries: assessing adherence to the double materiality approach Integrated accounting: Evaluating progress in combining financial and non-financial reporting ESG products: Clarifying the design and offering based on materiality analysis ESG ratings: Assessing methodological approaches and their contribution to sustainability transition

Thank you! Questions much appreciated!