Unintended Consequences of Texas Bar Covid-19 Shutdowns

Texas breweries and wineries faced stricter Covid-19 guidelines and shutdowns due to being classified as bars instead of restaurants, impacting their revenue and operations. The pandemic led to a significant decline in annual visitors, cancellation of events, and a shift towards online sales strategies. Studies showed that PPP loans helped businesses remain open and adapt to changing circumstances, with small, family-owned wineries proving more resilient.

Uploaded on Sep 15, 2024 | 0 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

SHIFTING INCENTIVES: ONE UNINTENDED CONSEQUENCE OF TEXAS BAR COVID-19 SHUT-DOWNS DR. SARAH MARX QUINTANAR SENIOR ASSOCIATE, PRICEWATERHOUSE COOPERS FORT WORTH, TEXAS WITH DR. MATT MCMAHON WESTCHESTER UNIVERSITY

MOTIVATION Texas policy defines establishments who make 51% or more of their revenue from the sale of alcohol as bars (most importantly, not as restaurants) Because of this definition, most Texas breweries and wineries were considered bars with respect to Covid guidelines and shut-downs Faced more stringent guidelines and shutdowns than restaurants This was largely due to the belief that they were inherently more risky in terms of spreading the virus Texas is the 6thlargest producer of craft beer in the U.S. and has around 600 breweries Texas is the 5thlargest producer of wine in the U.S. with over 500 wineries

COVID-19 IMPACTS FOR WINE & BEER IN THE U.S. 88% decline in annual visitors for 2020 Average winery had to cancel 5 large events (major tourist/sales losses) In May 2020 the average winery lost 70% of tasting room sales, but had an increase of 66% in direct-to-consumer (internet) sales Most utilized new marketing strategies like curbside pickup, reduced shipping costs, special direct to consumer promotions, home delivery by personnel, wine club specials, and virtual wine tastings Ability to shift to online and/or to-go modes of operation were vital About 70% of wineries and breweries applied for the Paycheck Protection Program loans

EXISTING LITERATURE Small, family-owned wineries in California were more able to adapt and remain open than those with hierarchies (Curtis & Slocum, 2021) Other studies have found evidence that PPP loans lessened revenue losses, increased retention rates for employees, and increased likelihood of businesses staying open (Li, 2021 and Bartik, Cullen et. al. 2020, for example) PPP loans within breweries and wineries: because primarily used for payroll, results were mixed depending on ability to shift employees to online work (Curtis & Slocum, 2021) Brewers were more likely to remain in operation through July 2020, smaller decreases in year-over-year production, and earlier reception of the loan was more impactful (Staples & Krumel, 2021) Texas wineries and breweries with PPP loans were more likely to remain open (Quintanar 2022)

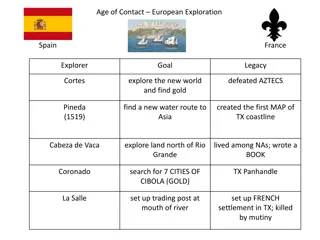

TEXAS POLICY TIMELINE May June 2020 State policy oscillates between capacity limits at 25% capacity with social distancing to 75% for restaurants July 31, 2020 TABC announces bars can apply for restaurant permits based on food requirements (51% rule) March 19, 2020 Gov. Abbott orders all restaurants and bars close at midnight June 27, 2020 Pickup and delivery of alcoholic drinks is allowed if sealed and sold with food

51% RULE, REDEFINED Friday July 24: The Texas Alcoholic Beverage Commission has determined that the 51 percent calculation of gross receipts should only include the sale of alcohol for on-premise consumption. Therefore, the calculation should exclude to-go, retail, and wholesale sales of alcoholic beverages Bars needed to show they had been making less than 51% in alcohol sales since April, while also excluding to-go, delivery, and retail sales to be rezoned as restaurants Bars can also apply for Food and Beverage certificates if they ramped up their on-site kitchen space or added a permanent food truck to their grounds- allowing them to add new food sales to gross receipts to change its ratio of alcohol to food and able to open for dine-in service too Revenue from food trucks could be included in sales

TEXAS POLICY TIMELINE, CONT. October 14, 2020 County judges allowed to opt-in of reopening bars at 50% indoor and unlimited outdoor September 21, 2020 restaurants 75% indoor capacity and bars remain closed March 10, 2021 Reopen Texas "100%"

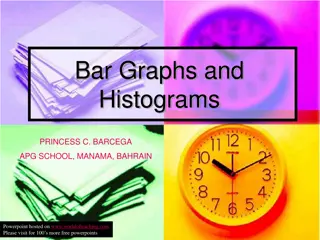

IMPACT VARIED DRASTICALLY The cost is significant (two-year terms) TABC Food and Beverage Designation: $5,300 Local city and county fees: $1,100 for breweries/wineries and $6,000 for food & beverage

TABC FOOD AND BEVERAGE CERTIFICATES GRANTED 45 40 35 30 25 Tarrant County Dallas County 20 15 10 5 0 Aug-18 Aug-19 Aug-20 Aug-21 Oct-18 Oct-19 Oct-20 Oct-21 Apr-18 Jul-18 Sep-18 Apr-19 Jul-19 Sep-19 Apr-20 Jul-20 Sep-20 Apr-21 Jul-21 Sep-21 Feb-18 Dec-18 Feb-19 Dec-19 Feb-20 Dec-20 Feb-21 Dec-21 Jan-18 May-18 Nov-18 Jan-19 May-19 Nov-19 Jan-20 May-20 Nov-20 Jan-21 May-21 Nov-21 Jun-18 Jun-19 Jun-20 Jun-21 Mar-18 Mar-19 Mar-20 Mar-21

DID THE POLICY BENEFIT TEXANS WITH RESPECT TO SAFETY? Estimates of the impact of sports events on COVID-19 range from an additional 9 deaths to an additional 895 cases and 58 deaths (Ahammer, Halla, and Lackner 2020 and Carlon et al. 2020) NIH denotes high risk factors of spreading infection to be large gatherings with low air flow, close contact, and/or areas of high infection rates (2020)

CONCLUSIONS Regression estimates still in progress ultimately linking TABC and PPP administrative data sources between individual establishments and their survival post-pandemic Licensing fees are not minimal for small firms (time and legal cost is large for all firms) In some cases substantial investment to meet the new criteria The argument: bars were higher risk and thus faced more stringent restrictions If breweries (and wineries) were not actually higher risk, but still faced additional costs with no benefit there were unnecessary penalties for these businesses without improving safety outcomes