Navigating Disruption: TransferWise's Path to Market Leadership

TransferWise, a key player in the remittance industry, faces challenges from disruptive technologies and regulatory issues. To maintain its competitive edge, TransferWise must address concerns like money laundering, embrace blockchain innovation, redefine banking relationships, and aim for zero transaction fees. Strategic moves such as partnering with AI and fintech firms, acquiring remittance services from banks, and leveraging tech breakthroughs can propel TransferWise towards sustainable growth and market leadership.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

TransferWise: Disruptor or Disrupted HEC Montreal CSC Consulting Olivier Cohen, Brandon Jacobs, Jessica Drolet, Richard Wallace

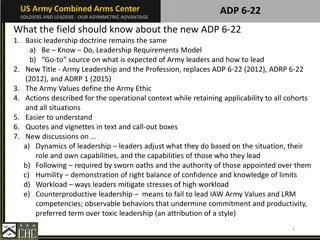

Introduction Analysis Alternatives Strategy Implementation Conclusion The Problems facing TransferWise How can TransferWise: Maintain its competitive edge and meet the challenges posed by new disruptive technologies Become market leader in remittance industry Achieve zero-fees

Introduction Analysis Alternatives Strategy Implementation Conclusion The Key Issues 1. Overcome concerns regarding money laundering and illegal activity through the platform 2. Manage emergence of blockchain technology eroding competitive advantage 3. Redefine nature of long- term relationship with established banks 4. Grow sustainably towards zero- transaction fee

Introduction Analysis Alternatives Strategy Implementation Conclusion TransferWise Going Forward 1. Create joint innovation hub with AI and fintech firms to drive new technology development Strategy 2. Partner with select banks to take-over their remittance services 3. Licence tech breakthroughs to finance reduction of fees to near-zero 4. Partner with tap-to-pay providers

Introduction Analysis Alternatives Strategy Implementation Conclusion Internal / External Analysis Strengths Weaknesses Established reputation Novel business model Large client base Attractive pricing Fast transactions Reliance on banking relationships Dip in profits Security concerns Links with Bank under scrutiny Opportunities Threats Expansion to new markets Partner with popular tech. and social media platforms Regulatory concerns Potential for fraudulent use Blockchain Technology TransferWise has high-potential for growth and market leadership, despite hurdles

Introduction Analysis Alternatives Strategy Implementation Conclusion Remittance Market Analysis Threat of entrants Med / Low Incumbents already established Banks and other institutions Supplier Power - Low Banks Financial institution Customer Power - High Axed on convenience Price sensitive Secure and safe Competition Branks, Western Union, TransferWise Threat of Substitutes Med / High Blockchain Similar halawa -based technologies Market still ripe for disruptors like TransferWise but also exposed to further disruption from blockchain

Introduction Analysis Alternatives Strategy Implementation Conclusion Alternatives 1. Partner with AI innovation hub and Fintech start-ups to develop new technologies to meet current challenges Leverage partner expertise to develop new technology Improve productivity internally License tech. services to other companies as new revenue source to offer additional liquidity 2. Convert TransferWise to a new crypto currency leveraging latest blockchain Currency will traded on crypto markets TransferWise becomes digital wallet Revenue through low transaction fees

Introduction Analysis Alternatives Strategy Implementation Conclusion Alternatives 3. Expand offering of financial services to finance zero-fee target Apply for investment licensing in UK, EU, and USA Leverage technology to enable Exchange-Traded Funds (ETF) investments Use revenues to fund improvements in security and technology 4. Re-focus on large commercial clients Offers high-volume accounts Reduces risk of fraud Different segment from blockchain

Introduction Analysis Alternatives Strategy Implementation Conclusion Decision Matrix Alternatives Reduce the risk of fraudulent activity Mitigate threat from blockchain Establish a new relationship with banking partners Deliver progress towards zero-fees 1. Partnerships in AI and Fintech and leverage innovation Hub 3 4 3 4 2. Convert to blockchain technology 2 4 3 2 3. Offer new investment services 1 2 2 4 4. Re-focus on commercial clients 3 3 2 2

Introduction Analysis Alternatives Strategy Implementation Conclusion Decision Matrix Alternatives Reduce the risk of fraudulent activity Mitigate threat from blockchain Establish a new relationship with banking partners Deliver progress towards zero-fees 1. Partnerships in AI and Fintech and leverage innovation Hub 3 4 3 4 2. Convert to blockchain technology 2 4 3 2 3. Offer new investment services 1 2 2 4 4. Re-focus on commercial clients 3 3 2 2

Introduction Analysis Alternatives Strategy Implementation Conclusion Decision Matrix Alternatives Reduce the risk of fraudulent activity Mitigate threat from blockchain Establish a new relationship with banking partners Deliver progress towards zero-fees 1. Partnerships in AI and Fintech and leverage innovation Hub 3 4 3 4 2. Convert to blockchain technology 2 4 3 2 3. Offer new investment services 1 2 2 4 4. Re-focus on commercial clients 3 3 2 2

Introduction Analysis Alternatives Strategy Implementation Conclusion Decision Matrix Alternatives Reduce the risk of fraudulent activity Mitigate threat from blockchain Establish a new relationship with banking partners Deliver progress towards zero-fees 1. Partnerships in AI and Fintech and leverage innovation Hub 3 4 3 4 2. Convert to blockchain technology 2 4 3 2 3. Offer new investment services 1 2 2 4 4. Re-focus on commercial clients 3 3 2 2

Introduction Analysis Alternatives Strategy Implementation Conclusion Decision Matrix Alternatives Reduce the risk of fraudulent activity Mitigate threat from blockchain Establish a new relationship with banking partners Deliver progress towards zero-fees 1. Partnerships in AI and Fintech and leverage innovation Hub 14 3 4 3 4 2. Convert to blockchain technology 2 4 3 2 11 3. Offer new investment services 1 2 2 4 9 4. Re-focus on commercial clients 3 3 2 2 10

Introduction Analysis Alternatives Strategy Implementation Conclusion TransferWise Going Forward 1. Create joint innovation hub with AI and fintech firms to drive new technology development Strategy 2. Partner with select banks to take-over their remittance services 3. Licence tech breakthroughs to finance reduction of fees to near-zero 4. Partner with tap-to-pay providers

Introduction Analysis Alternatives Strategy Implementation Conclusion 1. Developing the Innovation Hub Strategic partnerships with select A.I. and Fintech firms in a joint innovation hub Develop A.I. technologies to automate security checking of transactions Increases productivity, lowers costs Faster transactions Develop new fintech programs to drive TransferWise platform innovation, reduce operational costs Push towards zero-fees Become market innovation leader Push-back against blockchain

Introduction Analysis Alternatives Strategy Implementation Conclusion 2. Reshape Bank Partnerships Target Select banks in operating countries for partnerships to handle all remittance services Mutually beneficial For TransferWise Increase volume of customers gain mainstream credibility guaranteeing market share For Banks Increase attractiveness of their banking products Long-term goal: monopolize remittance in banking sector

Introduction Analysis Alternatives Strategy Implementation Conclusion 3. Licensing Tech. Breakthroughs Create additional revenue streams to finance zero-fees Licensing system or sale to non-competitors Open new division within TransferWise to license marketable technologies Target fin-tech and financial services sectors Large multi-nationals (airlines, oil & gas, mining, retail) Provide additional liquidity for TransferWise operations

Introduction Analysis Alternatives Strategy Implementation Conclusion 4. Tap-to-Pay Partnerships Expand services to point-of-sale transactions Strategic partnerships with credit and digital wallet providers Apple Pay Interac/Cirrus Visa/Mastercard Back-end platform for their international transactions Enables instant, low-fee international transactions for customers The ultimate evolution of travellers cheques Differentiates from blockchain cryptos through convenience and certainty

Introduction Analysis Alternatives Strategy Implementation Conclusion Alignment of 5 pillars and actions 1.Price Policy of 0% fee during emergencies 2.Trustworthiness Partnerships with reliable banks only Increase by developing new technologies (innovation hub) and partnerships 3.Speed 4.Coverage From 50 countries to 150 countries Integrate into more channels (eg: Facetime, Skype, Whatsapp, Telegram, LinkedIn) and tap-to-pay 5.Convenience

Introduction Analysis Alternatives Strategy Implementation Conclusion Low-cost high impact marketing campaigns User-generated content solving real customer problems (contest + blogger outreach with cash transfer) 0% rate during emergency situations (natural disasters) + ~$2 donation to cause On-campus activities and transparent ads on windows in high-education schools Blog posts in top 20 languages Sponsorships on business websites Expats and diaspora Travelers International students Businesses, sole traders, freelancers

Introduction Analysis Alternatives Strategy Implementation Conclusion 7 first year 2022 . All numbers in millions USD 2019 2020 2021 2023 2024 2025 Activities Budget Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 1. Expansion Explore corporate client opportunities Partnerships with Banks Social media campaigns Increase International footprint Integrate into more channels 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 2 1 2 1 2 1 1 1 1 1 2 70 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 2 2. Innovation Hub Innovation tech school (MIT) Partner with Element AI and tech developers Hire ethical hackers Lobby financial regulators Tap-to-pay 1 1 1 1 1 1 1 1 1 1 1 1 1 2 1 1 1 1 1 1 2 50 1 1 1 1 1 1 1 1 1 2 1 1 1 1 1 1 1 1 2 1 1 1 1 1 1 1 1 1 2 3. New stream of revenues FraudWatch Integrate zwithin TransferWise Offer as a service to clients 40 1 1 1 1 1 1 1 1 1 2 1 1 1 1 1 2 TOTAL 160 15 24 57 42 12 10

Introduction Analysis Alternatives Strategy Implementation Conclusion . In millions USD Total Revenues 2018 151 151 2019 174 174 2020 210 210 2021 284 284 2022 357 357 2023 431 431 2024 494 479 15 14% 43 3.5 324 10 113.35 79.3 16.6% 174,074 15.0% 0.275% 0.175% 0.100% 685,386 25% 2025 545 507 38 10% 46 3.5 348 2026 553 506 47 1% 49 3.6 374 2027 566 480 86 2% 51 3.6 391 2028 587 450 137 4% 53 3.6 409 2029 598 414 184 2% 55 3.7 427 Revenues on transactions Revenues on services Revenues Growth 15% 20 2.1 134 15 3.50 2.5 1.4% 55,200 15.0% 0.315% 0.280% 0.035% 591,220 9% 21% 23 2.3 159 24 2.62 1.8 0.9% 69,000 25.0% 0.305% 0.265% 0.040% 608,957 11% 35% 28 2.7 200 57 -3.89 -2.7 -1.0% 93,150 35.0% 0.305% 0.250% 0.055% 627,225 15% 26% 34 3.0 245 42 33.39 23.4 6.5% 121,095 30.0% 0.295% 0.225% 0.070% 646,042 19% 21% 39 3.3 291 12 85.82 60.1 13.9% 151,369 25.0% 0.285% 0.200% 0.085% 665,423 23% Advertising Cyber Security Other SGA Strategy Budget Operating Income (taxes ~ 30%) Net Income Net Margin Transactions Volume Transactions Volume Growth % %Revenues by $ 18 2 120 11.4 8.0 5.3% 48,000 147.93 103.6 20.4% 191,481 10.0% 0.265% 0.150% 0.115% 705,948 27% 125.88 88.1 17.4% 210,630 10.0% 0.240% 0.125% 0.115% 727,126 29% 120.61 84.4 17.6% 223,267 6.0% 0.215% 0.100% 0.115% 748,940 30% 121.64 85.1 18.9% 236,663 6.0% 0.190% 0.075% 0.115% 771,408 31% 112.42 78.7 19.0% 250,863 6.0% 0.165% 0.050% 0.115% 794,550 32% 0.315% 0.280% 0.035% 574,000 8% Fees FOREX practices Global Market Market Share

Introduction Analysis Alternatives Strategy Implementation Conclusion

Introduction Analysis Alternatives Strategy Implementation Conclusion

Introduction Analysis Alternatives Strategy Implementation Conclusion Risks Risks Mitigations Offering exclusivity in certain banks, emphasize differentiation from their competitors Difficulty getting buy-in from banks Diversified revenue streams through tech. licensing Blockchain drives fees to zero before TransferWise can match Long-term plan to launch tap-to-pay wallet Reticence from Tap-to-pay providers

Introduction Analysis Alternatives Strategy Implementation Conclusion Take-away Strategy 1. Create joint innovation hub with AI and fintech firms to drive new technology development 2. Partner with select banks to take-over their remittance services 3. Licence tech breakthroughs to finance reduction of fees to near- zero 4. Partner with tap-to-pay providers Results Diversified revenue streams Become market- leader in remittance Clear path to zero fees Increase user base

Introduction Analysis Alternatives Strategy Implementation Conclusion QUESTIONS