Stock Valuation Analysis and Calculations

The given content discusses various stock valuation scenarios involving dividend payments, growth rates, and required returns on investments. It covers calculations for determining current stock prices, future prices, dividend yields, and required returns based on different company scenarios. Examples include EDM Inc., Pasha Entertainment Inc., Take Time Corporation, and more. The calculations involve formulas like D1=P0*(1+g), D4=D0*(1+g)^4, and considerations for required returns ranging from 10.4% to 13%.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

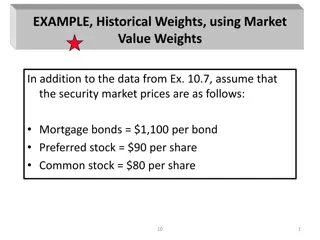

Class Problems Chapter 7B Stock Valuation 1. EDM, Inc. just paid a dividend of $2.35 per share on its stock. The dividends are expected to grow at a constant rate of 4.1% per year, indefinitely. If investors require a return of 10.4% on this stock, what is the current price? D1 P0 = D1 = D0 x (1+g) R - g $2.35 x (1+.041) = (.104-.041) = $38.83 2. What will the price be in three years? D4 D4 = D0 x (1+g)4 P3 = R - g $2.35 x (1 + .041)4 = (.104 - .041) Stock price grows at dividend growth rate = $43.81 P3 = P0 x (1 + g)3 = $38.83 x (1 + .041)3 = $43.81 3. What will the price be in 15 years? D16 D16 = D0 x (1 + g)16 P15 = R - g $2.35 x (1 + .041)16 = (.104 - .041) Stock price grows at dividend growth rate = $70.95 P15 = P0 x (1 + g)15 = $38.83 x (1 + .041)15 = $70.95 1

4. Pasha Entertainment, Inc. is expected to pay the following dividends over the next four years: $6, $12, $17, and $3.25. Afterward, the company pledges to maintain constant 5% growth rate in dividends, forever. If the required return on the stock is 11%, what is the current share price? D5 D5 = D4 x (1+g) P4 = (R g) $3.25 x (1.05) = (.11 - .05) = P4 = $56.88 $6 $12 $17 $3.25 $56.88 P0 = + + + + (1.11)2 (1.11)3 (1.11)4 (1.11)4 (1.11) = $67.18 5. Suppose you know that a company s stock currently sells for $67 per share and the required return on the stock is 11.5%. You also know that the total return on the stock is evenly divided between capital gains yield and dividend yield. If it is the company s policy to always maintain a constant growth rate in its dividends, what is the current dividend per share? D1 R= Dividend yield + Capital gains yield = + g P0 Dividend yield = Capital gains yield given from the problem .115 = Dividend yield + Capital gains yield x x .115 = 2x D1 D0 = (.115) = x (1 + g) .0575 = x $3.85 D1 D0 = Dividend yield = .0575 = 5.75% = 1.0575 P0 D1 = .0575 x P0 Answer D0 = $3.64 D1 = .0575 x $67 D1 = $3.85 2

6. Take Time Corporation will pay a dividend of $3.65 per share next year. The company pledges to increase its dividend by 5.1% per year, indefinitely. If you require a return of 11% on your investment, how much will you pay for the company s stock today? D1 P0 = R - g $3.65 = (.11 - .051) = $61.86 7. The next dividend payment by Dizzle, Inc. will be $2.48 per share. The dividends are anticipated to maintain a growth rate of 4.5% forever. If the stock currently sells for $39.85, what is the required return? D1 R= + g P0 $2.48 = + .045 $39.85 = .1072 or 10.72% 8. Mitchell, Inc. is expected to maintain a constant 4.6% growth rate in its dividend, indefinitely. If the company has a dividend yield of 5.8%, what is the required return on the company s stock? R= Dividend yield + Capital gains yield = .058 + .046 = .1040 or 10.40% 3

9. Gontier Corporation stock currently sells for $53.95 per share. The market requires a return of 10.3% on the firm s stock. If the company maintains a constant 4.9% growth rate in dividends, what was the most recent dividend per share paid on the stock? D0 x (1 + g) P0 = (R g) P0 x (R - g) D0 = (1 + g) $53.95 x (.103 - .049) D0 = (1 + .049) = $2.78 D0 10. Metallica Bearings, Inc. is a young start-up company. No dividends will be paid on the stock over the next nine years because the firm needs to plow back its earnings to fuel growth. The company will then pay a dividend of $19 per share 10 years from today and will increase the dividend by 5% per year thereafter. If the required return on this stock is 13%, what is the current share price? Find the stock price in Year 9: D10 P9 = (R g) $19.00 = (.13 - .05) = $237.50 $237.50 P0 = (1.13)9 P0 = $79.06 4

Class Problems Chapter 7C Stock Valuation 1. Ushuaia, Inc. currently has an EPS of $4.13, and the benchmark PE ratio for the company is 15. Earnings are expected to grow at 5% per year. What is your estimate of the current stock price? P0 = Benchmark PE ratio x EPS = 15 x $4.13 = $61.95 2. What is the target stock price in one year? EPS1 = EPS0 x (1 + g) P1 = Benchmark PE ratio x EPS1 = 15 x $4.34 = $4.13 x (1 + .05) = $4.34 = $65.05 - - or - - P1 = P0 x (1 + g) = $61.95 x (1 + .05) = $65.05 3. Assuming the company pays no dividends, what is the implied return on the company s stock over the next year? Similar to: (P1 - P0) D1 R= P0 = P0 R - g ($65.05 - $61.95) D1 = R= + g $61.95 P0 = .05 = 5% This is 0 if no dividends R = g (when no dividends) So, if EPS is growing at 5% per year, there are no dividends and the PE ratio is constant, then the implied return is 5%. 5

4. The Sleeping Flower Co. has earnings of $2.65 per share. The benchmark PE for the company is 18. What stock price would you consider appropriate? What if the benchmark PE were 21? P0 = Benchmark PE ratio x EPS Benchmark PE ratio = 18 EPS = $2.65 P0 = 18 x $2.65 = $47.70 If Benchmark PE ratio = 21 P0 = 21 x $2.65 = $55.65 5. Davis, Inc. currently has an EPS of $2.75 and an earnings growth rate of 8%. If the benchmark PE ratio is 21, what is the target share price five years from now? EPS5 = EPS0 x (1 + g)5 = $2.75 x (1 + .08)5 = $4.04 P5 = Benchmark PE ratio x EPS5 = 21 x $4.04 = $84.84 6. TwitterMe, Inc. is a new company and currently has negative earnings. Its sales are $1.35 million and there are 130,000 shares outstanding. If the benchmark price- sales ratio is 4.8, what is you estimate of the appropriate stock price? Sales P= Benchmark PS ratio x Sales per share Sales per share= Shares outstanding Benchmark PS ratio = 4.8 $1,350,000 Sales per share = $10.38 = 130,000 P = 4.8 x $10.38 = $10.38 = $49.85 6

Problem Set 1 ABC stock just paid a $2 dividend and will grow it at 4% thereafter. The company also has a bond maturing in 4 years which pays a 5% annual coupon and has a face value of $1000. You own 1 share of stock and 1 bond. The appropriate interest rate to use in both of the following calculations is 6% 1. What is the price of one share of stock (R=6%) ? $2 (1.04) = $104 (.06-.04) 2. What is the price of one bond (YTM=6%) ? 1 1 - $1,000 (1.06)4 Bond Value = $50 * + (1.06)4 .06 $1,000 = $50 * 3.4651 + 1.2625 = $965.35 The Federal Reserve Bank DECREASED interest rates to 5% 3. What is the new price of your share of stock (R=5%) ? $2 (1.04) = $208 (.05-.04) 4. What is the new price of your bond (YTM=5%) ? No math needed Bond price must be $1000 because YTM is the same as the coupon rate 5. How much money did you gain or lose as a result of the change in interest rates? ($208+1000) - ($104+965.35) = $138.65 gain