Expert Report on Valuation of Land for Logipol SA

Paul Sanderson, an experienced valuation expert, has been asked to prepare an expert report for Logipol SA regarding the valuation of land to be acquired for an extension of Metropolis Airport. His extensive experience includes advising on land acquisitions, negotiating compensation for rail systems

4 views • 20 slides

Online Stock Market Training From Basics to Advanced Strategies

The journey into stock market trading should begin with a solid foundation. Booming Bulls Academy\u2019s basic online stock market training courses are designed to introduce newcomers to the essential concepts such as types of stocks, market orders, and what influences stock prices. Understanding th

1 views • 9 slides

Escalate Your Trading with a Stock Market Course

Investing in the stock market is an effective way to build wealth and achieve financial independence. However, with proper expertise and training, navigating the complexities of the stock market may be more manageable. This is where a complete stock market course in India comes into play.\n

0 views • 9 slides

Overview of Financial Markets and Their Impact on the Economy

Financial markets encompass various segments like the bond market, stock market, and foreign exchange market, each playing a vital role in the economy. Bond markets facilitate borrowing for corporations and governments, while interest rates influence investments and savings. The stock market allows

0 views • 21 slides

Understanding Stock Market Data Visualization

Explore how stock data can be displayed through bar charts and candlestick charts, interpret stock market data to make informed decisions, and learn how to create visual representations of stock information using examples. Discover the significance of historical trading prices and volumes for invest

0 views • 15 slides

Understanding Stock Market Data Analysis

Explore the world of stock market data with a focus on daily trading progress, key terms, credible sources, and practical examples. Learn how to track stock trends and important statistics like net changes to make informed decisions. Dive into stock price differentials and percent increases to grasp

0 views • 14 slides

Understanding Suits Valuation Act 1887 and Its Purpose

The Suits Valuation Act 1887 serves to determine the jurisdiction of courts by valuing specific suits. Its purpose includes ensuring the proper forum, expediting justice, protecting rights, rectifying jurisdictional issues, and assigning relevant courts to each case. The act distinguishes between va

0 views • 24 slides

Understanding the Wide Scope of Valuation in Business

Valuation is a complex process that involves various aspects such as economics, laws, human dimensions, and more. It goes beyond just numbers, incorporating knowledge from different disciplines to provide a comprehensive evaluation. This article delves into the key terms, domains, and importance of

1 views • 50 slides

Understanding Stock Types and Evaluation

This content covers the basics of buying and selling stocks, evaluating different types of stocks, valuing stock prices, and understanding the benefits of owning stock. It discusses common stock, preferred stock, income stocks, growth stocks, and various stock investments. The information provided a

0 views • 49 slides

Understanding Goodwill Valuation in Business

Goodwill in business represents the intangible value of a company beyond its tangible assets. This article covers the meaning of goodwill, factors affecting its valuation, methods of valuation such as simple average profit method, and considerations before calculating average profits. An illustrativ

0 views • 13 slides

Valuation and Accounting for Unsold Stock in Consignment Transactions

Valuation and accounting for unsold stock in consignment transactions is crucial for determining true profit or loss. The cost of consigned goods plus proportionate expenses must be considered. Recurring and non-recurring expenses play a significant role in valuing closing stock. The value of unsold

1 views • 10 slides

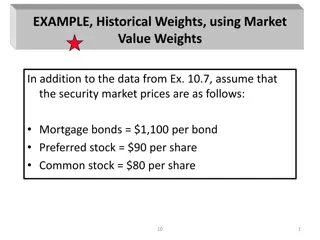

Historical Weights and Cost of Capital Analysis

The content discusses historical weights using market value weights for different securities like mortgage bonds, preferred stock, and common stock. It also delves into determining the overall cost of capital based on market value weights, including debt, preferred stock, common stock, and retained

0 views • 36 slides

Stock Valuation Analysis and Calculations

The given content discusses various stock valuation scenarios involving dividend payments, growth rates, and required returns on investments. It covers calculations for determining current stock prices, future prices, dividend yields, and required returns based on different company scenarios. Exampl

0 views • 7 slides

Stock Pitch Competition: Crafting a Winning Investment Thesis

Prepare for a stock pitch competition with the Exeter Student Investment Fund by understanding what makes a strong investment thesis, the importance of catalysts, and how to differentiate your insight for a mispriced stock. Learn the key components of a pitch, from industry and company overview to v

0 views • 14 slides

Understanding Ecosystem Valuation and Non-Market Techniques

Ecosystem valuation aims to assess user preferences for ecosystem goods and services, determining the economic value attached to nature's benefits. Ecosystems offer provisioning, regulating, cultural, and supporting services crucial for human well-being. Various non-market valuation techniques like

0 views • 5 slides

Understanding Stocks: Key Concepts and Market Dynamics

Explore the world of stocks with insights on different types of companies, initial public offerings (IPOs), stock exchanges, stock indexes, and factors influencing the market. Learn about publicly traded companies, IPOs, stock exchanges like NYSE and NASDAQ, stock indexes like Dow Jones and S&P 500,

0 views • 17 slides

Understanding Stock Valuation: Key Concepts and Approaches

Stock valuation is essential for investors to determine the intrinsic value of a stock compared to its market price. This process involves analyzing fundamental factors like revenue, dividends, and risk. Different models are used to calculate intrinsic value, guiding investment decisions based on wh

0 views • 13 slides

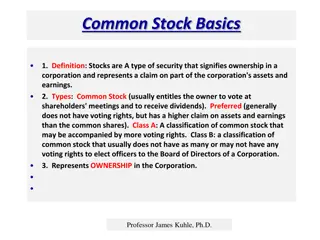

Understanding Common Stock Basics

Stocks represent ownership in a corporation, with common and preferred stock being the main types. Shareholders or equity owners have ownership rights, including voting at shareholders' meetings and receiving dividends. Common stock can have different classifications like Class A and Class B, each w

1 views • 50 slides

Using the BI Stock Screener for Targeted Industry Stock Analysis

Explore how to utilize the BetterInvesting Stock Screener for identifying great stocks in specific industries. The educational presentation by Gladys Henrikson for MicNova provides insights on effective stock screening methods adapted from Marion Michel's approach. Understand the disclaimer for educ

0 views • 15 slides

Development of Methodologically Robust Agricultural Capital Stock Statistics by FAO

In November 2015, the Food and Agriculture Organization of the United Nations (FAO) initiated a project to enhance Agricultural Capital Stock statistics, focusing on inclusive and efficient agricultural and food systems. The project involves developing methodologies for measuring capital stock and m

0 views • 38 slides

Stock Prices and Future Earnings: A Study on Accruals and Cash Flows

This study by Richard G. Sloan and Zhengying (Vivien) Fan explores whether stock prices fully reflect information in accruals and cash flows concerning future earnings. The research develops hypotheses, examines sample data, and conducts empirical analysis to assess the relationship between earnings

0 views • 19 slides

PAMAV Report 2022: Advancing Mineral Asset Valuation in Europe

Polish Association of Mineral Asset Valuators (PAMAV) has been actively involved in the harmonization of Polish and international mineral resource reporting and valuation systems. The association's main activities in 2021/2022 include updating the POLVAL Mineral Resources Valuation Code, expanding t

0 views • 5 slides

ICES Advice for 2015 Sea Bass Stock Structure Uncertain

Sea bass stock structure remains uncertain in IVbc, VIIa, and VIId-h with total landings advised to be below 1,155 t. The stock faces challenges such as slow growth, late maturation, and vulnerable spawning aggregations. Urgent management action is needed to reduce fishing mortality and prevent furt

0 views • 10 slides

Introduction to Valuation with Chris Young, Ph.D.

Join Chris Young, Ph.D., a leading expert in valuation, for an insightful session on the fundamentals of valuation, major components, and practical exercises. Explore topics ranging from economic consulting to recent industry activity and learn from Chris Young's extensive experience as a partner at

0 views • 52 slides

Northamptonshire Pension Fund 2013 Valuation Overview

The Northamptonshire Pension Fund 2013 Valuation Report discusses the implications for Academy employers, focusing on aspects like the triennial valuation, covenant, risks, DCLG/DfE guidance, and annual accounts. The report provides insights into the pensions landscape, fund details, and the valuati

0 views • 67 slides

Valuation Practices in Bangladesh: Insights and Guidelines

Exploring the valuation practices in Bangladesh, this article covers the use of valuations by banks, insurance companies, government entities, and more. It highlights the guidelines set by the Bangladesh Securities and Exchange Commission and the role of International Valuation Standards in asset va

0 views • 28 slides

Overview of Chinese Equity Markets: History and Regulation

Explore the evolution of Chinese stock markets from their beginnings in the centrally planned economy to the establishment of the Shanghai and Shenzhen stock exchanges in the 1990s. Learn about the regulatory framework, rights of stockholders, agency problems, and the role of the state in Chinese li

0 views • 19 slides

Understanding Equity Security Valuation and Types of Stock Sectors

Explore the basics of equity security valuation including relative value and intrinsic value analysis. Discover different types of companies in the modern economy, future economy, and old finance. Delve into various stock sectors such as US Financials, Industrials, Biopharma, Healthcare, Consumer St

0 views • 18 slides

Intensive Course on Stock Control and Inventory Management

This intensive course, led by Prof. Takao Ito, focuses on stock control and inventory management, exploring topics such as economic order quantity, two systems in stock control, and the supervision of supply and accessibility of items to maintain optimal stock levels. Participants will delve into de

0 views • 34 slides

Legal, Valuation & Planning Considerations for S Corporation ESOPs

S Corporations combined with Employee Stock Ownership Plans (ESOPs) offer various benefits like flexible transaction structures, tax advantages, and employee retirement benefits. This presentation covers the requirements for S Corporations, switching to S Corporation status, ESOP rules, benefits, st

0 views • 41 slides

Understanding Growth Companies and Stocks in Stock Valuation

When evaluating stocks for investment, it's essential to consider the difference between a good company and a good investment. While a great company may have strong performance, its stock may be overpriced compared to its intrinsic value, making it a poor investment choice. Growth companies and stoc

0 views • 39 slides

Improving Inventory Management Process for Freestock/Floor Stock

Addressing stock-outs in Freestock/Floor Stock inventory management using Six Sigma tools and methodologies. The project aims to reduce stock-outs by 25%, identify root causes, and optimize processes to enhance customer satisfaction and operational efficiency.

0 views • 12 slides

Industrial Sector Overview and Stock Recommendations

The industrial sector overview highlights industries like Aerospace & Defense, Machinery, and top holdings such as General Electric and United Technologies Corp. Sector performance is closely tied to economic health, impacted by events like hurricanes. Relevant valuation matrices help in assessing s

0 views • 15 slides

Financial Management: Valuation of Long-Term Securities and Stock

This content covers various aspects of financial management, including bond valuation, preferred stock valuation, common stock valuation, dividend valuation models, and dividend growth patterns. It discusses topics such as face value, coupon rates, types of bonds, semiannual compounding, and factors

0 views • 21 slides

Understanding Valuation Methods in Finance

Dive into the world of valuation methods in finance with insights on Discounted Dividend Model, Constant Growth Stock, implications of growth rates exceeding the required return, and practical examples like calculating required rate of return and stock prices using the Security Market Line. Explore

0 views • 25 slides

Understanding Market Analysis and Valuation in Real Estate

Explore essential concepts in real estate market analysis and valuation, including the unitary valuation principle, net lease drugstore market trends, the importance of location, fee simple ownership, and leased fee valuations. Gain insights into the economic principles governing highest and best us

0 views • 65 slides

Understanding Valuation Principles for Natural Resource Assets

Valuation of natural resource assets involves linking physical and monetary accounts, considering factors like economic value, extraction costs, market prices, and alternative valuation approaches. Economic theory emphasizes market prices as a means of measurement, but natural resources often requir

0 views • 25 slides

Transformation of Valuation Services Office at DOI

In the process of appraisal, consolidation, and implementation overview at the Valuation Services Office within the Department of Interior (DOI), significant changes have been made to enhance efficiency and effectiveness. This includes the consolidation of appraisal services under a single entity, r

0 views • 15 slides

International Merchandise Trade Statistics (IMTS) Valuation Recommendations

IMTS provides key recommendations for valuing goods in international trade, emphasizing the adoption of the WTO Agreement on Customs Valuation. The use of FOB and CIF valuation methods, along with specific guidelines for special categories of goods, ensures a standardized basis for valuation that is

0 views • 8 slides

Valuation of Companies in Distress: Insights on IBC & Fair Valuation

This document delves into the intricacies of valuing distressed companies, focusing on the challenges, reasons for distress, impacts, and the valuation process under the IBC framework. It emphasizes the importance of specialized knowledge and adjustments required in valuations of distressed firms, h

0 views • 37 slides