Analysis of GST Provisions in the Banking Industry

The Goods and Services Tax (GST) regime replaced the old service tax regime on July 1, 2017. In the context of the banking industry, the provisions governing GST for services provided by Cooperative Banks and Banking Cooperative Societies are similar to those of the service tax regime. While interest income is covered under GST, it is exempt through notification. This exemption applies to the major turnover generated by interest on loans. Other sources of income, such as loan processing fees and bank charges, are taxable under GST. The sale of repossessed assets is also discussed in relation to tax liability.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Co-operative Bank Conclave Goods and Services Tax Provisions in relation to Banking industry By CA. HEMANT RAJANDEKAR

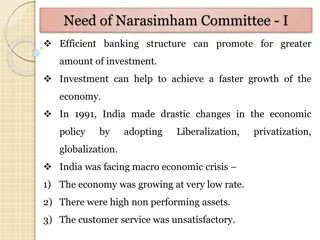

GST has replaced the old service tax regime from 1/7/2017. The essence of provisions governing GST in respect of services provide by Banking Company i.e. Co Operative Banks and Banking Co operative societies is more or less same as that of service tax regime. The turnover of interest income and investment income was exempt even in service tax. There is a difference between terms exempt from GST and not covered in GST. Interest income is covered in GST but exempt by way of notification.

DEFINATION OF AGGRAGATE TURNOVER sec 2 (6) "aggregate turnover" means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis), exempt supplies, exports of goods or services or both and inter-State supplies of persons having the same Permanent Account Number, to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax and cess; Major portion of turnover of a banking company is from interest on loans. This turnover ie interest earnings is exempt from GST as per entry no 27 of the notification 12/2017. Explanation to sec 10, Composition levy and Sec 22 Registration excludes Services provided by way extending deposit, loans and advances in so far the consideration is represented by way of interest or discount

TAXABLE TURNOVER AND EXEMPTED TURNOVER Hence what remain taxable is mostly other income ie loan processing Fees, DD /TT /NEFT/RTGS charges, cheque book charges, bank charges, annual fees for SMS, Locker rent etc to name a few. Moreover, each income arising from source other than that of interest need to be carefully scrutinized for the purpose of ascertaining applicability of GST. Turnover arising from interest income on loans and advances is exempt from GST Further Inter se sale and purchase of foreign currency amongst banks or authorized dealer of foreign exchange is also exempt. Thus, sale of foreign to person other than bank or authorized dealer is liable for GST. Value of taxable service shall be determined as per Rule 32 of CGST Rules 2017.

Sale of repossessed assets The lenders make sale of a repossessed asset on the strength of the hypothecation agreement, and not as a factor or agent. The matter was discussed in a Calcutta High Court ruling of Tata Motors Finance vs Asst Commissioner of Sales tax. While there have been rulings qualifying the position of the lender, there have been other rulings stating that the title ownership of the assets does not determine the tax liability in case of sale of repossessed goods. There is no question of GST on sale of immovable property. Where the subject matter of sale is a movable property Rule 32(5) of CGST Rule come in to picture.

The Rule states as follows: (5) Where a taxable supply is provided by a person dealing in buying and selling of second hand goods i.e. used goods as such or after such minor processing which does not change the nature of the goods and where no input tax credit has been availed on purchase of such goods the value of supply shall be the difference between the selling price and purchase price and where the value of such supply is negative it shall be ignored: Provided that the purchase value of goods repossessed from a defaulting borrower, who is not registered, for the purpose of recovery of a loan or debt shall be deemed to be the purchase price of such goods by the defaulting borrower reduced by five percentage points for every quarter or part thereof, between the date of purchase and the date of disposal by the person making such repossession.

ANY OTHER BUSINESS CARRIED ON BY THE BANKING COMPANY IN THE OPINION OF GST AUTHORITIES Profit/Loss from Sale and Purchase of SLR Securities. Banks buy designated securities to maintain its statutory liquid ratio. Bank withdraw or invest the amount in SLR securities to maintain the liquid balance as required by guidelines pf RBI. Further sale and purchase of securities is also guided demand generated by loans and surplus cash generated by acceptance of deposit. Investing and withdrawal is integral part of banking business and profit or loss arising from such transactions should not viewed separately from Banking business. The approach of the GST department would be disallow entire GST input credit as assessee has not followed sec 17(2).

INPUT TAX CREDIT. As per sec 17(4) of CGST A banking company or a financial institution including a non-banking financial company , engaged in supplying services by way of accepting deposits, extending loans or advances shall have the option to avail of, every month, an amount equal to fifty percent of eligible input tax credit on inputs, capital goods and input services in that month and rest shall lapse Thus, banks need to avail input tax credit as appearing in its GSTR 2B to the extent of 50% and rest shall lapse. Credit of GST paid under RCM should also be availed to the extent of 50% only

INPUT TAX CREDIT. Bank need to avail entire eligible credit and reverse 50% of the eligible credit in GSTR 3B by properly mentioning the reversal in column Precaution is to be taken for not availing credit of goods and services which are exclusively used for providing exempt services. Such credit is not eligible at the first instance. INPUT TAX CREDIT ON CAPITAL GOODS WHEN USED FOR PROVIDING TAXABLE AS WELL AS EXEMPT SERVICES. As GST credit in respect of Capital Goods are purchased by Banking Company, only 50% credit ia available. Balance 50% credit is to be capitalized alaong with cost of Asset and shall be subjected to depreciation. Useful life of such capital asset will be taken as 5 years from the date of purchase Now the total amount of input tax credited to electronic credit ledger for the whole useful life will be distributed over the useful life The ITC paid for the capital goods will be credited to electronic credit ledger

Capital Goods for the purpose of GST means goods which are having useful life of more than one year eg Note counting Machine, Computer, storage almirah etc INPUT TAX CREDIT ON CAPITAL GOODS WHEN USED FOR PROVIDING TAXABLE AS WELL AS EXEMPT SERVICES. Input Tax credited to electronic credit ledger Input Tax credit for one Month = ---------------------------------------------------------- x 1 60 ( 5 years x 12 months )

Le ne dene pad jate hai. Section 17(5) talks of blocked credits ie GST credits available in respect of works contract services, goods purchased for construction of immovable property etc are covered. Bank should be cautious for not availing and utilizing credits of prohibited items. In case such credits are availed by mistake, Department typically issues show cause notice demanding GST on exempted turnover rather than asking for reversal of ineligible credits. Sec 50(3) empowers to collect interest on only so much input tax credit which has been wrongly availed AND utilized. (Amended w.e.f. 1/7/2017 by notification 9/2022 dated 5/7/22. Hence institution should keep credit of 2-3 lacs as balance in electronic credit ledger so as to save them any lliability of interest and penalty ( My Suggestion )

GST credit Special precautions to be taken Rule 38 talks of credit to be availed only in respect of inputs and input services used for business purpose only and also keeping in mind blocked credit under sec 17(5) Further the rules talks of availing the eligible credit and then reversing the 50% in return GSTR 3B. Thus 100% credit has be availed and 50% is to be reversed in GSTR3B. Ignoring Input service distributor mechanism In case of Multi State Co-operative Banks, the GST registration number is separate for each state. Naturally there is case where Services are availed for the entire institution at Head office ie in a state in which h head office is registered. Foe example, The Banking software is purchased / maintained at Head office is used by all the branches including branches located in state other than the state in which Head office is located. A stautary auditor issues single invoice for Audit of all the bank branches ie a single invoice for audit of branches situated in different states As the services are utilized by branches situated in other states, so much of GST, as is proportional to turnover of the branches located in other states need to transferred to that state.

INOUT SERVICE DISTRIBUTOR However, the issue is not so straight forward. Head office can not bill for audit services to software sale so as to pass the credit to branches located in another state Head office has to get registration under category of input service distributor and accumulate credit of common services/purchases on this separate registration number taking proper precaution at the state of issuing of purchase order. Credit so accumulated on this specific GST registration number obtained under category of input service distributor can only be distributed by head office to branches located in different taxable territory. THANK YOU CA HEMANT RAJANDEKAR