Evaluation of Expense Allocation Proposal in ABC LIFE Insurance Company

ABC LIFE insurance company, facing reduced SH return from NPAR products due to expense allocation changes, contemplates increasing expense loading in PAR products. The presentation evaluates this proposal within the regulatory framework, exploring justifications, challenges, and alternative solutions to manage expenses effectively.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

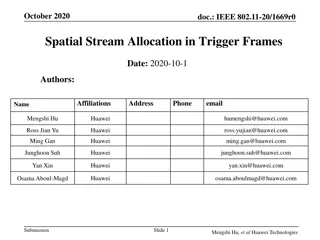

36th India Fellowship Webinar Date: 21st Jan,2022 Expense allocation to the Particiating fund Guide : Chandan Khasnobis Presented By : 1. Tarun Agarwal 2. Gaurav Jaswal 3. Megha Jain

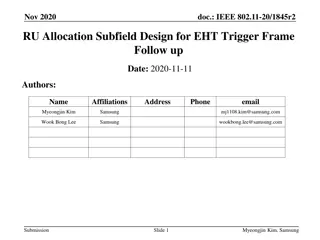

Mr. Chandan Khasnobis Mr. Chandan Khasnobis is a Partner at M/s.K.A. Pandit consultants and Actuaries. He has over 45 years of professional experience ranging across life insurance, pensions and health insurance. He has worked in covered multiple geographies including India, Kenya, Zimbabwe and United Kingdom. Particularly in India, he has held various responsibilities within the actuarial functions of some leading life insurers. He was the Head of the Department/Appointed Actuary for a period spanning 10 years in two different companies. . www.actuariesindia.org

Agenda Introduction State of company as a whole and PAR in particular. Regulations on Expenses of Management. Justifications of increasing expense loading. Arguments against increasing expense loading. Alternative solution for management of expenses Conclusion www.actuariesindia.org

Introduction ABC LIFE insurance is a 5 year old life insurance company concerned about the reduced SH return from NPAR due to recent changes in regulations relating to expense allocation. Array of products (UL, NPAR, PAR, Pensions) Strong investment department * * Small PAR proportion High expense overrun, thus low SH return In this presentation we evaluate the proposal of increasing expense loading in PAR products to make Non Par more profitable. www.actuariesindia.org

Regulation IRDAI (Expenses of Management of Insurers transacting life insurance business) Regulations, 2016 No insurer shall spend as expenses an amount basis the premiums received. Such percentages would be based on duration of business specified. Violation of limits will lead to penalties like Excess being charged to SH, etc. Duration of business Premium payment term % of FY s premium % of renewal premium 5-7 70 18 First 10 years of operations 8-9 80 19 10+ 90 20 5-7 60 15 After 10 years of operation 8-9 70 15 10+ 80 15 The Authority based upon the representation received from a newly registered insurer, in accordance with the provisions of the Act, may exercise forbearance for a period not exceeding ten years. www.actuariesindia.org

Additional Consideration of GN 6 Guidance note 6 Lays out the additional requirements for Management of participating life insurance business with reference to distribution of surplus Any deviation should be Renewal expenses Acquisition expense Expenses charged to asset share Sustainable Not affect PRE by it s effect on estate Is consistent with statutory assumptions AA may use a degree of discretion in allocating actual renewal expenses to asset share so long as policyholder reasonable expectation s are met. Acquisition charged to asset share should not depart from implicit expenses as they would be known with great certainty expenses The expenses charged to asset share should be consistent with bonuses projected in Illustration. www.actuariesindia.org

Justification Higher expense loading is justified because: New company with acquisition and maintenance expense overrun. Small existing book having few policies leads to higher Per policy fixed expenses vis- -vis NPAR and Linked. Higher expense loading would help in: Higher expense allowance will reduce SH contributions and increase SH return for par at the same time ensuring EOM compliance. Improved sales programs and quality of policy servicing. Increase in no. of PAR policies will help in achieving expense efficiency. www.actuariesindia.org

Other levers for IRR Reduced IRR due to extra expense loading could be improved by: Changing bonus structure: CRB rather than SRB Higher TB than regular bonuses Having cash bonus accumulation Changing Bonus philosophy: Including certain portions of surrender and mortality/RI surplus in Asset share. Changing Product structure: Reducing SA on death to 7 times AP Higher Interest assumption to improve bonus supportability in demonstration Including rider options to differentiate the product. www.actuariesindia.org

Debatable Purpose achieved/ defeated? Not a long term solution Impact on NB Impact on Estate Approvals Disagree Impact on Solvency Impact on PRE Future Consider ations Can we justify? Impact on Statutory Profits www.actuariesindia.org

Ways of addressing CEOs concern Detailed overrun analysis - Identify the LOBs contributing to overrun and re-price the products - Identify whether there is fixed or variable expense overrun Scale up the volume of business to reduce per policy expenses Fixed Expense Overrun Take actions to improve persistency Negotiate with distributors for lower commission Variable Expense Overrun Optimize digital distribution network Change business mix - Introduce longer PPTs in the par segment - Curb products with administrative complexity www.actuariesindia.org

Ways of addressing CEOs concern Holistic expense management - Digitalization of end-to-end processes - Consider outsourcing partnerships - Strict monitoring and control systems Seek exemption from the regulator - Regulator has the power to exempt a new company for a period of 10 years from inception Age of the insurance company ---> 0 5 yrs 10 yrs ABC Company s age Period till which exemption can be sought www.actuariesindia.org

Conclusion The Expenses Of Management Regulations, 2016 along with GN- 6 protects the par policyholders interests The CEO s suggestion could help avoid depressing shareholder returns However, this is NOT the ideal way to deal with the situation, as it is against the par policyholders interests The Company should explore other alternatives to protect shareholder returns www.actuariesindia.org

THANK YOU www.actuariesindia.org