Challenges and Objectives of International Compensation Management

International compensation management poses various complexities due to differences in salary levels, cost of living, exchange rates, and tax rates across countries. The objectives include recruitment, retention, consistency, mobility, adaptability, cost-effectiveness, and simplification of bargaining. Ensuring competitive and comparable compensation packages is crucial for organizational performance.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

International Compensation Ms Dinna Johnson Asst Professor Dept of Management Studies Nirmala college Muvattupuzha Dept of Management Studies NCM

Compensation is the amount of remuneration paid to an employee by the employer in return to the employee s services to the company. Almost all the employees accept jobs in MNCs, take-up assignments in various countries, and take-up the risk, bear inconveniences and discomforts in foreign assignments mostly based on the compensation package. compensation package plays a pivotal role in international human resource management as the employees leave their comfortable current jobs, home, relatives, friends and society at the home country to earn more finance and for better future prospects Dept of Management Studies NCM

Complexities of Compensation Management The salary and benefits levels vary from country to country. Cost of living varies widely among countries Varying requirements of providing housing, and medical and health facilities for employee family members and school facilities for employee children indifferent countries. Varying salary levels of expatriates in their respective home countries. These salary levels are viewed as opportunity costs by the expatriates while accepting compensation package for their foreign assignments Dept of Management Studies NCM

Foreign exchange rates fluctuate widely Varying tax rates. Varying rates of inflation and deflation among the developed and developing countries. Varying local conditions in host countries in terms of cost of living, availability of housing and medical facilities, school facilities and security situations that require the MNCs to design different pay packages for different countries; Dept of Management Studies NCM

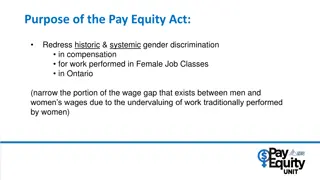

OBJECTIVES OF INTERNATIONAL COMPENSATION MANAGEMENT Recruitment and Retention of suitable Employees Consistency and Equity Facilitate Mobility Adaptability to Foreign Cultures and Environment Cost of Staff vis- -vis Ability to Pay Simplify Collective Bargaining Procedures Dept of Management Studies NCM

Organizational Performance Competitive and Comparable Compensation Package Dept of Management Studies NCM

Components of international compensation Pay or Base salary Cost of Living Allowance Tax equalization Allowance International Market Allowance Housing Allowance Educational Allowance Relocation Allowance Settling-in and settling out Allowance Medical Allowance Dept of Management Studies NCM

Hardship and Danger Allowance Exchange rate Protection Allowance Insurance Allowance Stock-Option Bonus Gratuity Pension Benefits Social Security Measures Dept of Management Studies NCM

Pay or Base salary The meaning of the term pay or base salary varies from country to country as well as from one MNC to the other with regard to international compensation. Some organizations provide some base salary to all categories of employees like PCNs,TCNs and HNCs. These organizations pay international market allowance for foreign employees and domestic market allowance for HCNs over and above the base salary. Some other MNCs provide base salary equivalent to the salary earned by the PNCs and TCNs in their respective home countries and pay additional allowances to meet the cost of hardships, inconveniences and risks Dept of Management Studies NCM

Structure of International Compensation package Dept of Management Studies NCM

Cost of Living Allowance (COLA) Cost of living varies from one city to other city of the same country and from one country to the other country. In addition, it varies from one period of time and the other period of time in the same city and country and year. Some MNCs include housing allowance, education allowance and tax equalization allowance in COLA, while others pay them separately. The COLA would be adjusted accordingly when it is inclusive of other allowances as well as exclusive of other allowances Dept of Management Studies NCM

Tax Equalization Allowance Personal income tax makes wide variation in the salary of employees among different countries. The jobs in United Arab Emirates, Oman and Brunei Darussalam are more attractive than that of Sweden. MNCs consider the varying tax rates in different places, while designing the compensation package for expatriates in order to maintain the same living standard as well as same ability to save compared to those of employee s home town and/or previous place of employment. Dept of Management Studies NCM

International Market Allowance Employees with distinctive skills and skills of short supply are demanded by many MNCs across the world. MNCs, in order to attract such employees pay competitive salary, by adjusting the compensation package. Adjustment of compensation package in this regard would be payment of international market allowance. Some MNCs include cost of living allowance, tax equalization allowance and exchange rate stabilization allowance in the international market allowance. However, international market allowance is to attract the employees by paying more than what they are offered by competitive employers. Dept of Management Studies NCM

Housing Allowance House rents in some cities/countries would be exorbitant and some times they are more than the employees after tax salary t would be rather difficult for an employee to accept overseas employment with such exorbitant house rents. They can t live in similar houses of their home country, even if they accept foreign employment with exorbitant rents. Hence, MNCs pay house rent allowance equivalent to on- going house rents in the place of employment. Some MNCs procure the houses on lease and pay the actual house rent directly to the house owners and relieve the employee from uncertainties of house rent cost hikes from time to time as well as cultural issues/ harassment from the land lords Dept of Management Studies NCM

Educational Allowance Educational allowances for expatriates include cost of language training to employee and his/her family members, training an educational cost for employee s continuous learning and development and educational expenses of school/university going children of the employee. Dept of Management Studies NCM

Relocation Allowance Movement of an employee and his/her family members from the home country to a foreign country involves a variety of expenses like temporarily closing up of the family activities and professional activities at the home, transferring the children from the home country school/university to the foreign schools/universities, payment of advanced taxes, rents and fee at the home country, acquiring visa, travel to foreign country, freight and loss of certain things including baggage. Dept of Management Studies NCM

Settling-in and Settling-out Allowances Settling-in and settling-out allowances are similar to relocation allowances. MNCs provide settling-in allowances in order to reduce employee s financial burden from buying various goods/services when they arrive in a foreign country. Settling-out allowance is provided to meet the costs of leaving for home country or any other foreign country. Dept of Management Studies NCM

Hardship Premium The dangerous geographical conditions like earth quakes in Indonesia, physical threat, violence and hostility to foreigners from locals make the foreign employment difficult. The Wars between the countries like Iran-Iraq war, Iraq-Kuwait war, and Eritrea and Ethiopia war also created problems for foreigners who worked in these countries during the war periods. Further, the military coups like those in Pakistan and Fiji Islands caused discomfort for the foreigners worked in these countries. Added to these hardships, prevalence of disease, inadequate/poor medical facilities in some developing countries particularly of those Africa, and South American countries create further hardship for foreigners to live and work in such countries. Dept of Management Studies NCM

Hardship allowance varies from 5% to 25% of base salary It is rather difficult for MNCs to recruit as well as retain the employees for such hard jobs and risky and discomfort locations, with the normal compensation package. Therefore, MNCs offer special allowance, i.e., hardship allowance in order to attract and retain employees for hard jobs as well as jobs in hard locations. Danger pay allowance is paid to employees where civil insurrection, civil war, terrorism, war time conditions threaten physical harm or pose imminent danger to the health or well-being of employee. Dept of Management Studies NCM

Exchange Rate Protection Allowance Foreign exchange rate fluctuations greatly determine the repatriation amount to home country of foreign employees. Adverse fluctuations reduce the repatriation amount, and thereby discourage the foreign employees from continuation of employment. For example, the fluctuations in the value of US dollar against Indian Rupee during 2007 and 2008 (from 1US$ = 46 to 1US$ = 39), prompted some Indian software professionals working US companies to quit the US jobs and return to India Dept of Management Studies NCM

Insurance Allowances MNCs either provide insurance allowance or buy insurance policies for employees in order to provide them security against all kinds of health issues, risks against life and physical security of employee and his/her family members. Different kinds of insurance facilities provided to employees include: Dept of Management Studies NCM

Health Insurance Prescription Drug coverage Dental Insurance Vision insurance Travel insurance Life insurance Vehicle insurance Emergency medical evacuation and repatriation service Medical information, records and physician assistance. Dept of Management Studies NCM

Stock Option Stock options are common in most of the MNCs in many countries. This benefit allows employees to purchase the shares of the MNCs at fixed and/or reduced prices. Employees are motivated when the MNC allows them to buy the shares at the reduced prices. The stock options are viewed as performance-based incentives. This scheme allows the MNCs to attract and retain competent employees, by creating a sense of belongingness and ownership among them Dept of Management Studies NCM

Bonus MNCs provide individual and/or group bonus to expatriates based on their performance like output, sales, productivity, savings and cost minimization. This benefit provides mutual advantage to the employees as well as MNCs. Dept of Management Studies NCM

Gratuity Gratuity is the retirement benefit and/or contract-termination benefit. This benefit encourages the employees to continue their employment with the same MNC until the completion of contract and for the long run Dept of Management Studies NCM

Pension Some MNCs pay pension to the expatriates and host country nationals who served the company for relatively long-period. However, MNCs face complexities in pension payment with regard to calculation, country of origin, varying legal requirements of different countries, and fluctuations in exchange rates. Therefore, they limit pension facility to certain categories of employees only. Dept of Management Studies NCM

Other Benefits Cafeteria Travel fares Recreational Allowances Facilities for physical and mental fitness Socialization programs Conveyance benefits Dept of Management Studies NCM

Social Security Measures For employment security For health protection For old age and retirement For personal identification, participation and stimulation Dept of Management Studies NCM

Performance management (PM) is a goal- oriented process directed toward ensuring that organizational processes are in place to maximize the productivity of employees, teams, and ultimately, the organization. It is a major player in accomplishing organizational strategy in that it involves measuring and improving the value of the workforce. PM includes incentive goals and the corresponding incentive values so that the relationship can be clearly understood and communicated. There is a close relationship between incentives and performance. Dept of Management Studies NCM

Performance appraisal (PA) is a formal system of review and evaluation of individual or team task performance. A critical point in the definition is the word formal, because in actuality, managers should be reviewing an individual s performance on a continuing basis. PA is especially critical to the success of performance management. Although performance appraisal is but one component of performance management, it is vital, in that it directly reflects For many organizations, the primary goal of an appraisal system is to improve individual and organizational performance. There may be other goals, however. A potential problem with PA, and a possible cause of much dissatisfaction, is expecting too much from one appraisal plan. Dept of Management Studies NCM

Performance Appraisal Process Dept of Management Studies NCM

Uses of Performance Appraisal Human Resource Planning Recruitment and Selection Training and Development Career Planning and Development Compensation Programs Internal Employee Relations Assessment of Employee Potential Dept of Management Studies NCM

Characteristics of an Effective Appraisal System Job-Related Criteria Performance Expectations Standardization Trained Appraisers Continuous Open Communication Conduct Performance Reviews Due Process Dept of Management Studies NCM

Incentive An Incentive or Reward can be anything that at tracts a employee s attention, stimulates him to work; Other words it can define as an incentive e scheme is a plan or programme to motivate individual or group performance. In other terms, incentives are also called as payments by results . Incentives are paid in addition to wages and salaries Incentives depend upon productivity, sales, profit, or cost reduction efforts. Now, let us also see the different incentive schemes. There are: (i) Individual Incentive Schemes, (ii) Group Incentive Programs and (iii) Plant Wide Incentive Schemes. Dept of Management Studies NCM

Individual Incentives include: Merit Pay Plans (annual increase, based on performance) Piecework Plans (pay based on number of units produced typically in a specified time period.) Time-savings bonuses and commissions Work best where clear objectives can be set and tasks are independent. Dept of Management Studies NCM

Group Incentives include: Incentives can be offered to groups, rather than individuals, when employees' tasks are interdependent and require cooperation. Plant-wide Incentives include: Direct employee efforts toward organizational goals (such as cost reduction) Scanlon Plan - supervisor and employee committees suggest labour-saving improvements IMPROSHARE - formula is used to determine bonuses based on labor cost savings Dept of Management Studies NCM

The Rewards are classified into two: Direct compensation Indirect compensation Dept of Management Studies NCM

Incentives In recent years some MNC have been designing special incentives programmes for keeping expatriate motivated. programmes for keeping expatriate motivated. In the process a growing number of firms have dropped the ongoing premium for overseas assignment and replaced it with on time lump-sum premium. The lump sum payment has at least three advantages. First expatriates realize that they are paid this only once and that too when they accept an overseas assignment. So the payment tends to retain its motivational value. Second, costs to the company are less because there is only one payment and no future financial commitment. This is so because incentive is separate payment, distinguishable for a regular pay and it is more readily for saving or spending. Dept of Management Studies NCM