Understanding Product Intervention Rules in MiFIR for Investor Protection

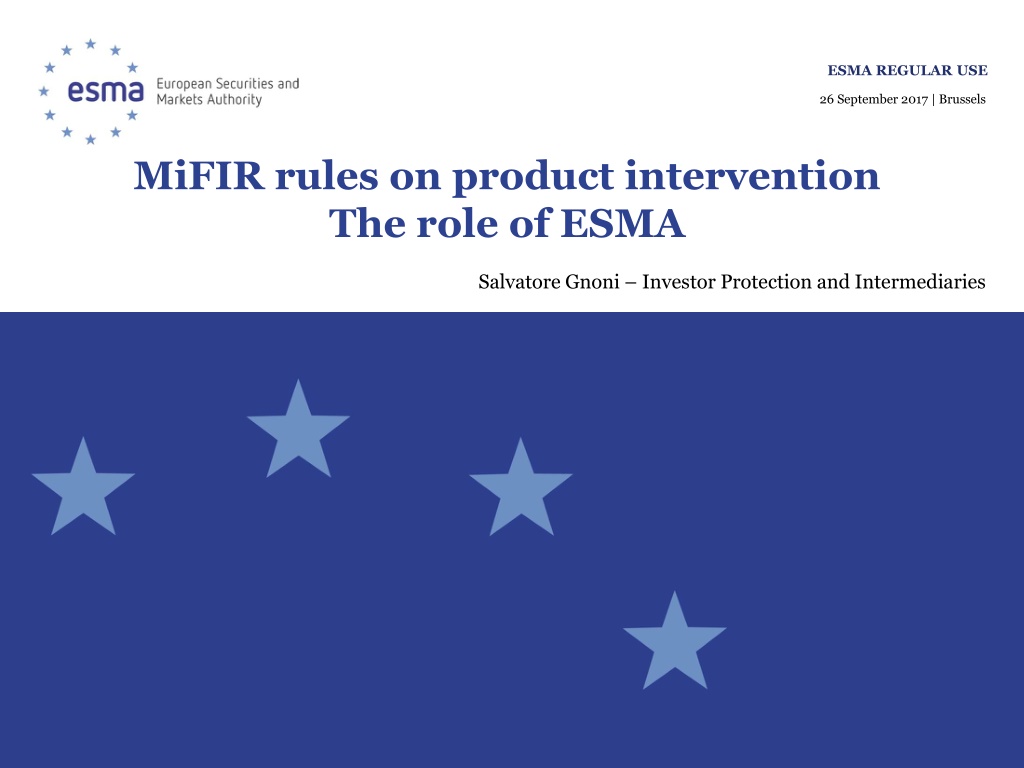

MiFIR rules on product intervention under ESMA involve regulating all phases of the product/service cycle to protect investors. It grants powers to authorities to intervene in marketing and selling certain financial instruments. ESMA's role, conditions for intervention, and differences between NCAs and ESMA measures are outlined.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

ESMA REGULAR USE 26 September 2017 | Brussels MiFIR rules on product intervention The role of ESMA Salvatore Gnoni Investor Protection and Intermediaries

MiFID II/MiFIR - Investor protection The investor protection regulatory framework covers all phases of the product/service cycle. Manufacturing of the product Marketing and distribution of products/provision of services Post-sale Product governance Inducements Independent advice Reporting on costs and charges Complaints- handling Suitability/appropriateness Information to clients Product governance On-going advice Organisational requirements for investment firms Best execution (Article 3 exemptions) Powers to national supervisors and ESMA 2

Product intervention - The broad picture Power to prohibit or restrict (a) the marketing, distribution or sale of certain financial instruments [and structured deposits] or financial instruments with certain features or (b) certain financial activities or practices MiFIR product intervention powers are granted to National Competent Authorities and to ESMA or, for structured deposits, to EBA Possibility to intervene on a precautionary basis before a financial instrument has been marketed, distributed or sold to clients. Product intervention powers in the PRIIPS Regulation The role of EIOPA Relevant provisions (Article 9 of ESMA Regulation) Recital (29) and Articles 39 to 43 of MiFIR (Regulation 600/2014/EU) Articles 19 and 21 of MiFIR Commission Delegated Regulation 567/2017 3

The conditions for the use of product intervention powers Main conditions for intervention [ESMA]: the existence of a significant investor protection concern, a threat to the orderly functioning and integrity of financial markets or commodity markets, or a threat to the stability of the whole or part of the financial system in the EU; Applicable EU regulatory requirements do not address the threat; and NCAs have not taken action to address the threat or the actions they have taken do not adequately address the threat Any intervention should consider: Proportionality risks of regulatory arbitrage 4

Main difference between NCAs and ESMA measures ESMA s measures are temporary and need to be renewed. Measures adopted by ESMA under Article 40 of MiFIR are temporary and cannot exceed 3 months. At the end of the 3 months, ESMA may renew a measure. NCAs measures can be permanent or temporary. 5

National measures ESMA coordination role ESMA to assess whether action taken by NCAs is justified and proportionate and that, where appropriate, a consistent approach is taken by NCAs ESMA to receive notification of national measures and to adopt an opinion on whether prohibitions or restrictions are justified and proportionate NCAs to explain publicly reasons for not following ESMA opinion 6

ESMA - Strengthening market monitoring and on-going work Product intervention powers allow NCAs and ESMA to take specific action on issues of significant importance. To be able to wisely use these powers, both NCAs and ESMA need to monitor financial markets to identify concerns to investor protection or the orderly functioning and integrity of financial markets. The task of monitoring the quite heterogeneous financial market across Member States and multiple asset classes is complex. Both ESMA and NCAs continue developing appropriate market monitoring. June 2017 - ESMA statement on preparatory work in relation to CFDs, binary options and other speculative products. 7

Thanks 8

![Innovative Solutions for Investor Success - [Your Name] & [Your Company Name]](/thumb/196869/innovative-solutions-for-investor-success-your-name-your-company-name.jpg)