Practical Concepts in Applied Arithmetic

Explore equivalent representations of rational numbers, convert between fractions, decimals, and percentages, understand ratios and proportions, solve money-related problems, and delve into situations involving proportionality. Learn about wages, salaries, gross pay, net pay, statutory deductions, income tax, VAT, and more through practical examples and calculations.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

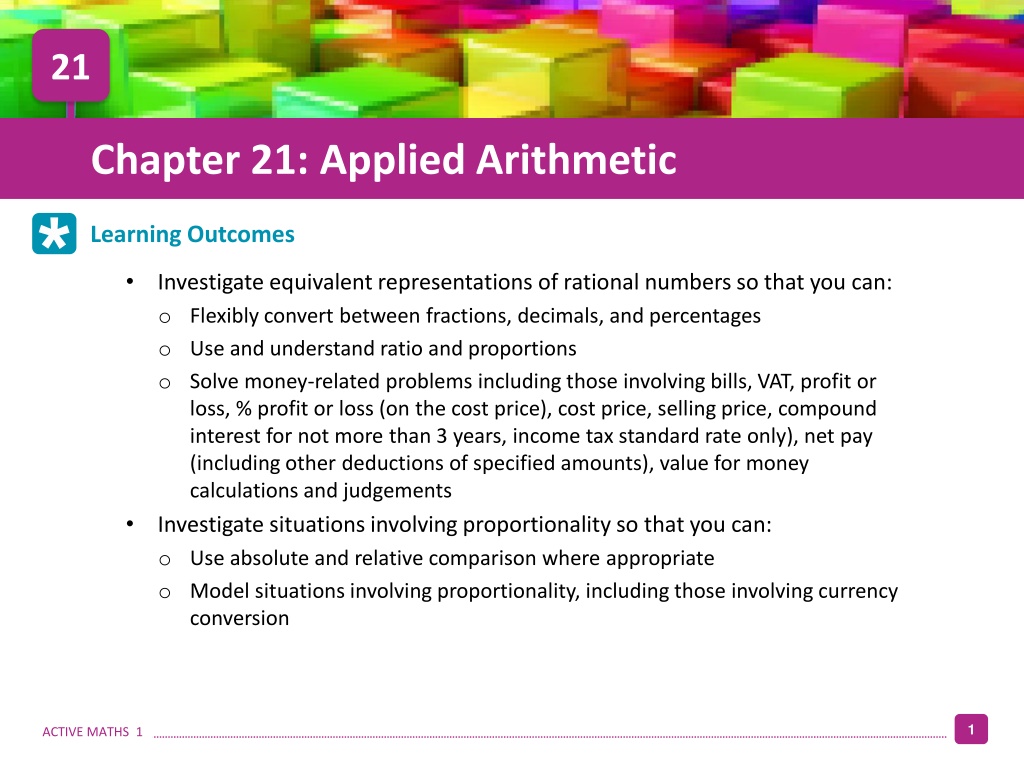

21 Chapter 21: Applied Arithmetic Learning Outcomes Investigate equivalent representations of rational numbers so that you can: o Flexibly convert between fractions, decimals, and percentages o Use and understand ratio and proportions o Solve money-related problems including those involving bills, VAT, profit or loss, % profit or loss (on the cost price), cost price, selling price, compound interest for not more than 3 years, income tax standard rate only), net pay (including other deductions of specified amounts), value for money calculations and judgements Investigate situations involving proportionality so that you can: o Use absolute and relative comparison where appropriate o Model situations involving proportionality, including those involving currency conversion 1 ACTIVE MATHS 1

21 Income and Deductions Wage: If you are paid according to the number of hours worked or goods produced, this is called a wage. Salary: If you are paid the same amount regardless of the number of hours worked or goods produced, this is called a salary. Gross pay: Gross pay or gross income is money earned before deductions are made. Net pay: Net pay or net income or take-home income is money received after all deductions have been made. Statutory deductions: Statutory deductions are payments that must be made to the state. Statutory deductions Income tax Pay-related social insurance (PRSI) Universal social charge (USC) 2 ACTIVE MATHS 1

21 Income Tax The lower rate is called the standard rate of tax. There are two rates of income tax. The higher rate is called the higher rate of tax. Gross tax: Gross tax is the amount of tax owed to the state before tax credits are deducted. Tax Credit: The tax credit is a sum deducted from the gross tax a taxpayer owes to the state. Tax payable: Tax payable is gross tax less the tax credit. Michael earns 27,000. He pays tax at a rate of 20%. He has a tax credit of 1,950. He has instructed his employer to pay his annual health insurance premium of 550 directly from his salary. Find Michael s: (a) Tax payable; (b) Total deductions; (c) Net pay. (a) Gross tax = 27,000 20% = 27,000 0.20 = 5,400 (b) Total deductions = Tax payable + Health insurance = 3,450 + 550 = 4,000 Tax payable = Gross tax Tax credit = 5,400 1,950 = 3,450 (c) Net pay = Gross pay Total deductions = 27,000 4,000 = 23,000 3 ACTIVE MATHS 1

21 VAT: Value Added Tax Value added tax (VAT): Value added tax (VAT) is a tax charged by the state on spending. Michelle sees a camera in a shop window. The price before VAT is 250. VAT is charged at 23%. How much will she pay for the camera? Step 1: Find 23% of 250: VAT = 250 0.23 = 57.50 Step 2: Find the price after VAT: Price after VAT = 250 + VAT = 250 + 57.50 = 307.50 Carol gets her hair done and the total bill comes to 56.75. VAT is charged at the reduced rate of 13.5%. What was the original bill before VAT was added? Original bill = 100% Original bill + VAT = 113.5% 113.5% = 56.75 1% = 56.75 113.5 = 0.50 100% = 0.50 100 = 50 Original bill = 50 4 ACTIVE MATHS 1

21 Household Bills Households have many bills, from groceries to phones and utilities such as electricity and gas. Paul has his telephone service with Digicell. His monthly standing charge is 50. This includes 300 minutes of calls and 200 text messages. If he exceeds the number of minutes allowed, he is charged 15c per minute. Every additional text message over the 200 limit costs 12c. In the month of December, Paul sends 210 text messages and the duration of all his calls is 320 minutes. VAT is charged at 21%. Calculate Paul s total bill. DIGICELL 50 Standing Charge 0 Text Messages included in plan 200 @ 0.00 10 @ 0.12 = 0.12 10 1.20 Text Messages outside of plan 0 Calls included in plan 300 mins @ 0.00 per min 20 mins @ 0.15 per min = 0.15 20 3 Calls outside of plan 50 + 1.20 + 3 54.20 Total Excluding VAT 12.47 VAT @ 23% 54.20 x 0.23 66.67 Total Including VAT 54.20 + 12.47 5 ACTIVE MATHS 1

21 Profit, Loss and Discounts Profit: If a product or service is sold for more than it cost to buy or produce, then the seller has made a profit. Loss: If a product or service is sold for less than it cost to buy or produce, then the seller has made a loss. Percentage profit mark-up: The percentage profit mark-up is the profit expressed as a percentage of the cost price: If a profit is made, the selling price is the cost price plus the profit. If a loss is made, the selling price is the cost price minus the loss. Discount: A discount is a reduction in the price of a bill or charge. 6 ACTIVE MATHS 1

21 Profit, Loss and Discounts Alix buys an iPod for 75 online. She then sells it for 100. Calculate: (a) The cost price (b) The selling price (c) The profit or loss made (d) The percentage mark-up (a) Cost price = 75 (price Alix paid) (b) Selling price = 100 (price Alix sells for) (c) Profit = Selling price Cost price = 100 75 = 25 (d) Percentage mark-up 7 ACTIVE MATHS 1

21 Profit, Loss and Discounts Murphy Table Tennis Supplies sends an invoice to TT Youth Club. The terms tell us that if this is paid within one month, a discount of 5% is applied. Calculate: (a) The amount of discount (b) The price after discount. (a) From the invoice, the club owes Murphy Table Tennis Supplies 435.60. The discount is 5% (if paid within one month). 435.60 @ 5% = 435.60 0.05 = 21.78 (b) 435.60 21.78 = 413.82 The price to be paid after discount is 413.82. 8 ACTIVE MATHS 1

21 Ratio & Proportion A pizza is cut into 14 equal slices and is shared between Alan, Brian and Ciara in the ratio 2 : 2 : 3 respectively. How many slices does each person get? Step 1: Write down the total number of parts: 2 + 2 + 3 = 7 parts Step 2: Express each person s share as a fraction of the total number of parts: Alan Brian Ciara Step 3: Multiply each fraction by the amount to be shared: Alan Brian Ciara 9 ACTIVE MATHS 1

21 Proportionality Two quantities are in direct proportion if, when the numbers involved are changed, their ratios stay the same. Allie s pocket money is in direct proportion to the number of hours of chores done. She gets 12 for each two hours of chores she does. (a) If Allie helps out at home for three hours, how much will she get? (b) How many hours would she have to help out for to get 36? (a) Find out what she gets for 1 hour: 2 hours = 12 1 hour = 6 So 3 hours = 6 3 = 18 Answer = 18 (b) Find the number of hours she needs to work to get 36: From part (a): 1 hour = 6 36 6 = 6 hours 10 ACTIVE MATHS 1

21 Value for Money Calculations and Judgements Proportion calculations can be used to decide which items in a shop offer the best value for money. Many items sold in supermarkets have a price and a price per 100 g (or per kg) on the shelf edge label in front of the product. This lets people compare products and get the best value for money. Chocolate finger biscuits are on offer in two different sizes in Gerry s local shop. A 140 g pack costs 1.50 while a 230 g pack costs 3.00. Which pack is better value? Step 1: Find the cost of 100 g for the 140 g pack: 140 g = 1.50 1 g = 1.50 140 100 g = ( 1.50 140) 100 = 1.07 Price per 100 g is 1.07 Step 2: Find the cost of 100 g for the 230 g pack: 230 g = 3.00 1 g = 3.00 230 100 g = ( 3.00 230) 100 = 1.30 Price per 100 g is 1.30 Step 3: Give your judgement: The 140 g pack is better value as it is cheaper per 100 g. 11 ACTIVE MATHS 1

21 Currency Exchange In the Eurozone, the unit of currency is the euro. If you travel to any country within the Eurozone, there is no need to change your money. However, if you travel to any country outside the Eurozone, you will need to change your money. For example, if you travel to Japan, you will need to convert your money from euro into Japanese yen. On a certain day, 1 = 0.92. Chris is travelling to London tomorrow and wants to change 200 into sterling ( ). How much sterling will he get? 1 = 0.92 200 = 0.92 200 = 184 Chris will get 184. The Ethiopian currency is called the birr. On a particular day, the euro birr exchange rate was 1 = 22 birr. Alicia was returning home from Ethiopia and converted her money in the airport. How much did she receive in euro (to the nearest cent) for 1,000 birr? 22 birr = 1 1 birr = 1 22 1,000 birr = ( 1 22) 1000 = 45.4545 1,000 birr 45.45 (rounded to the nearest cent) 12 ACTIVE MATHS 1

21 Compound Interest If you borrow money from a bank or any financial institution, they will also charge you for the use of the money they loaned you. This is called interest payable. When you invest (save) money in a financial institution, they must pay you for the use of this money. This is called investment interest. 100 is borrowed at 2% for three years. Calculate the final value. Method 1. Using a table year by year Principal ( ) Rate of interest Principal + interest Amount at end of year 100 100(1.02) 102 Year 1 0.02 Year 2 102 0.02 102(1.02) 104.04 104.04 104.04(1.02) 106.12 Year 3 0.02 13 ACTIVE MATHS 1

21 Compound Interest Jerome wins 10,000 in his local GAA club lotto. He invests the money at a rate of 3%. (a) Find the value of the investment at the end of the first year. (b) At the start of the second year Jerome withdraws 1,450. Find the value of the investment at the end of the second year if the interest rate offered in the second year is 3.5%. Method 1. Using a table year by year Principal ( ) Rate of interest Principal + interest Amount at end of year 10,000 Year 1 10,000(1.03) 10,300 0.03 Withdrawal 1,450 8,850 8,850(1.035) 9,159.75 Year 2 0.035 14 ACTIVE MATHS 1

21 Compound Interest FORMULA F = Final value (amount borrowed/invested + interest) P = Present value (amount borrowed/invested) F = P(1 + i )t i = Rate of interest per unit time (usually years) (always use decimal form) You can find this formula on page 30 of the Formulae and Tables booklet. t = Time (number of time periods you had the loan or investment) 100 is borrowed at 2% for three years. Calculate the final value. Method 2. Using the formula F = P(1 + i )t P= 100 i = 0.02 t = 3 years F = P(1 + i )t F = 100(1 + 0.02 )3 F = 100(1.02 )3 F= 106.12 15 ACTIVE MATHS 1