Banking Regulations in Bangladesh: A Comprehensive Overview

The Bangladesh Bank Order of 1972 established the central bank, Bangladesh Bank, which regulates banking activities under the Bank Companies Act of 1991. This legislation, along with the Financial Institutions Act of 1993, sets the framework for overseeing bank companies and non-banking financial institutions. Scheduled and non-scheduled banks play distinct roles, with scheduled banks requiring specific criteria for designation by Bangladesh Bank. The regulatory framework aims to safeguard the interests of companies and depositors while ensuring proper management within the banking sector.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

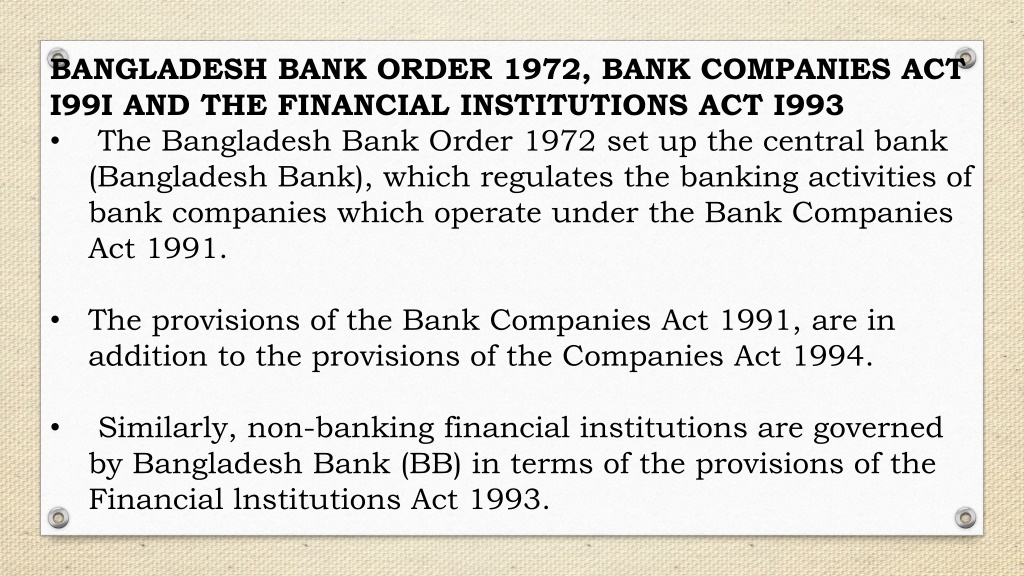

BANGLADESH BANK ORDER 1972, BANK COMPANIES ACT I99I AND THE FINANCIAL INSTITUTIONS ACT I993 The Bangladesh Bank Order 1972 set up the central bank (Bangladesh Bank), which regulates the banking activities of bank companies which operate under the Bank Companies Act 1991. The provisions of the Bank Companies Act 1991, are in addition to the provisions of the Companies Act 1994. Similarly, non-banking financial institutions are governed by Bangladesh Bank (BB) in terms of the provisions of the Financial lnstitutions Act 1993.

The latter two legislations delimit the scope of activities of bank companies and non-banking financial institutions, respectively. They provide for the regulatory steps which may be taken by Bangladesh Bank, including powers to license and give directions to such companies in the public interest, in the interest of monetary and/or banking policy, '

in order to Prevent the affairs of such companies being conducted in a manner detrimental to the interest of the companies or depositors, and to ensure their proper management

What is Scheduled Bank? Scheduled bank is a bank which, by notification in the official gazette, is declared as scheduled bank by Bangladesh Bank according to Article 37 of Bangladesh Bank Order, 1972. Scheduled Banks: The banks which get license to operate under Bank Company Act, 1991 are termed as Scheduled Banks. Non-Scheduled Banks: The banks which are established for special and definite objective and operate under the acts that are enacted for meeting up those objectives, are termed as Non-Scheduled Banks. These banks cannot perform all functions of scheduled banks.

Criteria for a Scheduled Bank: Bangladesh Bank may declare any bank to be scheduled bank under Article 37 of Bangladesh Bank Order, 1972 which is carrying on the business of banking in Bangladesh and which- i. is a banking company, or a co-operative bank, or a corporation or a company incorporated by or established under any law in force in any place in or outside Bangladesh; ii. has a paid-up capital and reserves of an aggregate value of an amount not less than that required to be maintained under of , : Provided that in the case of a co-operative bank, an exception may be made by the Bangladesh Bank;

It is mentionable that Bangladesh Bank, being empowered by the provisio under section 13(2) of the Banking Companies Act, 1991 and in consultation with the Government, through the notification no. BRPD(R 1)717/2008 511 dated August 12, 2008 has refixed that the minimum Paid-up Capital and Reserve Fund of banking companies shall be Taka 400 crore, of which the paid-up capital shall be not less than Taka 200 crore.2 i. satisfies the Bangladesh Bank that its affairs are not being conducted in a manner detrimental to the interests of its depositors;

Number of Scheduled Bank: There are 58 scheduled banks3 in Bangladesh who operate under full control and supervision of Bangladesh Bank which is empowered to do so through Bangladesh Bank Order, 1972 and Bank Company Act, 1991. Scheduled Banks are classified into following types: a. State Owned Commercial Banks (SOCBs): There are 6 SOCBs which are fully or mostly owned by the Government of Bangladesh. (In 2015, Government decided to treat BASIC Bank and BDBL as SOCB. )

a. Specialized Banks (SDBs): 3 specialized banks are now operating which were established for specific objectives like agricultural development. These banks are also fully or mostly owned by the Government of Bangladesh. Probashi Kallyan Bank is the latest specialized scheduled bank4. b. Private Commercial Banks (PCBs): There are 40 private commercial banks which are mostly owned by the private entities. PCBs can be categorized into two groups: i. Conventional PCBs: 32 conventional PCBs are now operating in the industry. They perform the banking functions in conventional fashion i.e interest based operations.

ii) Islami Shariah based PCBs: There are 8 Islami Shariah based PCBs in Bangladesh and they execute banking activities according to Islami Shariah based principles i.e. Profit-Loss Sharing (PLS) mode. The list of Islamic banks are: 1. Islami Bank Bangladesh Limited 2. ICB Islamic Bank Limited 3. Al Arafah Islami Bank Limited 4. Social Islami Bank Limited 5. Export Import Bank of Bangladesh Limited 6. First Security Islami Bank Limited 7. Shahjalal Islami Bank Limited 8. Union Bank Limited a. Foreign Commercial Banks (FCBs): 9FCBs are operating in Bangladesh as the branches of the banks which are incorporated in abroad.

Number of Non-scheduled Bank: There are some non-scheduled banks in Bangladesh. Some of them are: 1.Ansar VDP Unnayan Bank 2.Karmashangosthan Bank Jubilee Bank

According to Section 31 of the Banking Companies Act, 1991, no company shall carry out banking business in Bangladesh without obtaining a license from Bangladesh Bank. Bangladesh Bank will decide to grant licenses after considering the need and overall strategy congenial to effective monetary and financial sector policy for the country.

Bangladesh Bank must be satisfied that the following terms and conditions for the establishment of a new banking company in Bangladesh have been met:

Status of the new commercial bank. 1. Must be a public limited company incorporated in Bangladesh. Paid up capital requirement for a bank to be established: The paid up capital of new commercial bank shall not be less than Taka 400.00 Crore as required under Bank Company Act 1991. The share capital will be formed with ordinary shares only.

1. Sponsors and share capital contribution: Initial minimum capital Taka 400.00 crore shall be provided by sponsors of the proposed bank. The bank shall issue public shares within three (3) years from the date of commencement of the banking business. Public issues shall be at least equal to sponsors' share amount. her, sister of the individual or anyone dependent on that individual.

The minimum shareholding stake of each sponsor shall be Taka 1.00 crore and the maximum shall be 10% of the proposed bank s total share capital. This ceiling of 10% applies to an individual, company or family member, either personally, jointly or both. Family is defined herewith to include spouse, father, mother, son, daughter, brot

The ceiling of 10% may be relaxed in the case of a bank set up as a joint venture with a foreign financial institution or banking company. Sponsors holding 5% or more shares shall have to sign a capital maintenance agreement (CMA) stating that they would, jointly and severally inject additional capital if the bank ever fell below any minimum capital requirement.

In case of failure to inject such capital within the stipulated time, the responsibility would fall on individuals within the sponsors group to bear the entire burden of the required injection. The sponsors' shares shall not be transferred within a period of three (3) years from the commencement of the business, without permission from Bangladesh Bank.

If an individual or any member of his/her family is or had been a loan defaulter with a bank/financial institution at any time during the past five years shall not be eligible to apply as a sponsor of the proposed bank. An individual awaiting verdict of any undisposed lawsuit in any court/tribunal against his/her loan default status shall not be eligible to apply as a sponsor of the proposed bank.

A tax assessee shall not be eligible to be a sponsor if he/she has any unpaid undisputed arrear of income tax assessed for the current year or any past year.

A tax assessee penalized or awaiting court/tribunal verdict on any suit for offence under Chapter XXI of Income Tax Ordinance, 1984 shall not be eligible to apply as a sponsor of the proposed bank. A tax assessee who has not submitted overdue tax return for the current year or who has undisposed tax prosecution reopened under section 93 of Income Tax Ordinance, 1984 shall not be eligible to apply as a sponsor of the proposed bank.

1. Fit and Proper Test for Sponsors/Directors Competence, integrity and qualifications of the Sponsors of the proposed bank becoming the first Directors shall be evaluated. The evaluation process shall include background checks on whether previous activities, including regulatory or judicial judgments, profession, raise doubts concerning their competence, sound judgment, or integrity.

The Sponsors/Directors shall qualify the Fit and Proper Test criteria (see Annexure V) applicable for the Bank Directors in Bangladesh. His/her inclusion in the Board of Directors shall not contravene any law for the time being in force in Bangladesh and in the country of his/her present permanent domicile. He/she has not evaded any legal proceedings of any country for any criminal offences or crime against humanity except for offences of minor traffic violations etc.

Bangladesh Bank shall evaluate proposed sponsors as to expertise and integrity (fit and proper test), and any potential for conflicts of interest. The fit and proper criteria include:

(i) skills and experience in relevant financial operations commensurate with the intended activities of the bank; and (ii) no record of criminal activities or adverse regulatory judgments that make person unfit to uphold important position in a bank.

Fit and Proper Test: The concerned person must have management/business or professional experience for at least 10 (ten) years; (S)he has not been convicted in any criminal offence or involved in any fraud/forgery, financial crime or other illegal activities; (S)he has not been subject to any adverse findings in any legal proceedings, (S)he has not been convicted in regard to contravention of rules, regulations or disciplines of the regulatory authorities relating to financial sector;

(S)he has not been involved with a company/firm whose registration/ license has been revoked or cancelled or which has gone into liquidation; Loans taken by him/her or allied concern from any bank or financial institution have not become defaulted; (S)he has not been adjudicated a bankrupt by a court;

(S)he must be loyal to the decisions of the board of directors. However, in case of note of dissent, (s)he may record it in the minutes of the board meeting and/or bring it to the notice of Bangladesh Bank considering its merit.