Personalized Nutrition: A New Frontier for Breakfast Cereal Brands"

Breakfast Cereals Market By Product Type (Corn Flakes, Rice Flakes, Wheat Flakes, Granola, Muesli, Bran Flakes, and Others), By Type (Natural, High Fiber, High Protein, and Others), By Flavor Type (Original, Chocolate, Fruity, Mixed, Nut, and Others)

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

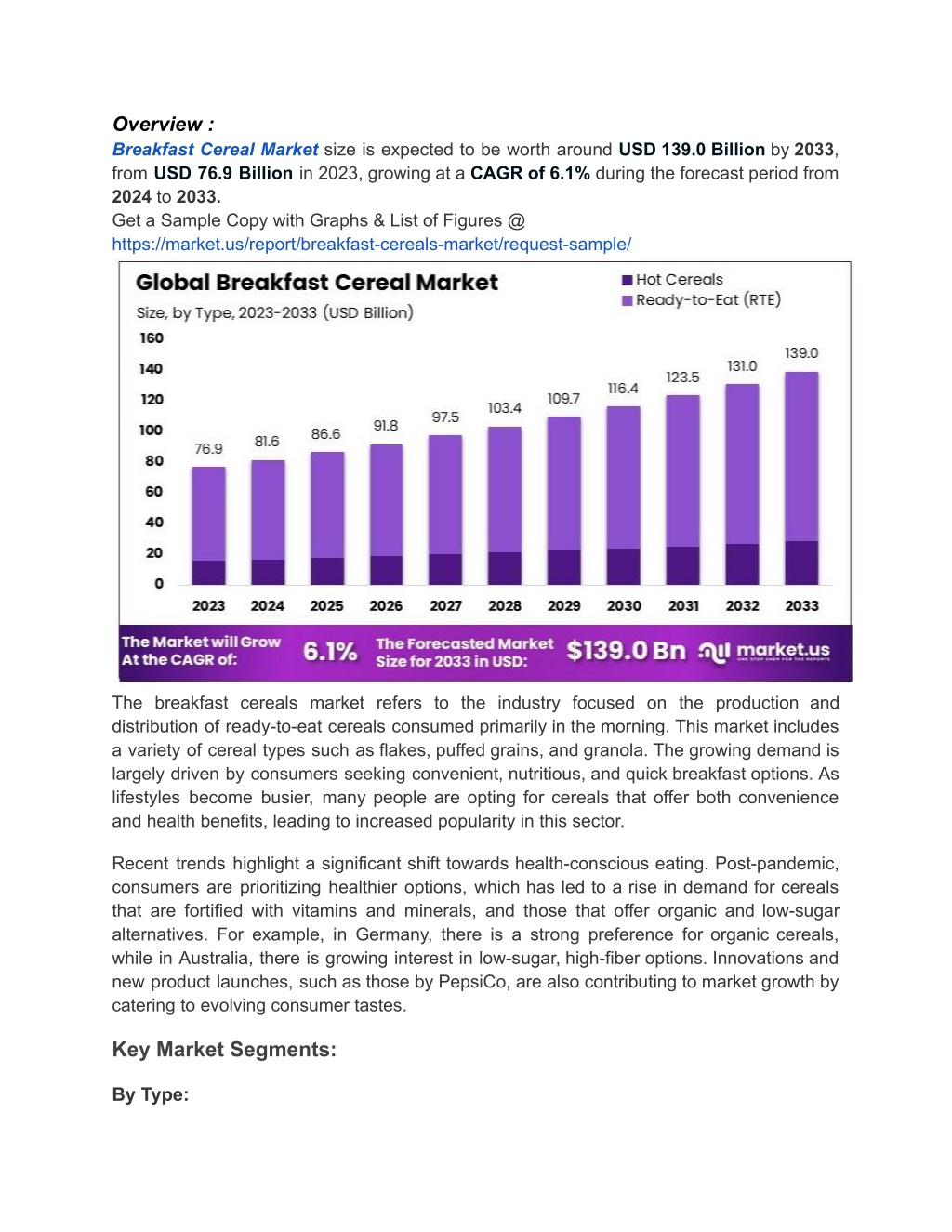

Overview : Breakfast Cereal Market size is expected to be worth around USD 139.0 Billion by 2033, from USD 76.9 Billion in 2023, growing at a CAGR of 6.1% during the forecast period from 2024 to 2033. Get a Sample Copy with Graphs & List of Figures @ https://market.us/report/breakfast-cereals-market/request-sample/ The breakfast cereals market refers to the industry focused on the production and distribution of ready-to-eat cereals consumed primarily in the morning. This market includes a variety of cereal types such as flakes, puffed grains, and granola. The growing demand is largely driven by consumers seeking convenient, nutritious, and quick breakfast options. As lifestyles become busier, many people are opting for cereals that offer both convenience and health benefits, leading to increased popularity in this sector. Recent trends highlight a significant shift towards health-conscious eating. Post-pandemic, consumers are prioritizing healthier options, which has led to a rise in demand for cereals that are fortified with vitamins and minerals, and those that offer organic and low-sugar alternatives. For example, in Germany, there is a strong preference for organic cereals, while in Australia, there is growing interest in low-sugar, high-fiber options. Innovations and new product launches, such as those by PepsiCo, are also contributing to market growth by catering to evolving consumer tastes. Key Market Segments: By Type:

Hot Cereals Ready-to-Eat (RTE) By Ingredient: Corn-based Cereals Rice-based Cereals Wheat-based Cereals Oat-based Cereals Multigrain Cereals By Distribution Channel: Supermarkets & Hypermarkets Convenience Stores E-commerce Others Type Analysis: Ready-to-Eat (RTE) cereals dominate the breakfast cereal market, holding a 79.6% share due to their convenience and variety. Major brands like Kellogg s, General Mills, and Nestle lead this segment, offering numerous flavors and nutritional options that cater to busy consumers seeking quick and nutritious breakfast solutions. Ingredient Analysis: Corn-based cereals, representing 25.6% of the market, are popular for their affordability and versatility. These cereals, including well-known products like cornflakes, are favored for their taste and texture. The ability to fortify corn-based cereals with essential vitamins and minerals further enhances their market appeal.

Distribution Channel Analysis: Supermarkets and hypermarkets lead the distribution channels for breakfast cereals, holding a 48.6% market share. These stores provide wide product ranges and accessibility, making them convenient for consumers. Extensive shelf space and promotional activities in these outlets significantly boost sales and product visibility. Market Key Players: Kellogg Co. General Mills PepsiCo Inc. Post Holdings Nestle S.A. Abbott Nutrition Carmans Fine Foods Food for Life Baking Co. Inc. Migros Back to Nature Food Company, LLC Dr. Oetker Attune Foods Bob s Red Mill Natural Foods Freedom Foods Group Driving Factors: The increasing health consciousness among consumers significantly drives the breakfast cereal market. Products like Kellogg s Special K, which promotes weight management, have grown due to their health appeal. Sales of cereals marketed for their nutritional benefits, such as those high in fiber and low in sugar, have surged, with healthy cereal bars experiencing a 15% growth in sales last year. Restraining Factors:

The cereal market faces significant competition from alternative breakfast foods such as Greek yogurt, breakfast bars, and smoothies. For instance, the rise of Chobani Greek yogurt, high in protein and probiotics, has taken market share from traditional cereals. Greek yogurt sales increased by 20% last year, highlighting the challenge cereals face as consumers diversify their breakfast choices. Growth Opportunities: The rise of plant-based diets presents a substantial growth opportunity for cereal manufacturers. Cereals made from alternative grains like quinoa, amaranth, and nut-based ingredients are gaining popularity. This trend is driven by increased awareness of food allergies and the health benefits of these ingredients. Challenges: Cereal manufacturers face the challenge of maintaining consumer trust amid growing scrutiny over health claims and nutritional content. Ensuring transparency and adhering to health regulations is crucial to sustaining consumer confidence and market growth.