Global Health Crises Drive Demand for Cleaning Solutions in Aftermarket

Cleaner and Degreaser Aftermarket By Part Types(Cleaner Aftermarket, Degreaser Aftermarket), By Product Type(Water-based, Solvent-based, Biobased), By Application( Automotive, Aerospace, Marine, Machinery and Equipment, Building and Construction, Oth

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

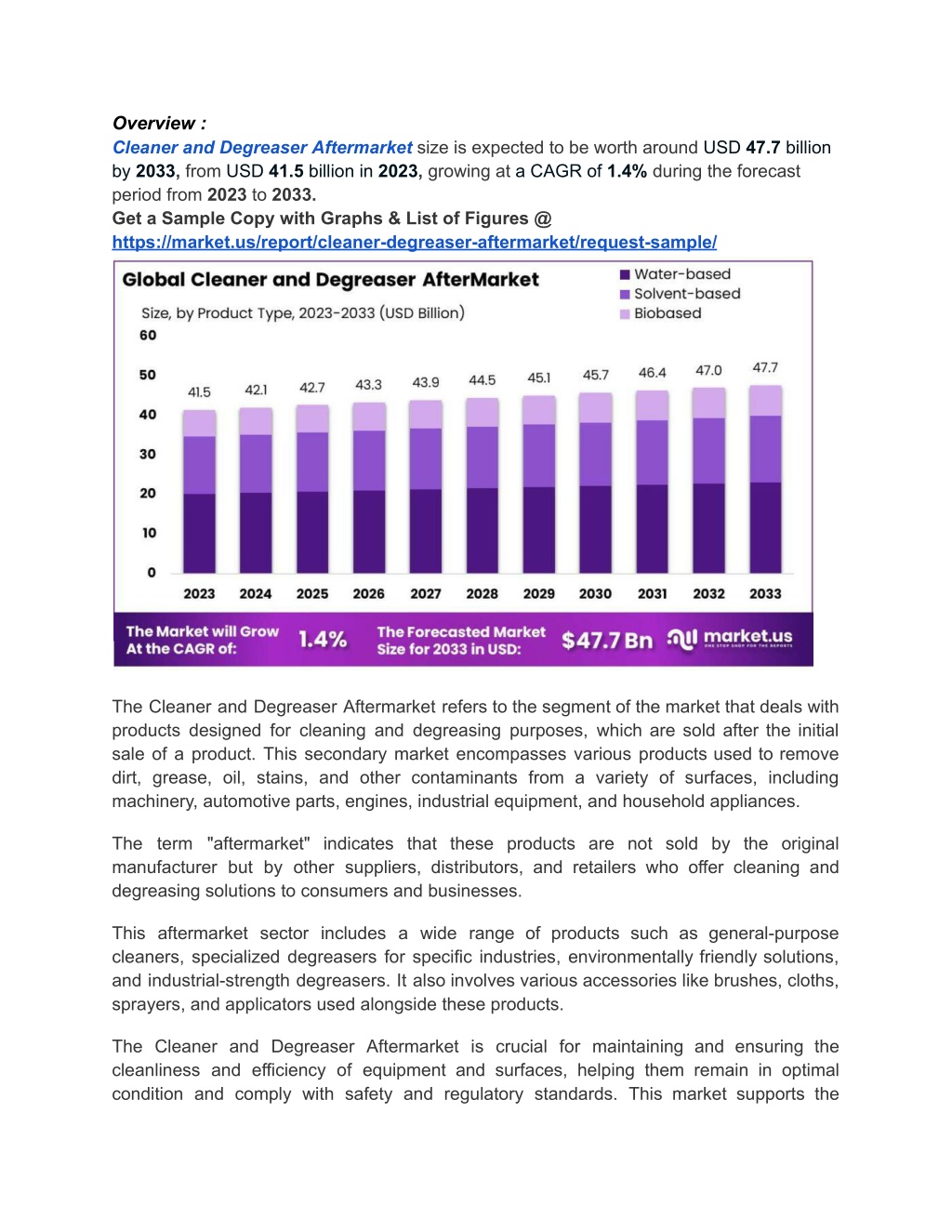

Overview : Cleaner and Degreaser Aftermarket size is expected to be worth around USD 47.7 billion by 2033, from USD 41.5 billion in 2023, growing at a CAGR of 1.4% during the forecast period from 2023 to 2033. Get a Sample Copy with Graphs & List of Figures @ https://market.us/report/cleaner-degreaser-aftermarket/request-sample/ The Cleaner and Degreaser Aftermarket refers to the segment of the market that deals with products designed for cleaning and degreasing purposes, which are sold after the initial sale of a product. This secondary market encompasses various products used to remove dirt, grease, oil, stains, and other contaminants from a variety of surfaces, including machinery, automotive parts, engines, industrial equipment, and household appliances. The term "aftermarket" indicates that these products are not sold by the original manufacturer but by other suppliers, distributors, and retailers who offer cleaning and degreasing solutions to consumers and businesses. This aftermarket sector includes a wide range of products such as general-purpose cleaners, specialized degreasers for specific industries, environmentally friendly solutions, and industrial-strength degreasers. It also involves various accessories like brushes, cloths, sprayers, and applicators used alongside these products. The Cleaner and Degreaser Aftermarket is crucial for maintaining and ensuring the cleanliness and efficiency of equipment and surfaces, helping them remain in optimal condition and comply with safety and regulatory standards. This market supports the

ongoing maintenance and operational efficiency across multiple industries, making it an essential component of industrial and commercial upkeep. Key rk t gm nt : By Part Types: Cleaner Aftermarket Degreaser Aftermarket By Product Type: Water-based Solvent-based Biobased By Application: Automotive Aerospace Marine Machinery and Equipment Building and Construction Others By Packaging: Aerosol Cans Spray Bottles Drums Others By Part Types: In 2023, the Cleaner Aftermarket held a dominant position with over 55.4% market share, driven by the demand for general cleaning products across various sectors. This segment

includes multi-surface cleaners, glass cleaners, and bathroom cleaners essential for maintaining hygiene in homes, offices, and commercial spaces. By Product Type: Water-based cleaner and degreaser products led the market with a 48.5% share in 2023, favored for their environmental friendliness and low toxicity. These products are widely used in household, industrial, and automotive applications, aligning with the growing demand for eco-friendly solutions. By Application: In 2023, the automotive sector dominated with a 32.3% share, using cleaners and degreasers for vehicle maintenance and engine cleaning. This segment is crucial for removing grease, oil, and dirt from automotive parts, ensuring optimal performance. By Packaging: Spray bottles were the most popular packaging option in 2023, holding a 36.7% market share due to their convenience and versatility. These bottles are easy to use and suitable for various cleaning applications in both household and commercial settings. rk t l r : BASF SE The 3M Company Dow Inc. Wurth USA Inc. DuPont de Nemours Inc. Zep Inc. PLZ Aeroscience Corporation ABRO Industries Inc. Treo Engineering Private Limited The Claire Manufacturing Company Airosol Company Inc. Carroll Company

Drivers: The heightened awareness of hygiene and cleanliness, especially following the COVID-19 pandemic, has significantly increased the demand for cleaner and degreaser products across various industries. Both businesses and consumers are prioritizing the maintenance of clean and sanitized environments to prevent the spread of germs and ensure safety. Restraints: Cost sensitivity remains a significant restraint in the cleaner and degreaser aftermarket. Despite the rising demand for high-quality products, price remains a crucial factor influencing purchasing decisions. Businesses, particularly small and medium-sized enterprises (SMEs), may hesitate to invest in premium cleaning solutions due to budget constraints. Opportunities: The cleaner and degreaser aftermarket has significant growth potential in emerging markets. Rapid urbanization, industrialization, and economic growth in regions like Asia-Pacific, Latin America, and Africa are driving demand for cleaning products.