Cereal Bars Market Trends: Fitness Bars Capture Leading Share

Cereal Bar Market size is expected to be worth around USD 41.4 billion by 2033, from USD 17.8 Bn in 2023, growing at a CAGR of 8.8%

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

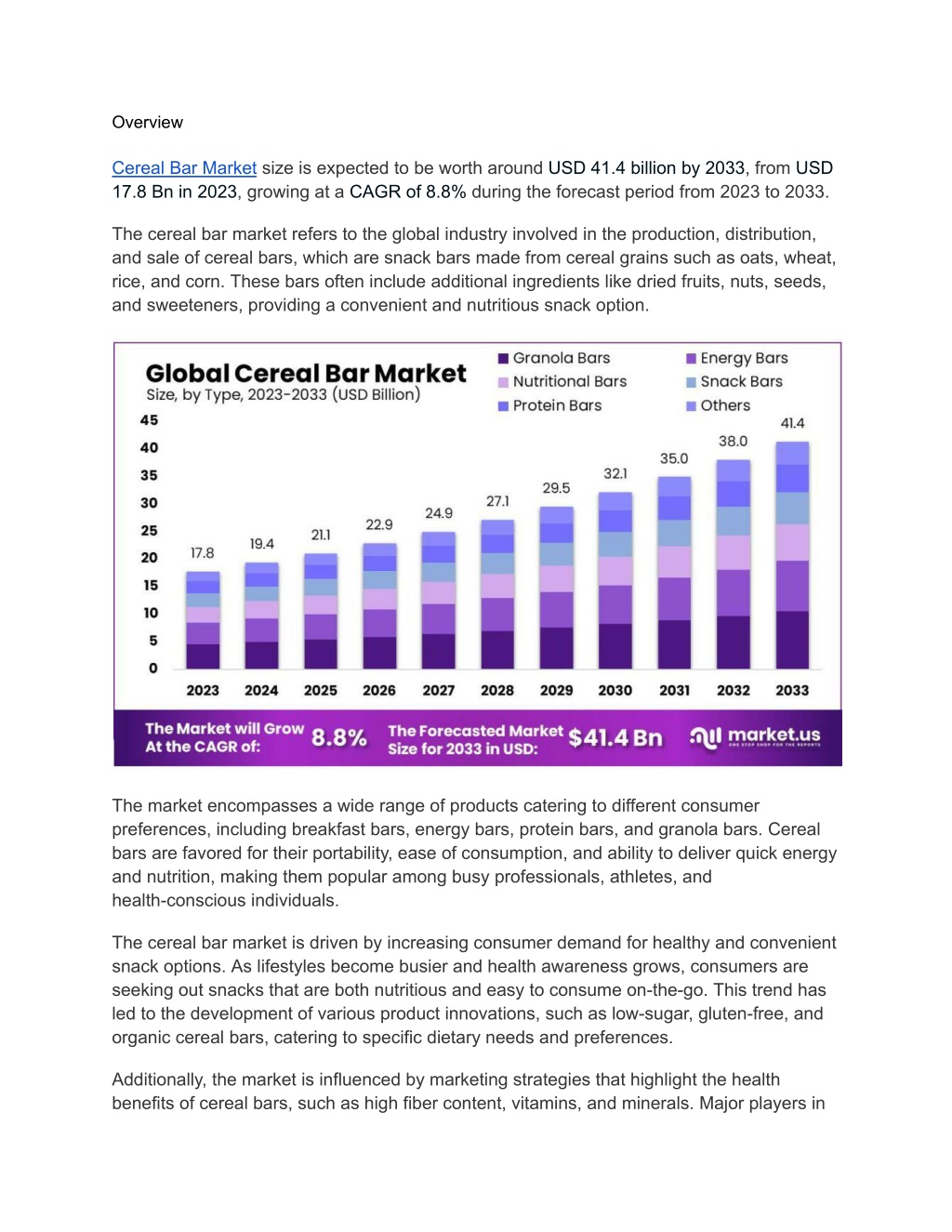

Overview Cereal Bar Market size is expected to be worth around USD 41.4 billion by 2033, from USD 17.8 Bn in 2023, growing at a CAGR of 8.8% during the forecast period from 2023 to 2033. The cereal bar market refers to the global industry involved in the production, distribution, and sale of cereal bars, which are snack bars made from cereal grains such as oats, wheat, rice, and corn. These bars often include additional ingredients like dried fruits, nuts, seeds, and sweeteners, providing a convenient and nutritious snack option. The market encompasses a wide range of products catering to different consumer preferences, including breakfast bars, energy bars, protein bars, and granola bars. Cereal bars are favored for their portability, ease of consumption, and ability to deliver quick energy and nutrition, making them popular among busy professionals, athletes, and health-conscious individuals. The cereal bar market is driven by increasing consumer demand for healthy and convenient snack options. As lifestyles become busier and health awareness grows, consumers are seeking out snacks that are both nutritious and easy to consume on-the-go. This trend has led to the development of various product innovations, such as low-sugar, gluten-free, and organic cereal bars, catering to specific dietary needs and preferences. Additionally, the market is influenced by marketing strategies that highlight the health benefits of cereal bars, such as high fiber content, vitamins, and minerals. Major players in

the cereal bar market continually invest in research and development to introduce new flavors and formulations, aiming to attract a broader consumer base and adapt to evolving market trends. The market's growth is further supported by increasing retail penetration and the expansion of distribution channels, including supermarkets, convenience stores, and online platforms. Key Market Segments By Types Granola Bars Energy Bars Nutritional Bars Snack Bars Protein Bars Others By Product Type Fitness Bars Weight Management Bars Meal Replacement Bars By Flavor Caramel Chocolate Peanut Butter Honey Others By Distribution Channel Supermarkets/Hypermarkets Convenience Stores Online Retail

Specialty Stores Others Download a sample report in MINUTES@https://market.us/report/cereal-bar-market/#requestSample In 2023, Granola Bars led the cereal bar market with a commanding 25.6% share. These bars, featuring wholesome ingredients like oats, nuts, and honey, resonated strongly with consumers seeking nutritious and tasty snacks. Fitness Bars emerged as top contenders, capturing a substantial 41.6% market share by catering to health-conscious individuals looking for convenient, nutritionally rich options. Chocolate-flavored bars took a significant lead with a 28.6% share, appealing universally with their indulgent taste. Supermarkets/Hypermarkets played a crucial role, securing a dominant 36.7% share as preferred outlets for consumers purchasing cereal bars during routine grocery trips.In 2023, Granola Bars led the cereal bar market with a commanding 25.6% share. These bars, featuring wholesome ingredients like oats, nuts, and honey, resonated strongly with consumers seeking nutritious and tasty snacks. Fitness Bars emerged as top contenders, capturing a substantial 41.6% market share by catering to health-conscious individuals looking for convenient, nutritionally rich options. Chocolate-flavored bars took a significant lead with a 28.6% share, appealing universally with their indulgent taste. Supermarkets/Hypermarkets played a crucial role, securing a dominant 36.7% share as preferred outlets for consumers purchasing cereal bars during routine grocery trips.