IPO Process -Guide to Successfully Taking Your Company Public

An IPO enables companies to raise capital, enhance credibility, and drive growth by offering shares to the public. It involves a detailed process that can provide significant advantages, including increased visibility and financial opportunities. Dis

- IPO

- Initial Public Offering

- Raising Capital

- Going Public

- Stock Market

- Public Offering

- Company Growth

- Fundraising

- IPO Process

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Affluence Advisory Pvt. Ltd. IPO Process: Guide to Successfully Taking Your Company Public The Capital market represents the Primary Market and the Secondary Market. The capital market has two interdependent and inseparable segments, the new issuers (the primary market) and stock (secondary) market. The primary market is used by issuers for raising fresh capital from the investors by making initial public offers or rights issues or offers for sale of equity or debt. An active secondary market promotes the growth of the primary market and capital formation, since the investors in the primary market are assured of a continuous market where they have an option to liquidate their investments. IPO stands for Initial Public Offering. In an IPO, a company offers its shares to the public for the first time via the primary market. A corporate may raise capital in the primary market by way of an initial public offer, rights issue or private placement. An Initial Public Offer (IPO) is the selling of securities to the public in the primary market. It is the largest source of funds with long or indefinite maturity for the company. The transition from a private to a public company can be an important time for private investors to fully realize gains from their investment as it typically includes a share premium for current private investors. Meanwhile, it also allows public investors to participate in the offering. An IPO is an important step in the growth of a business. It provides a company access to funds through the public capital market. An IPO also greatly increases the credibility and publicity that a business receives. In many cases, an IPO is the only way to finance quick growth and expansion. In terms of the economy, when a large number of IPOs are issued, it is a sign of a healthy stock market and economy. HOW AN IPO WORKS: Before an IPO, a company is considered private. As a pre-IPO private company, the business has grown with a relatively small number of shareholders including early investors like the founders, family, and friends along with professional investors such as venture capitalists or angel investors. An IPO is a big step for a company as it provides the company with access to raising a lot of money. This gives the company a greater ability to grow and expand. The increased transparency and share listing credibility can also be a factor in helping it obtain better terms when seeking borrowed funds as well. When a company reaches a stage in its growth process where it believes it is mature enough for the rigors of SEBI regulations along with the benefits and responsibilities to public shareholders, it will begin to advertise its interest in going public. A company issues an IPO for several reasons such as: CS Bhavesh Chheda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

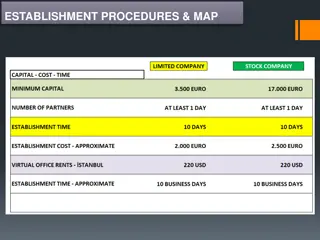

Affluence Advisory Pvt. Ltd. IPO Process: Guide to Successfully Taking Your Company Public 1.Raising Capital. 2.Exit for early investors. 3.Business Expansion. 4.Repayment of loans. 5.Enhanced credibility. TYPES OF IPO: An IPO is classified as either a Mainline IPO or an SME IPO based on the platform used by the issuer company for its IPO. 1.Mainboard IPO: A Mainline IPO, also known as a Mainboard IPO, is a regular IPO issued by large companies that have an extensive track record and meet the IPO eligibility criteria set by SEBI. The minimum paid-up capital of a Mainboard IPO after the issue should be Rs 10 crores. 2.SME IPO: An SME IPO is an initial public offering of small and medium enterprises (SMEs) or start-ups. The post-issue paid-up capital of SME IPO should not exceed Rs 25 crores. Main Board IPO can be listed on both the Stock Exchanges whereas SME IPO can be listed on any One Exchange. A Main Board IPO is an initial public offering of large and established companies with a paid-up capital of at least Rs 10 crores. A Main Board IPO is a regular IPO listed and traded on the stock exchange platforms of the NSE/BSE. Mainboard IPO SME IPO Strict and complex admission standards. Post-issue paid-up capital should be a minimum of Rs 10 crores. Offer Documents get vetted by SEBI. Relaxed Eligibility Norms. Post-issue paid-up capital should not exceed Rs 25 crores. Offer Documents get vetted by the Stock Exchange. Market making is mandatory for 3 years by Merchant Bankers. Need to file half-yearly audited accounts. IPO Underwriting is mandatory of which 15% should be underwritten by a merchant banker. The minimum IPO application size is Rs 1 lakh. Listing and trading can be on any one SME platform - BSE SME/NSE Emerge. Market Making is not mandatory. Need to file quarterly audited accounts. IPO Underwriting is not mandatory. The minimum IPO application size is between Rs 10,000 to Rs 15,000. Listing and trading can be on both NSE/BSE. CS Bhavesh Chheda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. IPO Process: Guide to Successfully Taking Your Company Public IPO Advantages and Disadvantages: IPO Advantages to the Company An IPO helps a company raise a large amount of funds to finance its growth, expansion, capital expenditures, repayment of loans, and more. IPO provides an exit route for the promoters and early investors. IPO Disadvantages to the Company Preparing an IPO requires a lot of time from the promoters, management and employees of the company. Although the IPO is a low-cost method of raising capital, it can be expensive because of the fees payable to intermediaries and fund managers. The IPO may result in dilution of ownership among various shareholders that were previously limited to a few promoters and investors. A company conducting an IPO is required to file regulatory documents regularly with the required disclosures. administrative costs for the company, as it must hire a team to oversee and complete these tasks. By going public, the company becomes accountable to its investors and therefore must maintain relationships with investors and meet their expectations. IPO is a cost-effective way to raise capital because companies do not have to pay interest on the funds raised from the public, nor do they have to return the capital raised. Public companies get easy access to finance compared to private companies. The reason is that public companies need to maintain transparency in their business operations which reduces the risk to lenders with all the information available for verification. IPO increases visibility and helps build a brand image for the company. This increases IPO increases the prestige of employees and builds their confidence in the company. It helps to retain employees and attract new staff. IPO enables the correct valuation of the company. IPO encourages discipline in management as the company is answerable to its shareholders for all their actions. By going public, a company gets to know the outsider's perspective. It helps them plan their actions for better prospects. CS Bhavesh Chheda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. IPO Process: Guide to Successfully Taking Your Company Public ELIGIBILITY CRITERIA FOR MAIN BOARD IPO: 1.Profitability Route (Entry Norm I) The companies must meet all the following conditions in terms of profit standards to be eligible for an IPO through this route: The company should have net tangible assets of at least Rs 3 crores in each of the three preceding years. For fresh issues (not OFS), of the above Rs 3 crores of tangible assets, not more than 50% should be cash or cash equivalent. The company should have an average operating profit (before tax) of at least Rs 15 crore in any of the three years out of the last five years. In case of a name change, 50% of the revenue generated in the previous year should be from the business carried on under the new name. The issue size should not exceed five times the net worth of the company before the issue (pre-issue). 2. QIB Route (Entry Norm II) The QIB route is an alternative route developed by SEBI for genuine, capable, and legitimate companies that are unable to meet strict profitability parameters. The companies going for IPO through the QIB route have to ensure that: IPO through the book-building process. Allocate at least 75% of the net offering to qualified institutional buyers. Refund of IPO subscription money if the minimum allotment requirement is not met. Post Issue Shareholding other than Promoters: Profitability Route Investors QIB NII Retail QIB Route Investors QIB NII Retail Sr. No. % 50 15 35 % 75 15 10 1 2 3 Note: In addition to SEBI Eligibility Criteria, the Stock Exchanges may from time to time specify additional eligibility criteria. CS Bhavesh Chheda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. IPO Process: Guide to Successfully Taking Your Company Public ELIGIBILITY CRITERIA FOR SME IPO: Eligibility criteria for SME IPO are decided by the Stock Exchanges from time to time. Given below are the present SME IPO Eligibility Criteria: BSE SME IPO Eligibility* SMEs must meet the following criteria set by the BSE SME platform for issuing SME IPO: The company should have been incorporated under the Companies Act, 1956. The company should have a positive net worth. The Net Tangible Assets of the company should be Rs 1.5 crore. The company should have a track record (operations) of at least three years. If not, the company should have been funded by banks/financial institutions/central government or state government and should have a positive net profit (before depreciation and taxes) in any of the last three years. The company should have a website. The company should have an agreement with both Indian depositories CDSL and NSDL. The company should facilitate trading in Demat form. The list of promoters should not have changed in the preceding year from the date of applying to BSE for listing under the SME segment. The company should submit a certificate to BSE stating that the company is currently not under any Board for Industrial and Financial Reconstruction (BIFR) matter nor received any winding up petition against the company. NSE SME IPO Eligibility NSE Emerge platform lists the following eligibility criteria for a company to issue an SME IPO: The company should be incorporated under the Companies Act 1956 / 2013 in India. The company should have a track record (operations) of at least three years. The promoters should individually or jointly hold at least 20% of the share capital after the issue. One of the promoters should have at least three years of experience in the same industry. The company should have operating profit and positive net worth in at least 2 out of 3 fiscal years. There should be no pending Board for Industrial and Financial Reconstruction (BIFR), insolvency, or bankruptcy proceedings against the company or promoters. The company should not have received any winding-up petition from NCLT/Court. CS Bhavesh Chheda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in

Affluence Advisory Pvt. Ltd. IPO Process: Guide to Successfully Taking Your Company Public No material regulatory or disciplinary action has been taken against the applicant company by any stock exchange or regulatory agency in the last three years. * Always check the latest/updated eligibility criteria of respective Stock Exchanges. Parties/Intermediaries Involved: 1.SEBI. 2.Stock Exchanges. 3.Merchant Banker/Lead Manager. 4.Underwriters. 5.Market Maker. 6.Company Secretaries. 7.Statutory Auditors. 8.Independent Chartered Accountants. 9.Registrar to the issue. 10.Legal Advisor. 11.Escrow Banker/Banker to the Issue. 12.Grading Agencies/Advertising Agencies/PR Agencies Disclaimer:This article provides general information existing at the time of preparation and we take no responsibility to update it with the subsequent changes in the law. The article is intended as a news update and Affluence Advisory neither assumes nor accepts any responsibility for any loss arising to any person acting or refraining from acting as a result of any material contained in this article. It is recommended that professional advice be taken based on specific facts and circumstances. This article does not substitute the need to refer to the original pronouncement CS Bhavesh Chheda | Affluence Advisory Pvt. Ltd. | Website - www.affluence.net.in |Email - connect@affluence.net.in