Road Accident Fund Performance Overview FY 2011-2012

The presentation gives an in-depth analysis of the Road Accident Fund's performance in the financial year 2011-2012, covering aspects such as corporate structure, operational challenges, funding issues, and legal considerations. It highlights the Fund's mission, business model, and operational context, emphasizing the need for addressing systemic environmental factors and improving operational efficiency to better serve accident victims within South Africa.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Overview on Performance of the Road Accident Fund Financial Year 2011 - 2012 19 September 2012

Purpose The purpose of this presentation is to give an overview of the performance of the Road Accident Fund in 2011/12 The presentation addresses the following elements: Background 2011/12 Indicators and Outputs Audit findings Priority focus areas

Background Corporate and Statutory Form Principal activities of the Fund Provide compulsory cover to all users of South African roads against injuries sustained or death arising from accidents involving motor vehicles within the borders of South Africa. Road Accident Fund Act, 1996 (Act No. 56 of 1996) & RAF Amendment Act, 2005 (Act No. 19 of 2005) The object of the Fund shall be the payment of compensation in accordance with this Act for loss or damage wrongfully caused by the driving of a motor vehicle Constitutional Court Rulings and legal precedents have shaped the mandate Fund is a national public entity (Schedule 3A of the PFMA) Board of Directors appointed by the Minister of Transport Committee structure well established

Background Business Model

Background Operational Context 1 . 2 . SYSTEMIC ENVIRONMENTAL 1.Fault based & founded on insurance 1. High accident rate and fatality rate principles 2. Strong interest groups 2.Benefit assessment is subjective 3. High degree of fragmentation and complex 4. Significant fraud opportunities 3.Inequitable benefits awarded 4.Inappropriate allocation of 3 . 4 . resources FUNDING OPERATIONAL 1. Disconnect between Fuel levy 2. Delays in finalising claims income and claim costs 3. Antagonistic customer interface 2. Increasing future liability 4. Lack of integration between role players

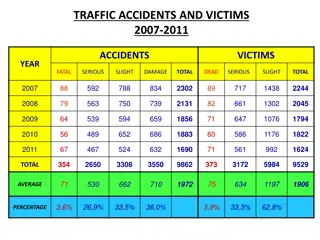

Background Operational Context Accidents with fatalities increased by 3.6% (11,228) Lead cause of death in <30 s 60 year funding regime driven by an accessible revenue From protecting a wrongdoer from being sued to supporting victims Compensation is fault based Rulings not always consistent In equitable outcomes shaped by legal spend and historic income ( 268m) Legal officer with whiplash awarded R2.8m for a week off Micro-economy sustained by RAF payments Lawyers, Advocates, assessors, experts etc Contingency fees in excess of 25% Scale of operation frequently overlooked 50% of matters on the Court roll relate to road accidents RAF is 4 x the size of the UK based Motor Insurer s Bureau

Background Mission, Vision and Values To provide the highest standard of care to road accident victims to restore balance in the social system. Vision To provide appropriate cover to road users within the borders of SA; to rehabilitate persons injured, compensate for injuries or death and indemnify wrongdoers as a result of motor vehicle accidents in a timely, caring and sustainable manner; and to support safe use of our roads Mission Ubuntu Solution focused Pride in what we do Values

Background Strategic Objectives Amend current legislation RABS Towards a comprehensive social security system Additional funding Manage/ Reduce legal costs Manage/ reduce operational costs Ability to pay claims A legislative dispensation that is aligned to principles of social security A solvent, liquid and sustainable RAF by 2020 A customer- centric, operationally effective and efficient RAF by 2017 A transformed and capacitated RAF by 2017 Improve customer service Fully implement NOM Improve claims processing Reduce fraud Change management Leadership development Talent management Culture reengineering

Purpose The purpose of this presentation is to an overview of the performance of the Road Accident Fund in 2011/12 The presentation addresses the following elements: Background 2011/12 Indicators and Outputs Audit findings Priority focus areas

Operational Indicators Revenue Composition of total revenue 18,000 17,104 16,989 16,000 14,526 14,474 14,000 12,683 11,969 12,566 12,000 10,000 R'million 8,405 8,845 8,000 8,222 6,000 4,000 2,550 2,000 470 180 9 12 113 104 60 48 40 2 - - - 3 - 2008 2009 2010 2011 2012 Financial year Total revenue Net fuel levies Investment income Government grant Reinsurance and other income

Operational Indicators Core Expenditure Composition of compensation 10,000 9,369 8,948 8,685 9,000 8,595 8,000 6,698 7,000 R'million 6,000 5,000 4,895 4,751 4,000 4,467 4,263 4,108 3,905 3,851 3,000 3,177 2,827 2,000 2,009 1,000 733 768 764 847 785 20 26 49 24 26 - 2008 2009 2010 2011 2012 Financial year Total Compensation Claimant medical costs Loss of earnings and support Funeral costs General damages

Operational Indicators Operational Demand Claims volumes (alll claims) 400,000 300,000 297,072 294,771 267,133 261,390 253,111 244,652 222,634 200,000 209,981 209,186 172,859 100,000 Number of claims - (164,400) (187,168) (100,000) (262,185) (311,207) (330,453) (200,000) (300,000) (400,000) 2008 2009 2010 2011 2012 Financial year Total claims lodged Total claims finalised Total claims outstanding

Operational Indicators Claim Processing Claims outstanding Reasons for outstanding claims: 450,000 102,474 112,779 69,346 400,000 1. 2. 90% of claims represented Case mix comprised of more serious cases Maximum medical improvement required Greater use of experts (industrial psychologists) Mvumvu Bill outcome awaited 31,832 350,000 23,197 45,666 86,935 36,246 14,260 300,000 Number 250,000 3. 200,000 332,903 150,000 207,445 238,193 340,925 265,240 271,800 208,406 260,807 4. 194,926 100,000 50,000 5. - 2004 2005 2006 2007 2008 2009 2010 2011 2012 Financial year Personal claims Supplier claims

Operational Indicators Claim Cost All claims: average per claim 60,000 400,000 331,155 350,000 336,511 50,000 300,000 290,710 270,479 40,000 250,000 Rand value Number 225,905 211,798 30,000 200,000 182,397 132,204 150,000 162,688 20,000 100,000 10,000 46,995 33,171 38,502 54,808 23,492 24,231 28,198 31,165 26,519 50,000 - - 2004 2005 2006 2007 2008 2009 2010 2011 2012 Financial year Average rand value Number of individual payments

Financial Indicators Statement of C.I 31 March 2012 R'million 31 March 2011 R'million Restated Statement of Financial Performance Revenue from non-exchange transactions - Transfers from Government - Net fuel levies 16,989 - - 16,989 14,474 14,474 Revenue from exchange transactions - Investment income and other revenue 115 52 Total Revenue 17,104 14,526 Expenses: - Claims expenditure (excluding provision for outstanding claims) - Reinsurance premiums - Employee costs - Administrative expenses - Depreciation, amortisation and impairment - Finance costs - Road Safety Project - Road Accident Fund Commission 13,220 12,216 12,941 23 28 655 238 64 24 621 224 60 43 - - - - Total Expenses 13,917 Surplus/(Deficit) before provision for outstanding claims 3,884 609 Provision for outstanding claims (20,372) (2,081) (Deficit)/surplus for the year (16,488) (1,472)

Financial Indicators Statement of F.P 2012 2011 2010 2009 2008 R'000 R'000 R'000 R'000 R'000 Total Assets Total Liabilities 8,572,315 (54,967,863) (46,395,548) 4,566,637 (34,481,626) (29,914,989) 3,878,585 (32,308,577) (28,429,992) 3,395,738 (43,231,115) (39,835,377) 3,296,916 (31,124,667) (27,827,751) 1. 2. Liability shaped largely by the Provision for Claims Incurred Reasons for the increase in the liability in 2011/12: Earlier assumptions were not sufficient Claims are more expensive (as qualifications apply to damages) Actual settlements are higher than estimates Beneficiary base has been widened (Mvumvu case) Closed cases reopened with Data for post-Amendment Act not credible yet

Operational Outputs Noteworthy Progress Governance No audit findings and King 3 effectively applied Compliance requirements met Stakeholder relationship management Key stakeholders identified and engaged Minister and Deputy Minister DoT, SATAWU, NT, DoH, FSB, DoJ, SADC counterparts SACO, SANCO, AA, SANTACO Financial management Unqualified audit obtained Procurement environment capacitated Investment policy maintained

Operational Outputs Noteworthy Progress Legal and compliance Regulations developed, submitted and some approved Risk mitigation measures successfully implemented Operations 149,000 claims processed (one third pre-Amendment) IT No material downtime and claim systems maintained HR Performance scorecards introduced Leadership Forum established

Operational Outputs Noteworthy Progress Customer Service Network Origination infrastructure optimised - 29,060 claims originated directly (21% of personal claims) - Nelspruit regional office planned 13,934 patients receiving continuous care - 1,849 home visits conducted Over 440 mass burials attended to Marketing Over 2,000 people serviced at RAF on the Road - In 2012: Over 2,500 people and R50m settled Quarterly staff newsletter and CEO s Blog introduced Campaigns run on radio, TV and print media

Operational Outputs Noteworthy Progress Forensics 6,782 cases finalised 3,160 fraudulent files detected at a value of R461m 502 arrests and 244 convictions in 2011/12 Decade of Action for Road Safety 2011-20 N3 Toll Concession (N3TC) Providing trauma equipment at Leratong Hospital RTMC on road safety measures aimed at the youth Contributing to the SADC Transport Forum

Summary of Performance 2011 2012 Performance Particularly challenging operating environment (longstanding) Significant work was executed with good progress made! Performance concerns relate to slower claim processing and the increased provision for outstanding claims - Increased number of open claims Increased litigation and protracted claim settlements Pended claims in expectation of legislative changes Lower output per staff member - Increased claims liability and provision - Increased volume of open claims - Higher average cost of a claim Must be appreciated that 149,000 claimants and there families were supported, in addition to 111, 628 previous claimants who have continued access to medical services

Purpose The purpose of this presentation is to an overview of the performance of the Road Accident Fund in 2011/12 The presentation addresses the following elements: Background 2011/12 Indicators and Outputs Audit findings Priority focus areas

Audit Opinion Unqualified Opinion Auditor-General findings - Emphasis of matter Going concern status - Predetermined objectives Achievement of planned targets - Compliance with laws and regulations Accounting authority did not take adequate steps to prevent fruitless and wasteful expenditure

Audit Going Concern Status Analysis of important financial indicators R 60,000,000 R 50,000,000 R 40,000,000 R'000 R 30,000,000 R 20,000,000 R 10,000,000 R 0 Provision for outstanding claims Accumulated deficit Net Fuel levy income Total cash claims expenditure

Audit Anomalous Expenditure 2012 R '000 2011 R '000 Interest and sheriff cost 22,108 26,267 Note: Values have reduced, disciplinary action was taken and an SOP has been developed Entire amount is not fruitless and wasteful as there is a disjuncture between RAF Act and Attorneys requirements 2012 R '000 2011 R '000 Irregular Expenditure - Current Year Less: Amounts condoned 7,042 7,042 14,529 Note: Values have reduced, disciplinary action was taken and management intervention are focused on reducing this further through integration between procurement, legal and line functions.

Audit Performance Targets Targets met - Timeously submitting Fuel Levy application - Manage RAF costs, increasing the RAF footprint across the country - Improving stakeholder communication and promoting road safety awareness - Rolling-out the Operating model - Submitting proposals/ comments to DOT on the No-Fault system - Increase BEE procurement and investing in social development

Audit Performance Targets Targets partially met - Appointments in the CSN pilot and a fully operational IT system - Building capacity among staff and employing people with disabilities Targets not met - Size of the liability - Number of open claims - Expanded physical presence

Purpose The purpose of this presentation is to an overview of the performance of the Road Accident Fund in 2011/12 The presentation addresses the following elements: Background 2011/12 Indicators and Outputs Audit findings Priority focus areas

Priority Focus Areas Processing open claims - Confirm the backlog by way of an audit - Repudiate unprocessed claims and run block settlements Enhancing operational delivery - Optimise performance and increase capacity - Align structure to operational demand and business processes Optimising Financial controls - Implement a Writ SOP and comply with policies and the PFMA - Take decisive steps where non-compliance occurs Managing the deficit - Quarterly reviews of the provision, as well as independent reviews - Reduce the backlog - Definitively prioritise the amendment of legislation to remove fault and to define a set benefit

Conclusion The RAF operates in a context which is different to other entities in our social security framework - Funding via the fuel levy is not associated with claim frequencies and costs - Beneficiary base is not constituted by past, present or future contributors to the RAF Fuel Levy - Benefit available to beneficiaries or claimants is not defined and in some instances is not limited to a maximum value - Social security obligation extends to protecting income, providing support, and funding healthcare needs

Conclusion Social Support Social Security Pillar Solvent Ben. Benefit Funding Loss of Income Loss of Support Medical Expenses Unlimited & Increasing Fuel Levy & Unrelated No All Yes Yes RAF Yes Payroll tax & Related Yes Employed ++Limited Yes No No UIF Payroll tax & Related Yes Employed +Limited Yes No Yes COIDA Fiscus & Budget Yes Poor +++Limited No Yes No SASSA

Conclusion The Board and management have a firm understanding of what must be done, how it should be done and the urgency with which the work is required All efforts will go into: - Ensuring that the four strategic pillars are fulfilled - Providing efficient support to the victims of car accidents - Preventing the catastrophic socio-economic effects of accidents in our society It is proposed that this overview of the performance of the Road Accident Fund in 2011/12 is noted.