Streamlining Parcel Delivery with Electronic Advance Data

Electronic Advance Data (EAD) is mandatory for efficient customs clearance and improved delivery processes. Learn about its benefits, requirements, and the timeframe for compliance. See how accurate data ensures faster clearance, avoids delays, and enhances customer experience. Implement EAD to move parcels swiftly through the delivery process and provide better notifications to recipients.

- Parcel Delivery

- Electronic Advance Data

- Customs Clearance

- E-commerce Requirement

- Improved Customer Experience

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

landmark global SENDER RECIPIENTS CONTENT Move your parcels to the fast lane With electronic pre-advice 01

Electronic Advance Data requirements Overview Benefit Timeframe and Scope Details Documentation and data required Data Quality Technical Readiness and Support S10 Identifier for tracked and untracked products MOVE YOUR PARCELS TO THE FASTLANE 2

Overview Electronic Advance Data (EAD) is a set of information with details about every single parcel, which enable a swift customs clearance. EAD provision is mandatory since 1st January 2021 Providing correct data in the correct format is required to guarantee the data can be used for customs & delivery. As additional benefit, destination operators will gradually use the data to enhance the delivery process to the adressee (e.g., phone/SMS/ email notifications). MOVE YOUR PARCELS TO THE FASTLANE 3

How do you benefit? Accurate ElectronicAdvance Data will ensure: Efficient and faster customs clearance and import process, which leads to improved customer experience. Avoiding delays and penalty charges. Compliance with destination countries requirements for EAD. Your notifications/ delivery at location of choice (depends on destination post) addressee can benefit from email and/or SMS delivery MOVE YOUR PARCELS TO THE FASTLANE 4

Timeframe and Scope Electronic Advance Data (EAD) is an industry-wide requirement in e-commerce for all items containing goods that requires customs and/or security clearance. It is mandatory since 1st January 2021. This requirement applies to: MiniPak Scan/Dragon Scan, MiniPak Sign MiniPak EU and MiniPak TT, MiniPak Sorted (UK) (semi-tracked) MiniPak Unsorted, MiniPak Sorted (EU) (untracked) MaxiPak Scan, MaxiPak Sign MOVE YOUR PARCELS TO THE FASTLANE 5

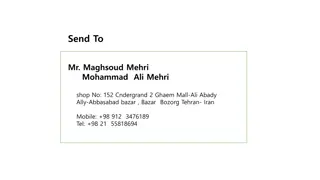

CN22 Customs ref: PO Box6412 BPOST Name bpost Pershipment From Notes: All dataneeds to be submitted electronically Street Zipcode Country Brucargo829C 1934 BE PB-PP |BPI-06412 City EMC If undelivered please return tosender BELGIE(N) - BELGIQUE Category (goods/documents) Value Sender s signature (to certifydeclaration) Date Importer ref: Name Business test test TO Street Zipcode Country teststreet 473 1253 UnitedStates R City Florida Tel * 01236547 Email * test@post.be Still, the CN22/CN23 label needs to be affixed on the outside of the shipment RG 005 471 046 BE Contents- per item Customs Declaration - CN22 may be opened officially - peut tre ouvert d'office Description as detailed as possible Quantity Weight Value Sender's instruction in case of non-delivery: Category of item: GOODS Service level:PRI Comments (e.g.quarantine...): Detailed Description of Contents Ventilator Explanation: Customs documents to be validated for export:NO Commercial Itemsonly HS TariffN 147852 Qty 1 Net kg 1,900 Value Origin CA 250,00 EUR Pershipment Total gross weight: 2,000KG Total value: 250,00 EUR Postagefee: Invoice: License: Certificate: Office & date ofposting: I certify that the particulars in this customs declaration are correct and this item does not contain any dangerous articles prohibited by legislation or by postal or customs regulations. These data shall be transmitted to the destination country operator and to customs authorities to pre-announce shipments (except for the information marked with (*); this is only used for delivery purposes). Unless you thick the box below, data related to the sender and addressee may also be used for the provision of information as to our services. As sender, you confirm having duly informed the addressee of these intended uses and having obtained his/her consent. The sender or addressee may request in writing the provision of its personal data as held in our registers by sending a signed and dated request to bpost, Contact Center, PO box 5000, 1000 Brussels, Belgium. Trade tariff(Harmonised System or HS)code for each item of the shipments. [ ] I do not wish that my personal data and the personal data of the addressee be used by bpost & its affiliates for providing us with information as to their services Date and sender signature: 26/07/2018 * This information will only be used for delivery purposes / Cette information sera uniquement usilis e dans le cadre de la livraison dupaquet Country of origin ofgoods MOVE YOUR PARCELS TO THE FASTLANE 6

CN23 Customs Declaration - CN 23 may be opened officially - peut tre ouvertd'office Pershipment Notes: All dataneeds to be submitted electronically 30100641700000000737187489 Customsref: PO Box6417 Name From Business BPOST Street Brucargo829C Category Value Sender s signature (to certifydeclaration) Date (goods/documents) Zipcode 1934 City EMC Country Belgium Tel* Still, the CN22/CN23 label needs to be affixed on the outside of the parcel. Email* Importerref: To test Name Business test Street street5 Zipcode 4567 City test Country Canada Pershipment 1236547 Tel* Email* test@post.be Sender's instruction in case of non-delivery: RETURN TO SENDER(AIR) Category of item: GOODS Explanation: Trade tariff(Harmonised System or HS code) for each item of the shipments. Country of origin of goods Service level: PRI Customs documents to be validated for export: NO Commercial itemsonly Comments (e.g. quarantine...): Detailed Description of Contents Qty Net kg Value HS Tariff N Origin ofgoods boots 2 9 250 789654 US Contents - per item Description as detailed as possible Quantity Weight Value License: Certificate: 10kg Total grossweight: Postagefee: Office & date of posting: 250 EUR Total value: Invoice: I certify that the particulars in this customs declaration are correct and this item does not contain any dangerous articles prohibited by legislation or by postal or customs regulations. These data shall be transmitted to the destination country operator and to customs authorities to pre-announce shipments (except for the information marked with (*): this is only used for delivery purposes). Unless you thick the box below, data related to the sender and addressee may also be used for the provision of information as to our services. As sender, you confirm having duly informed the addressee of these intended uses and having obtained his/her consent. The sender or addressee may request in writing the provision of its personal data as held in our registers by sending a signed and dated request to bpost, Contact Center, PO box 5000, 1000 Brussels, Belgium. [ ] I do not wish that my personal data and the personal data related to the addressee be used by bpost/its affiliates for providing us with information as to their services. Date and sender signature: 26/07/2018 MOVE YOUR PARCELS TO THE FASTLANE 7

EAD Requirements (1/3) Data required Reasoning Basic info (Mandatory) Sender and Addressee (Name, address including origin and destinationcountry, email or telephone) This group of information allows faster processing, increased quality of delivery and better returns quality (as applicable). Customs info (Mandatory) This code classifies your goods. Receiving countries use it together with the country of origin of contents to decide: a) whether to permit entry, and, b) percentage of duties and taxes. Note: If HS Code is not included or incorrect, your shipment could be stopped, delayed or refused entry in customs. Trade Tariff (Harmonised System or HS code) code and country of origin ofcontents HS codes shall be provided for each item in the shipment MOVE YOUR PARCELS TO THE FASTLANE 8

EAD Requirements (2/3) Data Required Reasoning Customs info (mandatory) Required for security, processing and customs clearance purposes by the receiving country. Incorrect or incomplete data will lead to: Incorrect customs fees meaning your items could be chargedtax at a higherrate. Delays and denied entry - if customs believe they could have been mis- declared or that there could be undeclared prohibitedgoods. Application of additional penalty processingcosts Item details: description quantity weight value ofcontents Postage paid and insurancecosts The S10 barcode item identifier, e.g. CC005471046BE, is used to reference the customs data for receiving postal authorities. If the S10 barcode is not provided, items could be charged, delayed or denied entry, as if you had not provided any customsinformation. Note: For untracked items, customers will be require to provide an S10 barcode format UX XXX XXX XXX BE. Please contact your Business eSolutions Manager S10 13 character barcode item ID (see additional information) See slides 12- 14 Additional product features (mandatory) Recipient telephone number and/or email Either email or telephone are mandatory for EAD for sender and the addressee. For delivery, this information will be used to contact the addressee to complete the customs clearance. Also, this information will enable provision of enhancements, such as automatic SMS or email notifications and delivery choices for the addressee, as more posts implement this type of solution. MOVE YOUR PARCELS TO THE FASTLANE 9

EAD Mandatory data elements summary (3/3) Item ID (S10 format) Sender name Sender e-mail Sender telephone Sender address (including location name, nb, country, postcode) Addressee name Addressee e-mail Addressee telephone Addressee address (including location name, nb, country, postcode) Number of items in the shipment Description (detailed) of each item in the shipment Weight of each item in the shipment Origin country of each item in the shipment HS code for each of the item in the shipment Monetary value of each item in the shipment Currency of the monetary value of each item in the shipment Total of monetary value of the shipment Currency of the total monetary value of the shipment Shipment weight Nature of content (goods, samples, documents, gift) Monetary postage paid amount Monetary postage paid currency Customs Refence ID, (e.g.: IOSS number, VOEC, Tax-ID), as applicable MOVE YOUR PARCELS TO THE FASTLANE 10

Data Quality It is very important to provide accurate data. Accurate data reduce delays in customs and unnecessary duties and taxes. Do not use repetitive or sequence numbers or letters, e.g.: 0000, 9999, 1234, AAA, XXXX, ABC Do not use fantasy names, e.g.: Mickey Mouse, Speed Racer Do not fill names, addresses or content info with N/A Provide correct amounts and weights MOVE YOUR PARCELS TO THE FASTLANE 11

Technical Readiness The following systems are ready to receive EAD: Mercury: portal, API, sftp or ftps eShipper: portal, sftp or ftps Shipping Manager: front-end, back-end, API, sftp or ftps Shipping Manager Light If you provide data by uploading files and need further information on the data format, please contact your Business eSolution Manager MOVE YOUR PARCELS TO THE FASTLANE 12

Support If you require support and information, please contact your Business eSolution Manager at: clientintegrationseu@landmarkglobal.com MOVE YOUR PARCELS TO THE FASTLANE 13

What is S10? S10 is a standardized unique postal item identifier recognized worldwide. S10 identifiers have four components with fixed length of 13 characters. - - - - 2 characters Service indicator 8 numbers Serial numbers 1 number Check Digit 2 characters Origin country code (ISO 3166 2-character) S10 item identifier should not be repeated for 13 months. S10 is a requirement for all international products. MOVE YOUR PARCELS TO THE FASTLANE 14

S10 for Tracked Products Tracked Landmark Global products and relation with the S10 (identifiers for illustration purpose): MaxiPak Scan/Sign - EE123456789BE MaxiPak Sign - CD604959050BE MaxiPak Sign - CP159357789BE MiniPak Scan/Dragon Scan - LX456987123BE MiniPak Sign - RR369852147BE Electronic Advance Data (EAD) information for all tracked items containing goods need to be provided by: - Entering data on Landmark Global systems, - Transfer data via API, ftp. MOVE YOUR PARCELS TO THE FASTLANE 15

S10 for Untracked (Semi-tracked) Products Products in scope: MiniPak (untracked containing goods) UA125159357BE MiniPak TT (semi-tracked containing goods) UA258963147BE MiniPak Unsorted EU, MiniPak Sorted (untracked containing goods)- UA987123654BE Provision of S10 for untracked & semi-tracked items containing goods is mandatory Customer that don t have S10, may contact Landmark Global to obtain pre-printed customs form declaration CN22 with S10 included. MOVE YOUR PARCELS TO THE FASTLANE 16

Additional Information What to do? Customers that have received a range for S10: use this ID in their packages and, shall provide the information on their data files. Customers that have not received a range for S10 please contact your Business eSolution Manager at clientintegrationseu@landmarkglobal.com For all other questions around S10 or EAD, please contact your Business eSolution Manager at clientintegrationseu@landmarkglobal.com MOVE YOUR PARCELS TO THE FASTLANE 17

landmark global SENDER RECIPIENTS CONTENT Thank you 09