Understanding Irish Economic History Since Independence

This topic delves into the economic evolution of Ireland since gaining independence, exploring key milestones such as shifts from globalization to autarky, and from autarky to globalization. It also discusses the economic structures of different decades, offering a comprehensive view of Ireland's economic development. From trade policies to fiscal and monetary approaches, the content provides insights into the economic landscape of Ireland as it transitioned into a global player.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

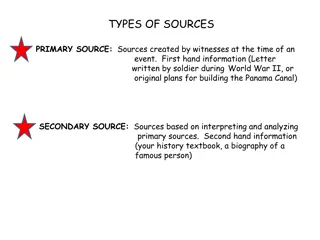

Presentation Transcript

TOPIC B: IRISH ECONOMIC HISTORY SINCE INDEPENDENCE TCD M.SC.(EPS) RONAN LYONS EC8001 IRISH ECONOMIC POLICY ISSUES & CONTEXT

MODULE OUTLINE Topic Title A B C D E F G H I J EoI Ch 1+ 1+ 2, 7 3, 4 6 8 5 9, 11 12, 13 10, 14* Dates MT1-2 MT3-4 MT5-6 MT8-9 MT10-11 HT1-2 HT3-4 HT5-6 HT8-9 HT10-11 Irish Economic History to Independence Irish Economic History since Independence The Economy & Economic Growth Public Finances, Debt & Taxation The Labour Market Social Justice & Inequality Regulation & Competition Competitiveness & Trade Health & Education Natural Resources & Real Estate

TOPIC B. READINGS John O Hagan & Carol Newman, Economy of Ireland (12thEdition) Chapter 1, Historical Background Further Reading: Andy Bielenberg & Raymond Ryan, An Economic History of Ireland Since Independence

TOPIC B: STRUCTURE Irish Economic History since Independence 1. 1932: From globalization to autarky 2. 1959: From autarky to globalization 3. The 1990s: The 30-year overnight success story 4. The 2000s: Bubble and crash

BROAD PERSPECTIVES Two competing conceptualizations of Ireland s economic performance 1920-2000 Delayed convergence Follows from basic growth theory (Topic C) Catch-up natural, hindered by poor policies before the 1990s Regional economy model Can only understand long swings of growth and recession with unusually mobile factors of production (L, K) Out-migration prevents wage lowering, thus dampening attraction of FDI hence need for government policy Other perspectives exist (e.g. role of interest groups)

IRELAND AT INDEPENDENCE Trade policy Tariff Commission set up in 1926 depoliticize decisions Under Dept of Finance control: conservative, free-trade Muscles were flexed, though: 59 tariffs by 1931 Fiscal policy Active fiscal policy some decades away indirect taxation on mass consumption goods (broadly regressive) Shannon Scheme exception (DoF failed to block) Monetary policy Caution and continuity: power of Irish Banks Standing Committee Currency Commission 1927 Irish punt, move towards CB

FREE-TRADE VS. PROTECTIONISM Pro-trade bloc led by Departments of Finance & Agriculture Based on pragmatism: agricultural export earnings paid the bills Vast bulk of these exports were to UK Context of significant cumulative trade surplus, 1914-1921 ( 77m) 1920s a time of trade deficits, falling agri prices Protectionist bloc led by Dept of Industry & Commerce Cf. nationalist vision of less dependence on Britain Irony: tariff-jumping British investment Import-substituting industrialization Tariffs paid for by consumers could help generate broader base Mirrored in attraction of FDI later

OUTBREAK OF ECONOMIC WAR 1932 election of FF marked decisive break in trade policy Stopping of land annuities sparked economic war Agriculture suffered in both short and long run Aim was shift from pasture to industry (+ tillage) Shift in power to Dept of I&C Self-sufficiency Few changes to fiscal or monetary policy 1934 Commission did not led to Central Bank [until 1942]

START OF AGRICULTURES DECLINE 1920s Ireland was one of family farms specializing in livestock, dairy 86% of exports agri, food/drink Explains land redistribution, from 1923 (on-going until 1970s) ~0.85m acres (of ~21m) compulsorily acquired [+~0.5m vol] Average size of farms halved 1900-1960 Bleak first two decades for sector as exporter Post-1920 collapse in agri prices left borrowers in trouble Economic War with Britain during 1930s meant loss of market share: from 27% in late 1920s to 20% in late 1930s 36% output fall led to slaughter of cattle, until 1936 Coal-Cattle Pact

FALSE DAWN FOR INDUSTRY? Partition stripped Irish Free State of most industry Just 10% of employment in 1926 low relative to Europe Concentrated in food/drink, and in Dublin Major names: Guinness, Ford, Goulding Post-WW1 upheaval did not help Kynoch s moved from Arklow to Britain as did Distillers Co Many woollen mills destroyed 1918-1923 1930s saw protection for native industry Hurt export-focused firms like Guinness (had to set up in England) and Ford (switched from tractors to cars) But growth in textile/clothing in particular

IRELANDS SERVICES INHERITANCE Well-developed service sectors in Ireland on independence Transport, communications, retail, banking Domestic service and retail the largest subsectors Roughly 100,000 each in 1920s Early setbacks Withdrawal of British troops associated with fall in local spending (e.g. of garrison towns) Disruption of transport network: wartime control of railways (1916-1921), Civil War target (1/3 inoperative by end-22) Longer-term challenge for rail: ever greater control by state (1924 amalgam, 1933 K write-down )

OUTBREAK OF WORLD WAR Rise in prices (shortages) but freeze on prices Fall in living standards; coal shortage led to re-turfing Dept of Supplies; more formal economic planning Lemass its Minister (moved from Dept of I&C) Cabinet Committee for Economic Planning Central Bank established in 1942 Increasing government control of rail & shipping Once war finished, government maintained interest in shaping economic outcomes Infrastructure spending, Public Capital Programme (1950) Rural electrification started in 1946

AGRICULTURE & INDUSTRY IN WAR Compulsory tillage orders saw doubling of output 1940: all farms >10 acres had to dedicate 12.5% to tillage 1943: all farms >5 acres had to dedicate 37.5% to tillage Shortages of capital and inputs meant increased use of horses, labour Dependence on British imports (incl petroleum) hit industry hard during war 25% fall in output, 1939-1942 House completions fell from 12,300 to 1,300 1939-1945 Protected industries dependent on home market Missed out on trade-driven growth post-WW2: 23% in Ireland vs. 73% elsewhere in OEEC

TOPIC B: STRUCTURE Irish Economic History since Independence 1. 1932: From globalization to autarky 2. 1959: From autarky to globalization 3. The 1990s: The 30-year overnight success story 4. The 2000s: Bubble and crash

POST-WAR EARLY INTEGRATION Ireland a founding member of OEEC (later OECD) Aim was distribute ERP (aka Marshall Aid) Ireland s role was to help feed Britain postwar shortages 1948-1952: received 41m in cheap loans, 6m in grants OEEC help shape data gathering Requirements of ERP led to establishment of CSO, 1949 Separate current and capital accounts from early 1950s IDA was established in 1949 Shannon Free Zone set up around this time also Anglo-Irish Trade Agreement Not all-in: did not join IMF, GATT (1948) European Coal & Steel Community (later EEC) not relevant

POLITICS AND ECONOMICS Ireland had a balance-of-payments (BoP) deficit at this point ERP helped fund this End of ERP meant a doubling of the BoP deficit to 61m FF s first budget back in power a deflationary one In turn contributed to their exit from government in 1954 1955 monetary experiment IBSC persuaded not to pass on UK interest rate increase inappropriate given lack of inflationary pressures Current A/C deficit increased to 6.5% - flight of capital and labour (peak of emigration) Honohan & Gr da: 1956 crisis defining event of post-war Irish economic history

SWITCH TO EXPORT-LED GROWTH Not an overnight switch to export-led growth 1949-1952: establishment of IDA; Coras Trachtala 1953-1958: removal of restrictions on FDI; Export Profits Tax Relief Scheme (0% CGT until 1980); exemption of exports from Control of Manufactures Nonetheless, landmark seen in T.K. Whitaker s Economic Development paper Reallocate social expenditure into more productive areas Led to First Programme for Economic Expansion (Lemass) Joined EFTA with UK (EEC founded 1957) Further pressure on agriculture sector

PATTERNS OF TRADE In 1920s, UK accounted for 97% of exports and 80% of imports By WW2, export figure was higher, imports down to ~50% Coras Trachtala helped boost Irish exports to US From 1% to nearly 10% by early 1950s UK markets open to Irish manufacturers from 1965 Source of Irish imports 60% 50% 40% Late 1940s Early 1960s 30% 20% 10% 0% UK US EU

MAKING YOUR OWN LUCK? Bryce Evans: a national coming of age happened to coincide with Lemass s coming of age EEC/EFTA emerged as credible constraint on policy International trade was buoyant, as was British growth First PfEE failed to deliver its objectives Tax burden did not fall, not did spending on housing Perception of success led to Second PfEE Meant to cover period 1964-1970 abandoned Similar fate befell Third PfEE Neo-corporatist institutions set up at this period Trade union and employer participation although early wage bargaining was not successful

FOCUS ON AGRI PRODUCTIVITY By early 1960s, state supports ~20% of output Poor output per worker and per acre Productivity improvements centred around mechanization, in particular tractor From 6,000 in 1947 to 30,000 in 1955 Freed up land used for horses (~10%) Also freed up labour: 148k labourers (1929) vs. 26k in 1979 1960s/70s: concentration and specialization Benefited from high EEC prices upon entry 45% increase in real prices between 1971 and 1978 Seen also in related industries: Kerrygold (1962) and five other creameries

LOCAL INDUSTRYS INDIAN SUMMER As of 1970, ~3/4s of industry output for home mkt ~10% of employment in British firms, vs. ~10% for rest-of-world Growing consumer demand of 1960s gave native industry an Indian summer Multinational consortium involved in Irish Refining Co (Whitegate, Cork) in 1957 Importance of energy security reflecting its importance as an input Growth phase for construction from 1950s to 1970s In banking, consolidation From six banks to two (BOI and AIB)

FROM RAIL TO CAR & AIR Rail services still struggling post-war 1948 Milne Report: sheer age of stock move to diesel 1957 Beddy Report: closure of stations lack of density 1964: policy acceptance that subsidy required for survival Increase in rail freight from 1950s on Reflecting some economic growth stopped in 1980s 1952: Bord Failte set up 20% bedroom grants in 1st PfEE, other expenses by mid-1960s Over-capacity Retail revolution in 1960s SuperQuinn, Quinnsworth, Musgrave 1,058 country general shops in 1951 to 76 in 1988

PREPARING TO ENTER EUROPE Failure to join EEC with UK led to interim liberalization 1965 Anglo-Irish Trade Agreement Increase in butter quota seen as important but as elsewhere in Europe, agriculture in relative decline Free secondary education from 1967 Perception that Ireland had missed post-war boom 1969 saw changes to regional policy Buchanan Report : focus on major cities + 10 regional and local centres dropped, as too political IDA achieved autonomy: ended up de facto in charge of regional policy twin strategy of high-productivity sectors plus lower-skilled manufacturing employment

TOPIC B: STRUCTURE Irish Economic History since Independence 1. 1932: From globalization to autarky 2. 1959: From autarky to globalization 3. The 1990s: The 30-year overnight success story 4. The 2000s: Bubble and crash

IRELAND'S DECISIVE BREAK Entry into EEC (EU) gave Ireland access to world s largest market Harness foreign capital to benefit of local labour Direct benefits also Transfers amounted to 2% of income after entry and 8% in early 1990s, before falling back to 1% by late 2000s Bulk of this through CAP support: typically >2/3s Single European Market (from 1992) Cohesion funds to offset regional disparities well-timed for Ireland: allowed investment that otherwise would not have taken place Diversification of export destinations

ATTRACTING FDI Early 1980s, IDA costing 2% of GNP Telesis Report (1982) greater focus on indigenous firms Landmark investments acted as signals E.g. of Intel (1990), after which Ireland attracted 40% of US electronic investment into Europe 1990-1994 Also Pfizer 10 firms invested 1975- 1986, majority in Cork harbour Policy skew to industry shows perception of services at time

SINGLE EUROPEAN MARKET Lowering of trade costs facilitates integration By late 1980s, Irish industry already MNC-led and export-focused More open to removal of final tariffs than industrial sectors in other EU countries A shift in the role of export Previously export growth (to UK) reflected domestic strength Now, export growth had a multiplier effect, boosting domestic economy A shift in markets UK source of 1/3 of imports since 1990s, down to 15% of X EEC destination for 45% of exports in 1990s

(MIS)USE OF FISCAL POLICY Only in 1970s was fiscal policy used to directly impact economic activity 1972, Colley deficit continued with FG/Lab (1stOil Crisis) 1977, FF manifesto promised abolition of property and motor tax, reduction of income tax and increase in public employment O Donoghue dash for growth saw current deficit grow from 3.6% 1977 to 6.1% 1978 Stimulating demand without increasing supply: inflation and wage-price spiral Exchequer deficit was 10%-16% of GNP from 1976 to 1987 both current and capital

1980S FOCUS ON REGAINING CONTROL Early 1980s: political turbulence No coherent response to Second Oil Crisis (1979) 1983 National Planning Board , Building on Reality Coalition strategy Deflationary fiscal policy, employment creation Contraction of spending, not expansion of taxes reflects economic thought at that time (UK, US) but also reality? Late 1980s: era of Tallaght Strategy and PDs Current deficit fell from 6% of GNP (1987) to 1.6% (1988) A rare case of Expansionary Fiscal Contraction ? Or offset by improved wage competitiveness + favourable external conditions?

1990S CONSENSUS Governments throughout the 1990s adhered to three core principles: 1. Social Partnership learnt from lessons in demise of 1960s and 1970s predecessors 2. Maastricht criteria binding constraint on fiscal policy (significant funds at stake) 3. Attracting FDI through low corporation tax confluence of external and Irish circumstances Also attempted to boost competition within economy 1987 PNR: union shift from wage increases to employment creation, tax reform Unions lost members but gained influence 1/3 of wage growth 1987-1997 due to tax reform

STEADY-STATE FOR FARMING? CAP freed up government spending dramatically Agri supports fell from 65% of budget in 1973 to 15% in 1989 Commodity-based system did little to stimulate value-add activities Major reforms 1992-2003: broke link between production and price support; focus on environment Continued concentration e.g. in pig, poultry Number of farms halved to ~130,000 in 2005 typical farm still reliant on off-farm income Return to renting of agricultural land: typically 1/3 of larger farms comprise plots that are rented From 20cwt of barley per acre 1920s to 46cwt 1990s

RISE OF SERVICES Since 1920s, sector s share has expanded consistently from 1/3 to As in other European countries, albeit somewhat lagged US deregulation of air travel in late 1970s European response 1989 two airline policy Aer Lingus had crushed Avair, but Ryanair survived Initially, detrimental impact on tourism Rise of package holiday Further deregulation a boost capacity of tourism sector tripled 1987-2007 (15k beds 1958, 24k 1994, 60k 2009) Financial deregulation rebirth of competition in banking?

TOPIC B: STRUCTURE Irish Economic History since Independence 1. 1932: From globalization to autarky 2. 1959: From autarky to globalization 3. The 1990s: The 30-year overnight success story 4. The 2000s: Bubble and crash

FISCAL POLICY: STILL CRAZY? After a long history of large deficits, government had a current account surplus 1997-2007 Allowed capital A/C deficit structural funds on top Also allowed cutting of taxes (e.g. CGT from 40% to 20%) Late 1990s fiscal policy stimulating supply-side Vs. 1970s counterpart: stimulating demand Nonetheless, with aim of stimulating economic growth Key part of fiscal policy has been favoured sectors 1950s: preference for industrial exports (zero tax) 2000s: construction sector compounded by lack of regulation of finance and construction 20908: fiscal policy only tightened once needed

MONETARY POLICY: GOING CRAZY? In relation to monetary/currency policy, theme is changing relationship with UK Advantage of 1:1 link eroding over time cf. trade patterns 1826 monetary union ended in 1978 (joined EMS) Full benefit only accrued once fiscal policy was controlled 1986-1992: fall in bond premium over Germany 1992-1993: speculative attacks, devaluation and free(r) float From 1999, single European currency Debate on joining was political, not economic

GLOBAL CAPITAL MARKETS 1980s/1990s: financial services underwent huge changes in both policy (deregulation), technology Entry into euro removed ER risk Irish banks could now access global capital markets No oversight/macro-prudential policy at Irish or ECB level Savings glut post-Asian Crisis meant almost limitless money available Low interest rates in euro due to sluggish growth inflationary pressures in Ireland Another theme: no longer a British economic satellite but out of sync with European partners

APPETITE FOR DESTRUCTION Pre-1990s: very cautious banking system Late 1960s: 3/4s in London assets (not Irish lending) Honohan: relied heavily on external finance to supplement what local [banks] cannot do From 1990s: caution to the wind >20% growth = danger! Over-exposed to one sector, Irish housing Role of competition? Duopoly then Anglo, INBS (dereg) and RBS Irish banking system: Credit-deposit ratio 200% 180% 160% 140% 120% 100% 80% 60% 40% 20% 0% 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010

INVESTMENT, BY TYPE 100% 90% 80% 70% Other Agri equipment Transport equipment Roads Other buildings Dwellings 60% 50% 40% 30% 20% 10% 0% 1953-56 1965-68 1978-82 1993-97 2006-09

THE FATEFUL NIGHT Failure of Irish banking system led to a 440bn government guarantee of all liabilities Deposit-, bond-holders protected, equity-holders wiped out Effective run on Irish banks: Deposits fell from 250bn in September 2008 to 150bn in November 2010

UNDER THE RADAR? Decline in manufacturing since 2000 masked pre- crisis by rise in construction Also blurring of lines between industry and services many Irish-based MNCs switched to latter in early 2000s Since 1990, exports of invisibles (i.e. services) have grown dramatically in importance By 2009, estimated that 1/3 of all service sales exported Financial services: from 600 IFSC employees in 1990 to 20,000 in 2005 debt, debt securitization, hedge funds Smart or lucky? 12.5% rate on services Balance of trade in services in strongly negative Clear (net importer of tourism) vs. unclear (royalties)

THEMES FROM IRISH HISTORY Specialization in agriculture, deindustrialization in century to independence Little success at later attempt to promote native industry Much more success since 1950s at export-led growth Transition to urban and services-based economy In line with but later than our European peers Blurring of lines between industry and services tradability Trade dependence Natural to pick a small number of sectors (e.g. livestock or ICT) but more vulnerable? Convergence in living standards but at own pace Role of government as agent of state s economic fortunes?

MORE DETAIL TO COME! Topic Title A B C D E F G H I J EoI Ch 1+ 1+ 2, 7 3, 4 6 8 5 9, 11 12, 13 10, 14* Dates MT1-2 MT3-4 MT5-6 MT8-9 MT10-11 HT1-2 HT3-4 HT5-6 HT8-9 HT10-11 Irish Economic History to Independence Irish Economic History since Independence The Economy & Economic Growth Public Finances, Debt & Taxation The Labour Market Social Justice & Inequality Regulation & Competition Competitiveness & Trade Health & Education Natural Resources & Real Estate

ESSAY & EXAM-STYLE QUESTIONS What does Ireland s economic history say about the potential for import-substituting industrialization? In relation to monetary policy, is Ireland no longer British but not (yet) European? Is Ireland s late catch-up evidence of delayed convergence or its status as a small economic region?