Understanding White Collar Crimes and Their Impacts

White collar crimes involve illegal activities committed by individuals of higher social class in professional settings. These crimes can include bribery, embezzlement, forgery, tax evasion, and fraud. They have significant economic repercussions and can erode investor trust in the market. Various types of white collar crimes, such as corporate fraud, are discussed, along with their classification and examples. The East India Company is highlighted as a historical case related to corporate misconduct.

Uploaded on Sep 18, 2024 | 2 Views

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

WHITE COLLAR CRIMES WHITE COLLAR CRIMES ZAINUB, SIP54 BTECH CS + CYBER LAWS UPES Vth year

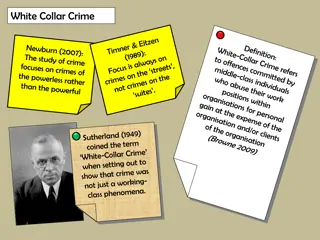

WHITE COLLAR CRIMES WHITE COLLAR CRIMES A person of upper Socio-economic class who violates the criminal law in course of occupational or professional activities. Professor Sutherland crimes committed by upper-class men in the course of their business or professional activities.

An illegal act committed to achieve an illegal goal. 1. illicit gain 2. avoid paying legal or formal fees, 3. withholding money or property, etc. includes criminal and civil law violations. Conventional crimes such as theft, break-in, arson, etc. are much less than the loss from white-collar crime, affect our country's trade and economy, and also lead to a loss of investor confidence in the market.

CLASSIFICATION OF WHITE COLLAR CRIMES CLASSIFICATION OF WHITE COLLAR CRIMES- - 1. Ad hoc crime: perpetrator pursues his / her individual goal without interacting with the victim personally ex. credit card fraud, hacking etc. 2. Bribery: When money, goods, services or information of any kind are offered to support the acts Influencing the policyholder's opinions and decisions is considered bribery. 3. Embezzlement: When a person who has been authorized with money or property uses it for their own purpose. 4.Counterfeiting: Copies or imitates an item without being authorized to do so.

5. Forgery: When a person licences any counterfeit instruments such as a check etc . 6.Tax evasion: Often used by the middle class for unaccountable income. 7.Professional crime: offenses committed by doctors and lawyers in the course of their profession. 8. Fraud : willful deception for personal gain or harm to another person or organization. it is illustrated in both the Criminal Code and the Civil Code.

FRAUS OMNIA VITIATE FRAUS OMNIA VITIATE - - FRAUd VIOlATES EVERyThINg FRAUd VIOlATES EVERyThINg Types of corporate fraud 1. Fraudulent financial statements 2. Employee fraud 3. Supplier fraud 4.Customer fraud 5.Investment fraud 6.Bankruptcy fraud 7.Asset appropriation 8. Corruption Fraud is defined under- 1. Indian Contract Act, 1872 2. Indian Penal Code, 1860

CASE CASE- - EAST INDIA COMPANY EAST INDIA COMPANY Trading company licensed by the Crown and gent of the Crown. Commissioned to help the British state economically and politically. It was the first multinational in the world to pursue both investment opportunities and territorial power. The India-based EIC employees sought commercial profit for themselves, the Crown and the East India House; While aggressively acquiring Indian territory on behalf of the Empire. In the late 1700s, Edmund Burke had Robert Clive (the founder of the Empire) and Warren Hastings (Governor General of India) indicted for political impeachment with corruption issues. Trail couldn't judge anyone. To achieve all of these goals, EIC's corporate behavior was inconsistent. Sometimes the company followed ethical safety and financial practices. Sometimes it was easy to commit financial theft and bribery, or violate civil liberties and human rights.The concept of corporate social responsibility was subordinate to his interests. The company was subsequently dissolved under the East India Company's share buyback act.

FIRST INDEPENDENT INDIAN CASE FIRST INDEPENDENT INDIAN CASE- - MUNDHRA SCAM MUNDHRA SCAM Haridas Mundhra, an industrialist and stock speculator, sold fabricated stocks to the Life Insurance Corporation (LIC) defrauded LIC for 125 million . Mr. Jawahar Lal Nehru (then Prime Minister) set up a one-man commission headed by Judge Chagla Judge Chagla closed the matter. Haridas was found guilty and sentenced to 22 years in prison and T. Krishnamachari, then Minister of Finance, resigned from his office.

ENRON SCAM ENRON SCAM Enron corporation is an American energy company based in Houston, Texas. On October 16, 2001 - The third quarter loss was posted at $ 618 million and then $ 1.2 billion in stocks was withdrawn. October 31, 2001: The SEC updates the investigation to a formal investigation. on December 2, 2001: Enron filed for Bankruptcy. 4,000 employees were sacked, 20,000 workers lost their jobs and $73 billion was lost in the stock value.

Enron's management used complex and seedy accounting schemes to reduce Enron's tax payments, to increase Enron's income and profits, to increase Enron's share price and creditworthiness, to hide losses at off-balance sheet subsidiaries, to create an off-balance sheet plan design to channel money for themselves, friends and family. To fraudulently misrepresent Enron's financial condition in a public report

SATYAM SCAM SATYAM SCAM- -2009 2009 Biggest scam in Indian history. Chairman Ramalinga Raju has tampered with the financial statements and accounting books. Over declared assets of Rs 490 crore. Counterfeit cash balance greater than Rs 5000 crore on the balance sheet. Rs 376 million interest component that never went into the company's coffers. Unspoken liabilities of Rs 1,230 crore. Chairman, Managing Director, Chief Executive Officer and Chief Finance Officer and the Key Managerial Personal got arrested. audit firm partners also arrested. People in Satyam lost a staggering Rs 100,000 crore in market cap as investors reacted sharply and dumped the shares, pushing the stock down 78% to Rs 39.98 on Bombay.

HARSHAD MEHTA CASE HARSHAD MEHTA CASE Came as a biggest shock in Indian history. Harshad Mehta received forged bank receipts from small banks, which were transferred to other banks as collateral for cash. This money was used to drive up stock prices on the stock market. broken bank receipts were busted. Drastic impact on the stock market, economy and progress of the country. The banking system was cheated of whopping 5 billion rupees . Even the chairman of one of the banks committed suicide.

LEGISLATIONS LEGISLATIONS- - Indian Contract Act[13] (Section-17) Indian Penal Code[14] (section-25) Prevention of Corruption Act[15] Prevention of Money Laundering Act[16] The Companies Act[17] Clause 49 of Listing Agreement Securities and Exchange Board of India Act[18] CARO Act[19] Essential Commodities Act[20] (Section-6) Information Technologies Act[21] (Section 43-44)

With the advancement in technology and personal greed increasing day-by-day. some are not even addressed. responsible for economic loss of country also. THANKYOU... THANKYOU...

![Prevention and Combating of Hate Crimes and Hate Speech Bill [B.9B.2018]](/thumb/60513/prevention-and-combating-of-hate-crimes-and-hate-speech-bill-b-9b-2018.jpg)