The Revival of Special Drawing Rights: A Comprehensive Analysis

The G20 has urged the IMF to propose a new USD 650 billion general allocation of Special Drawing Rights (SDR) to enhance global liquidity and aid the post-pandemic recovery. This article delves into the history, functions, and potential revival of SDRs as a crucial IMF tool, exploring the motives behind the recent decisions and the implications for the reformed international monetary system.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

REVIVIAL OF SPECIAL DRAWING RIGHTS? REVIVIAL OF SPECIAL DRAWING RIGHTS? Edwin (Ted) Truman Senior Fellow April 20, 2021

We call on the IMF to make a comprehensive proposal for a new Special Drawing Rights (SDR) general allocation of USD 650 billion to meet the long-term global need to supplement reserve assets. A new allocation would enhance global liquidity and will help the global recovery, building on the last assessment made by the IMF in 2016. We also invite the IMF to present proposals to enhance transparency and accountability in the use of the SDRs while preserving the reserve asset characteristic of the SDRs. In parallel, we ask the IMF to explore options for members to channel SDRs on a voluntary basis to the benefit of vulnerable countries, without delaying the process for a new allocation. G20 Communique, April 7, 2021 2

OUTLINE I. What are Special Drawing Rights (SDR)? II. What motivated this decision? III. Does the decision point to a revival of the SDR as an IMF tool? 3

Reminder: What are SDR? Reminder: What are SDR? SDR are Reserve assets issued to all IMF members proportionate to their quotas Also, reserve liabilities Members pay interest on their liabilities and receive interest on their assets If liabilities = assets, no net interest is paid (currently 0.05 percent) SDR can be used to meet a country s external financing needs. Members transfer SDR to other countries in return for hard currency, for example to the United States but also to other members Can be used without conditions on economic policies 4

HISTORY The SDR mechanism was established in 1968 to support the Bretton Woods monetary system SDR were first issued in 1970-1972 August 15, 1971: United States closed its gold window C20 reform effort (1972-1974) failed to reach agreement on a new system 5

IN THE REFORMED INTERNATIONAL MONETARY SYSTEM The SDR remained in the IMF s toolkit in the subsequent 1976 amendment to the Articles of Agreement Article VIII, Sec. 7 obligates each member [T]o ensure that the policies of the member shall be consistent with the objectives of promoting better international surveillance of international liquidity and making the special drawing right the principal reserve asset in the international monetary system More aspiration than reality 6

THE SDR DID NOT GO INTO HIBERNATION IMMEDIATELY The economic and financial turbulence in the 1970s Along with some technical changes in the SDR Led to an allocation of SDR 12.1 billion in 1979-1981 Raised the share of SDR to 7 percent of international Reserves The SDR tool was effectively inactive for 30 years not for want of efforts by some 7

THE SDR OUT OF HIBERNATION 2007-2009 Global Financial Crisis and Global Recession International financing dried up Elevation of the G20 to the Leaders level in November 2008 US endorsed an allocation of $250 billion in SDR at the London G20 meeting in April 2009 SDR allocated by late August that year 8

THE SDR IN THE GLOBAL PANDEMIC Global pandemic and worst global recession since the Depression Many pressed for a large SDR allocation of $650 billion The arguments against one were even weaker than in 2009 In April 2020, the G20 and the IMFC discussed the proposal Proposal had almost universal support Except from the United States 9

BIDEN ADMINISTRATION CHANGED US POSITION BIDEN ADMINISTRATION CHANGED US POSITION on an SDR Allocation on an SDR Allocation February 25 -- Janet Yellen endorsed an SDR allocation February 26 -- G20 (chaired by Italy) endorsed an allocation March 19 -- G7 (chaired by the United Kingdom) announced support for a $650 billion allocation April 2 -- Secretary Yellen notified the Congress that she would vote to support the allocation 10

THE SDR IS A CONTROVERSIAL TOOL Statements in opposition The Democrats Plan to Bail Out China. Sometimes an idea gets legs in Washington that is so objectively bad, you re almost tempted to admire it for beating the odds. Statements in support Allocating a new round of SDRs . . . would avoid the stigma of normal IMF lending programs. . . . They have a proven record as a technological solution: in 2009, a $250 bill issue of SDRs helped to stabilize the global economy. Financial Times, March 1, 2021 [S]upport is building among the IMF s membership for a possible SDR allocation of $650 billion. This would benefit all our members, but especially the most vulnerable, by boosting reserves without adding to debt burdens. It will send a powerful message of multilateral solidarity freeing up resources for vaccination programs and other urgent needs. IMF Managing Director, Kristalina Georgieva Congressman French Hill Wall Street Journal,February 3, 2021 Special drawing wrongs: Issuing special drawing rights will be a sign of failure of the IMF The Economist, April 3, 2021 March 30, 2021 11

IMPLEMENTATION April 5 Yellen speech makes argument #1 April 7 G20 endorsed the $650 billion allocation April 8 IMFC endorsed the allocation By end-April Managing Director s proposal will be sent to IMF Governors for their vote Congress will not vote to prevent US voting for the proposal By late July or early August allocation of SDR 12

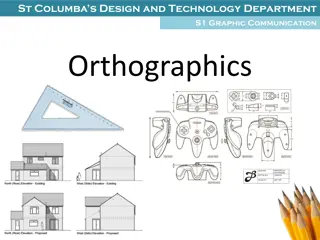

Summary of SDR allocations as a percent of Summary of SDR allocations as a percent of international reserves international reserves % Reserves International Reserves USD bil SDR in USD bil Cumulative SDR in USD bil Year of Allocation % Reserves Before Allocation After Allocation 1970-1972 90 9.3 10.3 9.3 0 10.3 (Including gold) 213 9.3 4.4 9.3 0 4.4 3.1 7.1 1979-1981 390 15.7 4.0 27.9 0.5 4.6 2009 6,927 285.3 4.1 318.7 2.4 7.8 2021 12,052 650.0 5.4 939.2 13

POSSIBLE FURTHER EVOLUTION A new five-year basic period starts on January 1, 2022 Another $650 allocation would then be possible without the US Congress voting to approve The next (16th) review of IMF quotas (and the quota formula) is to be completed by the end of 2023 A decision to increase and redistribute quotas is likely Less predictable is approval by the US Congress But that may not be necessary Another SDR allocation could be part of the package How the system responds to the 2021 allocation will help determine the SDR s future 14

TENATIVE CONCLUSIONS The SDR has become one of the IMF s crisis-management tools Regular SDR allocations are not likely The evolution of the SDR may turn on two issues that were central to the negotiations in the 1960s A. The adjustment process and meeting demands for international reserves B. Currency manipulation (foreign exchange policies) and its effects on the adjustment process 15

THANK YOU THANK YOU 16