The Future of REDD+ Financing: Insights and Initiatives

Explore the latest developments in REDD+ financing, including commitments and initiatives by the Forest Carbon Partnership Facility and the BioCarbon Fund. Discover options available for countries seeking upfront financing and support for sustainable forest landscapes. Learn about different pathways for using Emission Reductions (ERs) for Nationally Determined Contributions (NDCs) and the pricing mechanisms associated with them.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

FCPF Knowledge Day Series FCPF Knowledge Day Series Session 1 Session 1 Future of REDD+ Financing Future of REDD+ Financing 6 December, 2021

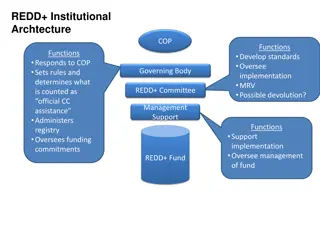

FCPF and ISFL a snapshot Forest Carbon Partnership Facility (FCPF) - Carbon Fund - All 15 ERPAs in the Carbon Fund portfolio have been signed over $721 million committed in results-based payments. - ERPAs are committed through December 2025 - ERPAs currently under implementation first verification and payment completed. Monitoring, Reporting, and Verification and subsequent payment is underway for several others. BioCarbon Fund Initiative for Sustainable Forest Landscapes - ISFL - 5 programs in the ISFL portfolio (Colombia, Ethiopia, Indonesia, Mexico, Zambia) - Ethiopia completed the first ERPD assessment and now entering ERPA negotiations - ERPD assessment is underway Colombia, and shortly underway for the other 3 programs - ERPAs to be signed will be committed through 2030 for about $250 million in results-based payments.

Map of the different initiatives Standard Finance Non-market Warsaw framework Article 5/9 Market Article 6 Voluntary markets

Options for countries CERF, Emergent, LEAF LEAF/Emergent CERF FCPF and ISFL Upfront financing availability Transaction costs Built into Bank lending operations Readiness and technical assistance ? Verification, TREES registration and financial intermediary Disbursement by financial intermediary as per high level investment framework Registration under ART/TREES 2022-2026 NO NO Disbursement mechanism Disbursement by recipient as per benefit sharing plan Disbursement by recipient as per benefit sharing plan Access for countries CERF methodology will build on FCPF/ISFL Registration under FCPF CF or ISFL FCPF: -2024 ISFL: -2030 Vintage -2040? ART Registry ER Transaction Registry CATS Registry CATS Registry Recommended types of countries High/middle income countries most likely Low and high/middle income countries Low and high/middle income countries 4

Options for countries CERF, Emergent, LEAF CERF LEAF/Emergent FCPF and ISFL ER use for NDCs under RBP option ER transaction type (i) Retransfer ERs use for NDCs (FCPF Tranche B, ISFL partly) (i) RBP Option (Pathways 1-3) With or without ER title transfer, corresponding adjustment not required (ii) Non-RBP Option (Pathway 4) Corresponding adjustment of Supplier s NDC required (ii) Retained ERs use/cancelled by buyer (FCPF Tranche A, ISFL partly) To be determined. Floor price? Price (Contract ERs) (i) Retransfer ERs: $5 for FCPF; $5 for ISFL (ii) Retained ERs: $5 for FCPF; $5 for ISFL To be determined Price (Additional ERs) (i) Retransfer ERs: $5/$6 or tbn for FCPF; $5 for ISFL (ii)Retained ERs: $5 for both FCPF and ISFL To be determined Price (Excess ERs not sold to fund Participants) Could be higher. Example those sold in an auction or other bilateral agreements 5

Differences between ART/TREES & FCPF/ISFL Standards FCPF and ISFL Standards ART/TREES Eligible entities Governments, Subnat. Jurisdictions (SJ) Governments, requirements more stringent Crediting Period End date: FCPF 2024, ISFL 2029 Start date: Possible retroactive FCPF REDD+ (HFLD), ISFL AFOLU End date: 5yr renewable, limited to 2030 for SJ Start date: as early as 4yr before TREES concept REDD+ (HFLD) Scope Methodological requirements Discounts Methodological framework, detailed methodology defined by country Uncertainty (10-15) and Buffer (10-40%) More detailed and stringent requirements Uncertainty (sliding scale deductions applied), Buffer (5-20%) and Leakage (0-20%) Based on Cancun SGs, with specific indicators subject to verification YES Safeguards World Bank ER Title YES Validation &Verification Accredited third party Accredited third party 6