Stock Markets

Explore the world of equity and stock securities as they are traded in primary and secondary markets. Learn about common and preferred stocks, dividend payments, and ownership claims in corporations. Dive into the complexities of stock prices, dividends, and investment returns.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Chapter 8 Dr. Lakshmi Kalyanaraman 1

description of equity or stock securities and the markets in which they trade. description of the different types of corporate stock. how they are sold to the public and then traded; first in primary markets and then in secondary markets. the major stock market indexes. Form of markets. Dr. Lakshmi Kalyanaraman 2

Allows suppliers of funds (investors) to efficiently and cheaply transfer funds to users of funds (corporations exchange for financial claims and government) in Dr. Lakshmi Kalyanaraman 3

Common stock and preferred stock All public corporations offer common stock but many do not offer preferred stock Both offer two part rate of return Capital gains if the stock appreciates in price over time Periodic dividend payments Dr. Lakshmi Kalyanaraman 4

P P P D = + R 1 t t t t P 1 1 t t Pt= stock price at time t Dt = dividends paid over time t 1 to t (Pt Pt 1) / Pt 1 = capital gain over time t 1 to t Dt / Pt 1 = return from dividends paid over time t 1 to t Dr. Lakshmi Kalyanaraman 5

Suppose you owned a stock over the last year. You originally bought the stock for $40 and just sold it for $45. The stock also paid an annual dividend of $4 on the last day of the year. What is your return on this investment? Capital gains = ($45-$40)/40 = 12.5% Dividend income = 4/40 = 10% Return = 12.5% + 10% = 22.5% Dr. Lakshmi Kalyanaraman 6

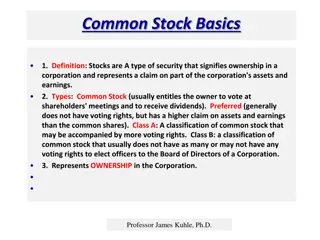

Fundamental ownership claim in a public or private corporation Characteristics 1. Discretionary dividend payments 2. Residual claim status 3. Limited liability 4. Voting rights Dr. Lakshmi Kalyanaraman 7

Unlimited if firm highly profitable No guaranteed dividend rights even if firm profitable, growing firms Corporation does not default if dividends are missed and common stock holders have no legal recourse (not like interest payment on debt) Profitable firm may reinvest profits Payment and size decided by Board of directors elected by shareholders Taxed twice firm level and personal level Dr. Lakshmi Kalyanaraman 8

Affects both components of return Dividend, Dt/Pt-1, decreases Capital gains , (Pt Pt-1)/Pt-1, increases What is the impact of non-payment of dividends on stock returns? Dr. Lakshmi Kalyanaraman 9

Investors can partially avoid this double taxation effect by holding stocks in growth firms that reinvest most of their earnings to finance growth rather than paying larger dividends. earnings growth leads to stock price increases. And stockholders can sell their stock for a profit and pay capital gains taxes rather than ordinary income taxes on dividend income. Under current tax laws, capital gains tax rates are lower than ordinary income tax rates. The capital gains tax rate depends on several things, including the holding period of the investment, the investor s income level, and any tax-code changes made during the holding period. Dr. Lakshmi Kalyanaraman 10

A corporation has after- (corporate) tax earnings that would allow a $2 dividend per share to be paid to its stockholders. If these dividends are paid, the firm will be unable to invest in new projects, and its stock price, currently $50 per share, probably would not change. The return to the firm s stockholders in this case is: Capital gains = ($50-$50)/50 = 0% Dividend income = 2/50 = 4% Return = 0%+ 4% = 4% Dr. Lakshmi Kalyanaraman 11

Suppose a stockholder bought the stock at the beginning of the year (at $50) and sold it at the end of the year (at $50). The stockholder s ordinary income tax rate is 30 percent and the capital gains tax rate is 20 percent.) The return to the stockholder in this case is all in the form of ordinary income (dividends). Thus, the after-tax rate of return to the stockholder is: 4%(1-0.30) = 2.8% Dr. Lakshmi Kalyanaraman 12

Alternatively, rather than pay dividends, the firm can use the earnings to invest in new projects that will increase the overall value of the firm such that the stock price will rise to $52 per share. The return to the firm s stockholders in this case is: Capital gains = ($52-$50)/50 = 4% Dividend income = 0/50 = 0% Return = 4%+ 0% = 4% the return to the stockholder is all in the form of capital gains and is taxed at 20%. after-tax rate of return to the stockholder is 4% (1 - ? 0.20) =? 3.2%. Dr. Lakshmi Kalyanaraman 13

In the event of bankruptcy, they have residual claim:In the event of liquidation, common stockholders have the lowest priority in terms of any cash distribution. After all senior claims are paid: Creditors such as employees Bondholders Government for taxes Preferred stockholders Common stockholders Hence, common stock is riskier than bonds Dr. Lakshmi Kalyanaraman 14

limited liability No matter what financial difficulties the issuing corporation encounters, neither it nor its creditors can seek repayment from the firm s common stockholders. This implies that common stockholders losses are limited to the original amount of their investment. Losses limited to original investment if firm s assets fall less than debt in case of corporation Unlike sole proprietorship and partnership ownership interests Unlimited liability Shareholders wealth outside ownership claims unaffected Dr. Lakshmi Kalyanaraman 15

No control over firms daily activities overseen by managers in the interest of stockholders and bond holders Common stockholders control the firm s activities indirectly by exercising their voting rights in the election of the board of directors Normally one vote per share of common stock. Dr. Lakshmi Kalyanaraman 16

Have two classes of common shares outstanding, with different voting rights assigned to each class. One class has limited number of votes per share than the other For example, class A may have one-tenth vote per share while class B one vote per share Or Class A may elect 20% of board and class B 80% Dr. Lakshmi Kalyanaraman 17

In straight voting, election for one director at a time In cumulative voting, all directors up for election voted at the same time Number of votes = Number of shares held Number of directors to be elected A shareholder may assign all votes to a single candidate or may spread over more than one Candidates with highest total votes get elected Dr. Lakshmi Kalyanaraman 18

By shareholders not attending the meeting Proxy returned to the issuing firm allows shareholders to vote by absentee ballot or authorize a representative to vote on their behalf Dr. Lakshmi Kalyanaraman 19

Hybrid between bond and common stock Like common stock represents ownership right Like bond carries a fixed periodic (dividend) payment Senior to common stock but junior to bonds preferred stockholders are paid only when profits have been generated and all debt holders have been paid (but before common stockholders are paid) In case of insufficient profits and missing dividends, no bankruptcy can be forced Dr. Lakshmi Kalyanaraman 20

Generally does not have voting rights unless dividend payments are missed Dividends only in case of profits Cumulative vs. noncumulative Cumulative missed dividends go into arrears and must be paid before any common stock dividends Noncumulative missed dividends do not go into arrears and never paid Dr. Lakshmi Kalyanaraman 21

Nonparticipating dividend fixed regardless of profits Participating dividends more in exceptionally profitable years Dr. Lakshmi Kalyanaraman 22

Corporations find preferred stock beneficial as a source of funds because, unlike coupon interest on a bond issue, dividends on preferred stock can be missed without fear of bankruptcy proceedings. Dr. Lakshmi Kalyanaraman 23

if a preferred dividend payment is missed, new investors may be reluctant to make investments in the firm. Thus, firms are generally unable to raise any new capital until all missed dividend payments are paid on preferred stock Dr. Lakshmi Kalyanaraman 24

Markets in which corporations raise funds through new issues of securities both ownership and debt securities Government raises funds through issue of debt securities Dr. Lakshmi Kalyanaraman 25

Corporations raise funds through new issues of securities Before common stock can be, shares must be authorized by a majority vote of both the board of directors and the firm s existing common stockholders Most of the time through investment banks Investment banks act as distribution agents in best efforts underwriting Underwriter does not guarantee a price to the issuer Acts as a distribution agent for a fee Risk of sale on corporation Dr. Lakshmi Kalyanaraman 26

Investment banks act as principals in firm commitment underwriting Guarantees a price to the corporation for the newly issued securities Underwriter buys the whole stock from the issuer for a guaranteed price called net proceeds Resells them to investors at a higher price called the gross proceeds Dr. Lakshmi Kalyanaraman 27

Underwriters spread = Gross proceeds Net proceeds Underwriter s compensation for risk and expenses is underwriter s spread Gross proceeds price at which the investment bank sells the stock to investors Net proceeds guaranteed price at which the investment bank purchases the stock from the issuer Dr. Lakshmi Kalyanaraman 28

A syndicate is a group of investment banks working in concert to issue stock; Originating house - the lead underwriter who negotiates with the issuing company on behalf of the syndicate Shares of stock issued through a syndicate of invest- ment banks spreads the risk associated with the sale of the stock among several investment banks. A syndicate also results in a larger pool of potential outside investors, increasing the probability of a successful sale and widening the scope of the investor base Dr. Lakshmi Kalyanaraman 29

An initial public offering (IPO) is the first public issue of financial instruments by a firm A seasoned offering is the sale of additional securities by a firm whose securities are already traded in secondary markets preemptive rights give existing stockholders right in which new shares must be offered to them and give them ability to maintain their proportional ownership Dr. Lakshmi Kalyanaraman 30

This means that before a seasoned offering of stock can be sold to outsiders, the new shares must first be offered to existing shareholders in such a way that they can maintain their proportional ownership in the corporation A rights offering generally allows existing stockholders to purchase shares at a price slightly below the market price Dr. Lakshmi Kalyanaraman 31

Public sale stock issue offered to general investing public Private placement stock sold to a limited number of large investors Dr. Lakshmi Kalyanaraman 32

A red herring prospectus is a preliminary version of the prospectus that describes a new security issue Shelf registration allows firms to offer multiple issues of stock over a two-year period with only one registration statement Dr. Lakshmi Kalyanaraman 33

Stocks once issued are traded Bought and sold by investors Securities brokers intermediaries The U.S. has three major stock markets the New York Stock Exchange Euro next (NYSE Euro next) the National Association of Securities Dealers Automated Quotation (NASDAQ) the American Stock Exchange (AMEX) Dr. Lakshmi Kalyanaraman 34

Market order Is when an investor makes a market order through a broker to buy or sell an investment immediately at the best available current price. Market order is the default option and is likely to be executed because it does not contain restrictions on the price or the time frame in which the order can be executed. It provides immediate liquidity. Limit order to transact at a specified price Left with a specialist to be executed Dr. Lakshmi Kalyanaraman 35

the current market price of a stock equals the present value of its expected future dividends (or the fair market value of the security). When market traders determine that a stock is undervalued ( the current price of the stock is less than its fair present value), they will purchase the stock, thus driving its price up. when market traders determine that a stock is overvalued (i.e., its current price is greater than its fair present value), they will sell the stock, resulting in a price decline. Dr. Lakshmi Kalyanaraman 52

The degree to which financial security prices adjust to news and the degree (and speed) with which stock prices reflect information about the firm and factors that affect firm value is referred to as market efficiency It has three measures: weak form semistrong form strong form Dr. Lakshmi Kalyanaraman 37

Current stock prices reflect all historic price and volume information so investors cannot use past price information to make excess return. Old news and trends are already impounded in historic prices and are of no use in predicting today s or future stock prices Investors cannot make more than fair return by using information based on historic price movements However, with public and private information, investors can make more than fair return Dr. Lakshmi Kalyanaraman 38

As public information arrives about a company, it is immediately impounded Investors cannot make more than fair return using public news releases Since historic information is a subset of all public information, hence already reflected on share prices However, with private information, investors can make more than fair return Dr. Lakshmi Kalyanaraman 39

Stock prices reflect both public and private information There is no set of information that allows investors to make more than fair return Insider trading laws prohibit investors from trading on the basis of private information. Dr. Lakshmi Kalyanaraman 40