Buying and Selling Stocks in Financial Markets

Discover the process of buying and selling stocks in financial markets through initial public offerings (IPOs) and secondary markets. Learn about earning dividends, capital gains, and the risks associated with investing in stocks. Explore the types of stock available and how trading stocks with stockbrokers can help investors achieve capital gains. Gain insights into organized stock exchanges like the New York Stock Exchange.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Chapter 11: Financial Markets Section 3: Buying and Selling Stocks pgs.330-337

The Stock Market https://upload.wikimedia.org/wikipedia/commons/1/1f/NYSE.jpg Remember that we learned in Chapter 8 that corporations raise money through stock and bond issues. When a company 1stissues stock, it is sold to investment bankers in the primary market. This is known as an initial public offering (IPO), this is the stock sale that raises money for the corporation. Then most stock is then resold to investors through a stock exchange, a secondary market where securities (stocks & bonds) are bought & sold. People that buy these stocks, do so with the expectation that the stock price will rise. Gains made from the sale of securities are called capital gains.

Why Buy Stock? http://www.rgbrenner.com/wp-content/uploads/2012/02/Capital-Gain-and-Loss-300x175.jpg 1. To earn dividend payments which are a share of the corporation s profits that are paid back to the stockholders. To earn capital gains by selling the stock at a price greater than the purchase price if the you sell the stock at a loss it is called a capital loss. As we learned before investing in stocks has more risk. Corporations are not required to pay dividends. Also, there is no guarantee that the stock price will be higher when the investor wants to sell the stock. 2.

Types of Stock There are two types of stock. Common Stock is a share of ownership in a corporation, giving holders voting rights and a share of profits. Preferred Stock is a share of ownership in a corporation giving holders a share of profits (paid before common stockholders) but no voting rights. Most people buy common stock. Both types of stock give a share of ownership in the corporation that entitles a shareholder to receive dividends, the difference is that holders of preferred stock receive guaranteed dividends and will be paid before common stockholders. The holders of common stock usually get one vote per share to elect the board of directors.

Trading Stock Most people who invest in stock do so with the hope of earning capital gains when they sell it. When investors perceive that a company s value is likely to increase, the demand for the stock will increase and its price will rise. As the price rises, more people will want to sell the stock for a profit. Few investors buy stock directly from companies. Most investors use a stockbroker, an agent who is paid from a commission for buying and selling securities on behalf of customers. http://leadlifestyle.com/images/how-to-become-a-stock-broker.jpg

Organized Stock Exchanges http://newyorkpanorama.com/blog/wp-content/uploads/2008/09/2008-09-NYSE-day-2-1200.jpg The New York Stock Exchange (NYSE) is the oldest and largest of the stock exchanges in the U.S. It is located on Wall St. in NYC. Most of the largest and most successful U.S. corporations pay to list their stock here. Trades take place in the auction format. Since 1996, floor traders have used hand-held computers to execute trades. In 2006, The NYSE merged with Archipelago and is now called NYSE Arca and is an all-electronic exchange unlike the traditional NYSE. In 2007, NYSE merged with Euronext, a group of European stock exchanges. And in 2008, NYSE Euronext bought the American Stock Exchange (AMEX), which has smaller companies.

Over-the-Counter (OTC) Stock Exchanges http://s.marketwatch.com/public/resources/MWimages/MW-DF139_nasdaq_ZG_20150209120238.jpg OTC is used to describe the market for stocks that are not traded on a formal stock exchange. In 1970, the National Association of Securities Dealers introduced a centralized computer system that allows OTC traders around the country to make trades at the lowest price. This automated quotation system became know as NASDAQ. The NASSDAQ is one of the world s largest stock exchanges. In 1990, the NASD started another electronic market called the OTC Bulletin Board (OTCBB). This market deals in the stocks of smaller companies.

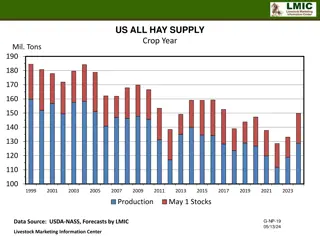

Futures and Options Markets http://www-fp.pearsonhighered.com/assets/hip/images/bigcovers/0132993341.jpg Businesses involved in agriculture developed ways to protect themselves from the price fluctuations typical of that market. A future is a contract to buy or sell a commodity at a specified future date and price. An option is similar contract that gives the right, but not the obligation, to buy or sell. The futures and options contracts developed for agriculture can now be used for stocks and other financial instruments.

Recent Developments http://i2.cdn.turner.com/money/dam/assets/150708135029-nyse-down-780x439.jpg Revised market regulations and advances in computer technology have changed the way stocks are traded. Stocks listed on any exchange are now available to any trading firm. Trades now take place 24 hours a day. Many individual investors have access to the Internet & have become more knowledgeable about investing and may not need stockbrokers. As a result, computer technology matches buyers and sellers automatically, providing rapid trades at the best possible prices.

Measuring How Stocks Perform Almost half of all U.S. households now own stocks, t/f the market s performance is followed closely. Stock indexes provide a snapshot of how a stock market, or a segment of a stock market, is performing. The Dow Jones Industrial Average (DJIA) is a well-known index that tracks the stocks of 30 of the largest companies traded on the NYSE. (see the companies on pg.335) Another important & better index is the Standard & Poor s 500 (S&P 500). It is more reliable b/c it has many more companies. https://tommyajayi.files.wordpress.com/2016/02/dow-jones-logo1.jpg?w=640

Bulls and Bears When stock prices rise steadily, it is described as a bull market. When the trend in stock prices is a steady decline, it is considered a bear market. Generally, a 20% increase over at least 2 months is considered a bull market, likewise, a 20% decline over 2 months or more is considered a bear market. Most bull or bear markets last only a year or so. The most severs bear market began in 1929, when it fell from 341 to 41 and it did not hit 341 again until 1954. https://lh3.ggpht.com/UsW59Jj_0kjCVZ0G3rIuBFz1HnCeRq92Svht7S53b6x7hmZmqURzfRxuRXtFnN8m7Q=w300