Seda Quarter3 Report

Seda's Quarter 3 report for the 2023/24 Financial Year showcases the organization's performance on 24 key indicators, achieving high success rates. The report delves into performance comparisons, human resources status, financial overview, governance, compliance updates, marketing initiatives, and key projects progress. Areas of strength and improvement are detailed, with corrective measures discussed. The performance dashboard illustrates metrics such as jobs created and sustained, customer satisfaction levels, workforce demographics, and financial spend data.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Seda Quarter 3 Report PORTFOLIO COMMITTEE 28 FEBRUARY 2024 Mr. N Mbatha

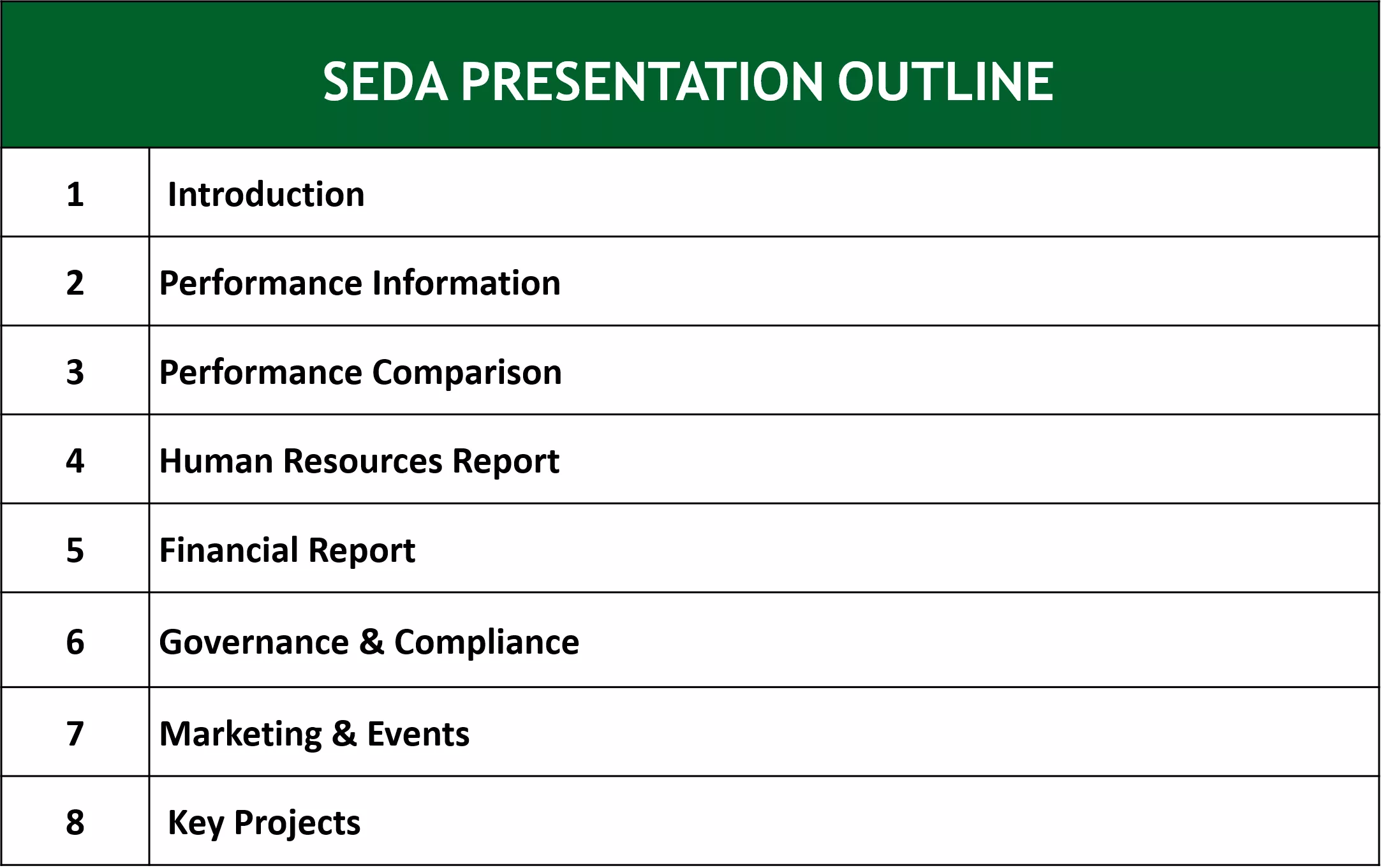

SEDAPRESENTATIONOUTLINE 1 Introduction 2 Performance Information 3 Performance Comparison 4 Human Resources Report 5 Financial Report 6 Governance & Compliance 7 Marketing & Events 8 Key Projects

1. INTRODUCTION The report highlights the organisation's performance for the 3rd Quarter of the 2023/24 Financial Year; and In this Financial Year, the Organisation will be monitoring and tracking its performance on 24 Indicators A total number of 19 indicators were tracked and measured during Quarter 3; Seda achieved 100% and more on 16 indicators; and This translates to 84.2% performance achievement. The Organisation underperformed on 3 indicators Two Indicators achieved between 80% to 99% category: Number of jobs created by SMMEs and Cooperatives supported through non-financial support interventions. Number of township and rural based businesses supported with non-financial support interventions. One Indicator achieved below 50% category: Number of Cooperatives assisted through Cooperatives Development Support programmes. Reasons for variance and corrective measures are discussed in the slides to follow.

PERFORMANCEDASHBOARD 538 1 301 336 54 0 619 0 67% 29 6 101 214 7%

PERFORMANCE DASHBOARD Jobs Created & Sustained Jobs Created & Sustained 3 603 Seda Branches - 53 Incubation Centres - 110 Seda Access Points - 79 Created 882 Sustained 2 781 Seda Colocation Points - 57 Turnover Increased above 5% - 402 Scale-Up SMMEs 29 Customer Satisfaction 94% Seda Workforce Profile - 660 Quarter 2 Spend 102,3% African - 568 (86.06%) Coloured - 58 (8.79%) R 227,05 million Indian - 8 (1.21%) Client Profile Q3 Total Clients SMMEs Cooperatives White - 22 (3.33%) - 6 924 - 6 609 (95%) - 315 (5%) Foreign Nationals - 4 (0.61%)

PERFORMANCE DASHBOARD Total Number of Clients (5 417) broken down as per below: Quarter 3 TREP Clients Category 2500 2112 2000 1646 1475 1500 1000 500 184 0 MEN WOMEN YOUTH PWD

PERFORMANCE DASHBOARD Quarter 3 Designated Groups Performance PWD (7%) YOUTH (30%) WOMEN (40%) 0 1000 2000 3000 4000 5000 6000 7000 Women (40%) 6035 4113 Youth (30%) 4456 3085 PWD (7%) 383 720 Achievement Target

SEDA QUARTER 2 PERFORMANCE COMPARISON QUARTER 3 PERFORMANCE COMPARISON 20 18 16 14 12 10 8 6 4 2 0 Indicators Measured Indicators Achieved Indicators Under Achieved 2 3 Percentage 2022_23 2023_24 19 19 17 16 89.5% 84.2%

PROGRAMME 1: ENTERPRISE DEVELOPMENT PROGRMME Q3 YTD Achieve ment Annual Targets Q3 Q3 Corrective Measures YTD Target NO. Output Indicator Achieve ment Reason for Variance Target Variance Number of people who attended entrepreneurship awareness sessions 13,000 20 000 3 000 6 935 3 935 None None 24 155 1.1 Plans are put in place to exceed this target during the fourth quarter to make up for the loss. 3 BA vacancies in Ekurhuleni branch, system problems that do not allow the Joburg Branch Manager to draw reports for Ekurhuleni branch and Service Access Points underperformed. Number of township and rural based business supported with non- financial business development 12 600 18 000 3 600 3 594 6 14 433 1.2 Number of SMMEs and Cooperatives supported to participate in local markets 1 750 2 500 500 1 236 736 None None 2 643 1.3 Number of SMMEs and Cooperatives supported with international markets readiness interventions 500 100 796 696 None None 350 3 382 1.4

PROGRAMME 1: ENTERPRISE DEVELOPMENT PROGRMME Q3 YTD Achieve ment Annual Targets Q3 Q3 Reason for Variance Corrective Measures YTD Target NO. Output Indicator Achieve ment Target Variance Number of SMMEs and Cooperatives supported through trade missions 34 9 None None 300 25 275 120 1.5 Number of SMMEs and Cooperatives supported with business development 1 400 538 138 None None 2 000 400 1 967 1.6 Number of SMMEs and Cooperatives supported in priority sector with non- financial business development to scale-up their business 30 29 9 None None 65 50 20 1.7 Number of SMMEs and Cooperatives supported with training, mentorship and coaching 14 000 6 101 2 101 None None 20 500 4 000 16 551 1.8

PROGRAMME 1: ENTERPRISE DEVELOPMENT PROGRMME Q3 YTD Achieve ment Annual Targets Q3 Q3 Reason for Variance Corrective Measures YTD Target NO. Output Indicator Achieve ment Target Variance Consolidating the Programme and funds between Seda and sefa. The Programme will be opened in January 2024. call for proposals inviting cooperatives to apply for this grant funding will be issued in January 2024. Consolidating the Programme and funds between Seda and sefa. The Programme will be opened in January 2024. call for proposals inviting cooperatives to apply for this grant funding will be issued in January 2024. Number of Cooperatives Assisted through the Cooperatives Development Support Programme A A 0 10 40 10 10 40 1.5

PROGRAMME 2: SEDA TECHNOLOGY PROGRAMME Q3 YTD Achieve ment Annual Targets Q3 Target Q3 Corrective Measures YTD Target NO. Output Indicator Achieve ment Reason for Variance Variance Number of SMMEs and Cooperatives supported through the incubation programme 1260 1 800 1 301 941 None None 2 608 360 2.1 Number of SMMEs and Cooperatives supported through the technology transfer assistance programme 50 50 50 54 4 None None 54 2.2

PROGRAMME 3: IMPACT AND SUSTAINABILITY PROGRAMME Q3 YTD Annual Targets Q3 Q3 Reason for Variance Corrective Measures YTD Target No. Output indicator Achieve ment Achieve- ment Target Variance Number of SMMEs and Cooperatives supported with quality improvement interventions Number of SMMEs and Cooperatives supported with productivity improvement interventions Number of SMMEs and Cooperatives whose turnover has increased by a minimum of 5% per annum Number of jobs created by SMMEs, and Cooperatives supported through non- financial support interventions 700 1 000 200 619 419 None None 2 261 3.1 700 1 000 200 336 136 None None 1 326 3.2 500 700 150 402 252 None None 1 062 3.3 The number of jobs created per supported SMME was lower in the 3rd Quarter than originally projected due to the subdued economic conditions. The number of jobs created per supported SMME was lower in the 3rd Quarter than originally projected due to the subdued economic conditions. Sufficient resources needs to be allocated to large- scale and high impact projects that have a potential for creating jobs. 3 150 4 500 900 822 78 3 407 3.4

PROGRAMME 3: IMPACT AND SUSTAINABILITY PROGRAMME Q3 YTD Annual Targets Q3 Corrective Measures YTD Target No. Output indicator Q3 Target Achieve ment Reason for Variance Achieve- ment Variance Number of jobs sustained by SMMEs and Cooperatives supported through non- financial support interventions 5 500 8 000 1 500 2 781 1 281 None 9 357 None 3.5

PROGRAMME 4: ADMINISTRATION Q2 YTD Annual Targets Q2 Corrective Measures YTD Target No. Output indicator Q2 Target Achieve ment Reason for Variance Achieve- ment Variance Percentage of innovative ideas implemented - 40% - - - Due in Q4 - 4.1 Number of priority systems digitised - 1 - - - Due in Q4 - 4.2 Percentage stakeholder satisfaction - 85% - - - Due in Q4 - 4.3 Clients happy with improved service excellence Percentage of customer satisfaction 85% 85% 85% 94% 9% - 94% 4.4

PROGRAMME 4: ADMINISTRATION Q2 YTD Annual Targets Q2 Q2 Reason for Variance Corrective Measures YTD Target No. Output indicator Achieve ment Achieve- ment Target Variance Percentage of employee satisfaction 55% 4.5 55% 55% 67% 12% 67% 10% 4.6 Percentage of vacancy rate 10% 10% 7% 3% 7% Percentage of staff who performed at 311 & above in the performance evaluation recognized for excellence - 4.7 60% - Due in Q4 None - Percentage implementation of the Ecosystem development plan - 4.8 70% - Due in Q4 None -70%

KEY HUMAN RESOURCES FIGURES The total approved structure - 713 The total number of staff as of the end of December 2023 was 660 The vacancy rate as of the end of December 2023: 7% The Enterprise Development Division and Seda Technology program, are the Core Divisions.

WORKFORCE PROFILE CONT Total Headcount is 660 as at 31 December 2023 Core Business Function: Enterprise Development Division (EDD) and Seda Technology Programme (STP) Support Business Functions: Corporate Services, Finance, Risk and Compliance, Internal Audit, Stakeholder Relations and PR, Legal Compliance, and Governance Permanent Staff vs Fixed Term Employees Fixed Term Employees 23% Permanent Staff 77% Permanent Staff Fixed Term Employees

WORKFORCE PROFILE CONT Core vs Support Staff Support 21% Core 79% Core Support National vs Provincial Office National Office 26% Provinces 74% National Office Provinces

WORKFORCE PROFILE CONT Seda Gender Profile Females 41% Males 59% Males Females Employees with Disabilities Males Females 1% 3%

WORKFORCE PROFILE CONT SEDA Racial profile 568 600 500 400 300 200 100 58 22 8 4 0 African Coloureds Indians White Foreign Nationls

WORKFORCE PROFILE CONT WORKFORCE AGE ANALYSIS 72 144 444 18-35 36-55 56-65

BUDGET 2023/2024 The total revenue budget for Seda for the 2023/24 financial year amounts to R1,140 billion and the total expenditure budget amounts to R 1,140 billion (including capital). The total includes R122,3 million from the National Skills Fund (NSF) and R73 million for the CDSP.

EXPENDITURE SPLIT OF CORE vs SUPPORT FUNCTIONS Actual Expenditure Target Achieved Core: Core: Core: 75% R 194,5 million 86% Support: Support: Support: 25% R 32,6 million 14%

EXPENDITURE SPLIT OF CORE VS SUPPORT FUNCTIONS Annual Budget R'000 Q3 Q3 Q3 Budget R'000 Expenditure R'000 Variance R'000 Variance % Details Personnel cost 390.2 98.6 106.7 -8.1 -8% Projects, Programme and Administrative 715.4 116.2 113.9 2.2 2% Depreciation Capital Expenditure 16.5 18.0 3.6 3.5 3.5 2.9 0.1 0.6 3% 16% Total 1,140.1 221.9 227.1 -5.1 -2% The expenditure as for the second quarter (October December 2023), amounted to R 227,1 million against a budget of R 221,9 million, resulting in overspending of R 5,1 million. The spending for Quarter 3 exceeded the budget by 2,3%, due to the catching up from past quarter that underspend. The year-to-date (April December 2023) is 0.08% overspend, which is a minor variance. 99,98% of invoices (3 558) were paid within 30 days, amounting to R 114,53 million. 4 Invoices paid late amount to R243.77

EXPLANATION OF VARIANCES Personnel costs The main cause is the Provision for leave, most staff took leave in January 2024 rather than in December 2023 as anticipated. The variance has been reduced in January 2024. Project, Programme and Administration The underspending of 4,19% in is due to project deferred to Q4. Most of these are externally funded and the service providers were appointed after the procurement process was completed in Q3. Depreciation - The year to date underspending of 3.26% (R118 187) is minor. Capital expenditure Assets ordered are in progress and will be delivered in Q4. Overall expenditure for the Quarter is 2.3% (Overspend).

SPLIT PER PROVINCE PROVINCE EXPENDITURE Eastern Cape R 41,289,810 Free State R 28,559,597 Gauteng R 40,609,824 KwaZulu-Natal R 37,342,753 Limpopo R 30,013,512 Mpumalanga R 27,786,106 Northern Cape R 27,601,237 North West R 31,628,402 Western Cape R 39,687,577 SUB- TOTAL R 304,518,819 National Office -R 77,469,147 TOTAL R 227,049,672

AG AUDIT, THE FINDINGS AND REMEDIAL ACTIONS EXTERNAL AUDIT Performance Information issues were mainly the data management, record keeping and inconsistent classification of clients into townships, rural and urban. - Action: In the third quarter the organisation reported on the newly developed Clients and Performance Information Management system and is continuing to enhance the system. Other major findings are relating to the Incubators, mainly the implementation and monitoring the deliverables as per the MoA. - Action: The entity is reviewed the MoA with the incubators and amended the clauses that were inappropriate and costly to implement . Misuse of funds by new incubators under establishment Payments to establish incubators are now payable based on milestones and subject to verification of work.

BOARD & COMMITTEE MEETINGS COMMITTEE NO OF SCHEDULED MEETINGS DATES 10/10/2023 (SP) 24/10/2023 (SP) 01/11/2023 (SP) 29/11/2023 BOARD MEETINGS 4 14/11/2023 AUDIT AND RISK COMMITTEE 1 20/10/2023 30/10/2023 STRATEGYAND ORGANISATIONAL PERFORMANCE COMMITTEE 2 22/11/2023 SOCIALAND ETHICS COMMITTEE 1 13/10/2023 23/11/2023 26/10/2023 HUMAN RESOURCES AND REMUNERATION COMMITTEE 1 INCUBATION COMMITTEE 1 10/10/2023 13/10/2023 20/10/2023 07/12/2023 NATIONAL BID ADJUDICATION COMMITTEE 4

MARKETING & EVENTS Events initiated and support provided to Seda divisions and the DSBD Audiovisual Communication Brand Management External and Audio Visuals National events supported 35 national events supported Brand Management & and websites Updating of a new comprehensive Seda profile commenced in Q3 and is to be finalized end of March 2024. Worked with the Learning Academy to develop a Strategic Value Proposition (SVP) training video for staff. Success Stories and event videos/photos produced for digital media. Eastern Cape Success stories (x4) Limpopo success story video (Amphiguard Brickyard). Tertiary institution outreach events 2x Tvet college and university outreach events held Internal Brand Advocacy program. The CCM Unit is continuing to enhance the Seda Brand. Generic events initiated by the CCM unit. South Africa s Youth Entrepreneurial Ecosystem Convening, Tembisa 24 October 2023 KwaZulu Natal Manufacturing Webinar 31 October 2023 Masisizane SME Funding Readiness Masterclass Webinar 16 November 2023 Website The procurement process to migrate the website and intranet to Microsoft 365 has commenced and the migration will be initiated in the new year Promotional material SMME &Cooperatives portal(Ipapatse) The launch of the portal is currently on hold pending integration with the e-THUSE system. 202 graphic designs created 2024 Seda branded tent calendars and notebooks procured. Partnerships Collaborated with EXXARO with theYes4Youth learners' programme Collaborated with Old Mutual s Masisizane Fund

KEY PROJECTS PROJECTS FOR PERSONS WITH DISABILITIES The Umzimvubu Local Municipality in the Eastern Cape, hosted a Disability Awareness session that Seda participated in providing on-wheel services, including a presentation on assistance available to people with disabilities. Seda Eastern Cape and Happy Home People with Disabilities Children s Centre based in Mthatha had an engagement reaching out to SMMEs that are owned by People with Disabilities. In the Thabo Mofutsanyana branch fifty-two (52) entrepreneurs with disabilities were trained on Start-Up 1 in November 2023. In Ficksburg, twenty-eight (28) people were trained in partnership with NHBRC to enhance their skills in home building and health & safety. In the Xhariep district, fifteen (15) people living with disabilities who are in the clothing and textile sector were capacitated on Money Management so that they can keep financial records, manage cash flow, and general financial management in the running of their businesses. The training was in November at the Multi-Purpose Community Centre in Zastron.

KEY PROJECTS PROJECTS FOR PERSONS WITH DISABILITIES Continues The Waterberg Branch formed a partnership with all local municipalities in the district and Anglo Zimele to conduct sector-specific awareness sessions to assist clients with disabilities to access procurement opportunities at the mine. Empretec Training for people with disabilities took place in Tzaneen in October 2023 and fourteen (14) participants attended. The AL-Waagah Institute for the Deaf has successfully partnered with Seda to provide skills development and training opportunities for the Deaf community, particularly in the context of entrepreneurship and small business management. This collaboration aims to leverage the expertise and resources of both organizations to benefit the Deaf community. The institute, in collaboration with Seda, had a Market Day in October 2023 where the clients were given an opportunity to showcase their products to the public. Thirty (30) clients displayed their products. A virtual meeting with South African Disability Alliance (SADA) took place in October 2023.

KEY PROJECTS Mafikeng Trade Market Hub North-West The Mafikeng Local Municipality was requested to assist by seconding engineers to help the project with drafting plans, costing and project management; A R 2million budget allocation was made by the Mafikeng Local Municipality and Dikelello Consulting Engineers and Project Managers was subsequently appointed; Since their appointment, the service provider compiled draft plans which were tabled at the task team meeting. After that they proceeded to compiling preliminary plans with costs, which were approved by the task team, to enable the Service Provider to then finalize plans for implementation; The Mafikeng Local Municipality has registered the project in the Integrated Development Plan (IDP), while the Ngaka Modiri Molema District has submitted the project for its inclusion in the District Development Model; The task team is working on the qualifying criteria for the potential tenants, which will be adopted prior to external adverts to recruit clients; and Refurbishment of the identified building is currently underway at near completion.

KEY PROJECTS Charcoal Manufacturing Project - Eastern Cape A Charcoal Manufacturing Project situated in Matatiele has been identified by the Alfred Nzo branch for further assistance; One Co-op trading as Echo Char, was selected for adoption but after the site visit and engagements with the business owners, it was established that there are eight (8) enterprises involved in the manufacturing of the charcoal in the area; The focus of the project will be to get all the eight (8) enterprises into a consortium and not to assist them individually; The project will be divided into phases with the first phase being the development of a concept plan; The project is still at the idea generation stage and looking at engaging other stakeholders to be involved for its success; and The Alfred Nzo branch is currently looking at developing a concept plan for the project, and a memo has been submitted requesting additional funds to undertake the intervention.

KEY PROJECTS Excell Mining and Construction Services (Pty) Ltd Northern Cape Excel Mining s core functions include Mining Maintenance, Plant Maintenance, Civil Services, Crane Hire, Fabrication, and Installation; The company employs a total of one hundred and twenty-three (123) employees with a turnover of over R108 million; and The client has been invited to apply for the JSE Entrepreneurship Programme and Seda has initiated a website development project which is at procurement stage.

KEY PROJECTS EXPORT DEVELOPMENT AND ENTERPRISE AND SUPPLIER DEVELOPMENT The Intra-African Trade (IAT) fair Egypt was held from the 9th to the 15th of November; nineteen (19) Seda clients participated to showcase their products. Titanic Global Logistics secured a contract worth over R 40 million to assist with the export of goods with Exploshot R250 000.00 p/m, Numo Meats - R 368 476.50 p/m, Roland Adaimoni R 570 000.00 p/m and Silver Emarald R 120 000.00 p/m. Other SDP Opportunities facilitated for SMMEs: One SMME, a chicken supplier was linked to Spar and other local businesses in Port St John; Three (3) SMMEs were listed as vendors with Ola Superstore in Fezile Dabi; and Two (2) SMMEs were listed as suppliers on Makro online.