Overview of Indian Oilseed Sector 2016-17: Trends and Estimates

Indian Oilseed Sector in 2016-17 saw a production of 38.6 million tons, including various oilseeds like groundnut, soybean, and cottonseed. The sector faced challenges with stagnant production, changes in crop preferences, and significant reliance on oil imports. Estimates for 2017-18 indicate a fluctuation in production levels, with cottonseed emerging as a prominent oilseed. Domestic oil availability remained stable, reflecting trends in consumption patterns over the years.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Presented by Mr. Atul Chaturvedi

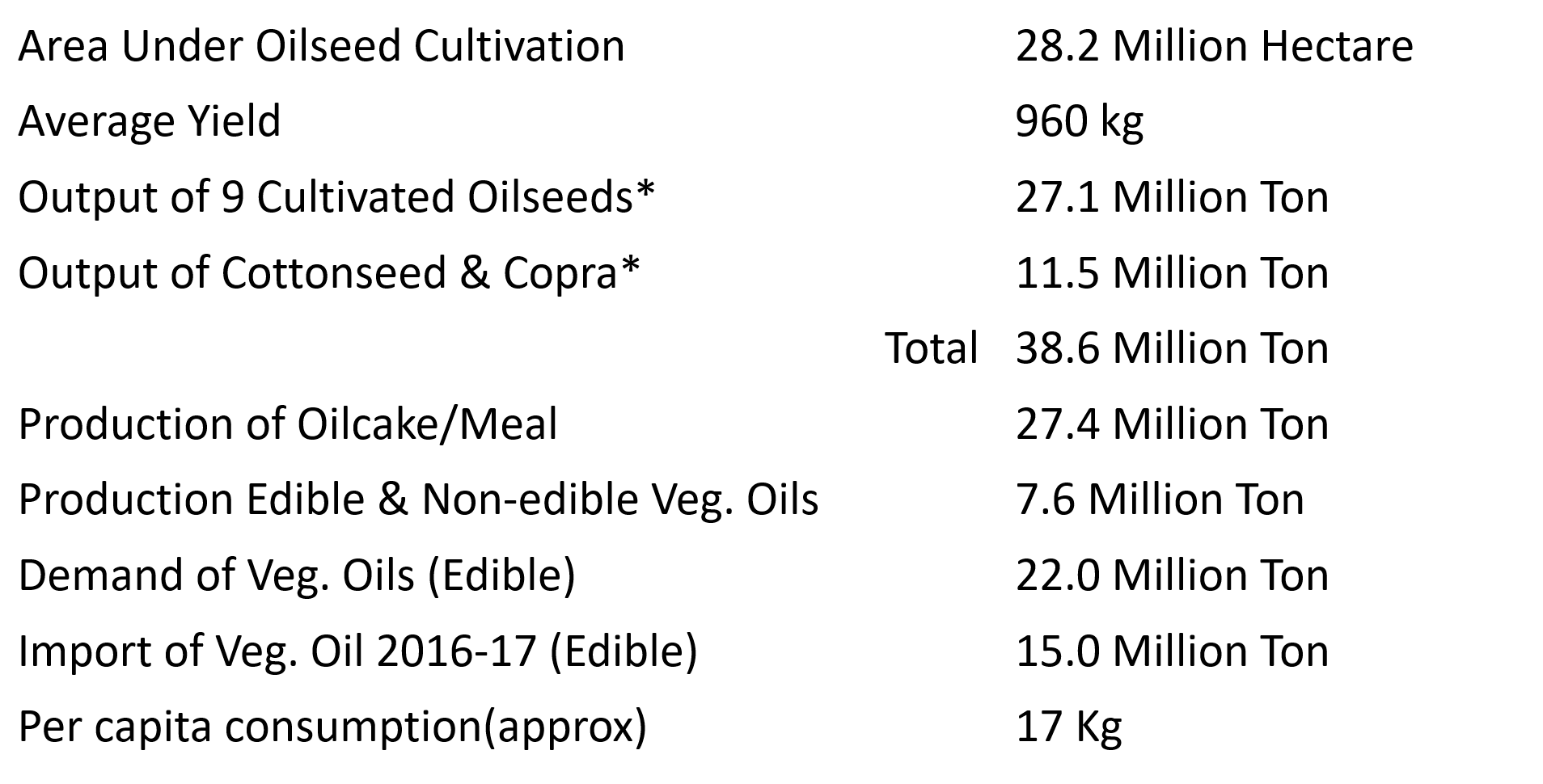

Indian Oilseed Sector 2016-17 (At a Glance) Area Under Oilseed Cultivation 28.2 Million Hectare Average Yield 960 kg Output of 9 Cultivated Oilseeds* 27.1 Million Ton Output of Cottonseed & Copra* 11.5 Million Ton Total 38.6 Million Ton Production of Oilcake/Meal 27.4 Million Ton Production Edible & Non-edible Veg. Oils 7.6 Million Ton Demand of Veg. Oils (Edible) 22.0 Million Ton Import of Veg. Oil 2016-17 (Edible) 15.0 Million Ton Per capita consumption(approx) The Overall turn over of the oilseed sector is Rs.175,000 Crores (28 Billion) and on import front, its 3rd item after Crude Petroleum and Gold. India spending over Rs.70,000 crores (11/12 bln.$) for import of edible oils per annum and dependence on import is nearly 70%. * Trade Estimates 17 Kg

OILSEEDS PRODUCTION (TRADE ESTIMATE) (2012-13 to 2016-17) Major Oilseeds Groundnut Rape/Mustard Soybean Others Sub-Total Cottonseed Copra Grand Total 12-13 4.3 6.9 10.7 2.8 24.7 10.2 0.6 35.5 13-14 6.5 6.7 9.5 2.6 25.3 12.5 0.7 38.5 14-15 4.9 5.1 8.5 2.6 21.1 11.9 0.6 33.6 15-16 4.5 5.9 7.2 2.7 20.3 10.9 0.6 31.8 16-17 6.9 7.2 10.6 2.4 27.1 10.9 0.6 38.6 Source: SEA Note : Government estimate for major nine oilseeds is higher than trade estimate Stagnant Oilseed Production. Soya and Mustard languishing Groundnut should not be considered an Oilseed. Oilseed production increase has not kept pace with increase in consumption.

Estimates for oilseed Production 2016-17 Vs 2017-18 Production in Million tons Oilseed 2016-17 2017-18 Change in % Groundnut 6.9 6.6 (-) 4.3 Soybean 10.6 9.0 (-) 15.09 Rape Mustard 7.2 7.0 (-) 2.7 Others 2.4 2.5 (+) 4.1 Total 27.1 25.1 (-) 7.3 Cottonseed 10.9 12.4 (+) 13.7 Copra 0.6 0.6 Total 38.6 38.1 (-) 1.3 Bumper Cotton crop has cushioned the shortfall of Soya and Groundnut. Cottonseed is now emerging as India s top oilseed. Soya, Groundnut loosing ground.

Domestic Oil Availability 2016-17 Vs 2017-18 Oil 2016-2017 2017-2018 Groundnut oil 5.70 5.70 Soya 14.4 14.4 Rape Mustard 18.7 18.7 Cotton 12.4 13.2 Rice Bran 9.6 10.0 Others 9.7 8.5 Total 70.5 70.5 The source of the above data is Govind Bhai and his GGN-research. Govind Bhai anticipates increase of 6.10 lakhs MB of domestic oil on account of large carryout. We feel crushing may remain lukewarm and carryout is becoming a norm. We feel oil availability domestically may remain same.

Edible Oil Consumption in India (Oil wise) Particulars 2001-02 2007-08 2015-16 Qty % Qty % Qty % Palm Oil 2944 29.08 4437 35.81 9685 45.41 Soy Oil 2258 22.30 2170 17.51 4872 22.84 Mustard Oil 1721 17.00 1814 14.64 1938 9.09 Sunflower Oil 309 3.05 539 4.35 1541 7.22 Cotton Oil 443 4.38 1070 8.64 1267 5.94 Groundnut Oil 1216 12.01 689 5.56 239 1.12 RBO 430 4.25 770 6.21 930 4.36 Others 804 7.94 901 7.27 858 4.02 Total 10125 100% 12390 100% 21330 100% Consumption has grown from 10Mln to 22Mln in 16 yrs.( 120%) Domestic oils now constitute only 30% of total consumption. Consumption of Palm oil in India is now nearly 45% of the total consumption followed by Soybean oil and Rapeseed Oil.

Per capita consumption of edible oil in India vs. World S. No Year India World 1 2000-2001 11.1 18.95 2 2009-2010 13.3 24.54 3 2016-2017 17 25 Rising income levels and cheap imports have helped increase per capita consumption. Indian Growth story is very much intact and our demand will keep growing.

Import Break-Up (MMT) Oils 2014-15 2015-16 2016-17 Palm (Edible) 9.54 8.44 8.9 Soybean Oil 2.99 4.23 4.0 Sun Oil 1.54 1.52 1.80 Rapeseed Oil 0.35 0.38 0.30 Sunflower Oil - 0.01(--) - Total 14.42 14.57 15.0 Palm constitutes biggest slice of oil import followed by Soya and Sun. Incremental imports in last few years have been cornered by Soft Oils Sunflower Oil imports may rise on account of duty advantage Imports may rise by one million tons per annum

Import Projection 2017-18 Oilseed Projection (Million Tons) Palm 9.50 Soya 4.0 Sunflower 2.0 Rapeseed 0.30 Total 15.8 Import may go up by 0.8 to 1.0 million tons. We project consumption growth at around 4%. Sunflower and Palm may gain while Soya may remain unchanged in volumes.

Indian Consumption Growth Expectations Population @ 1.76% Growth Consumption @ 3% Growth Consumption @ 4% Growth Consumption @ 5% Growth Year Per Capita (In Kg) Per Capita (In Kg) Per Capita (In Kg) In Bn. MnT MnT MnT 2015 1.25 15.2 19.00 15.6 19.5 15.9 19.87 2017 1.28 16.0 20.48 17.0 21.75 17.4 22.27 2019 1.31 17.0 22.27 18.0 23.58 19.1 25.02 2021 1.34 18.0 23.79 19.5 25.70 21.0 27.72 2023 1.38 19.0 25.24 21.1 27.80 23.2 30.56 2025 Assuming 4% growth we may require 30MMT by 2025. Import s can rise to 21-22 million ton if oilseed production stagnates. Edible Oil security in danger. 1.42 20.2 26.78 22.8 30.0 25.6 33.69

What needs to be done ? Land consolidation through leasing and Corporate farming Allow GM cultivation Encourage Mustard & Soya Cultivation Support Producer instead of Consumer Bury Essential Commodities Act. Encourage Palm cultivation in South India