Overview of Auto Enrolment: Legal Duties and Safeguards

Auto Enrolment presentation by Kevin Cunningham, Managing Director & IFA at Bleathwood IFA Ltd, provides valuable financial advice on the steps needed to prepare for auto enrolment, legal duties, and lessons learned from employers who have staged. The presentation covers important topics such as staging dates, assessment of staff, communication, payroll data management, and common myths about auto enrolment. Employers are urged to plan ahead, seek help when needed, and ensure compliance with legislation to safeguard employee interests.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Auto Enrolment Auto Enrolment Presentation by Kevin Cunningham Managing Director & IFA Bleathwood IFA Ltd Financial Advice you can Value

Auto Enrolment It s the same as Stakeholder Pensions in the workplace! NO Auto Enrolment requires a lot more work and action Financial Advice you can Value

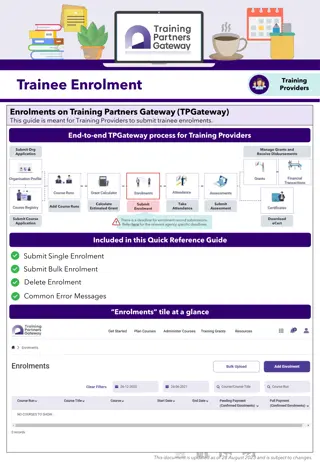

Steps you need to take Know when you need to be ready Staging Date, start planning 12 months before staging Assessment Staff, Costs, Existing Arrangements, Staff Contracts Communication Staff, Existing Pension Provider, Key People Research Payroll, Solution Options Stage Opt in relevant Staff, Communicate, Record Data Records Payroll Data, Opt Outs Review, Diarise & Register Financial Advice you can Value

Overview of legal duties and safeguards Automatic enrolment legislation gives employers a duty to: automatically enrol all eligible jobholders communicateto workers providing timely and appropriate information allow non-eligible jobholders to Opt-in and entitled workers to join manage Opt-outs within the Opt-out period and promptly refund contributions automatically re-enrol all eligible jobholders every three years complete declaration of compliance (registration) with the Regulator keep records, and maintain payments of contributions. The employee safeguards state that employers: must not induce workers to Opt-out or cease membership of a scheme must not indicate to a potential jobholder that their decision to Opt-out will affect the outcome of the recruitment process Financial Advice you can Value

Lessons learnt from employers who have staged Plan to have your pension and payroll ready 6 months ahead of staging. Employers need to know how to do each task, not just that it needs to be done. Get help and advice if you need it, but remember that the responsibility for complying with the automatic enrolment legislation remains with the employer. Keep in mind the importance and scale of employee data cleansing in advance of staging. Employers should test their software in advance, including: assessment, payroll to pensions provider communications, and employee communications. Financial Advice you can Value

Common Myths Myth Reality Self employed contractors are not subject to Automatic Enrolment It is possible for a self employed person to be a Worker under A. E. in certain circumstances The Pensions Regulator will never find out if the employer does not carry out its duties The Pensions Regulator get daily PAYE data from HMRC and Staff may also whistleblow It is only a 50 fine for small employers The regulator can issue a 400 fixed penalty for failing to comply with the employer duties and this may be followed by escalating penalty Postponement delays the staging date and there is no need to do anything until then Postponement does not change the staging date (and other duties still apply in this period) Employers can use their existing pension scheme for Automatic Enrolment It may not be possible, as the scheme may not be suitable and / or the provider may not allow it. Sole employee/Director companies will not have any Automatic Enrolment employer duties A sole employee (who is a Director of that company) is exempt, but the company may have non-employees who are considered workers Financial Advice you can Value

Auto Enrolment Questions ?? Financial Advice you can Value

Auto Enrolment Kevin Cunningham Bleathwood IFA Ltd Bleathwood House 45 Upper Packington Road Ashby de la Zouch Leicestershire LE65 1ED 01530 417943 kevin@bleathwoodifa.co.uk Bleathwood IFA Ltd is an appointed representative of Sense Network Ltd which is authorised and regulated by the Financial Conduct Authority Financial Advice you can Value