Offshore Wind Development in India: Key Players and Projects Overview

Explore the offshore wind industry in India through the lens of key entities like IT Power Consulting, SeaChange Offshore, and CmY Consultants. Learn about their contributions, past projects, and insights discussed during a significant event held in March 2016. Discover the latest advancements, challenges, and strategies shaping India's offshore renewable energy landscape.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Offshore Wind in India MNRE Tuesday 22nd March 2016 Joe Hussey IT Power Consulting Karma Dunlop Seachange Offshore Charles Yates CmY Consultants

Agenda 10:30 11:00 11:00 12:30 12:30 13:15 13:15 - 14:00 Brief round the table introductions from attendees Scene-setting from MNRE, BHC and the EU Delegation Presentations on the British High Commission Project s Deliverables: IT Power, CmY Consultants, SeaChange Offshore Lunch Break Contextualizing the deliverables in Current OSW development In India NIWE Wind resource assessments FOWIND Project update and plan FOWPI Project plan and timeline Break into discussion groups to debate: India s first offshore wind project focus on technical and data considerations Financing and tariffs strategies for a sustainable industry Discussion wrap up Key thoughts from each group s leader 14:00 - 15:00 15:00 15:30 15:30 15:45 15:45 16:00 Q&A Session Videolink with Huub Den Rooijen, Director Energy, Minerals & Infrastructure, UK Crown Estate Closing address and next steps 2 IT Power Consulting Seachange Offshore CmY Consultants

IT Power Consulting Renewable energy consultancy since 1981 Technical, engineering, policy and strategy advisory services Offshore energy group in Bristol since 1992 Over 80 offshore renewable energy projects 3 IT Power Consulting Seachange Offshore CmY Consultants

SeaChange Offshore The principals of SeaChange Offshore have extensive experience in the Development, Consenting and Construction of offshore projects. Over the past 15 years this has increasingly focussed on offshore renewables. Ormonde Offshore Wind Project 2000 - 2012 Project Director for Eclipse and Vattenfall - award winning, innovative project. UK Round 2 OREAL Co developer with GE Wind and Fluor International 2002 Baryonyx Offshore Wind Project US Offshore Wind initiative successful applicant for FOA 410 funding 2011 UK Floating Offshore Wind, Scotland With Atkins, successfully applied for Crown Estate Demonstrator Lease 2013 4 IT Power Consulting Seachange Offshore CmY Consultants

Ormonde Wind Farm Recipient of the UKRenewables 1st Large Project Award 2012 - Ormonde Offshore Wind Farm, This award recognises exceptional achievement in a large scale project during all the stages of project development. Built in record time, Ormonde was the first large project using jacket foundations and 5MW turbines in the UK. 5 IT Power Consulting Seachange Offshore CmY Consultants

Introduction to CmY Consultants We provide commercial, financial and regulatory expertise Deliver independent, expert advice on risk and business issues Worked with Ofgem to award 1.4bn of contracts for transmission links to offshore wind farms Working with the BHC to promote investment in Indian renewables Charles is an impressive advisor combining excellent sector and technical knowledge with an ability to provide concise and pragmatic advice. 6 IT Power Consulting Seachange Offshore CmY Consultants

Why Offshore? Potential to significantly contribute to renewable generation & COP commitment Generates jobs, supply chain opportunities and taxes Large additional area for wind generation Potential for exports (foundations, steel etc.) Attracts new foreign investment State of the art technology with major cost reductions Takes advantage of stronger, more reliable offshore winds 7 IT Power Consulting Seachange Offshore CmY Consultants

UK has over half of the global offshore wind 8 IT Power Consulting Seachange Offshore CmY Consultants

Cost reductions are driving capacity growth Installed capacity MW 9 IT Power Consulting Seachange Offshore CmY Consultants

Components of an Offshore Wind Farm 10 IT Power Consulting Seachange Offshore CmY Consultants

Offshore Wind Farm up to 2 Gigawatts 11 IT Power Consulting Seachange Offshore CmY Consultants

Stakeholder Engagement, November 2015 12 IT Power Consulting Seachange Offshore CmY Consultants

Industry Consultation General opinions and comments from Indian consultees: Turbine suppliers could be interested in development Would need site commitment if tendering for met mast Want government to take the lead in; Supply of data Clearances and EIA guidelines De-risking the process and political certainty Providing evidence of a pipeline and ambition for OSW Low Gujarat wind speeds Good TN speeds Need data Accept that costs will initially be high and need tariff Willing and able to provide significant local content 13 IT Power Consulting Seachange Offshore CmY Consultants

Industry Consultation EU Developers DONG Energy Interest in India but in the longer term currently busy with UK, USA and Netherlands Would need a business case to attract them to the market tariffs, seabed lease fees, wind resource, further opportunities Need project terms to allow flexibility in technical details and the timing of milestones Need to be able to divest of projects once operational and lower risk 14 IT Power Consulting Seachange Offshore CmY Consultants

Industry Consultation EU Developers RES Offshore (Renewable Energy Systems) Interested in India s future market Three key issues, authorities need to: Give confidence and certainty in the new market De-risk projects Provide visibility of opportunity to develop long term pipeline Strategy must offer scale and volume to develop and maintain a supply chain and pipeline of projects Permitting/consenting regulatory regime that is streamlined and efficient one stop shop Helpful for government to fund environmental / technical studies but must consult with developers 15 IT Power Consulting Seachange Offshore CmY Consultants

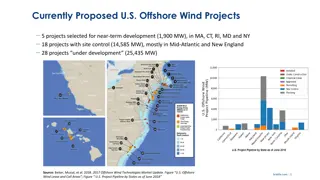

Roadmap Timeline Targets and Pipeline 17 IT Power Consulting Seachange Offshore CmY Consultants

Options for Concession Tendering Developer led applications for any desired project/location Developer led applications within State defined strategic areas or blocks State led tenders for individual projects/sites Applications either ad-hoc or during specific time periods 19 IT Power Consulting Seachange Offshore CmY Consultants

Competition for Defined Blocks Benefits Gov t can strategically plan Any delays in demarcation/approvals is before dev application Lower risk to developers as more is known upfront so FDI is more likely Closer to NELP approach which companies may be more comfortable with Bids judged on technical proposals as well as commercial/finance specifics Drawbacks More upfront effort and expense required by MNRE/NIWE Longer time before met mast is in the water 20 IT Power Consulting Seachange Offshore CmY Consultants

Concession Timeline June 2017 earliest date for bidding process to start Driven by wind data Public announcement min. 3 months before PQQ PQQ 4 months Full bid 7 months 21 IT Power Consulting Seachange Offshore CmY Consultants

Concession Competition: Existing Data & Activities NIWE INCOIS/NCSCM/NIOT/NIO GEOLOGY etc. Minimum +1 year on-site LiDar Wind resource data Waves & currents Seabed conditions (soil, geology and depth) Other Marine Stakeholders MOD Dept. of Shipping Aviation Oil & Gas 22 IT Power Consulting Seachange Offshore CmY Consultants

Concession Competition: Industrys Voice Dedicated website: Where developers can register their interest and be kept abreast on the opportunities and relevant offshore wind consultation events. In depth industry consultation prior to formal bid competition, to inform and fine tune the bid competition process does it make sense? Government is able to obtain feedback and gauge interest in the offshore wind bids before announcement and take steps to amend the process or increase interest if necessary from the feedback from developers. Will provide feedback and planning time for companies to understand regulations, evaluate risks, and undertake financial modelling to put together a business case. Establishment of an offshore wind energy trade association. 23 IT Power Consulting Seachange Offshore CmY Consultants

Concession Competition: Applicants The competition should apply a broad definition of Developer , permitting companies to: Local and foreign companies bid singly or in consortium with other companies, be large utility companies, venture capitalist organisation or EPC contractor The tender competition should be structured but also allow for flexibility to stimulate Developers submission of innovative solutions and the most commercially competitive tender. Undergo a pre-qualification process which assessesthe financial strength, technical ability, and track record in the delivery of infrastructure and energy projects 24 IT Power Consulting Seachange Offshore CmY Consultants

Competition for New Projects Block selection by FOWIND/NIWE/MNRE Strategic decision made after reviewing existing data, LIDAR data, uses of the sea & consultation (MSP) Available data supplied to bidders upfront 25 IT Power Consulting Seachange Offshore CmY Consultants

Pre-Qualification Consortium members Company info, consortium governance, balance of local vs international, corporate relation between partners Commitment of resources What criteria Technical expertise; design, engineering, operations, maintenance Capability to deliver large projects; project management and corporate structure Experience; offshore O&G/wind/infrastructure/power scale and cost of projects Financial strength; audited financial records/balance sheet for previous 5 years? Credit? Evaluation weighting Focus on project delivery and financial strength want developers able to carry project through Management structure and capability is key as most other things can be contracted out 26 IT Power Consulting Seachange Offshore CmY Consultants

Full Bid - ITT Plan for project; Project description/ capacity / layout Work programme Procurement plan - Supply chain & local content identifying long lead items and showing evidence that these can be delivered on time Finance & investment plan Requested Tariff Generation estimates / financial modelling / IRR Insurance considerations evidence of consultation with insurers EIA considerations identification of initial scoping and possible issues H&S and Quality processes Evaluation Focus on ultimate success rather than cost Need to demonstrate ability to deliver the work plan to time, budget and quality Show understanding of what s required in the project, how it will be done and how it will be managed 27 IT Power Consulting Seachange Offshore CmY Consultants

Block Identification and Site Data Availability

FOWIND Blocks - Gujarat 29 IT Power Consulting Seachange Offshore CmY Consultants

FOWIND Blocks Tamil Nadu 30 IT Power Consulting Seachange Offshore CmY Consultants

NELP Exploration Blocks (2010) 31 IT Power Consulting Seachange Offshore CmY Consultants

Preferred Blocks Blocks split into smaller sites for individual projects. Strategy for splitting block informed by: Developer and industry consultation Spatial variability of wind resource Bathymetry and seabed conditions Development constraints Offshore wind build out programme for India 32 IT Power Consulting Seachange Offshore CmY Consultants

Support Mechanisms & Tariffs Lincs OWF

Key Features of Offshore Income I Country UK Germany Denmark Belgium Netherlands France Name of scheme Contracts for Difference Einspelsevergutung ( 50 EEG) Public Service Obligation (PSO) Groenestroom- certificaten SDE + Renewable Energy Directive offshore Installed capacity GW 4.0 2.8 1.3 0.7 0.2 0.0 Target capacity 2020 GW ~11.0 6.5 2.2 2.2 1.6 6.0 Subsidy type Feed-in premium Feed-in tariff Subsidy payment per kWh Guaranteed price (strike price) less electricity market price Based guaranteed price less electricity market price Guaranteed price less electricity market price Guaranteed price less electricity market price which is reduced by ~10% Required price) less electricity market price + imbalance and profile factor and capped Guaranteed price (feed-in tariff, depending on tender round, location and bid) Guaranteed price cents /kWh Strike price = highest price in an auction (pay as cleared), now 16.0) Based on pre-determined average, now 15.4 (first 12 years) then 0.039 (to year 20) Project specific (determined in an auction), now 8.44 14.10 Based on pre- determined average, now 13.8 Project specific (determined in an auction), now capped at 12.4 Project specific, now 15.0 22.0 Guaranteed price is index linked Yes, Consumer Price Inflation No Yes, Consumer Price Inflation 34 IT Power Consulting Seachange Offshore CmY Consultants

Key Features of Offshore Income II Country UK Germany Denmark Belgium Netherlands France Definition of the electricity market price Hourly average price Monthly average price Hourly average price Yearly average price Yearly average price subject for the Borssele projects to a floor of 0.029 / kWh N/A Tax depreciation and incentives Accelerated depreciation Straight line depreciation Accelerated depreciation May be a one-off deduction of 13.5% of the acquisition value Accelerated depreciation Nominal corporate income tax rate 20% 22.4% - 32.4% depending on location 23.5% 33% 25% 33 1/3 % 35 IT Power Consulting Seachange Offshore CmY Consultants

Support Mechanisms for Offshore Wind Project specific tariff is based on Central Electricity Regulatory Commission Tariff Regulations of 17 Sept. 2009 Cl 16 provides for a pre-tax return on equity of: 19% per annum for the first 10 years 24% per annum 11th years onwards Proposed additional support: Government funds evacuation using Green Corridor grants Debt on attractive terms from public sector banks Free inter-state transmission Bundling of offshore wind and coal / solar to enhance affordability 36 IT Power Consulting Seachange Offshore CmY Consultants

Offshore transmission Who builds, owns & operates offshore electrical transmission infrastructure? Offshore wind farm developer or a grid operator? No precedent in India In UK, OFTOs take responsibility for offshore transmission assets under long-term licences. Pros for India Cons for India Proven and has successfully delivered 2.5 bn of investment in transmission Introduces additional interface between the OFTO and the developer. Adds complexity. Developers freed from providing finance for the transmission link Developer may feel revenue dependent on 3rd party adds risk. Reduces costs through competition and appropriate allocation of risks independent body required to run OFTO tender and regulate the OFTO. Attracted global bidders and accessed low cost capital not currently willing to invest in wind. Cost of OFTO tender may be significant Can either be generator build (model used in the UK so far) or OFTO build. OFTO approach would need to be adapted to fit in with Indian legal framework and power sector 38 IT Power Consulting Seachange Offshore CmY Consultants

Summary Lots of interest in India s offshore wind potential but more needs to be known Industry needs clear vision and targets Consult industry and advertise opportunities Utilise the power of OWESC to mobilse public decision-makers/stakeholders Reduce uncertainty of tariff and offshore transmission Collect and publicise site data wind / ocean / seabed 40 IT Power Consulting Seachange Offshore CmY Consultants

A Way Forward Industry consultation - tender & strategy [NIWE] Gather existing data [NIWE & FOWIND] Finalise block selection & sites [FOWIND] Collect wind data from LIDAR [FOWIND] New survey data [FOWPI & NIWE] In principal phase 1 clearances [MNRE] Consult CERC over tariff options [MNRE] Prepare EIA guidelines for OSW projects [MoEF] Plan for offshore transmission [MNRE] Launch tender process [MNRE / NIWE] 41 IT Power Consulting Seachange Offshore CmY Consultants

Thank You! Joe Hussey Karma Dunlop Charles Yates IT Power Consulting CmY Consultants Seachange Offshore joe,.hussey@itpower.co.uk +44 117 214 0516 charles@CmYconsultants.london +44 776 833 7854 kdunlop@seachange-offshore.com +44 198 375 9362 www.indiaoffshorewind.com

Concession Timeline 43 IT Power Consulting Seachange Offshore CmY Consultants

International Approach to Issuing Concessions Belgium Applications to Commission for the Regulation of Electricity and Gas (CREG) are made for individual, developer defined site areas within a zone, specifically allocated for offshore wind development by the government s marine spatial planning. The zone has been completely filled and the country s busy waters mean that further projects, outside of this zone, are likely to be feasible. Denmark The competitive tender is judged predominantly on the price of electricity of the bid. Sites are selected and initially developed by the government (Danish Energy Authority - DEA), providing site data for feasibility assessment, engineering and EIA. The onshore and offshore electrical transmission system is provided and operated by the state owned transmission system operator. The DEA also has an open door policy for ad hoc applications. France Competitive tender for state defined project sites, with a large emphasis on the bid price of electricity for each applicant. Germany Ad hoc project applications submitted to the Bundesamt fur Seeschifffahrt und Hydrogaphie (BSH translates to Federal Maritime and Hydrographic Agency, a government agency), with proposals needing to fit with national Marine Spatial Planning and within pre-determined offshore wind development zones. Applications are judged on BSH s published standards, findings of the EIA, and impacts on sea users. Approvals are given on a first come first served basis. Netherlands Similar to Denmark, a new competitive tendering process is being introduced that will be judged on price of electricity. Tenders are offered for specific projects within planned offshore wind zones. The government provides the site data for EIA and engineering. The Transmission System Operator (TSO) builds and operates the onshore and offshore grid infrastructure. Sweden Ad hoc applications may be made, provided that the requested project sites comply with the country s marine spatial plan. There is little policy in place for offshore wind as Sweden has many other renewable energy resources that are exploitable at a lower price. Despite being the first country in the world to research offshore wind, the industry s progress has almost halted. United Kingdom Competitive tender judged on ability to successfully deliver a project rather than the cheapest price. Originally a developer led site selection process but now switched to a strategic zonal approach with developers selecting sites within zones. USA Auction process for project areas, where competition between applicants is deemed to exist. Project areas are pre- determined by the federal government and offered on a state-by-state basis. Auction judged by the highest price offered for project area. If no competition exists from other bids, negotiations for lease terms commence. The USA has a very complex concession and permitting process, which has led to very slow progress being made. 44 IT Power Consulting Seachange Offshore CmY Consultants