Jaguar Valuation and Strategic Alternatives Analysis

"Discover why Jaguar could achieve positive outcomes for shareholders through a strategic process, with insights on its undervaluation, potential premium, and various strategic alternatives available. Explore in-depth valuation methodologies and strategic paths to potentially maximize shareholder value."

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

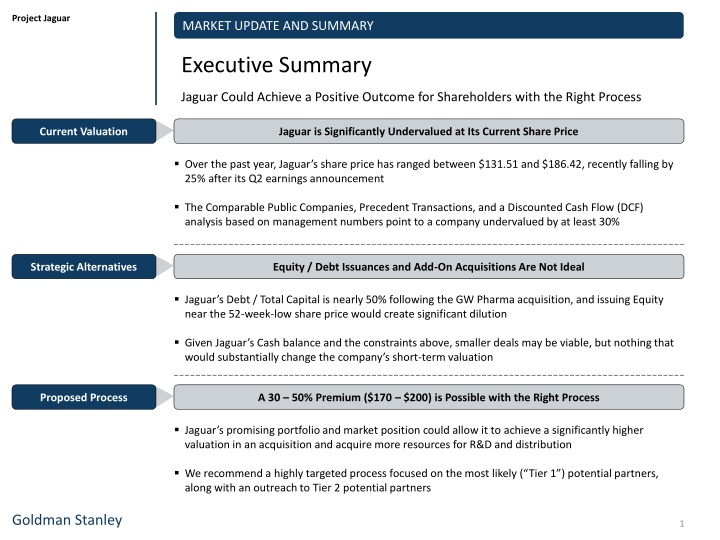

Project Jaguar MARKET UPDATE AND SUMMARY Executive Summary Jaguar Could Achieve a Positive Outcome for Shareholders with the Right Process Current Valuation Jaguar is Significantly Undervalued at Its Current Share Price Over the past year, Jaguar s share price has ranged between $131.51 and $186.42, recently falling by 25% after its Q2 earnings announcement The Comparable Public Companies, Precedent Transactions, and a Discounted Cash Flow (DCF) analysis based on management numbers point to a company undervalued by at least 30% Strategic Alternatives Equity / Debt Issuances and Add-On Acquisitions Are Not Ideal Jaguar s Debt / Total Capital is nearly 50% following the GW Pharma acquisition, and issuing Equity near the 52-week-low share price would create significant dilution Given Jaguar s Cash balance and the constraints above, smaller deals may be viable, but nothing that would substantially change the company s short-term valuation Proposed Process A 30 50% Premium ($170 $200) is Possible with the Right Process Jaguar s promising portfolio and market position could allow it to achieve a significantly higher valuation in an acquisition and acquire more resources for R&D and distribution We recommend a highly targeted process focused on the most likely ( Tier 1 ) potential partners, along with an outreach to Tier 2 potential partners Goldman Stanley 1

Project Jaguar JAGUAR VALUATION Valuation Conclusions A 30 50% Premium ($170 $200) is Possible with the Right Process Jaguar Could Maximize Shareholder Value via a Broad Process Including Tier 1 and Tier 2 Partners Management Case Valuation is Justified Jaguar s margins exceed those of its peer companies and its revenue growth rates are in-line with theirs, but it trades at a 20% 60% discount following its Q2 earnings announcement #1 This level represents a 50%+ premium to Jaguar s current share price; the valuation methodologies point to a range of $170 $200, but a deal at $170 makes little sense given the past 12 months trading history #2 Goal: $200 / Share Discounted Cash Flow (DCF) Analysis The implied value is between $170 and $230 per share, but these projections do not include possible synergies in an M&A deal, so they may understate Jaguar s value to potential partners #3 Premiums Paid Analysis Premiums Paid indicate a median implied share price in the $190 $230 range, depending on the time period and adjustments (i.e., undisturbed vs. raw share prices) #4 Goldman Stanley 2

Project Jaguar POTENTIAL STRATEGIC ALTERNATIVES Potential Alternatives for Jaguar Both Standalone and Strategic Options Should Be Considered Multiple potential paths forward exist for Jaguar Many paths are not mutually exclusive (i.e., the company could pursue several at the same time) Given current market conditions and the company s capital structure, M&A options are more likely to maximize shareholder value 1 Continue Expansion, Development, and Licensing Efforts Organic 2 Standalone Issue Equity Capital Structure 3 Issue Debt 4 Tuck-In Acquisition Acquisition 5 Transformational Acquisition Strategic 6 Merger / Combination with Strategic Sale / Merger Goldman Stanley 3

Project Jaguar POTENTIAL STRATEGIC ALTERNATIVES Assessment of Standalone / Strategic Alternatives Key Considerations Should Be Process Speed, Valuation, and Market Conditions Description Benefits Considerations 1 Continue geographic expansion into Europe and Asia-Pac and internal development efforts No additional headcount required Leverages existing customer and distributor relationships Enhances future growth prospects Internal development is expensive and increasingly risky Difficult to find solid IPs to license Status Quo 2 Complete a follow-on equity offering at a modest (~5%) discount to raise additional capital Quick completion time (weeks) No additional interest expense or covenants Jaguar is currently trading near its 12-month low price Significant shareholder dilution Issue Equity 3 Issue traditional debt (senior notes) or another convertible bond Lowest-cost form of financing Lenders are already familiar with Jaguar s name and credit profile Jaguar has 52% Debt in its capital structure, far above any public peer Covenants may restrain M&A activity Issue Debt 4 Complete a < $500 million acquisition of a pre-revenue company Jaguar could gain promising pipeline drug candidates Enhances growth profile Difficult to find good targets in this size range May distract management Tuck-In Acquisition 5 Complete a larger (> $5 billion) acquisition of a company with substantial revenue The right deal could dramatically increase Jaguar s valuation Enhances growth and market access Jaguar just completed a $6 B deal A major would result in significant shareholder dilution Transformational Acquisition 6 Merge with a peer company or sell to a larger multinational strategic acquirer Likely the optimal path to maximize shareholder value in the short term Critical mass, synergies, and access Relatively few qualified partners with capacity Management bandwidth constraints Sale to a Strategic Goldman Stanley 4

Project Jaguar PROCESS RECOMMENDATIONS Key Recommendations Comparison of Targeted and Broad Processes Targeted Process Broad Process We recommend engaging in targeted discussions with the Tier 1 candidates At the same time, Goldman Stanley will reach out to Tier 2 candidates The M&A process with Tier 1 candidates will take significantly longer, so we recommend parallel processes Depending on the responses from Tier 1 and Tier 2 candidates, Goldman Stanley and Jaguar may approach additional partners Approach fewer than 5 potential partners Approach 10 100 potential partners Description Goldman Stanley will create a management presentation and financial model Goldman Stanley will create a management presentation, financial model, and CIM On average, 6-12 months required More likely to maximize shareholder value Benefits Higher offer probability Goldman Stanley could also approach financial sponsors active in the healthcare space Less management bandwidth Less likely to maximize shareholder value Highly variable timing due to iterative process Considerations More intense management focus required as discussions with potential partners accelerate More management bandwidth required throughout the entire process Goldman Stanley 5

Project Jaguar PROCESS RECOMMENDATIONS Process Alternatives Comparison of Alternatives and Recommended Hybrid Process Specialized Negotiations With One Party Highly Targeted Process Targeted Discussions + Broader Search Broad M&A Process Broad Marketing RECOMMENDED Combination of targeted discussions plus broader search conducted in background maximizes success probability and minimizes disruption to Jaguar Additional parties contacted depend on responsiveness of Tier 1 and Tier 2 partners Interested parties would sign NDAs and then proceed into due diligence and valuation discussions with Jaguar Goldman Stanley 6