Insights from 50 Years as an Actuary

Frank Buck shares valuable lessons learned during his 50-year career as an actuary, reflecting on the evolution of the profession, technological advancements, and the importance of communication and continuous learning.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

LESSONSLEARNEDAFTER 50 YEARSASANACTUARY Frank Buck May, 2017 1

DISCLAIMER : THEVIEWSEXPRESSEDINTHISPRESENTATION AREMINEANDNOTNECESSARILYTHOSEOF FWD AND/ORPREVIOUSEMPLOYERS. 2

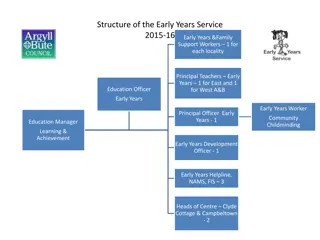

History September Started work as an actuarial student 1965 July Fellow of the Institute of Actuaries 1973 1984 Member of the American Academy of Actuaries 2002 Fellow of the Society of Actuaries Chair Financial Reporting Section of SOA Chair International Section of SOA Joint author of US GAAP for Life Insurance Companies Speaker at many conferences on a range of topics 3

HISTORY - CONTINUED Consultant Company 20 years 30 years Philippines s UK HK Canada USA Thailand 2015 + 1965 1978 1978 1983 1984 2000 2003 2006 2014 2000 2003 2006 2014 OTHER COUNTRIESWHERE I HAVEWORKED Spain Switzerland Taiwan UAE Vietnam China Germany India Indonesia Italy Argentina Australia Bangladesh Brazil Chile Japan Korea Malaysia Mexico South Africa 4

HOW DIFFERENT WAS IT BACK THEN? Actuaries held most senior positions in most life insurance companies Universal Life had not been invented Guaranteed Annuity Options did not exist UK Government Bonds (Gilts) reached 15% Personal Computers did not exist To recalculate a book of endowment rates after a change in interest rates could take 10 people 1 to 2 weeks If a typist made a mistake, the whole page had to be re-typed or, for minor errors, white-out was used Risk Managers did not exist Men wore suits (and ties) Business Casual (for me) started in 2003 5

MY FIRST CALCULATOR I GOT MY FIRST COMPUTER IN 1987 6

LESSONS LEARNED - 1 Don t be afraid to ask if you do not understand what someone else is saying Jargon is pervasive but not universal Speakers always assume that you know what they are talking about Actuaries are particularly bad here 7

LESSONS LEARNED - 2 Beware of present values Future earnings patterns are important The following have the same present value at 5% 8

LESSONS LEARNED - 3 Don t trust computers Always perform a check for reasonability o Particularly with spreadsheets o Have your work checked Don t believe the IT guy Never accept an answer The system can't do that o The IT department might not know how to do it (in which case we can train them) o The solution might not be cost effective o However, the system can always do it. 9

LESSONS LEARNED - 4 Documentation is important Start writing the report before you start doing the work o It helps you to focus on the objectives Documentation always takes much longer that you anticipate o However, it makes the work easier next time The act of documenting can highlight a misunderstanding or error Take responsibility for your work o Put your name on the report (standard of practice in most mature markets) o Give credit to those who assisted you Spreadsheets are not good documentation 10

LESSONS LEARNED- 5 Listening is the most important skill that you can develop Everyone s attention span is short Focus on what your client/colleague/boss wants Ask if you do not understand 11

LESSONS LEARNED - 6 Communication is essential Actuaries have lost control because non-actuaries do not understand them We have to communicate to accountants, investment bankers, auditors, rating agencies, regulators, etc. We have to communicate to sales people, marketers, other members of senior management, boards of directors Learn how to explain actuarial concepts to non-actuaries You will understand your work better if you have to explain it 12

LESSONS LEARNED - 7 Develop a general sense for your business Calculating numbers is only the first step What do the results mean? What management actions do you recommend? Be pro-active in presenting results 13

LESSONS LEARNED - 8 Don t be afraid to try something new You can always go back (to some extent) if the new challenge does not work out The first move is the most difficult Stretch yourself by taking on different responsibilities 14

LESSONS LEARNED - 9 When you take over a role from someone else, make sure you understand how the previous person performed the role Assumptions used and how derived Spreadsheet linkages Interaction with others Approximations used 15

LESSONS LEARNED - 10 Don t be afraid to make a mistake We often have to make a decision with limited information We don t always have time to prepare the perfect answer Qualified decisions are OK HOWEVER, DON T MAKE THE SAME MISTAKE AGAIN 16

LESSONS LEARNED - 11 Teams usually achieve more than individuals It is important to bounce ideas off each other Different disciplines bring different perspectives But the teams have to be well organized and well led Consultants often hunt in packs 17

LESSONS LEARNED 12 Regulators always react too late Nobody tested the impact of declining interest rates and many jurisdictions struggled to respond Before the US financial crisis most models had property values increasing or staying level Regulators always overreact Solvency II requires 1,000+ scenarios IFRS 17 requires major systems changes Is stochastic really necessary for Thai par business? Forcing disclosure of sales commissions destroyed the Australian life insurance market 18

LESSONS LEARNED - 13 Celebrate success Reaching a goal deserves recognition Always compliment team members on work well done Have fun 19

LESSONS LEARNED - 14 Always have outside interests Doing other things keeps the mind fresh Maintain a work/life balance Resist pressure to overwork Try different things Don t be a workaholic My hobbies I started karate when I was 60 I started yoga when I was 64 I learned to scuba-dive when I was 70 I now play golf, practice yoga and cook 20

SUMMARY Don t be afraid to ask if you do not understand Beware of present values Don t trust computers Documentation is important Listening is very important Communication is essential Develop a general sense for your business Don t be afraid to try something new Don t be afraid to make a mistake Celebrate success Always have outside interests 21