Industrial Costing and Basic Concepts in Cost Accounting

Classification and basic concepts of cost accounting, tasks in company cost and performance accounting, main contents of corporate accounting, key factors of internal and external accounting, differences between cost and performance accounting versus investment accounting. Learn about decision-making processes, controlling objectives, and financial accounting.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

Lecture Industrial Costing SS 2016/2016 Prof. Dr. Olga Popova, OVGU Prof. Dr. J rg Jablinski, OWL 1

Chapter 1 Classification and basic concepts of cost accounting 2

Main tasks in a company Cost- and performance accounting supports management of a company Providing information, which are necessary for guiding the company as a whole or at the individual areas Typically the Corporate Governance includes the following fields of activity: planning the decision-making process leading the decision-making process controlling the achievement of objectives incl. plan dates 3

Main contents of the corporate accounting Balance Sheet accounting Financial and tax accounting: overview of assets and liabilities of a company, profit and loss account Financial Accounting Cash flow accounting on paying and -out as an overview of the liquidity of an enterprise Investment Accounting Assessment of long term investment decisions Cost- and performance accounting Accounting as the basis of planning, leading and controlling 4

Key factors of internal and external accounting Internal Accounting External Accounting Recipients of Information Externals from outside the company (state, banks etc.) Corporate members Accounting Purposes Planning, leading, controlling & decision making Assets, finances and income; distribution and taxation Specific country laws (in Germany for example HGB, IFRS, AO) Guidelines Scarcely Guidelines Object Depiction Disaggregated account for parts of the company Aggregated calculation for segments and the whole company Temporal Rhythm Variable (daily, weekly, monthly or annual reports) Fixed (annual, half-yearly and quarterly reports)) Future and past-oriented (planned /actual accounting ) Past-orientated (actual accounting ) Temporal Focus 5

Cost- and performance accounting vs. Investment accounting Differences in the temporal range of the considered decisions Cost- and performance accounting basis for operational decisions operating range of up to one year Example: production cost of a product during the next quarter Investment accounting base for decisions with long-term effects time value of money means to be well timed for success example: purchase of a system for using during several years 6

Cost-benefit-analysis Objective: achieving the best possible accounting purposes Decisive criterion: The benefits of improved decision making must exceed the costs of developing and maintaining this information Costs and benefit of expansion of cost- and performance accounting Benefit of expansion Costs of expansion optimal expansion expansion of cost- and performance accounting 7

Important systems of cost accounting Accounting purpose determines the necessary information different costs for different purposes Influence quantities of the expansion of cost- and performance accounting industrial and service-related business production processes competitive strategy Classification of systems on the basis of significant accounting purposes of documentation, planning and controlling Accounting purpose of controlling can be achieved by using information from past, actual and planned accounting records Range of cost allocation as a further distinguishing factor Full cost-accounting Marginal cost-accounting 8

Full cost-accounting Cost types accounting Cost center accounting Cost unit accounting Overhead Costs Overhead Costs Overhead Costs Profit and loss accounting Direct Costs Direct Costs Performance-accounting 9

Marginal cost-accounting Cost types accounting Cost center accounting Cost unit accounting Profit and loss accounting: Contribution margin accounting Fixed Fixed overhead Costs overhead Costs Performances Variable overhead Costs Variable overhead Costs Variable overhead Costs - Variable Costs = Contribution Margin Direct Costs Direct Costs - Fixed Costs Business Success Performance-accounting 10

Basic concepts of cost- and performance accounting : Valued, tangible targeted good s consumption. Costs: Performances: Valuated, properly targeted on good s origin. Tangible target orientation : Relating to operating purpose (tangible goal) of the company. Valuation : Valued at price, i.e. value sizes. Good s Consumption / Good s Origin : Costs arise for the first time only at the moment of the good s consumption. Performances arise for the first time only at the moment of the good s origin. 11

Flow variables of internal and external accounting Calculated quantities (flow variables) Subsystems of accounting Cumulative values and their components cash balance + available at any time bank deposits = amount of cash and cash equivalents Inpayment / Outpayment Financial Accounting, Investment Accounting Cash and cash equivalents + All other receivables - undetermined liabilities = financial assets + tangible assets = net assets Revenues / Expenditures Balance Sheet accounting Proceeds / Expenses Cost- and performance accounting Performances/ Costs Operating assets 12

Definition of outpayment, expenses and costs Outpayment Not effecting net income Effecting net income - Repayment of a credit - Buying a device Expenses Neutral expenses -not relating to a purpose of the main activity -not relating to an accounting period - extraordinary Rent reserve rooms, donation Purpose expenses Sales of equipment by price, that is lower than the purchase price imputed depreciations -imputed rent -imputed interest Destruction of equipment caused by accident Other Costs Extra Costs Basic Costs Imputed Costs Costs 13

Cost terms and their significance (part 1) Total Costs : Costs of all goods the company has at least begun to sell during a given period. Unit Costs : Costs incurred in producing one unit of a good or service. Costs which can be accurately traced to a cost object with little effort Direct Costs : Costs which cannot be accurately attributed to specific cost objects Overhead Costs : 14

Process of cost accounting Cost category Cost allocation Costing object Unit Costs Example : Material direct costs Cost accounting Example : Produkt (Inlay) Overhead Costs Example: Material overhead costs Cost coding 15

Cost terms and their significance (part 2) Variable Costs : A corporate expense that varies with production output. Variable costs are those costs that vary depending on a company's production volume; they rise as production increases and fall as production decreases. A cost that does not change with an increase or decrease in the amount of goods or services produced. Fixed costs are expenses that have to be paid by a company, independent of any business activity. Fixed Costs : (linear) Cost Function : Ctotal = Cfix + cvar x Fixed Costs Variable costs depending on output x 16

Average cost per unit : caverage= Ctotal/ x Marginal Costs : Cost of the next unit or one additional unit of volume or output. Pattern of Cost Behavior : Total costs and Average cost per unit Ctotal caverage Ctotal= Cfix+ cvar x caverage = Ctotal/ x Cfix x (amount) x (amount) 17

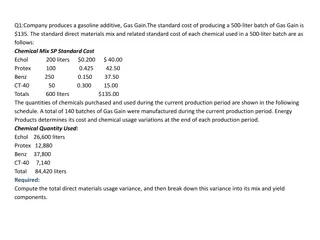

Exercise 1: Flow Variables Below you will find some business transactions of the company X; fill in the right solutions in the table. Determine the following transactions: inpayment (+), outpayment (-), revenue (+), expenditures (- ), proceeds (+), expenses (-), performances (+) or costs (-).There are several possible flows of a business transaction. 1.Cash purchase of raw materials in the amount of 62.000,- . 2.Receiving a long-term bank credit in the amount of 500.000,- . 3.Credit purchase of raw materials in the amount of 90.000,- . 4.Residual book value of an engine purchased in the previous year in the amount of 100.000,- (replacement value 140.000,- ) is amortized linearly during next four years 5.Credit sales of finished goods in the amount of 450.000,- (delivery time is before payment). The selling price (50.000,- ) is higher than the stock valuation of finished products at the warehouse (equal in financial accounting and cost accounting). 6.Cash sale of a machine from the current assets with 7.500,- (the net book value in the financial accounting is 0,- ). 7. Repayment of a credit in the amount of 100.000,- by bank transfer. 18

Process + Inpayment/ Outpayment + Revenue/ Expenditures + Proceeds/ Expense + Performances/ Costs 1. 2. 3. 4. 5. 6. 7. 19