Important Changes in Motor Vehicles Act 1988 and Motor Vehicles Amendment Act 2019

Central Government has announced amendments to the Motor Vehicles Act 1988 and Motor Vehicles Amendment Act 2019 effective from April 1, 2022. The changes include the implementation of Detailed Accident Report procedures, appointment of Nodal Officers for motor third party cases, and definitions related to insurance against third party risks. The new provisions also cover various aspects such as grievous hurt definitions and the necessity of insurance against third party risk.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

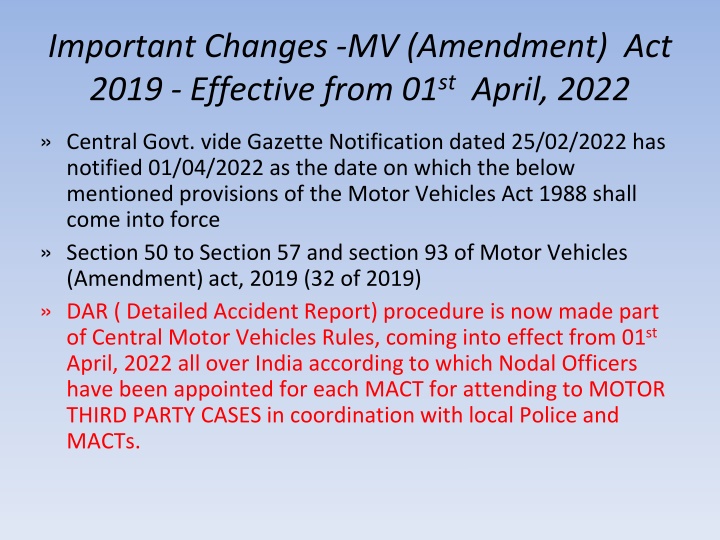

Important Changes -MV (Amendment) Act 2019 - Effective from 01stApril, 2022 Central Govt. vide Gazette Notification dated 25/02/2022 has notified 01/04/2022 as the date on which the below mentioned provisions of the Motor Vehicles Act 1988 shall come into force Section 50 to Section 57 and section 93 of Motor Vehicles (Amendment) act, 2019 (32 of 2019) DAR ( Detailed Accident Report) procedure is now made part of Central Motor Vehicles Rules, coming into effect from 01st April, 2022 all over India according to which Nodal Officers have been appointed for each MACT for attending to MOTOR THIRD PARTY CASES in coordination with local Police and MACTs.

INSURANCE OF MOTOR VEHICLES AGAINST THIRD PARTY RISKS Sec.145 of MV Act,1988 Few of the relevant definitions are as follows:- Authorised Insurer Carrying on General insurance business in India under GIBNA, 1972. Liability The term liability includes no fault liability. Policy of Insurance Expression includes certificate of insurance. Property Includes goods carried in the motor vehicle, roads, bridges, culverts, causeways, trees, posts and milestones. Third Party Includes the government Sec. 145(g) Sec.146 of the MV ACT,1988 Necessity of insurance against Third Party risk No person shall use, except as a passenger, or cause or allow any other person to use, a motor vehicle in a public place, unless there is in force in relation to the use of the vehicle, a policy of insurance complying with the provisions of chapter-XI of the Act. Vehicle carries or meant to carry dangerous or hazardous goods Additional policy of insurance under the Public Liability Insurance Act, 1991. Compulsory Insurance not applicable to vehicle owned by Central Government or State Government and used for government purposes. Trusted since 1906

The Motor Vehicles (Amendment) Act, 2019 Section 145 Definitions New Provision (c) grievoushurt shall have the same meaning as assigned to it in section 320 of the Indian Penal Code. (d) hit and run motor accident means an accident arising out of the use of a motor vehicle or motor vehicles the identity whereof cannot be ascertained in spite of reasonable efforts for the purpose Old Provision New Provision (e) property includes goods carried in the motor vehicle, roads, bridges, culverts, causeways, trees, posts and mile-stones (g) property includes roads, bridges, culverts, causeways, milestones and baggage of passengers and goods carried in any motor vehicle trees, posts, (g) Government. third party includes the (i) Government, the driver and any other co-worker on a transport vehicle. third party includes the Section 146 i.e. Necessity for insurance against third party risk is kept as it is. Trusted since 1906

The Motor Vehicles (Amendment) Act, 2019 Grievous Hurt Definition 320. Grievous hurt. The following kinds of hurt only are designated as grievous : (First) Emasculation. (Secondly) Permanent privation of the sight of either eye. (Thirdly) Permanent privation of the hearing of either ear, (Fourthly) Privation of any member or joint. (Fifthly) Destruction or permanent impairing of the powers of any member or joint. (Sixthly) Permanent disfiguration of the head or face. (Seventhly) Fracture or dislocation of a bone or tooth. (Eighthly) Any hurt which endangers life or which causes the sufferer to be during the space of twenty days in severe bodily pain, or unable to follow his ordinary pursuits. Trusted since 1906

IMPORTANT DEFINITIONS Sec.2(34) of MV Act, 1988 Public Place Road, Street, way or other place, whether a through fare or not, to which the public have a right of access Covers even places of private ownership where members of public have access whether free or controlled Accident in garage in the process of reversing a tractor Road inside the gate of the secretariat- considered as Public Place. Sec.2(28) of MV Act, 1988 MotorVehicle means any mechanically propelled vehicle adopted for use upon roads whether the power of propulsion is transmitted thereto from an external or internal source. Important Additional definitions in the M. V. (Amendment) Act, 2019 (1A) aggregator means a digital intermediary or market place for a passenger to connect with a driver for the purpose of transportation; (4A) community service means an unpaid work which a person is required to perform as a punishment for an offence committed under this Act; (12A) golden hour means the time period lasting one hour following a traumatic injury during which there is highest likelihood of preventing death by providing prompt medical care; Invalid carriage is replaced by adapted vehicle. Trusted since 1906

The M.V. (Amendment) Act, 2019 Section 14- Currency of Driving Licence Authorisation Old Provision New Provision Transport Vehicle Valid for 3 Years Valid for 5 Years Transport vehicle carrying goods of dangerous or hazardous nature Valid for 1 Year Valid for 3 Years Any Other Licence Valid for 20 Years or till the person attains the age of 50 Yrs., whichever is earlier Age of the licence holder Validity Below 30 Yrs. Till the age of 40 Yrs. Attained 30 Yrs. & Below 50 Yrs. Valid for 10 Yrs. If the person has attained the age of 50 Yrs.- Valid for 5 Years Attained 50 Yrs. & below 55 Yrs. Till the age of 60 Yrs. Attained 55 Yrs. Valid for 5 Years Trusted since 1906

The M.V. (Amendment) Act, 2019 Section 15-Renewal of driving licences Old Provision New Provision where the application for the renewal of a licence is made more than thirty days after the date of its expiry, the driving licence shall be renewed with effect from the date of its renewal where the application for the renewal of a licence is made either one year prior to date of its expiry or within one year after the date of its expiry, the driving licence shall be renewed with effect from the date of its renewal The grace period of 30 days for every driving licence has been omitted by the Amendment Act. Trusted since 1906

The M. V. (Amendment)Act, 2019 NO FAULT LIABILITY TOWARDS THIRD PARTY Chapter X dealing with LIABILITY WITHOUT FAULT IN CERTAIN CASES from Section 140 to 144 is deleted . Section 163A- Special provisions as to payment of compensation on structured formula basis along with Schedule II as amended by Notification dt. 22.05.2018 is deleted . A new Section 164 under Chapter XI is introduced on No Fault Liability and the amount received is full & final Old Provision New Provision Section 163A Section 164 Death : R. 5,00,000 /- Death : Rs. 5,00,000 /- Permanent Disability : Rs. 5,00,000/- percentage disability as per Schedule I of the Employee s Compensation Act, 1923 (8 of 1923)] : Provided that the minimum compensation in case of permanent disability of any kind shall not be less than fifty thousand rupees. Grievous Hurt : Rs. 2,50,000 /- Minor Injury : Rs. 25,000 /- None Trusted since 1906

The M. V. (Amendment)Act, 2019 Section 147 Requirements of policies and limits of liability Old Provision New Provision Limits of liability : Notwithstanding anything contained under any other law for the time being in force, for the purposes of third party insurance related to either death of a person or grievous hurt to a person, the Central Government shall prescribe a base premium and the liability of an insurer in relation to such premium for an insurance policy under sub-section (1) in consultation with the Insurance Regulatory and Development Authority. Injury/Death-Unlimited TPPD- Rs. 6,000 /- A policy of Insurance issued before the commencement of the Motor Vehicles (Amendment) Act, 2019 shall be continued on the existing terms under the contract and the provisions of this Act shall apply as if this Act had not been amended by the said Act. Trusted since 1906

The M. V. (Amendment)Act, 2019 A new Section 149 is introduced Settlement by insurance company and procedure therefore (1) The insurance company shall, upon receiving information of the accident, either from claimant or through accident information report or otherwise, designate an officer to settle the claims relating to such accident. (2) An officer designated by the insurance company for processing the settlement of claim of compensation may make an offer to the claimant for settlement before the Claims Tribunal giving such details, within thirty days and after following such procedure as may be prescribed by the Central Government. (3) If, the claimant to whom the offer is made under sub-section (2), accepts such offer, (i) the Claims Tribunal shall make a record of such settlement, and such claim shall be deemed to be settled by consent; and (ii) the payment shall be made by the insurance company within a maximum period of thirty days from the date of receipt of such record of settlement; (b) rejects such offer, a date of hearing shall be fixed by the Claims Tribunal to adjudicate such claim on merits. Trusted since 1906

The M. V. (Amendment)Act, 2019 Duty of insurers to satisfy judgments and awards against persons insured in respect of third party risks Old Provision New Provision Section 149 Section 150 In addition to the earlier mentioned defences , Section 150 (2) adds following with respect to breach of a specified condition of policy : Driving under the influence of alcohol or drugs as laid down in Section 185 There is non-receipt of premium as required under Section 64VB of the Insurance Act , 1938. The aspect of pay & recovery as mentioned earlier in Section 149(5) is deleted in the Amendment Act. It shall be the duty of the owner of the vehicle to furnish to the tribunal or court the information as to whether the vehicle had been insured on the date of the accident, and if so, the name of the insurance company with which it is insured. Trusted since 1906

The M. V. (Amendment)Act, 2019 Section 161 : Special provisions as to compensation in case of hit and run motor accident Old Provision New Provision Amount of Compensation : Amount of Compensation : Death : Rs. 25,000 /- Grievous Hurt : Rs. 12,500 /- Death : Rs. 2,00,000 /- Grievous Hurt : Rs. 50,000 /- The Central Government may by notification frame scheme for payment of mentioned or such higher amount , specifying the manner in which it shall be administered . There is no mention of Solatium Fund. Section 162 is a new addition : Scheme for the cashless treatment of victims of the accident during the golden hour ( time period lasting one hour following a traumatic injury) Trusted since 1906

The M. V. (Amendment) Act, 2019 Old Provision New Provision Section 158(6): As soon as any information regarding any accident involving death or bodily injury to any person is recorded or report under this section is completed by a police officer, the officer-in-charge of the police station shall forward a copy of the same within thirty days from the date of recording of information or, as the case may be, on completion of such report to the Claims Tribunal having jurisdiction and a copy thereof to the concerned insurer, and where a copy is made available to the owner, he shall also within thirty days of receipt of such report, forward the same to such Claims Tribunal and insurer. Section 159 :The police officer shall, during the investigation, prepare an accident information facilitate the settlement of claim in such form and manner, within three months and containing such particulars and submit the same to the Claims Tribunal and such other agency as may be prescribed. report to Trusted since 1906

The M. V. (Amendment) Act, 2019 Scheme for Interim relief Old Provision New Provision Section 140 to 144 Section 164A, 164B Death : Rs. 50,000 /- Permanent Disablement : Rs. 25,000 /- The Central Government schemes It shall also provide for procedure to recover funds disbursed under such scheme from the owner of the motor vehicle, where the claim arises out of the use of such motor vehicle Creation of Motor Vehicle Accident Fund for providing interim relief, cashless payment during golden hour, payment to be made in hit & run cases, and for providing compulsory insurance cover to all road users in the territory of India. Trusted since 1906

The M. V. (Amendment) Act, 2019 Section 166 : Application for compensation Old Provision New Provision No Time Limit for filing compensation No application for compensation shall be entertained unless it is made within six months of the occurrence of the accident Nexus between accidental injury and death was required The right of a person to claim compensation for injury in an accident shall, upon the death of the person injured, survive to his legal representatives, irrespective of whether the cause of death is relatable to or had any nexus with the injury or not. . Section 173 : Appeals No appeal shall lie against any award of a Claims Tribunal if the amount in dispute in the appeal is less than ten thousand rupees No appeal shall lie against any award of a Claims Tribunal if the amount in dispute in the appeal is less than one lakh rupees Trusted since 1906

279 IPCRASH DRIVING OR RIDING ON A PUBLIC WAY 304A IPC CAUSING DEATH BY NEGLIGENCE Whoever causes the death of any person by doing any rash or negligent act not amounting to culpable homicide, shall be punished with imprisonment of either description for a term which may extend to two years, or with fine, or with both. 337IPC. Causing hurt by act endangering life or personal safety of others 338 IPC Causing grievous hurt by act endangering life or personal safety of others 427. Mischief causing damage to the amount of fifty rupees Trusted since 1906

OTHER IMPORTANT PROVISIONS- The M. V. (Amendment) Act, 2019 Trusted since 1906

18 Trusted since 1906

![RE: ELECTORAL MATTERS AMENDMENT BILL [ B42-2023]](/thumb/18837/re-electoral-matters-amendment-bill-b42-2023.jpg)