Healthcare Sector's Growing Adoption of RFID Tags Boosts Thermal Paper Market"

Thermal Paper Market By Printing Technology (Direct Thermal, Thermal Transfer, Others), By Width (2.25u201d (57mm) and 3.125u201d (80mm)), By Application (Lottery & Gaming, Point of Sale (PoS), and Tags & Labels), By Region and Companies - Industry

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

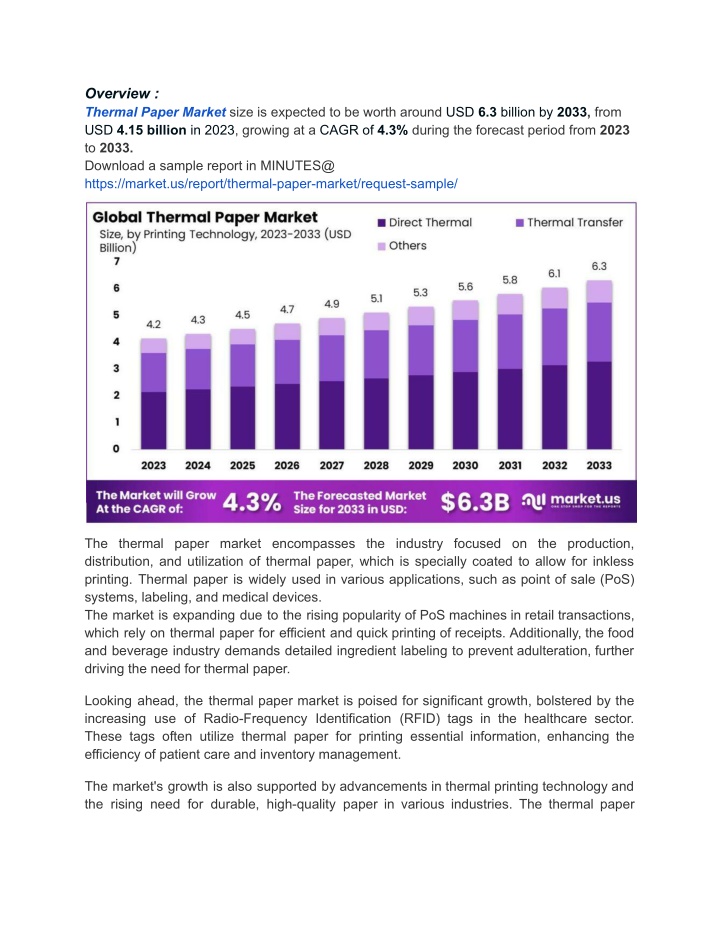

Overview : Thermal Paper Market size is expected to be worth around USD 6.3 billion by 2033, from USD 4.15 billion in 2023, growing at a CAGR of 4.3% during the forecast period from 2023 to 2033. Download a sample report in MINUTES@ https://market.us/report/thermal-paper-market/request-sample/ The thermal paper market encompasses the industry focused on the production, distribution, and utilization of thermal paper, which is specially coated to allow for inkless printing. Thermal paper is widely used in various applications, such as point of sale (PoS) systems, labeling, and medical devices. The market is expanding due to the rising popularity of PoS machines in retail transactions, which rely on thermal paper for efficient and quick printing of receipts. Additionally, the food and beverage industry demands detailed ingredient labeling to prevent adulteration, further driving the need for thermal paper. Looking ahead, the thermal paper market is poised for significant growth, bolstered by the increasing use of Radio-Frequency Identification (RFID) tags in the healthcare sector. These tags often utilize thermal paper for printing essential information, enhancing the efficiency of patient care and inventory management. The market's growth is also supported by advancements in thermal printing technology and the rising need for durable, high-quality paper in various industries. The thermal paper

market report provides a comprehensive overview of market size, growth factors, and key trends, highlighting its expanding role in modern commerce and industry. rk t gm nt : By Printing Technology: Direct Thermal Thermal Transfer Others By Width: 2.25 (57mm) 3.125 (80mm) Other Widths By Application: Lottery & Gaming Point of Sale (PoS) Tags & Labels Other Applications By Printing Technology: In 2023, thermal paper dominated the market with over a 51% share, driven by its extensive use in receipts and tickets. Direct Thermal printing led the sector, offering various widths for different applications. Thermal Transfer printing, while a smaller segment, provided durability for barcode labels and signage. Width Analysis: The thermal paper market is categorized by widths of 2.25 (57mm), 3.125 (80mm), and others. The 3.125 width paper is most in demand for POS terminals and lottery tickets, spurred by the rise of supermarkets and digital billing counters. The 2.25 width also holds a significant market share due to its use in ticketing, labeling, and card payment terminals. Application Analysis:

Point-of-Sale (PoS) applications led the market in 2023, accounting for 67% of global revenue due to the ease of printing and widespread use in public utilities and retail markets. The demand for PoS transactions is rising in emerging economies, although the adoption of electronic receipts may slow growth. rk t l r Oji Holdings Corp. Appvion Inc Koehler Group Mitsubishi Paper Mills Ltd. Hansol Paper Co. Ltd. Gold Huasheng Paper Co. Ltd. Henan Province JiangHe Paper Co. Ltd. Thermal Solutions International Inc. Iconex LLC Twin Rivers Paper Company Rotolificio Bergamasco Srl Jujo Thermal Ltd Drivers: The thermal paper market is driven by the expanding retail and Point-of-Sale (POS) sectors, where thermal paper is essential for receipt printing. The rise of e-commerce further boosts demand for thermal paper in shipping labels, packing slips, and invoices. Regulatory requirements for accurate record-keeping also drive market growth, while thermal printing's convenience and speed, requiring no ink or ribbons, enhance its appeal. Restraints: Environmental and health concerns regarding the chemicals used in thermal paper production, especially BPA, pose significant challenges. These chemicals make recycling difficult and raise health risks, impacting market growth. Additionally, the increasing shift to digital receipts reduces the demand for thermal paper. The costs of raw materials and concerns about chemical exposure further slow market expansion. Opportunities:

There is significant potential in developing eco-friendly thermal paper that avoids harmful chemicals, capturing the growing demand advancements can lead to higher-quality thermal paper with improved durability. Exploring new applications in healthcare and shipping, embracing sustainability trends, and expanding into developing markets with growing digital transactions can drive market growth. for safer alternatives. Technological Challenges: Thermal paper faces issues such as image fading due to heat, light, or moisture, making long-term record-keeping difficult. The presence of BPA raises health concerns, and the environmental impact of production and disposal poses challenges. The market also contends with the increasing adoption of digital receipts, fluctuating raw material costs, and the risk of counterfeiting.