Glycerol Market

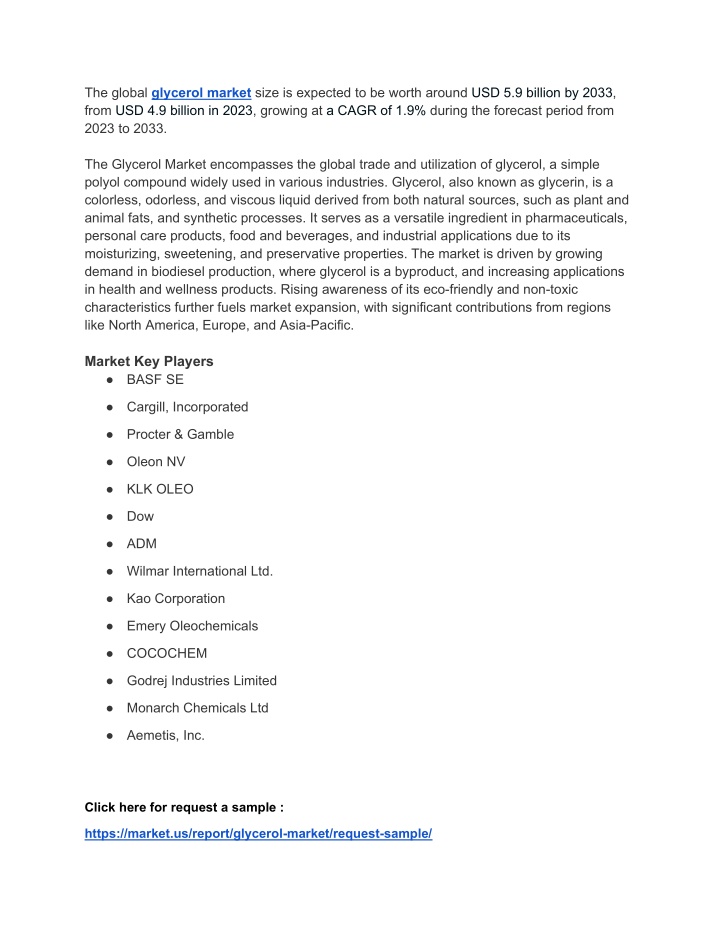

The global glycerol market size is expected to be worth around USD 5.9 billion by 2033, from USD 4.9 billion in 2023, growing at a CAGR of 1.9% during the forecast period from 2023 to 2033.n

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

The global glycerol market size is expected to be worth around USD 5.9 billion by 2033, from USD 4.9 billion in 2023, growing at a CAGR of 1.9% during the forecast period from 2023 to 2033. The Glycerol Market encompasses the global trade and utilization of glycerol, a simple polyol compound widely used in various industries. Glycerol, also known as glycerin, is a colorless, odorless, and viscous liquid derived from both natural sources, such as plant and animal fats, and synthetic processes. It serves as a versatile ingredient in pharmaceuticals, personal care products, food and beverages, and industrial applications due to its moisturizing, sweetening, and preservative properties. The market is driven by growing demand in biodiesel production, where glycerol is a byproduct, and increasing applications in health and wellness products. Rising awareness of its eco-friendly and non-toxic characteristics further fuels market expansion, with significant contributions from regions like North America, Europe, and Asia-Pacific. Market Key Players BASF SE Cargill, Incorporated Procter & Gamble Oleon NV KLK OLEO Dow ADM Wilmar International Ltd. Kao Corporation Emery Oleochemicals COCOCHEM Godrej Industries Limited Monarch Chemicals Ltd Aemetis, Inc. Click here for request a sample : https://market.us/report/glycerol-market/request-sample/

Type Analysis In 2023, the refined glycerol segment emerged as the most profitable, accounting for 78.0% of total revenue. Refined glycerin, a colorless and odorless liquid with a high boiling point, is favored for its moisturizing and emulsifying qualities, making it a valuable ingredient in personal and home-care products. This demand is expected to grow in the future. Conversely, the crude glycerol segment, though less popular due to its impurities and lack of fatty acids, is projected to see a 6.2% compound annual growth rate over the next five decades, driven by its applications in personal care products and nutraceuticals. Source Analysis In 2023, biodiesel held a dominant market position, capturing more than a 59.5% share, largely due to the rising demand for renewable energy sources and the global expansion of biodiesel production. This segment is expected to grow at 6.5% annually, as biodiesel, a byproduct of chemical and enzymatic processes in biodiesel and bioethanol production, is preferred for its low cost, biodegradability, and non-toxic characteristics. Additionally, the fatty alcohols segment, used in detergents, surfactants, industrial solvents, and various consumer products, is projected to experience the highest compound annual growth rate, driven by increased demand across several industries. End-Use Analysis In 2023, personal care and cosmetics dominated the glycerol market with a 34% share, primarily due to its widespread use in skincare, haircare, and cosmetic products for its moisturizing and emollient properties. This growth is attributed to rising personal care and pharmaceutical product demand, fueled by improved lifestyles and health awareness in emerging economies, particularly in Latin America and the Asia Pacific. Glycerol, valued for enhancing smoothness, lubrication, and acting as a humectant, is extensively used in

water-based personal care products, shaving creams, and lubricants. The pharmaceutical segment, benefiting from glycerol's healing and nutritional properties, is expected to see the highest growth, with applications in toothpaste, expectorants, and mouthwashes. Additionally, glycerol's versatility extends to food preservatives, explosives, perfumes, antifreeze, lubrication, and printing inks. Key Market Segments By Type Refined Crude By Source Biodiesel Fatty Acids Fatty Alcohols Soaps By End-use Food & Beverage Nutraceutical Pharmaceutical Industrial Personal Care & Cosmetics Other End-uses Drivers The increasing demand for biodiesel is a major driver of the glycerol market. As consumers and the transportation industry seek cleaner, renewable fuel sources,

glycerol's pivotal role in biodiesel production becomes crucial. This demand is further boosted by stringent environmental regulations targeting carbon emissions. Additionally, the personal care segment significantly contributes to market growth. Glycerol's versatility in personal care and cosmetics products, such as moisturizers, shampoos, and toothpaste, drives its demand. Its ability to moisturize and smoothen skin, along with its use in products like shaving creams and eye drops, fuels market expansion. These factors rising biodiesel demand and the surge in glycerol usage in personal care are primary drivers propelling the global glycerol market forward. Restraints Several factors restrain the glycerol market. Fluctuating supply and demand can lower prices and affect profits for producers. The costs of raw materials, such as vegetable oils used to make glycerol, can vary significantly, making production more expensive. Competition from alternative substances that may be cheaper or easier to use challenges glycerol's market position. Regulatory variations across regions add complexity and can slow market growth. Environmental concerns, despite glycerol being renewable, may impact its demand. Additionally, glycerol's limited use in some industries restricts its growth in those areas. Opportunity There are promising opportunities in the global glycerol market. In the pharmaceutical industry, glycerol's increasing utilization, including preventing substance precipitation and component extraction, presents new growth avenues. The industry's shift towards eco-friendly products, supported by government policies, boosts glycerol's demand. Glycerol's role in producing food for people with diabetes is also significant, offering a viable solution as a sweetener in specialized food products. Furthermore, increased biofuel production provides more avenues for glycerol utilization. These opportunities driven by pharmaceutical applications and

glycerol's role as a sweetener in specialized foodsare expected to propel market growth in the coming years. Challenges The glycerol market faces several challenges. Supply-demand swings can disrupt prices and profitability. Fluctuating costs of raw materials, such as vegetable oils, affect production expenses. Competition from alternative substances can diminish glycerol's market presence. Regulatory differences across regions complicate compliance and can slow market growth. Environmental concerns, despite glycerol's renewable nature, may impact demand. Moreover, glycerol's limited applicability in certain industries restricts its growth potential in those areas.