Checking Account Forms

Checking account forms and registers are essential tools for tracking transactions, reconciling balances, and managing your finances effectively. Learn how to use a check register, reconcile your bank statements, and record various transactions to keep your account in order.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

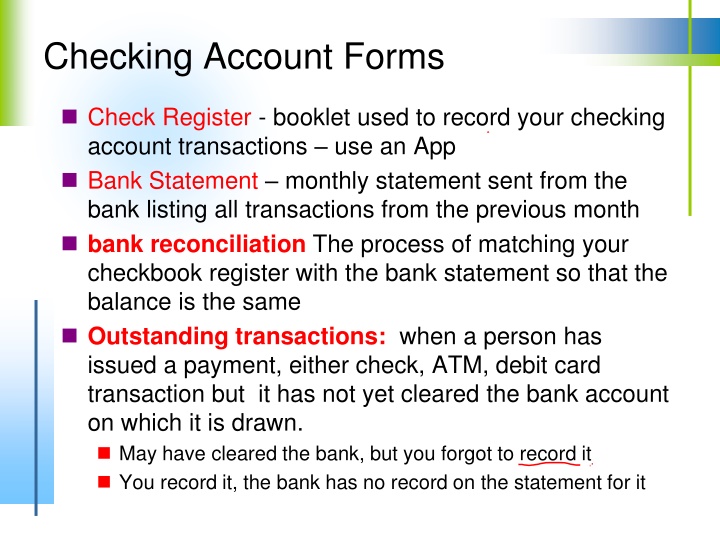

Checking Account Forms Check Register - booklet used to record your checking account transactions use an App Bank Statement monthly statement sent from the bank listing all transactions from the previous month bank reconciliation The process of matching your checkbook register with the bank statement so that the balance is the same Outstanding transactions: when a person has issued a payment, either check, ATM, debit card transaction but it has not yet cleared the bank account on which it is drawn. May have cleared the bank, but you forgot to record it You record it, the bank has no record on the statement for it

Check Register Check Register: Tracks all checks, online payments, fees, interest and deposits You can do this In a booklet, online, on an app, or in excel We use the paper version for class Enter Starting Balance or previous page balance in top right corner Check # Date Description Payment Fee Deposit/ Credit + Balance Forward

Check Register Enter Current Balance in top right corner Enter Transaction # (some still show Check #) 1001 = check payment check number DC = Debit card payment ETF or ON Online payment ATM or WD = Withdrawal of cash (ATM or at bank) DEP = Deposit SC Service Charges NSF Overdraft charge Column with is for reconciliation process when in the both your register and in back put a check here Trans Or Check # Date Description Payment Fee Deposit/ Credit + Balance Forward

10/1 Beginning Balance = 0 10/1 Initial Deposit of $200.00 to open account 10/1 Wrote Check 1001 to Sam s Club for groceries $72.00 10/2 Check 1002 was voided 10/5 On-line payment to US Bank Credit Card. $25.00 The White Lines = transaction info Gray Lines = purpose and the New balance 1001 = check # ATM ON WD DEP SC Check # Date Description Payment Fee Deposit/ Credit + Balance Forward

Start a new page 10/6 Automatic Deposit of your work paycheck for $350.00 10/7 Wrote check 1003 for $22 to Best Buy for movies 10/8 Stopped for gas at Holiday and used your Debit card to pay for your gas at $46.00 1001 = check # ATM ON WD DEP SC Check # Date Description Payment Fee Deposit/ Credit + Balance Forward

Additional Bank Payments On your Check register handout, input the following transactions: 10/20 Ate at Applebee s for $30.80 used your Debit card to pay it 10/25 Deposited $40 for some Playstation games you sold to your buddy 10/28 Withdrew $20.00 cash using your ATM card 10/29 Check 1004 paid your Verizon phone bill for $57.23

Check # Date Description Payment Fee Deposit/ Credit + Balance 0 Dep 10/1 Open Account 200 00 +200 00 Initial Deposit 200 00 1001 10/1 72 00 -72 00 Sam s Club Groceries 128 00 1002 10/2 Voided 0 00 -0 00 128 00 ON 10/5 US Bank 25 00 -25 00 Credit Card Pay. 103 00 Bank Statement Reconcile

Check # Date Description Payment Fee Deposit/ Credit + Balance 103.00 DEP 10/6 Deposit 350 00 +350 00 Paycheck 453 00 1003 10/7 Best Buy -22 00 -22 00 Movies 431 00 DC Pay 10/8 Holiday -46 00 -46 00 Gas 385 00 DC Pay 10/20 30 80 -30 80 Applebee s Dinner 354 20 WD 10/29 Cash Withdrawal 20 00 -20 00 Spending money 334 20 Reconcile Dep 10/29 Deposit 40 00 +40 00 Sale of Games 374 20 1004 10/29 Verizon 57 23 -57 23 Phone bill 316 97 Bank Statement

Bank Reconciliation Bank Statement: Mailed monthly Lists checks processed, withdrawals, deposits, interest and service charges The process of matching your checkbook register with the bank statement is known as bank reconciliation When completed, checkbook balance will equal reconciliation!!!! Reconciliation is done on the back of the statement Use the Bank Statement Work Together assignment

Bank Statement Your Name Gate City Bank For Month Ended October 31, 2010 10/1 10/4 10/5 10/6 10/9 10/8 10/20 10/28 Ending Balance as of October 31, 2010 Checks/WD 1001 72.00 ON 25.00 1003 ETF ETF SC Deposits 200.00 350.00 Balance 200.00 128.00 103.00 453.00 431.00 385.00 354.20 348.20 348.20 22.00 46.00 30.80 6.00 Use your Check register handout and do this example together! Page 1 Page 2 Reconcile

Reconciliation Your Check register balance = $316.97 Bank Statement Balance = $348.20 Why are they different? Reconciliation process will balance these statements

Reconciling Your Checking Account 1. Enter ending balance from bank statement Check for cleared items Check off on Balance & Register if in both places No check in register, not cleared bank No check on Statement, not in register Add deposits not on statement and Total lines 1 and 2. 4. List and spending made you did not check off as not shown on statement. 5. Total outstanding checks/debit transactions. 6. Subtract line 5 from line 3. (Result should match checkbook balance) Does it? Why not? 2. 3. Page 1 Page 2 Bank Statement

Assignment Complete items 4 6 on page 91 (forms on Activity 9.4 on page 96 of your Student Activity Guide) Get your On Your Own Personal Budgeting Simulation . Complete the following assignments on Page 14-32 Read 13, complete 2A 2B 2C 2D 2E 2F 2G

Chapter Other Bank Services

Types of Checking Accounts Joint accounts Special accounts Standard accounts Interest-bearing accounts Share accounts

Banking Services A full-service bank - a financial institution offering the public services traditionally expected of banking institutions including: Groups: What services do banks offer? Savings and checking accounts Safe deposit boxes, loans, and ATMs On-line banking and bill pay services Consumer credit such as mortgage financing, commercial lending and credit card services. Purchase CDs and Bonds Certified checks, cashier s checks, money orders, and debit cards.

Guaranteed-payment Checks Certified check is a personal check that the bank guarantees or certifies to be good Bank stamps your check as good and holds the money from your account Charge a small fee Used on large purchases i.e. a car from a private seller Cashier s check, also called a bank draft, is a check written by a bank on its own funds Guarantees payment usually a loan Traveler s checks are check forms in specific denominations used instead of cash while traveling

Money Orders Banks sell money orders - check to purchaser Used if you do not wish to use cash or do not have a checking account Like a check but can never bounce Banks charge for purchasing a money order Can purchase through the post office or local merchants

Debit Cards Plastic card that deducts money from a checking account almost immediately to pay for purchases Used instead of a check Amount of the purchase is deducted from your checking account and paid to the merchant

Bank Credit Cards A Visa or MasterCard Use it instead of cash at any business Banks usually charge both an annual fee for use of the card and interest on the unpaid account balance.

Overdraft Protection If you write a check for more than what is in your account = Overdraft or NSF: Bank charges $30 - $35 overdraft fee for every check written Entered as NSF in your account In 2009, how much was collected in overdraft fees? New law in 2010 will prevent use of ATM card Must select this option If you have $2.00 in account and write a check for $3.00 Overdraft protection Your checks are covered even if you have insufficient funds A fee is normally charged for this service - $20 for the year Check the bank for your options $38.5 B

Automated Teller Machines ATM = Automated Teller Machine To use ATMs, you must Have a card that is electronically coded Know your personal identification number (PIN) ATM transactions include: Use debit card to withdraw cash from your accounts Use debit card to check your account balance Use a Visa/MasterCard to receive cash

Online and Telephone Banking Ability to access your accounts from a computer or telephone anytime, day or night Services include: Transferring money from one account to another Paying bills by authorizing the bank to disburse money Getting account balances Check if checks or deposits have cleared Ability to electronically transfer money An electronic funds transfer (EFT) uses a computer-based system to move money from one account to another

Other Services: Stop Payment A request that the bank not honor a specific check Reason = check has been lost or stolen Banks charge a fee for stopping payment on a check Safe Deposit Store valuable items or documents Yearly fee based on the size of the box Keeping important documents and other items in a safe deposit box ensures that the items won t be stolen, lost, or destroyed. Examples: Birth, marriage, and death certificates Deeds and mortgage papers Stocks and bonds Jewelry or Coin collections

Other Services (continued) Loans Banks offer loans to finance the purchase of cars, homes, home improvements, vacations, and other items Trusts Provide advice for estate planning and trusts Banks can act as trustees of estates for minors and others A trustee is a person or an institution that manages property for the benefit of someone else under a special agreement.

Other Services (continued) Notary Public Verifies a person s identity, witnesses the person s signature on a legal document, and verifies the signature as valid. Financial institutions typically have a person on their staff who is a notary public. This person provides notary services for account holders, usually without charge. For noncustomers, however, there is typically a small fee. Financial Services Purchasing or selling savings bonds Investment brokerage services

Bank Fees Bank charges help cover bank s operating costs To avoid fees, choose the right kind of account Shop around and find the account that is right for you Be aware of the rules of your account

Finance Minutes Write a short paragraph listing why banks charge fees. Include in your paragraph a few things that banks charge fees for and how much these fees are if you know them.

Examples of Bank Fees Loan fees Trustee fees Check cashing fees Per-check fees Monthly service fees Overdraft fees NSF check charges ATM transaction fees Safe deposit box fees Teller service fees Minimum balance fees Fees for guaranteed- payment checks Notary service fees Online bill payment fees Fees to return canceled checks

Assignment: Chapter 9, Lesson 9.2 Complete the Bank Services Worksheet

Group Assignment: Choose a Bank Based on what you have learned: What should you consider when choosing a bank? Student Ideas: Pick the top 5 items, with most important first

Group Assignment: Choose a Bank Offers the most services to meet your needs Has the best interest rates Has the lowest fees for its services Offers free checking services Has FDIC Insurance Federal Deposit Insurance Corporation Protects customers against loss up to $250,000 per account.

Assignment: In your textbook: Complete the following items under Apply your Knowledge in the textbook: #3 and #4 - hand in the worksheets #6 on handout from instructor In the Student Activity Guide: Activity 9.5 on page 96 Page 87 & 88 - Study Guide