CER SME Gas Market Survey Results 2014 in Ireland

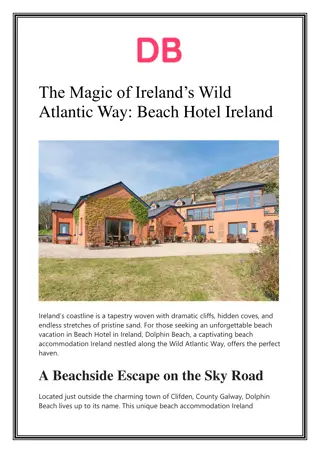

Conducted in March 2014, the survey delves into the Gas Market for SMEs in Ireland, covering insights from 400 electricity and 250 gas interviews. The respondents, mainly decision-makers in gas supply-related issues, represent a broad spectrum of SMEs. The data collection methodology involved Computer Assisted Telephone Interviewing (CATI), ensuring a 20-minute survey length. Key findings like respondent profiles, market spread, and roles involved in gas-related decisions are highlighted.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

You are allowed to download the files provided on this website for personal or commercial use, subject to the condition that they are used lawfully. All files are the property of their respective owners.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author.

E N D

Presentation Transcript

CER SME Gas Market Survey Results 2014 Prepared for: Prepared by: & April 2014

Background Electricity and Gas SME surveys conducted during March 2014 Total of 400 electricity and 250 gas interviews completed Margin of error on a sample size of 400 is 5% and 6% on a sample of 250. For smaller subsamples the margin will be greater. Survey data collection methodology was Computer Assisted Telephone Interviewing (CATI) Survey length of approximately 20 minutes Respondents were decision makers for electricity or gas supply related issues within the organisation Included both private sector and public sector, government organisations and sole traders The final respondent set comprises a broadly representative of the SME sector organisations with fewer than 250 employees in Ireland Sample was quota controlled on number of employees and region. A spread across sector NACE code was also ensured. 2

Respondent & Market Profile

Respondent profile (Base: All Gas SMEs - 250) Number of employees NACE Agriculture, forestry and fishing 2012 1% 2013 2% 2014 - 49% 50% Industry Mining and quarrying Manufacturing 2012 6% 5% 6% 2013 Construction 6% 6% 3% 39% 2014 Wholesale and retail trade; repair of motor vehicles and motorcycles 18% 14% 11% Business and Professional Services 19% 14% 25% Public administration and defence; social security, Education Human health and social work activities 26% 29% 16% 20% 16% 18% Other Transportation and storage 2% 2% 2% 16% 14% 12% 13% 12% Accommodation and food service activities Leisure hotels Arts, entertainment and recreation 9% 9% 8% 13% 19% 8% 8% Other service activities 7% 24% 6% Activities of extraterritorial organisations and bodies 4% 5% - 0-5 6-10 11-50 51-100 101-250 Charity - - 8% Population of respondents is spread across different business sizes in the SME gas market There is a higher representation of the <5 employee category compared with previous measurement 4

Respondent profile (Base: All Gas SMEs - 250) RespondentOther/ Role of Respondent Nobody shared 2013 2014 2013 2014 2013 2014 Paying the bill 86% 78% 13% 23% 1% - 18% 18% 17% 17% 16% Monitoring the level of usage 15% 82% 86% 13% 8% 4% 7% 13% 12% 11% 11% 9% 10% 10% 10% 8% Reducing the size of the bill 85% 88% 12% 12% 3% 3% 4% Deciding on the tariff that suits your organisation 80% 80% 19% 20% 1% 5% Accountant Other manager/director Managing director Administrator Maintenance manager Office Manager Operations manager Financial Making changes to your account 83% 86% 16% 17% 1% 2% Billing details, payment methods etc 88% 78% 12% 24% 0% 1% Deciding on which energy supplier will be used 2013 2014 79% 86% 20% 22% 1% 1% Respondents sought for survey were those responsible for gas supply related issues responsibility is dispersed across many different roles within SME organisations The highest role proportion is the managing director/finance director role 5

Expenditure on gas (Base: All Gas SMEs - 250) Expenditure on gas (% of non-wage costs) Annual expenditure on gas ( ) 2012 2013 2014 2012 2013 2014 70% 34% 32% 31% 57% 54% 23% 22% 21% 19% 19% 19% 17% 17% 30% 14% 12% 12% 18% 16% 8% 12% 12% 10% 8% 7% 4% 1%-5% 6%-9% 10%-14% >14% <1,500 <2,500 <5,000 <10,000 10,000+ Excluding don t knows Average expenditure on gas as a percentage of non-wage costs was 6.3% (2013:7%) 47% of respondents provided an answer to this question reflecting a combination of sensitivity and knowledge Average annual expenditure was 49,956 (2013: 47,224) This included a small number of large consumptions 81% of respondents provided an answer to this question 6

Energy management: Cost and Usage Reviews (Base: All Gas SMEs - 250) Frequency of gas costand usage reviews Cost Usage 2012 2013 2014 2012 2013 2014 Annually 63% 68% 57% 53% 63% 37% Every three months 10% 10% 4% 11% 10% 8% Every two months 4% 5% 8% 5% 5% 7% Monthly 9% 6% 8% 10% 6% 15% Don't know 5% 4% 1% 6% 5% 3% Never 9% 8% 11% 15% 10% 19% Other 10% 12% Business most commonly review both cost and usage annually There has been a continued decline in the proportion stating they review usage annually, with minor increases in more frequent reviews A total of 19% of SMEs never review usage, while 11% claim to never review cost 7

Market share: SME gas suppliers (Base: All Gas SMEs - 250) Market Share of each supplier based on CER data Satisfaction with service by Supplier in supporting the business 1% 2% 3% 1% 7% 19% 16% 38% Very Dissatisfied Electric Ireland 43% BGE Dissatisfied 25% Airtricity Neither Satisfied nor Dissatisfied Satisfied Flogas Energia 41% Vayu 7% Very Satisfied 8 Don't know Proportions weighted to be representative by market share Satisfaction with service by Supplier is high at 79% 8

Satisfaction with SME gas suppliers (Base: All Gas SMEs - 250) Satisfaction with service by Supplier 2012 2013 2014 100% 94% 90% 88% 85% 84% 84% 82% 80% 80% 73% 77% 75% 9 Bord Gais Airtricity* FloGas Electric Ireland* Energia* Unweighted Base Size: (93) (28) (61) (18) (29) * Small sample size Satisfaction with service by Supplier has declined marginally compared with previous measurements * Caution small base 9

Bill Delivery and Frequency (Base: All Gas SMEs - 250) Bill delivery channel by Supplier Bill delivery channel 27% 85% 0% 6% 84% 9% 82% 8% 2% 16% 17% 19% 27% 98% 86% 81% 80% 19% 70% 13% 12% 6% 3% 2% 2012 2013 2014 Bord Gais Airtricity* FloGas Electric Ireland* Energia* Post Email Website Post Email Website Bill Frequency Majority of SME s receive their bill by post with evidence of a continued increase in the website channel 2012 2013 2014 Monthly 56% 69% 47% Two Monthly 37% 28% 50% Lower reporting of monthly bill frequency, with increases in the reporting of a two month bill frequency Quarterly 5% 3% 1% Other 2% 0% 3% * Caution small base 10

Payment Record and Arrears (Base: All Gas SMEs - 250) Stated bill payment record Stated bill payment record by Supplier Bord Gais Airtricity* FloGas Electric Energia* 0% 2% 0% 1% 2% 3% Ireland* Paid on time and in full 93% 94% 97% 100% 95% 98% 99% 94% Sometimes in arrears, but not currently 2% 3% 2% - 5% Currently in arrears 4% 3% 2% - - 2012 2013 2014 Currently in arrears Sometimes in arrears, but not currently Paid on time/in full Refused 1% - - - - 94% of SMEs claim to pay on time and in full, a decrease on previous measurements This continued high rate may reflect a broad interpretation of what constitutes arrears and perhaps some reluctance to disclose such sensitive information * Caution small base 11

Competition & Deregulation

Perceptions of price change over time (Base: All Gas SMEs - 250) Has the price charged by your supplier changed in the last year? 12% 29% 37% 45% 56% 60% 48% 24% 10% Increased 30% 7% Decreased Same 12% 6% Don t know 42% 32% 37% 22% 22% 10% 15% 12% 12% 12% 9% Increased Decreased Same Don't Know Bord Gais Airtricity* FloGas Electric Ireland* Energia* Just under half the SME respondents perceive that there has been an increase in the price charged by their supplier in the past 12 months This is most noteworthy in the case of Bord Gais Energy, where 60% held that perception * Caution small base 13

Impact of gas cost on business and competition (Base: All Gas SMEs - 250) Agree with statement 2012 2013 2014 The cost of gas is a significant business challenge for my business 56% 57% 50% The cost of gas puts my business at a competitive disadvantage to businesses based in other EU countries. 32% 33% 21% The response is not characterised by an excessive concern with the impact of the cost of gas on EU level competitive activity, with 79% either neutral or disagreeing that their business is put at a competitive disadvantage due to the cost. 14

Awareness of competitors (Base: All Gas SMEs - 250) Unprompted awareness of Natural Gas Suppliers 15 Supplier Named - Unprompted 87% 2012 2013 2014 79% 85% 87% Bord Gais (etc) 34% 54% 48% Airtricity 48% 46% 45% 33% 39% 37% 37% Flogas 30% 34% 46% Energia 6% 23% 35% 45% Electric Ireland 6% 5% 6% Vayu Bord Gais Airtricity Flogas Energia Electric Ireland Vayu Unprompted awareness reflects top of mind presence in the consumer mind and provides a good estimate of perception of competitive activity in a market 87% mentioned Bord G is (or related name) 48% mentioned Airtricity in 2014, down from 54% in 2013. Mention of Electric Ireland increased to 45% from 35% in 2013 15

Satisfaction with Aspects of Competition (Base: All Gas SMEs - 250) Range of Offers Level of Competition 40% 16 43% 38% 29% 28% 27% 23% 27% 25% 2013 2013 14% 2014 16% 11% 2014 11% 11% 8% 6% 7% 5% 6% 4% V.satisfied Satisfied Neither Dissatisfied V dissatisfied V.satisfied Satisfied Neither Dissatisfied V dissatisfied Quality of Competition 39% 37% 25% 25% 2013 22% 18% 2014 8% 7% 5% 4% V.satisfied Satisfied Neither Dissatisfied V dissatisfied Notable decline across all metrics of competition, in particular Satisfaction with Range of Offers. The drop in satisfaction scores indicates consumers disengagement with competition as neither /nor scores have increased vs. 2013. Relatively low levels of Satisfaction with Competition articulated by SME sector 16

Awareness that prices are not regulated (Base: All Gas SMEs - 250) Q: Are you aware gas prices charged by suppliers are not regulated which means that suppliers can set their prices at whatever level they choose? Aware of non regulation of price, by Supplier Aware of non regulation of price 2012 2013 2014 45% Aware 32% 36% 24% 58% 60% 63% 68% 17% 21% Somewhat Aware 6% 6% 15% 12% 17% 9% 38% 25% 24% 23% 21% Not Aware 62% 58% 61% Bord Gais Airtricity* FloGas Electric Ireland* Energia* Aware Somewhat Aware Not Aware There is a comparatively low level of market knowledge amongst the SME respondents, with 61% not aware that prices are no longer regulated There is very little variation by supplier for this measure * Caution small base 17

Improvement and Dis-improvement since Deregulation (Base: All Gas SMEs - 250) Level of innovation in services provided by suppliers Cost of Gas Level of service provided by suppliers 2012 2013 2014 2012 2013 2014 2012 2013 2014 25% 30% 27% 28% 28% 34% 19% 20% 20% Improved Improved Improved 34% 22% 19% 10% 12% 8% 10% 15% 19% Dis-improved Dis-improved Dis-improved Responsiveness of suppliers to business needs Range of options available by suppliers to business customers Ability of businesses to select supplier that best meets their needs 2012 2013 2014 2012 2013 2014 2012 2013 2014 28% 22% 20% 24% 29% 44% Improved Improved 26% 25% 18% Improved 10% 15% 16% 7% 12% 14% Dis-improved Dis-improved 12% 13% 23% Dis-improved 18

Contact by Suppliers (Base: All Gas SMEs - 250) Contacted by other supplier with a view to switching in the past 12 months Contact Channel 2012 2013 2014 Phone 23% 28% 26% 41% Mail 7% 6% 9% 59% Yes Business visit 15% 11% 23% 2013- Yes: 35% No: 65% No On average, SME respondents recall higher levels of contact from competitors to their gas supplier, with increased in the level of both mail and business visit contact 19

Awareness and understanding of offers available (Base: All Gas SMEs - 250) Q: Thinking about the different offers available from gas suppliers, please rate your understanding of the offers available.? Level of understanding of offers x supplier Level of understanding of other offers 2012 2013 2014 16% 26% 29% 38% 46% 36% 18% 25% 13% No/Small Understanding 24% 48% 43% 26% 20% 27% 18% 16% Some understanding 33% 14% 12% 15% 29% 15% 13% 10% 8% 28% 37% 34% Mostly/Fully understand Bord Gais Airtricity* FloGas Electric Ireland* Some understanding Not aware Energia* 26% 20% 37% Not aware of the offers available No/small understanding Mostly/full understanding There is an increase in the proportion of respondents indicating that they are not aware of other offers, of which SME s might avail There has been no change in the level of understanding of those in the Some/Mostly/Full categories * Caution small base 20

Awareness and understanding of offers available (Base: All Gas SMEs - 250) Ease of comparison of other offers Ease of comparison of other offers 30% 29% 24% 13% 9% 36% 18% 2012 2013 2014 The comparatively low level of market understanding is confirmed in the high proportion of SME s (over 1/3) who report that they have not compares offers 14% 10% Very difficult Neither easy nor difficult Very easy Difficult Easy No comparison attempted The ease of comparison of offers has decreased by 6% since 2013 21 21

Gas Switching experience level of switching (Base: All Gas SMEs - 250) How many times have you ever switched gas suppliers? How many times have you switched gas suppliers by supplier? 27% 36% 7% 8% 28% 33% 15% 49% 51% 35% 27% 29% 19% 71% 24% 30% 15% 14% 14% 14% 9% 9% 19% Bord Gais Airtricity* FloGas Electric Ireland* Energia* 18% Never Once Twice More than twice Never Once Twice More than twice The reported rate of switching, within the past 12 months, has increased form 16% in 2013 to 22% in 2014. While the total amount of SMEs who have ever switched gas supplier is now at 64%. The proportion of SME s who indicate that they have never switched has decreased to 36% from 46% in 2013 - just over 70% of Bord Gais s SME respondents report that they have never switched supplier. Amongst the switchers, 34% have switched once or more than once on the last 12 months (84% of these switched more than 3 months ago) and 18% reported that they had switched back to a previous supplier. * Caution small base 23 23

Switching experience level of switching for gas Base: All who switched supplier in past 12 months - 59 Among switchers, which supplier did you consider switching to? Current Customers of: Among switchers, considered switching to: Electric Ireland* Bord Gais* Airtricity* Flogas* Energia* No other supplier considered Electric Ireland 24% 21% 19% 39% 16% 7% 27% 21% 41% 15% 72% 24% Bord Gais 43% 21% 33% 33% 56% 67% Airtricity 34% - 47% 30% 45% 42% Energia 37% 48% 57% 21% 29% 49% Vayu 9% - 33% 10% 12% - *Small base size In general SME s that report having switched tend to look at a number of other suppliers, with Flogas exhibiting a slightly different pattern in 24 24

Gas - Switching Package/option with existing supplier For Non switchers - Changed the package with existing supplier e.g. for a better discount (Base: Did not switch last 12 months 191) 14% 86% Yes No Among non switchers, 14% reported changing package to avail of discounts related to direct debit or online billing 25 * Caution small base

Gas - Changing Payment channel and Bill frequency with existing supplier (Base: All Gas SME 250) Q: Have you changed the payment channel or frequency of payment in the past 12 months 3% (* Question reworded during fieldwork) 97% Yes No Comparatively low levels of engagement in the areas of changing bill frequency and payment channel, but similar to previous years 26

Switching experience level of switching among SME gas customers with Electricity (Base: All Gas SME 250) How many times have you switched Electricity suppliers by supplier? How many times have you switched Electricity suppliers? 28% 28% 12% 30% 32% 9% 39% 47% 29% 22% 35% 25% 18% 39% 50% 26% 19% 24% 16% 12% 10% 8% 18% 26% Bord Gais Airtricity* Flogas Electric Ireland* Energia* Never The level of switching for an alternative supplier of electricity among SME gas customers, is comparatively high with 46% indicating they had switched at least twice Once Twice More than twice Never Once Twice > Twice Of these, 34% switched in the past 12 months Of those SME s who did not switch, 37% considered switching to an alternative electricity supplier 27 27

Gas Switching consideration (Base: All non-Gas switchers 191) Switching consideration by supplier? Switching consideration: 47% 2013 2014 57% 46% 38% 23% 39% 35% 31% 16% 54% 43% 42% 39% 23% Bord Gais Airtricity* FloGas Electric Ireland* Energia* Considered switching Contacted alternative supplier Considered switching Contacted alternative supplier Increase noted in both the category of SME s who considered switching and of those, the proportion who contacted an alternative supplier 28 * Caution small base

Gas Switching Dual Fuel vs Non Dual Fuel How many times have you switched gas suppliers? 21% 42% 19% 19% 17% 18% 41% 23% All Dual Fuel (Base: 68) Non Dual Fuel (Base: 182) Never Once Twice > Twice Those on dual fuel are more likely to have switched gas suppliers, with 2 in 5 dual fuel customers switching gas suppliers more than twice. 29

Gas Reasons for switching, amongst switchers Base: All switched supplier in past 12 months 49* Not Important Important Top 5 reasons 2013 2014 2013 2014 To achieve a reduction in the total cost of electricity 68% 92% 12% 4% The previous supplier had recently announced a price rise 40% 51% 44% 35% My business bill increased in size because my previous supplier had increased prices 36% 50% 48% 37% To avail of a combined offer for electricity and natural gas 24% 38% 48% 49% The new supplier offered greater assistance on energy reduction initiatives 37% 37% 48% 46% Among SME s using natural gas, the Top 5 considerations for switching focus on the quest for a reduction in cost 30 * Caution small base

Gas Reasons for switching, amongst switchers Base: All switched supplier in past 12 months 49* Not Important Important 2013 2014 2013 2014 The new supplier offered a more flexible tariff structure 40% 36% 40% 37% I expected the customer service from the new supplier would be better My business was not satisfied with the service provided by our former supplier I was unhappy with the service I have received from my former supplier 20% 34% 52% 51% 24% 27% 52% 65% 24% 20% 48% 69% To get more information on electricity usage 16% 15% 56% 59% I preferred the online billing option from my new supplier 28% 14% 48% 69% Additional considerations for switching include increases in the relevance of meeting service expectations 31 * Caution small base

Gas Reasons for switching back to old supplier, amongst switchers Base: All switched back to previous supplier 10* Not Top 6 reasons: Important Important To achieve a reduction in the total cost of electricity 94% 0% The business expected to get more savings by returning to my original supplier 94% 0% To avail of a combined offer for electricity and natural gas 62% 24% The price the business received from my new supplier was not as good as I had expected My business bill increased in size because my previous supplier had increased prices 43% 43% 29% 64% The previous supplier had announced a price rise 35% 59% Top 6 reasons for returning to the original supplier all relate to price considerations 32 * Caution small base

Gas Reasons for switching back to old supplier, amongst switchers Base: All switched back to previous supplier 10* Not Other Reasons cited The business was not satisfied with the service provided by our new supplier Important Important 24% 57% The service from the new supplier was not as good as the service received from my original supplier 16% 65% I preferred the online billing option from my original supplier 13% 87% The business s original supplier offered greater assistance on energy reduction initiatives 10% 62% The original supplier offered a more flexible tariff structure 10% 62% I did not find the bill of my new supplier understandable 0% 85% I did not like the frequency with which I received a bill 0% 94% Top amongst non price considerations in the decision to return to the original supplier is service falling short of expectations 33 * Caution small base

Understanding of Discount agreement (Base: All switched last 12 months 59) Q: Are Howlong does the discount offered when you switched last for? Price Guarantee Period NO restrictions on future switching? 34% 30% 37% 11% 21% 2% 28% 6% 3% 0% 8% 7% 68% 37% 58% 2% 2012 2013 2014 2% 2% 0% 22% 2012 2013 2014 0% Period of restriction 0% 0% 6% 0% 10% 7% 2012 2013 2014 6 months 0% 8% 3% 1 year 93% 75% 88% No guarantee 6 months 1 year < 2 years 3 months 9 months 2 years Don t know 2+ years 7% 8% 7% Don t know 0% 8% 2% 34 * Caution small base

Gas Non Switchers reasons for not switching Base: All non switchers - 191 Not Important Important Top 7 reasons 2012 2013 2014 2014 We are satisfied with the service that we receive from our current supplier We do not believe that the level of discount is sufficient to justify switching 57% 56% 58% 18% 26% 34% 46% 23% Other priorities have meant that this has not been considered 36% 45% 41% 38% We do not believe that the prices will stay as low as the alternative suppliers claim We do not believe that the prices will be as low as the alternative suppliers claim 28% 36% 38% 35% 25% 34% 34% 40% We are concerned about whether the alternative supplier will be as responsive if there is a leak - 26% 25% 53% We are concerned about whether the alternative supplier will provide a reliable supply of gas 23% 33% 25% 60% The top scoring considerations for not switching focus on their assessment of the alternative options and offers 35

Gas Non Switchers reasons for not switching Base: All non switchers - 191 Other reasons Not Important Important 2012 2013 2014 2014 We are concerned that the alternative suppliers may not stay in the electricity market for long We are not able to switch because of the contract with our current supplier 26% 19% 56% 13% 13% 75% The offers from the other suppliers are too complex 23% 13% 57% We would be charged a penalty and the saving to be made with a new supplier would not cover this penalty 10% 76% We would have had to pay a large deposit 9% 81% We do not believe that we are able to switch because of arrears on the business account 11% 8% 86% We do not want a new supplier to ask about our current supplier if there were arrears on the business account 10% 6% 87% It is not possible for my business to switch due to outstanding arrears on our business gas account 23% 1% 92% 36

Experience of switching process Base: All switched last 12 months - 59 Rating the overall experience of switching by Supplier 37 72% 79% 79% 79% 85% 16% 16% 28% 6% 21% 0% 9% 5% 8% 0% 0% 0% 0% 0% 0% Bord Gais Airtricity* Flogas Electric Ireland* Energia* Very difficult Difficult Neither Easy Very easy The overall rating of the experience of switching increased from 78% in 2013 to 95% stating that it was easy or very easy the process of switching is not a barrier to switching Of those who switched, 3% indicated that they were required to pay a deposit 37 * Caution small base

Impact of switching process Base: All switched and received a bill - 56 Rating the overall experience of switching 2012 2013 2014 Agree Disagree Agree Disagree Agree Disagree My business bill was reduced by the amount I expected 63% 11% 71% 9% 62% 5% The service from my new supplier was satisfactory We understood the terms and conditions of the offer the business had signed up for 79% 0% 80% 3% 85% 2% 84% 3% 89% 5% 85% 2% The impact of the switching process is as expected for the SME s who switched, with the exception of price where under 62% agreed that it reduced by the amount they expected 38 38

Impact of switching process (Base: All changed package 30/Changed supplier & received a bill 56) Changed Package - Agree Changed Package - Disagree My business' bill was reduced by the amount I expected 57% 15% We understood the terms and conditions of the offer the business had signed up for 67% 11% We have complied with the terms and conditions (for instance online billing or payment by direct debit) 80% 5% SME s who have changed supplier seem to have greater understanding of the terms and conditions compared with those who remained with their existing supplier, but changed package 39 39

Dual Fuel Factor in the decision not to have a single supplier for dual fuel (Base: All non-dual fuel 182) Factor in the decision to change to a single supplier for dual fuel (Base: All dual fuel 68) Not at all a benefit Not at all a benefit Benefit Benefit The savings are greater if your business uses two different suppliers Satisfied with the service provided by our current supplier for each and see no reason to switch You do not trust a single supplier to provide both electricity and gas The greater reduction in electricity prices offered when your business also used the same supplier for gas The greater reduction in gas prices offered when you also used the same supplier for electricity 32% 44% 62% 16% 55% 23% 62% 17% 14% 72% The greater saving overall 70% 10% Do not want to receive a single bill for both gas and electricity 19% 68% The convenience of having a single supplier for both 59% 24% You are concerned about what would happen if your business fell behind on payments for either 17% 72% Aspects of the service provided by your supplier - for both electricity and gas 44% 26% Have not got around to switching to a single supplier 19% 62% Saving and convenience considerations are the more frequently cited benefits for switching to a single supplier for gas and electricity 41

Billing & Payment

Bill Understanding and impact (Base: All gas SME 250) Understand the calculation of the bill Makes it easy to understand the gas charged for 79% 100% 76% 100% 75% 67% 67% 69% 68% 67% 63% 59% 80% 80% 60% 60% 40% 40% 20% 20% 0% 0% Change vs 2013 Change vs 2013 (-11%) (=%) (-25%) (+5%) (+1%) (-12%) (+11%) (-13%) (-17%) (-6%) Bill is easy to understand Bill makes it easy to understand the gas used 100% 100% 72% 72% 69% 68% 67% 67% 65% 62% 80% 80% 58% 55% 60% 60% 40% 40% 20% 20% 0% 0% Change vs 2013 Change vs 2013 (-14%) (-6%) (-18%) (-2%) (-13%) (-14%) (-3%) (-23%) (-6%) (-7%) 43 * Caution small base

Bill Frequency (Base: All gas SME 250) My business would prefer to receive bills more frequently Business would prefer to receive bills more frequently by Supplier? 9% 8% 48% 12% 69% 73% 78% 90% 56% 19% 15% 13% 10% 9% 33% 17% 17% 4% 13% 6% Bord Gais Airtricity* FloGas Electric Ireland* Energia* Strongly disagree Disagree Neutral Agree Strongly agree Agree Neutral Disagree 44 * Caution small base

Experience and knowledge of Complaint process Proportion of respondents who complained over last year (Base: All gas SMEs 250) Complaint topic (Base: All who made a complaint 15*) 2014 5% Billing and payment 81% 3% Reliability of supply/power failures/supply issues 16% 2% Other 2% 2012 2013 2014 5% of SME respondents reported that they had complained within the last 12 months The most common category of complaint is in relation to billing and payment (81%) Networks related issues such as reliability of supply followed at 16% 46 * Caution small base

Experience and knowledge of Complaint process Aware that you can complain to CER? (Base: All gas SMEs 250) Complaint made to (Base: All who made a complaint 15*) 2013 2014 Your current or previous supplier 63% 59% 36% 50% 16% ESB Networks The Commission for Energy Regulation 0% 0% 64% 0% 25% Other 2013- Yes: 66% 2012- Yes: 66% 0% 0% Don't know Yes No 3 in 5 of the respondents complained to Suppliers in the first instance, followed by Networks. Data are based on very small samples and are therefore exhibiting large changes over time 47 * Caution small base

Satisfaction with complaint handling (Base: All who made a complaint 15*) Satisfaction with COMPLAINT OUTCOME Satisfaction with COMPLAINT HANDLING 15% 20% 30% 30% 19% Very Dissatisfied 19% Very Dissatisfied 0% Dissatisfied 0% Dissatisfied Neither Satisfied nor Dissatisfied Satisfied 16% 20% 16% Neither Satisfied nor Dissatisfied Satisfied 16% Very Satisfied Don't know Very Satisfied 2014 Satisfaction with problem handling is based on small samples and data should be used as directional 48 * Caution small base