ALBANIA

This content focuses on the Remittances and Payments Program (RPP) for enhancing financial inclusion in Albania from a payments perspective, highlighting the importance of accessible financial services and transfer mechanisms. It explores measures aimed at facilitating financial transactions and promoting economic participation through efficient payment systems.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

ALBANIA Remittances and Payments Program (RPP) Financial Inclusion in Albania A Payments Perspective

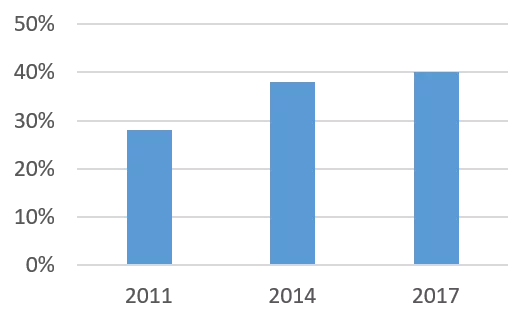

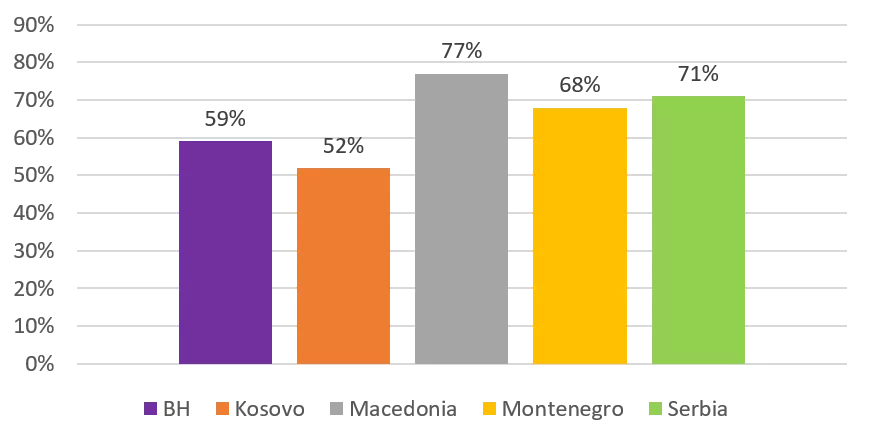

IN ALBANIA, 40% OF THE ADULT POPULATION HAS AN ACCOUNT AT A REGULATED FINANCIAL INSTITUTION (FINDEX 2017), UP FROM 37% IN 2014 ACCOUNT PENETRATION IN ALBANIA (2011, 2014, 2017) 50% 40% 30% 20% 10% 0% 2011 2014 2017 ACCOUNT PENETRATION IN THE WESTERN BALKANS ( 2017) 90% 77% 80% 71% 68% 70% 59% 60% 52% 50% 40% 30% 20% 10% 0% BH Kosovo Macedonia Montenegro Serbia 2

AND USAGE OF EXISTING ACCOUNTS TO PAY ELECTRONICALLY IS EXTREMELY LOW NUMBER OF NON-CASH PAYMENTS PER CAPITA IN THE WESTERN BALKANS (2016) SELECTED COUNTRIES 70.0 62.1 60.0 50.0 40.0 26.4 30.0 20.0 10.0 5.4 4.3 0.0 Albania Kosovo Montenegro Serbia 3

The World Bank analyzed the situation and prepared the report Financial Inclusion in Albania a Payments Perspective , covering the following aspects: 4 4

The recommendations and conclusions of that report were then systematized in the Albanian Retail Payments Strategy 2018-2023, as follows: Vision Guiding Principles per Timeframe, roles and responsibilities foundation and catalytic pillar Specific actions 5

To promote the intensive use of modern (i.e. fully electronic) retail payment instruments across the whole country, with the goal of achieving 10 cashless payments per capita by year 2023. Supporting objectives of the NRPS Albania will aim at achieving an adult account ownership ratio of 70% by 2023, similar to the level already achieved by middle-income countries as a whole. Implementing the NRPS aims not only at increasing levels of ownership and usage of accounts, but also at improving the quality of payment services to customers. 6

Thank You! Thank You! Jose Antonio Garcia jgarciagarcialun@worldbank.org Ceu Pereira ceupereira@worldbank.org

undefined

undefined