Challenges and Strategies for Walt Disney in Overcoming Market Disruptions

Walt Disney is encountering key challenges such as post-merger integration, cannibalization threat, and disruption from over-the-top (OTT) services. The presentation discusses strategies focusing on organizational assets, customer acquisition, experience, online-offline strategy, and integration to tackle these challenges. Internal analysis reveals strengths like a strong reputation and brand, M&A experience, and multiple revenue streams, but weaknesses include a lack of technology focus in new media. Overall, the recommendations aim to help Walt Disney stay competitive in the evolving media landscape.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

IF YOU WANT TO GO WHERE YOU NEED TO BE

YOU CANNOT STAY THE WAY YOU ARE

Nanyang Consulting N WALT DISNEY Blowing Up The Castle? Presented to: Robert A. Iger, Chairman and CEO at The Walt Disney Company Presented by: Daniela, Minghao, Victor, Vishnu 11 January 2019

Agenda Agenda Page 4 1 Problem 2 Recommendations 3 Internal & External Analysis 4 Strategic Alternatives 5 Implementation 6 Financial Analysis 7 Contingency Plan 8 Conclusion

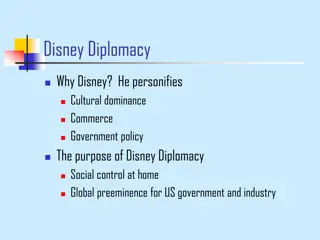

Problem: Problem: Walt Disney is facing three key challenges that need to be overcome to compete in an increasingly disrupted market Page 5 Post-Merger Integration Cannibalization Threat Disruption from OTT How can you make best use of the Fox acquisition? How can you disrupt your business model while mitigating for cannibalization? How can you stay competitive? Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Recommendation: Recommendation: Three strategies will enable Walt Disney to overcome the identified challenges and prepare for the future Page 6 Organizational Assets Customer Acquisition Customer Experience Online-Offline (O2O) Strategy Integration Strategy Customer Segment Strategy Post-Merger Integration Cannibalization Threat Disruption from OTT Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Internal Analysis: Internal Analysis: Walt Disney exhibits extensive experience and strong core competencies in the media industry Page 7 Strengths Weaknesses Strong reputation and brand Revenues largely from traditional cable Large volume of content (Pixar, Disney, TV (40%) ESPN Sports) Traditional media Family-focused image Large integration challenge ahead Multiple streams of revenues (e.g. theme Lack of technology focus in new media parks, merchandise) (e.g. streaming, analytics) M&A experience Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

External Analysis: External Analysis: Walt Disney exhibits extensive experience and strong core competencies in the media industry Page 8 Opportunities Threats Technological advancements improving customer experience Strong competition incl. new entrants Exponential growth in streaming services (e.g. Netflix, Amazon) Increased (mobile) connectivity Rapid decrease in subscribers to cable TV Globalization Customers looking for long-tail offerings Disintermediation Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Competitor Analysis: Competitor Analysis: The following positioning map illustrates the competitive landscape Walt Disney competes in Page 9 Large Content Volume Walt Disney Netflix HBO Hulu Standalone Services Diversified Services YouTube Premium Amazon Prime Low Content Volume Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Strategic Alternatives: Strategic Alternatives: Six key strategies have been considered and analyzed to identify the best-fit recommendations Page 10 Strategic Fit Customer Fit Innovation Level STRATEGY DECISION Profitability Feasibility + + + License Content to Competitors + Stimulate a Content War + + Go All-In on OTT Chosen Strategies + + + + + Integration Strategy + + + + + Customer Segment Strategy + + + + + + Online-Offline (O2O) Strategy Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Implementation (1/3): Implementation (1/3): Integration Strategy Page 11 What Develop and launch an integration strategy for Walt Disney & Fox Why Reduce integration risks and fully exploit potential synergies despite differing cultures Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Implementation (1/3): Implementation (1/3): Integration Strategy Page 12 How Operations & HR Culture Determine content from Fox that will be integrated into Disney s offerings vs. standalone Invite an experienced integration consultant to the Progressively integrate Fox franchises, e.g. Marvel company (e.g. focus groups, workshops) into Disney theme parks and merchandise Initiate quarterly culture events, e.g. dinner and Leverage on HR from both organizations (integration dance, movie nights team) Install cross-organizational communication channels, Form a dedicated future technologies team across e.g. Skype for Work both organizations for e.g. AR/VR, gamification Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Implementation (2/3): Implementation (2/3): Customer Segment Strategy Page 13 What Develop a coherent customer segmentation strategy to convert non-payTV users in the US and international subscribers to Disney DTC (direct-to-consumer channel) Why Avoid cannibalization of cable TV subscribers in the US and increase DTV subscribers from international Disney fan base Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Implementation (2/3): Implementation (2/3): Customer Segment Strategy Page 14 How Operations & HR Marketing Conduct market research on international OTT Sponsor a family-related script-writing contest subscribers at Universities, e.g. HEC Paris Hire a local marketing team (Paris, London, Give-away free-trials to e.g. Millennials through Tokyo) for SNS (social networking service) partnerships, e.g. Grab Rewards, Deliveroo Hire a US digital marketing team to focus OTT- Leverage on digital marketing channels (e.g. users marketing, targeting cable TV leavers Instagram) with strong video content Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Implementation (3/3): Implementation (3/3): Online-Offline (O2O) Strategy Page 15 What Leverage Disney s US and international theme parks to promote streaming subscription service Why Use real estate as strategic angle to increase the subscriber base rapidly Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Implementation (3/3): Implementation (3/3): Online-Offline (O2O) Strategy Page 16 How Operations & HR Marketing Focus on live sports as a key differentiator Hire a dedicated team focusing on cross-marketing Sponsor University sports competitions, e.g. MBA strategies Olympics Train hotel staff on usage of streaming service in Offer a 2-month free trial with entry ticket to hotel rooms at Disney resorts theme parks Establish an analytics team to focus on optimizing Promote streaming service at merchandising spots customer conversion rate Offer free subscription service at hotel rooms and Establish a dedicated customer satisfaction team Disney resorts Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Key Performance Indicators: Key Performance Indicators: The following metrics should be used to monitor the success of the suggested strategies Page 17 Key Performance Indicator Target 1 2 3 4 5 6 7 8 Less than 10% Attrition rate of employees 90% Employee satisfaction level Customer satisfaction level (DTC) 92% 32.5 million by 2023 Number of DTC subscribers Cannibalization rate of cable TV with DTC Below 2% 2+ p.a. Pace of introduction of Fox franchises into theme parks 40% Conversion rate of free-trials to paid service 5 million p.a. Number of DTC sign-ups due to theme park trials Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Timeline: Timeline: The following schedule illustrates how the suggested strategies should be implemented Page 18 2019 2020 2021 2022 2023 H1 H2 H1 H2 H1 H2 H1 H2 H1 H2 INTEGRATION STRATEGY Integration consultant, culture events Consultant Events Integrate Fox franchises Future technologies team Hire Develop CUSTOMER SEGMENT STRATEGY Market research US marketing team and campaign Launch Develop International marketing team and campaign Launch Develop ONLINE-OFFLINE STRATEGY Hire cross-marketing team and launch initiatives Hire Launch Train hotel staff Train Analytics team Hire Work Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Financial Analysis: Financial Analysis: The following costs are associated with the proposed strategies Page 19 in Mil $ Integration Strategy Integration Costs Technology Development Additional Salary & Admin Customer Segment Strategy Markeitng Team Contests Digitial Marketing Cost O2O Strategy Anlytics Team Offline Marketing Training Loss of Revenue from Licensing Total Aditoinal Costs 2019 2020 2021 2022 2023 35 700 20 25 800 25 20 900 30 20 950 40 20 1,000 45 40 20 40 20 40 20 40 20 40 20 1,400 1,200 1,200 1,200 1,200 2,857 4 2,802 4 2,907 4 2,992 4 3,067 4 133 133 133 133 133 5 5 5 5 5 500 550 555 580 600 Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Financial Analysis: Financial Analysis: DTC is expected to be profitable in the 4th year of implementation Page 20 2019 2020 2021 2022 2023 Trends 32.5 9.99 3,893 Subscribers Monthly Avg Cost ($) Revenue (Mil $) 17.9 8.99 1,931 20.5 8.99 2,217 23.1 8.99 2,497 28.6 8.99 3,088 Profit (957) (616) (441) 65 795 Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Financial Analysis: Financial Analysis: DTC is expected to be profitable in 5th year with a low subscriber take up scenario Page 21 2019 11.2 8.99 1,207 2020 2021 2022 2023 Trends 26.1 9.99 3,134 Subscribers Monthly Av Cost Revenue 16.0 8.99 1,724 18.0 8.99 1,942 21.1 8.99 2,278 Profits (1,650) (1,078) (965) (714) 67 Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Financial Analysis: Financial Analysis: Two profits scenarios have been evaluated and unveil the profitability of the strategies Page 22 1,000 500 - 2019 2020 2021 2022 2023 (500) (1,000) (1,500) (2,000) Profits Predicted Profits Slow subscriber Take up Scenario Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Contingency Plan: Contingency Plan: The following risks are underlying the suggested strategies and need to be mitigated in a timely manner Page 23 Anticipated Risk Probability Mitigation 1 2 3 4 5 6 7 Medium Close satisfaction tracking Top talent leaving the firm Low Increase marketing efforts Below forecasts sign-up for DTC Resistance from staff on integration Medium Strong feedback culture Medium Hire fresh staff, e.g. incubate talent Slow technological progress Low Reexamination of marketing channels Accelerated cannibalization Inability of offline channels to drive DTC subscribers Family-friendly brand image dilution Low Offer better packaging of free-trials Low Careful content selection Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Conclusion: Conclusion: Three strategies have been introduced and outlined that will allow Walt Disney to manage the disruption it is undergoing Page 24 Organizational Assets Customer Acquisition Customer Experience Online-Offline (O2O) Strategy Integration Strategy Customer Segment Strategy Post-Merger Integration Cannibalization Threat Disruption from OTT Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion

Nanyang Consulting N THANK YOU FOR YOUR ATTENTION We now welcome any questions you may have. Kindly turn this page for the appendix.

Nanyang Consulting N APPENDIX Kindly turn this page to access supporting material.

Financial Analysis: Financial Analysis: The following s subscriber number assumptions are underlying the financial model Page 27 2019 188.1 2020 191.6 2021 194.4 2022 196.5 2023 199.8 TV Users US OTT Viewer US OTT viewer UK OTT viewer India Total Conversion 202.7 206.1 209.4 211.5 215.5 19 2.1 20 2.2 22 2.4 24 3 27 3.5 246 13% 223.8 8% 228.3 9% 233.8 10% 238.5 12% 32.5 Subscribers 17.9 20.5 23.1 28.6 Problem Recommendation Analysis Alternatives Implementation Financials Contingencies Conclusion