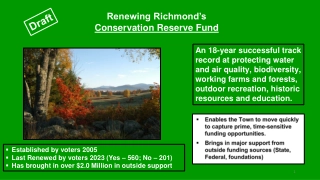

Renewing Richmond's Conservation Reserve Fund

Richmond's Conservation Reserve Fund has a successful 18-year track record in protecting water and air quality, biodiversity, working farms and forests, outdoor recreation, historic resources, and education. Established in 2005 and last renewed by voters in 2023, the fund has brought in over $2.0 mi

0 views • 9 slides

UNC Charlotte Budget Office Overview

Explore the functions of UNC Charlotte's Budget Office, detailing the personnel, budget management, fund types, and revenue sources. Learn about the key figures in the office and the different fund categories like General Fund, Non-General Fund, and Personnel Budget. Gain insights into budget proces

0 views • 45 slides

Effective Working Capital Management in Business

Working capital management is crucial for businesses to optimize cash flow and ensure operational efficiency. It involves balancing current assets and liabilities, with a focus on accounts payable, accounts receivable, inventory, and cash. Proper management of working capital is essential for busine

1 views • 9 slides

CAPITAL STRUCTURE

Capital structure refers to the mix of a firm's capitalization, including debt, preference share capital, equity share capital, and retained earnings. Choosing the right components of capital is crucial based on the organization's function and risk level. Different patterns/forms of capital structur

1 views • 6 slides

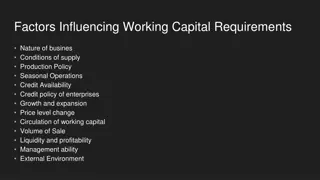

Factors Influencing Working Capital Management

Factors influencing working capital include the nature and size of the business, demand of creditors, cash requirements, time for manufacturing goods, volume of sales, terms of purchases and sales, and the business cycle. The nature of the company, creditor demands for security, cash needs, and the

0 views • 7 slides

Theories of Capital Structure and their Applications

The theories of capital structure explore the relationship between debt and equity in a firm's financing decisions. By optimizing the mix of debt and equity, a company can minimize its cost of capital and maximize its value. The Net Income Approach highlights the benefits of using debt to lower the

0 views • 7 slides

Factors Influencing Economic Growth: Human Capital and Capital Goods

Factors such as investment in human capital, capital goods, natural resources, and entrepreneurship play a crucial role in determining a country's economic growth. Human capital encompasses the skills and abilities of workers, while capital goods are the tools and equipment used to produce goods and

2 views • 28 slides

UK Shared Prosperity Fund

The UK Shared Prosperity Fund in North Yorkshire aims to support local communities, businesses, and skills development through allocated funding across various sectors. The fund focuses on investment priorities such as community support, local business empowerment, and skills enhancement. With a str

0 views • 8 slides

Aditya Birla Capital Scholarship for Classes 9 to 12.

The Aditya Birla Capital Scholarship:\nThe Aditya Birla Capital Scholarship, run by the Aditya Birla Capital Foundation, aims to help students in school and college by offering financial aid and educational support. The scholarship provides up to INR 60,000 (one-time) for academic expenses, and st

1 views • 5 slides

Community Programs and Service Fund (Fund 80) Overview

The Community Programs and Service Fund (Fund 80) is a local taxpayer-funded initiative that allows school boards to provide community education, training, recreational, cultural, and athletic programs and services. This fund is separate from the regular school curriculum and operates under specific

0 views • 20 slides

Mutual Capital Investment Fund: Addressing Capital Needs in the Insurance Community

Mutual Capital Investment Fund, LLC, aims to provide capital to mutual insurance companies facing capital needs without converting to stock form or selling minority interests. Led by Mutual Capital Group, the Fund seeks commitments up to $100 million and offers a unique investment opportunity for mu

0 views • 8 slides

Fund Accounting Entities and Definitions Explained

Explore the world of fund accounting entities and definitions, including the roles of various funds such as General Fund, Debt Service Funds, Capital Projects Funds, Food and Community Service Funds, Custodial Fund, and Trust Funds. Learn about the unique characteristics and regulations that govern

0 views • 39 slides

Overview of Working Capital Management in Financial Management

Working capital management involves strategic decision-making regarding a company's current assets and liabilities to optimize liquidity, profitability, and risk. This process includes understanding working capital concepts, financing current assets, managing liability structure, and maintaining the

0 views • 26 slides

Features of an Appropriate Capital Structure and Optimum Capital Structure

While developing a suitable capital structure, the financial manager aims to maximize the long-term market price of equity shares. An appropriate capital structure should focus on maximizing returns to shareholders, minimizing financial insolvency risk, maintaining flexibility, ensuring the company

2 views • 5 slides

Understanding Risk, Cost of Capital, and Capital Budgeting in Corporate Finance

Explore the concepts of risk, cost of capital, and capital budgeting in corporate finance, including the Capital Asset Pricing Model (CAPM), cost of equity, beta estimation, and cost of capital. Learn how to reduce the cost of capital and understand the impact of reducing the Weighted Average Cost o

0 views • 20 slides

Understanding Multinational Capital Structural Decision

Multinational corporations rely on capital to fund their expansion and projects. Capital structure decisions impact the cost of capital, profitability, and overall value. MNCs face complexities in balancing debt and equity for financing operations, choosing markets and currencies, and internationali

1 views • 37 slides

Understanding the Working Capital Fund: Governance, Services, and Structure

The Working Capital Fund (WCF), established in 1944, is a fund without fiscal year limitation that supports centrally-managed Activity Centers providing various services such as Information Technology, Financial Management, and Administrative Services to USDA and Non-USDA organizations. The WCF empl

0 views • 11 slides

Understanding the Classification and Importance of Capital in Business

Capital is crucial for businesses, whether for promotion, functioning, growth, or expansion. It can be classified as promotional, long-term, short-term, or development capital. Factors influencing capital requirements include business activity, size, product nature, technology, business cycle, and l

2 views • 13 slides

Capital Gains and Assets Overview in Income Tax Law and Accounts

This content provides an overview of capital gains and assets in income tax law and accounts, covering topics such as types of capital assets, assets not considered capital assets, kinds of capital assets (short-term and long-term), transfer year of chargeability, computation of capital gains, and c

0 views • 15 slides

Gauteng Partnership Fund (GPF) Funding Programmes Overview

Explore the Gauteng Partnership Fund (GPF) funding programmes, including the Entrepreneur Empowerment Property Fund, Rental Housing Fund, and Student Accommodation Fund. Learn about the funding criteria, loan terms, equity contributions, and pricing structures for various programs under GPF. Whether

0 views • 17 slides

Options for REDD+ Fund Management System in Nepal

Assessing options for an effective, efficient, and equitable fund management system for REDD+ finance in Nepal is crucial as the program moves into the implementation phase. This assessment focuses on identifying and evaluating potential financing mechanisms for REDD+ in Nepal, considering various f

3 views • 14 slides

Working Capital and Current Ratio in Accounting

Understanding indicators like net current assets (working capital) and current ratio is crucial in accounting. Net current assets reflect the ability to settle current liabilities and the capital required for operational functions. Managing working capital effectively involves factors like stock man

0 views • 12 slides

Fiscal Year 2022 Capital Budget Presentation Overview

In the presentation to the Board of Finance, the Capital Committee outlines the Fiscal Year 2022 draft capital budget, emphasizing the importance of the Capital Improvement Program and the history of the capital program investments. The proposed budget addresses the critical need for reinvestment in

0 views • 11 slides

Understanding Financing Decisions and Capital Funding

Explore the world of financing decisions and capital funding through images and descriptions. Discover how financial systems function, estimate external funds for growth, and learn about debt vs. equity capital. Delve into corporate financing methods, sources of funds, and the importance of raising

0 views • 78 slides

Development of Methodologically Robust Agricultural Capital Stock Statistics by FAO

In November 2015, the Food and Agriculture Organization of the United Nations (FAO) initiated a project to enhance Agricultural Capital Stock statistics, focusing on inclusive and efficient agricultural and food systems. The project involves developing methodologies for measuring capital stock and m

0 views • 38 slides

Report on Fund Utilization for Regional Activities by the Regional Fund Manager

Clara Atari Ipigansi-Olagbaju, the Regional Fund Manager for WCO-WCA, provides insights into the fund utilization for regional activities at the Experts Committee Meeting in Banjul, Gambia. This report outlines the responsibilities, expectations from regional structures, and the process for making a

0 views • 25 slides

Estimating the Cost of Capital in Corporate Finance

Explore the process of estimating the cost of capital essential for discounted cash flows models in corporate finance. Learn how to determine the cost of debt, equity capital, and the Weighted Average Cost of Capital (WACC) by combining different sources of financing. Gain insights into capital stru

0 views • 59 slides

Treasury Fund Overview and Analysis

The Treasury Fund is the central repository for all funds managed by the General Secretariat, consolidating cash and bank accounts while accounting for separate funds. The composition, loans, temporary loan history, and quota balance provide a comprehensive snapshot of the Treasury Fund's financial

0 views • 16 slides

Field Fund Working Group Meeting Insights and Analysis

The Field Fund Working Group Meeting #4 held on December 9, 2020, virtually discussed various topics related to field fund allocations, fee considerations, and capital improvement plans. The meeting covered important aspects such as benchmarking, investment in capital projects, recurring field maint

0 views • 38 slides

Financial Overview of ABC School District

ABC School District's presentation to the Board of Education covers an in-depth analysis of the district's funds, including sources of revenue, fund balances, and observations. The overview highlights the various funds within the district, such as the Operating Fund, Special Revenue Fund, Debt Servi

0 views • 21 slides

Adaptation Fund Status Update: GEF Introduction Seminar Highlights

The Adaptation Fund, since its inception, has mobilized over US$864 million in resources, with a significant portion from various contributions. With allocated funds for projects in 81 countries, including LDCs and SIDS, the Fund supports 80 adaptation and resilience projects benefiting around 5.8 m

0 views • 13 slides

Factors Influencing Working Capital Requirements and Management

Factors such as nature of business, supply conditions, production policy, seasonal operations, credit availability, growth, and external environment influence the working capital needs of a business. Factors like credit availability, seasonal sales fluctuations, and liquidity affect the amount of wo

0 views • 11 slides

Understanding Net Investment in Capital Assets and Its Importance

Net Investment in Capital Assets is a critical component of an entity's financial position, reflecting the value of capital assets owned. It represents the portion of the net position that is not spendable as it is invested in assets. Calculating Net Investment in Capital Assets involves subtracting

1 views • 17 slides

Rural Development Fund - Enhancing Remote Working Facilities

The Rural Development Fund aims to enhance existing remote working facilities and business continuity plans. With a focus on small capital projects in hubs, the fund supports upgrades such as infrastructure expansion, privacy booths, security systems, office space conversion, energy efficiency impro

0 views • 9 slides

Understanding Fund Accounting in School Districts

Explore the world of fund accounting in school districts through an in-depth look at different fund types, their definitions, and the regulations governing them. Learn about the unique characteristics of instructional funds, debt service funds, capital projects funds, food and community service fund

0 views • 36 slides

Children's Services Flexi Fund Process Overview

This document outlines the Children's Services Flexi Fund process for districts, providing key information on utilizing the fund, messages for stakeholders, and the application process. The initiative aims to support children experiencing family violence by offering flexible funding for services not

0 views • 17 slides

Understanding Venture Capital: Key Concepts and Regulations

Venture capital is a form of financing provided to startup companies with high growth potential. It involves high risk and requires a long-term horizon, often coming in various forms like equity, conditional loans, and participation in management. The process includes stages such as seed capital, ex

0 views • 10 slides

Venture Capital Fund Experience in Basilicata Region

Sviluppo Basilicata has developed significant experience in managing Risk Capital Funds for SMEs in the Basilicata Region over the past two decades. They have successfully invested in various enterprises, leading to positive exits and the establishment of a new Regional Venture Capital Fund. The Reg

0 views • 18 slides

Understanding Capital Adequacy Ratio (CAR) in Banking

Capital Adequacy Ratio (CAR) is a crucial metric in banking that measures a bank's capital against its risk. Also known as CRAR, it enhances depositor protection and financial system stability worldwide. The CAR formula involves dividing a bank's capital by its risk-weighted assets, comprising tier

0 views • 7 slides

Financial Overview and Projections for 2016-2019

Detailed financial data including budget assumptions, child development fund, special reserve fund, and capital facilities fund for the years 2016-2019. The information covers revenues, expenditures, fund balances, and projections for each fund.

0 views • 16 slides