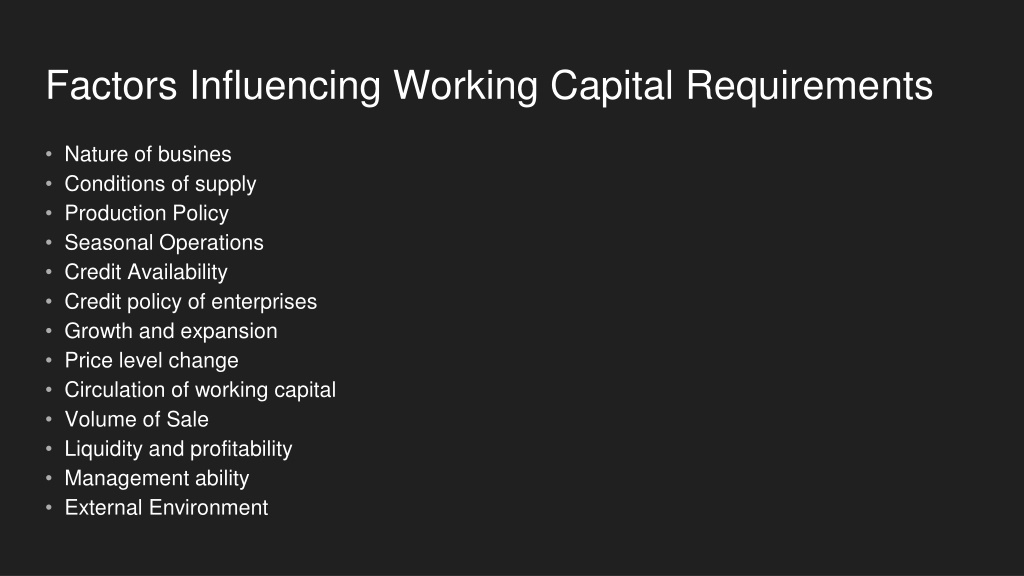

Factors Influencing Working Capital Requirements and Management

Factors such as nature of business, supply conditions, production policy, seasonal operations, credit availability, growth, and external environment influence the working capital needs of a business. Factors like credit availability, seasonal sales fluctuations, and liquidity affect the amount of working capital required. Understanding these factors is crucial for efficient working capital management.

Download Presentation

Please find below an Image/Link to download the presentation.

The content on the website is provided AS IS for your information and personal use only. It may not be sold, licensed, or shared on other websites without obtaining consent from the author. Download presentation by click this link. If you encounter any issues during the download, it is possible that the publisher has removed the file from their server.

E N D

Presentation Transcript

Factors Influencing Working Capital Requirements Nature of busines Conditions of supply Production Policy Seasonal Operations Credit Availability Credit policy of enterprises Growth and expansion Price level change Circulation of working capital Volume of Sale Liquidity and profitability Management ability External Environment

Concerns in public utility services need less working capitals. Example, if a concern is engaged in electric supply, need less current assets. The supply of inventory prompt and adequate, less funds will be needed.

In case of seasonal flutuation sales, production will fluctuate accordingly and utilise requirments of working capital will also fluctuate. It is not always possible shift the burden of production and sale to slack.

If credit facility is availability from banks and suppliers on favourable term conditions, less working capital will be needed. In some enterpries most of the sale is at cash and even it is received advance while, in other sales is at credit and payment received only after a month or two.

It is difficult to precisely determine the relationship between volume of sales and the working capital needs. With the increase in price level more and mre working capital will be needed for the same magnitude of current assets.

Less working capital will be needed with the increase in circulation of working capital and vice-versa This is directly indicated with working capital requirement, with the increase in sales more working capital is needed for finished goods. With development of financial institutions, means of communication, transport facility, etc.

There is a negative relationship between liquidity and profitability. Proper co-ordination in production and distribution of goods may reduce the requirement of working capital

It protects a business form the adverse of shrinkage in the values of current assets. It is possible to pay all the current obligation promptly and to take advantage of cash discounts. It ensures, to a greater extent maintenance of a company's credit standing and production for such emergencies as strikes, floods, fires etc., It permits the carrying of inventories level that would enable a business to serve satisfy the needs of its customers.

It enables a company to extend favorties credit terms to its customers. It enables a company to operate its business more efficiently because there is no delay in obtain materials, etc., because of credit difficulties. It enables a business to with stand period depression smoothly. There may be operating losses or decrese retained earnings. There may be excessive non-operating or extraordinary losses. The management may fail to obtain funds from other sources for purposes of expansion.

There may be an unwise dividend policy. Current funds may be invested in non-current assets. The management may fail to accumulate funds necessary for meeting debentures on maturity. Increasing price may necessitat bigger investments in inventories and fixed asset.

Thank you Ms. Nithya Devi Asst. Prof. of Commerce (CA) Bon Secours College for Women, Thajavur