Challenges and Opportunities for Reforms of Non-Oil Revenues Administration in South Sudan

The presentation highlights the reliance on oil revenues in South Sudan and the need for reforms in non-oil revenue administration. It discusses sources of non-oil revenue, factors hindering revenue mobilization, and opportunities for reforms to diversify the economy. The objectives of non-oil reven

3 views • 23 slides

Enhancing Domestic Revenue Mobilization in South Sudan: NRA Initiatives

The presentation by Hon. Athian Ding Athian, NRA Commissioner General, at the 1st National Economic Conference in South Sudan focused on the National Revenue Authority's mandate, strategic plan, revenue performance, and policy options for boosting non-oil revenue. The NRA aims to achieve a Tax-to-GD

1 views • 21 slides

San Francisco Business Tax Revenue Forecast Update Fall 2023

San Francisco is facing a significant loss in business tax revenue compared to budget projections, with estimates ranging from $40M to $55M in annual losses for current and future fiscal years. The Homelessness Gross Receipts Tax (HGR) is a key source of revenue, but its revenue has been volatile an

0 views • 7 slides

An Introduction to Cargo Revenue Management

\nIn the bustling world of air cargo, where efficiency and profitability are paramount, Cargo Revenue Management (CRM) emerges as a pivotal strategy for airlines and logistics companies. This intricate process involves the optimization of cargo space to maximize revenue, ensuring that every inch of

3 views • 5 slides

Revenue Management Systems (RMS) for Cargo

In the competitive and dynamic world of cargo transportation, optimizing revenue is crucial for the sustainability and growth of businesses. Revenue Management Systems (RMS) for cargo have emerged as vital tools in this endeavor, leveraging advanced technology to enhance profitability. This blog pro

1 views • 7 slides

Revenue Management for Air Cargo by Revenue Technology Services

Revenue management for air cargo is a crucial aspect of modern logistics, aimed at maximizing revenue through effective planning and strategic pricing. Revenue Technology Services (RTS) offers innovative cargo solutions designed to optimize the use of air cargo space, enhance operational efficiency,

1 views • 6 slides

Collaborative Planning in Cargo Revenue Management

In today's fast-paced and competitive logistics industry, effective cargo revenue management is crucial for maximizing profitability and ensuring operational efficiency. Revenue Technology Services (RTS) has been at the forefront of providing innovative solutions for the cargo industry, emphasizing

1 views • 6 slides

Compliance and Regulatory Considerations in Cargo Revenue Management

Cargo revenue management is an intricate balancing act that involves maximizing revenue while managing the capacity and pricing of cargo space. For companies like Revenue Technology Service (RTS), the key to successful cargo revenue management lies not only in optimizing these factors but also in en

1 views • 5 slides

Training and Development for Cargo Revenue Managers

In today's fast-paced and ever-evolving business environment, the role of a cargo revenue manager is more critical than ever. The field of cargo revenue management is a dynamic and complex area that requires professionals to stay updated with the latest industry trends, technologies, and strategies.

1 views • 6 slides

Advanced Analytics for Cargo Revenue Enhancement

In the fast-evolving world of logistics and transportation, optimizing revenue streams is crucial for maintaining competitive advantage. One of the most effective ways to achieve this is through advanced analytics. Leveraging sophisticated data analysis techniques, revenue technology services can tr

1 views • 5 slides

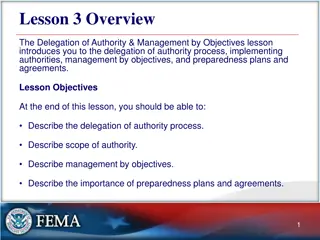

Understanding Delegation of Authority and Management by Objectives

The lesson on delegation of authority and management by objectives covers the process of delegating authority, implementing authorities, management by objectives, and the importance of preparedness plans and agreements. It discusses the authority having jurisdiction, scope of authority, and the dele

1 views • 31 slides

Five Dimensions to Our Spiritual Authority

Explore the five dimensions of spiritual authority - Redemptive, Inherited, Positional, Delegated, and Empowered authority - outlined in the context of Christ's triumph and our identity as children and heirs of God. Scriptures from Romans 8:16-17 and Galatians 4:6-7 emphasize our position as joint h

0 views • 20 slides

Understanding Public Revenue and Taxation Fundamentals

Public revenue encompasses all income sources of the government, ranging from taxes to non-tax revenue. Taxes, the primary revenue source, are compulsory payments collected without direct benefits to taxpayers and play a crucial role in public finance and economic development. Non-tax revenue includ

0 views • 54 slides

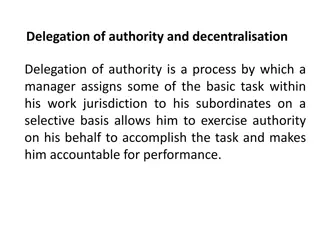

Understanding Delegation of Authority in Management

Delegation of authority in management is a crucial process where managers assign tasks to subordinates, allowing them to exercise authority on their behalf. Louis A. Allen defined authority as the rights entrusted to a position holder to enable task performance. Effective delegation involves element

0 views • 13 slides

Virgin Islands Police Department Revenue Estimation Conference Highlights

The Virgin Islands Police Department held a revenue estimating conference on March 14, 2023, led by Commissioner Ray Martinez. The event discussed current fees for various services provided by the department, revenue generation and projections over fiscal years, annual revenues and projections, as w

1 views • 10 slides

Dimensions of Spiritual Authority: Five Empowering Realms in Christ

Explore the five dimensions of spiritual authority rooted in Christ's triumph, our identity as sons and daughters of God, our authority in Christ, the delegated authority as Christ's representatives, and the empowered authority through the anointing. Delve into how Jesus ministered under the anointi

0 views • 25 slides

Understanding Revenue Concepts in Different Market Conditions

Explore revenue concepts like Total Revenue (TR), Marginal Revenue (MR), and Average Revenue (AR) along with elasticity of demand in various market structures such as perfect competition, monopoly, monopolistic competition, and oligopoly. Learn about short and long-run equilibrium conditions and the

0 views • 21 slides

County Government Revenue Sources and Allocation in Kenya

The county government revenue in Kenya is sourced from various avenues such as property rates, entertainment taxes, and service charges. Equitable share forms a significant part of this revenue, allocated based on a formula developed by the Commission on Revenue Allocation. The funds given through t

0 views • 14 slides

Revenue synergy

,\n\nI'm excited to introduce Revenue Synergy's exceptional revenue cycle management and medical billing services. As the top medical billing company in the US, we offer innovative solutions that optimize your revenue cycle and enhance financial performance. Our team ensures precise billing, minimiz

0 views • 5 slides

ALA FY 2017 Financial Report Summary

ALA's FY 2017 financial report highlights total revenues, expenses, net operating revenue, revenue sources, general fund summary, and detailed revenue and expense breakdowns. Revenues amounted to $48,808,627 with net revenue of $314,944. Key revenue sources included dues, contributions, grants, and

1 views • 16 slides

Complete Welsh Phrasebook and Folding Guide

This printable Welsh phrasebook includes essential phrases like "Thank you" and "Please," along with instructions to fold a paper to create a useful pocket reference. The guide covers Scout badges, Scout Law, initiation ceremonies, and more in both formal and informal Welsh language expressions.

0 views • 4 slides

Alisal Union School District 2021-2022 Budget Workshop Overview

The Alisal Union School District held a budget workshop to review revenue projections, expenditure projections, enrollment and staffing projections, additional federal and state funding, and supplemental and concentration expenditures. The workshop highlighted revenue sources, including local contro

2 views • 26 slides

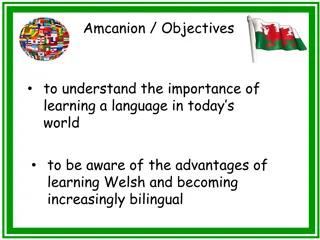

Embracing the Power of Learning Welsh for a Multilingual Future

Discover the importance of language learning in today's global landscape and the advantages of becoming bilingual, with a focus on Welsh. Learning languages enhances cultural understanding, opens up new opportunities in travel, job prospects, and academic success, and fosters tolerance towards diver

0 views • 14 slides

Welsh Natural Language Toolkit Overview

The Welsh Natural Language Toolkit (WNLT) is an open-source software for Welsh NLP, offering features like tokenization, lemmatization, part-of-speech tagging, and named entity recognition. With a user-friendly GUI and CLI, as well as an accessible API, WNLT simplifies NLP tasks for both technical a

0 views • 29 slides

Welsh Revenue Authority Statistics Publication Experience in HTML - GSS Sharing Seminar

Welsh Revenue Authority (WRA) is a new tax authority for Wales aiming to raise funds for public services through devolved Welsh taxes. They publish statistics in HTML format since 2018, focusing on detailed datasets and innovative breakdowns for better user experience. The shift to HTML publishing h

0 views • 14 slides

Learn Welsh Alphabet and Pronunciation

Explore the Welsh alphabet, vowels, pronunciation rules, and common names in Wales. Discover the unique characteristics of the Welsh language, including circumflex accents and double letters. Improve your ability to recognize letters, pronounce words, and identify places and colors in Welsh.

0 views • 14 slides

Challenges Faced by Welsh Local Authorities during the Austerity Era

Exploring how Welsh Local Authorities managed the pressures of reduced central funding and increased service demands during the Austerity Era. The study delves into the financial strategies adopted, impacts on income and expenditure, and the unique context of Welsh Government spending. Despite simil

0 views • 19 slides

Welsh School Subjects and Opinions PowerPoint

Practice Welsh vocabulary for school subjects and opinions by finding the Welsh translations and creating a PowerPoint presentation. Use provided phrases and examples to complete the task, enhancing your language skills. Include images and follow the instructions to create a visually engaging presen

0 views • 30 slides

Challenges and Strategies for International Students in Welsh Universities

This academic research by Supachai Chuenjitwongsa explores the challenges faced by international students in Welsh university settings, focusing on academic and cultural adaptation, teaching strategies, and learning experiences. It highlights the increasing number of non-UK students and discusses co

0 views • 30 slides

Shifting Accountability Procedures in Welsh School Leadership

Explore the evolving accountability procedures in Welsh school leadership, influenced by distinctive Welsh governmental policies post-devolution. Discover the implications and key events shaping the narrative towards more meaningful self-evaluation for learning, rather than focusing solely on data r

0 views • 11 slides

CITES Tasks and Methods in the Netherlands - Scientific Authority Overview

The Netherlands has a Scientific Authority for CITES tasks and methods, playing a crucial role in the Convention on International Trade in Endangered Species of Wild Fauna and Flora. This independent body advises the Management Authority and assists in preventing extinction due to international trad

0 views • 30 slides

Understanding Revenue Limits and Calculation Process in School Financial Management

This educational material covers topics such as revenue limits, the components within revenue limits, what falls outside of the revenue limit, and a four-step process for revenue limit calculation in the context of school financial management. It includes detailed information on the regulation of re

0 views • 34 slides

Awakening to Spiritual Authority in Christ

Christians often overlook their true identity and authority in Christ, hindering their ability to wield spiritual authority effectively. The ignorance within the Church has allowed Satan to thrive. It is crucial for believers to awaken to the reality of spiritual warfare, comprehend the disparity be

0 views • 24 slides

Evaluation of Welsh Language Acquisition in Foundation Phase Schools in Wales

The report evaluates the effectiveness of Welsh language acquisition among children in Welsh-medium non-maintained schools across Wales during the Foundation Phase. Findings indicate positive outcomes in language, literacy, and communication skills, with Welsh-speaking and non-Welsh-speaking pupils

0 views • 22 slides

Understanding Revenue Requirements for Non-program Food Sales

Non-program food revenue plays a crucial role in school food service operations. Schools need to ensure that the revenue from non-program food sales meets a specified proportion to cover costs effectively. Failure to comply may result in corrective action during reviews by the state agency. To meet

0 views • 9 slides

Louisiana Department of Revenue Operational and Tax Policy Initiatives

Louisiana Department of Revenue (LDR) is focused on efficiently collecting state tax revenue, regulating charitable gaming, alcohol, and tobacco sales, and supporting state agencies in debt collection. The LDR's leadership team is dedicated to various aspects of revenue management and compliance, wi

0 views • 32 slides

Analysis of State Budget Trends by John Gilbert - Nov. 1, 2020

This comprehensive analysis by John Gilbert, a Budget and Revenue Analyst, delves into the multiyear trend of state budget outlook, general revenue fund trends, sources, growth, and projections. The analysis includes comparisons between revenue and expenditures, trend-based revenue projections, grow

0 views • 5 slides

The Economics and Politics of Foreign Aid and Domestic Revenue Mobilization

This study explores the relationship between foreign aid, taxation, and domestic revenue mobilization, highlighting the impact of aid on tax/GDP ratios and the constraints faced in revenue systems. It discusses how aid influences policy choices, accountability, and bureaucratic costs, impacting reve

0 views • 25 slides

Understanding Revenue Recognition Guidelines under LKAS 18

LKAS 18 provides guidelines on how to recognize revenue from various sources like sale of goods, rendering services, interest, royalties, and dividends. Revenue recognition is based on specific conditions being met, such as transfer of risks and rewards of ownership, reliable measurement of revenue,

0 views • 26 slides

Overview of Exchequer Returns for End-Q1 2023

The Exchequer Returns for End-Q1 2023, as reported by John McCarthy, Chief Economist of the Department of Finance, indicate a year-on-year increase in total revenue, driven by growth in tax revenue. However, non-tax revenue decreased significantly. Expenditure also saw a notable rise, particularly i

0 views • 12 slides