FINANCE – Office of Research Grants and Contracts

Learn about compliance requirements and best practices for preparing budgets for research grants. Topics covered include eligible costs, direct versus indirect costs, VAT, and more.

2 views • 61 slides

Analysis of Government Interventions on Energy Prices in Ireland

Household energy prices in Ireland have risen sharply due to increases in Energy and Supply costs, primarily driven by higher wholesale gas prices. Government interventions, including electricity credits and VAT rate reduction, have helped mitigate the impact on households, although concerns remain

1 views • 4 slides

Understanding EVE Model for Indirect Taxes Using Household Data

The EVE model developed by PBO analyzes household expenditure to estimate taxes paid on goods and services, facilitating the assessment of policy proposals' cost and impact. Utilizing microsimulation, EVE covers a range of indirect taxes like VAT, excises, and carbon tax, providing valuable insights

0 views • 19 slides

Bookkeeping in Bromsgrove

JRMA United Kingdom, based totally in Bromsgrove, specializes in green VAT answers. With a crew of experienced professionals, they navigate the complexities of value-added tax to ensure compliance and optimize financial tactics for agencies. Trust JRMA.Co.Uk for expert steering, reliable advice, and

1 views • 2 slides

Các đồ ăn vặt ban đêm tốt cho bà bầu

B\u00e0 b\u1ea7u \u0111\u00f3i \u0111\u00eam c\u00f3 th\u1ec3 \u0103n nh\u1eefng \u0111\u1ed3 \u0103n v\u1eb7t \u0111\u1ec3 xua tan c\u01a1n \u0111\u00f3i \u0111\u1ed3ng th\u1eddi b\u1ed5 sung nh\u1eefng d\u01b0\u1ee1ng ch\u1ea5t cho thai k\u1ef3. G\u1ee3i \u00fd 5 m\u00f3n \u0111\u1ed3 \u0103n v\u1

0 views • 3 slides

Challenges and Solutions in VAT Registration for Dubai-based Businesses

Discover the challenges of VAT registration in Dubai, UAE, and learn effective solutions to navigate the process smoothly. Ensure compliance with UAE tax regulations with these expert tips and strategies.

1 views • 11 slides

Bookkeeping in Bromsgrove

Navigating VAT regulations in Droitwich is made easier with my expertise as a knowledgeable professional. With a comprehensive understanding of VAT laws and compliance requirements, I provide valuable guidance to businesses in effectively managing th

1 views • 2 slides

Afghanistan Revenue Department Implements Value Added Tax

The Afghanistan Revenue Department has introduced Value Added Tax (VAT) as a step towards self-reliance and economic stability. The program aims to inform taxpayers about VAT, its purpose, implementation process, and impact on domestic revenues. By adopting VAT, Afghanistan aims to decrease reliance

0 views • 35 slides

Bookkeeper in Worcester

Navigating VAT regulations in Droitwich is made easier with my expertise as a knowledgeable professional. With a comprehensive understanding of VAT laws and compliance requirements, I provide valuable guidance to businesses in effectively managing th

2 views • 1 slides

Enhancing VAT Revenue in Zambia through Electronic Fiscal Devices

Analyzing the impact of Electronic Fiscal Devices (EFDs) on VAT remittances in Zambia and exploring policies to complement their implementation. The study discusses the design, distribution, and effects of EFDs, highlighting a reduction in remittances post-registration. The research also examines se

0 views • 16 slides

A Guide to Making Tax Digital (MTD) for VAT Regulations

The new Making Tax Digital (MTD) for VAT regulations came into effect from April 1, 2019. Businesses with a taxable turnover over £85,000 must keep digital records and file VAT returns using HMRC-approved software. The Government Gateway for VAT returns will be disabled, and businesses need to regi

0 views • 10 slides

Overview of TRAIN Revenue Regulations No. 13-2018 on Value-Added Tax

These regulations under the Tax Reform for Acceleration and Inclusion (TRAIN) Act (RA 10963) focus on Value-Added Tax provisions, amending Revenue Regulations No. 16-2005. They cover zero-rated sales, VAT-exempt transactions, claims for input tax, refund procedures, and more. Conditions for VAT appl

1 views • 54 slides

Brexit VAT Treatment of Goods and Services Overview

The Brexit VAT treatment of goods and services impacts cross-border supplies to the UK, VAT refunds for goods, separation provisions under the Withdrawal Agreement, and the Ireland/Northern Ireland Protocol. Changes in VAT regulations and protocols are outlined for businesses and traders within the

3 views • 10 slides

Sales Tax Administration Presentation at ZICA AGM by Commissioner Domestic Taxes-ZRA

The presentation discusses the transition from Value Added Tax to Sales Tax in Zambia, outlining the reasons for the change, challenges with VAT, and benefits of Sales Tax. It emphasizes the simplicity and efficiency of Sales Tax administration compared to VAT, aiming to improve tax collection and r

0 views • 27 slides

Comprehensive Overview of Divine IT Limited and PrismVAT

Divine IT Limited is a pioneering IT consultancy firm offering ERP solutions and web applications since its inception in 2005. With a strong focus on innovation and customer retention, the company has garnered several accolades and certifications. One of its flagship products, PrismVAT, is a web-bas

0 views • 20 slides

Uganda's Tax Policy and Revenue Mobilization: Challenges and Measures

The Ministry of Finance, Planning, and Economic Development in Uganda faces challenges in revenue mobilization and implementing tax policy measures. The tax policy aims to generate revenue for budget financing, promote investment and exports, redistribute income, and ensure compliance with regional

0 views • 22 slides

Understanding Value Added Tax (VAT) and Unemployment Insurance in Mathematical Literacy NQF Level 3

Dive into the realm of Value Added Tax (VAT) in South Africa, distinguishing between VAT-inclusive and VAT-exclusive pricing, and exploring the Unemployment Insurance Fund. Learn how to calculate VAT on exclusive prices and decipher payslips to enhance your mathematical literacy skills at NQF Level

0 views • 23 slides

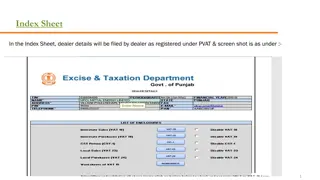

Overview of Dealer Details Filing Procedures Under Different Forms

This content outlines the process for dealers to file various details under different forms such as Index Sheet, VAT-18, VAT-19, CST Form, VAT-23, VAT-24, Worksheet-4, Worksheet-5, and Worksheet-6. With the arrival of GST, changes in the filing requirements have been highlighted, emphasizing the imp

0 views • 10 slides

Balanced Bookkeeping and VAT Your Complete Financial Solution

Balanced Bookkeeping and VAT Your Complete Financial Solution.pdf

7 views • 7 slides

European Islands VAT and Taxation Policy Overview

European islands have unique VAT and taxation policies. Various islands in Europe have different approaches to VAT, including special rates and exemptions. For example, in Greece, certain islands have lower VAT rates compared to the mainland. Countries like Germany and Spain exclude specific territo

0 views • 8 slides

Are You Making These Common Mistakes with VAT Returns in UK

Are You Making These Common Mistakes with VAT Returns in UK

1 views • 4 slides

Towards a Modern VAT System for Intra-Union Trade

The European Commission aims to replace the current fragmented and complex VAT system for intra-Union trade with a definitive system. This new system, based on taxation at the destination, seeks to reduce VAT fraud, enhance compliance, and bring uniformity to EU supplies. The two-step legislative ap

0 views • 19 slides

Understanding Vat Dyes: Properties, Dyeing Process, and Limitations

Vat dyes are known for providing excellent color and fastness properties to textile materials, especially natural and manmade fibers. The dyeing process involves steps like aqueous dispersion, vatting, absorption by fibers, re-oxidation, and soaping off to ensure colorfastness. However, there are ce

0 views • 25 slides

Understanding the Reduced Rate of VAT in the Hospitality Industry

Delve into the intricacies of the Reduced Rate of VAT in the hospitality sector through this upcoming live webinar presented by Richard Taylor, VAT Manager at Albert Goodman. The webinar covers various aspects including catering, hotel and holiday accommodation, admission to attractions, and account

0 views • 16 slides

VAT in Worcester

JRMA offers comprehensive VAT services in Kidderminster, ensuring businesses comply with tax regulations while maximizing savings. With meticulous attention to detail, they handle VAT registration, returns, and advisory, easing the burden for clients

2 views • 1 slides

VAT Returns in the UK Let EFJ Consulting Handle the Heavy Lifting

VAT Returns in the UK Let EFJ Consulting Handle the Heavy Lifting

2 views • 4 slides

e-Prelude.com Maintenance and Inventory Management Guide

Dive into the world of e-Prelude.com through this comprehensive guide that covers items maintenance, software information chart, item definition, item creation process, table maintenance, warehouse table access, accounts receivable and accounts payable functions, VAT rate table, and terms of payment

0 views • 21 slides

Understanding Time and Value of Supply in VAT Webinar Series

This course note covers the essential aspects of time and value of supply in relation to VAT rules. It explains key rules that determine when VAT must be accounted for and paid, focusing on important regulations impacting vendors. Topics include general time of supply rules, rules for connected pers

0 views • 44 slides

The Impact of Brexit on UK Taxes, VAT, and Duties

Explore the fiscal implications of Brexit on UK tax policies, VAT regulations, and duties. Understand the historical treaties and statutes that led to the current state. Learn how EU membership affected UK sovereignty in taxation and the unique role of the European Communities Act in shaping UK law

0 views • 34 slides

Comparative Study of Sales Tax on Services in Various Countries

This content provides information on the scope and implementation of sales tax on services in different countries like Pakistan, India, Australia, Canada, France, Japan, and Malaysia. It highlights the VAT/GST regimes across the globe, the number of countries implementing VAT/GST by region, and coun

0 views • 55 slides

Dispute over VAT Liability in Car Purchase Case

Cartrader A bought cars from B Ltd., paid VAT, but B Ltd. didn't remit VAT. C involved in evasion. A held liable initially, successful appeal against VAT evasion assessment. Dispute over A's knowledge of C's intentions.

0 views • 10 slides

Understanding VAT Reverse Charge for Construction Services

Overview of VAT reverse charge for construction services effective from 1st March 2021, covered areas, how it works, services covered & not covered, and specifics on labor-only construction services eligible for reverse charge. Details on invoicing, accounting, and transitional arrangements, with ex

0 views • 25 slides

Breaking Through the VAT Code Professional Guidance for Efj Consulting

Breaking Through the VAT Code Professional Guidance for Efj Consulting

1 views • 4 slides

Bookkeeper in Worcester1

JRMA, based in Bromsgrove, offers expert VAT services tailored to businesses of all sizes. Navigating the complexities of VAT regulations can be challenging, but with JRMA\u2019s professional guidance, businesses can ensure compliance while optimizin

1 views • 1 slides

VAT Registration for Startups: What Startups Need to Know in Dubai

Learn the essentials of VAT Registration in Dubai, UAE for startups. Discover when to register, steps involved, and the benefits of compliance to boost your business growth.

0 views • 9 slides

Customs Investor Facilitation Center's INFAC Scheme Details

The INFAC Scheme, offered by the Customs Investor Facilitation Center, aims to implement import duty concessions for the textile and garment industry in Sri Lanka. Registered manufacturers, exporters, and service providers in the industry can benefit from this scheme by availing duty concessions on

0 views • 18 slides

Preparing for Brexit Customs Declarations VAT and Duty Webinar Overview

Detailed webinar presented by Richard Taylor, VAT Manager at Albert Goodman, discussing changes in import procedures for EU movements, duties, VAT, customs declarations, and more post-Brexit transition period.

0 views • 24 slides

Need Expert VAT Returns in UK Advice Contact EFJ Consulting Today

Need Expert VAT Returns in UK Advice Contact EFJ Consulting Today

0 views • 3 slides