Cost Accounting Standards for Determining Transportation Costs

Understanding the importance of transportation costs in procurement and distribution, this guide outlines the standards for determining average costs, separation of transportation costs in accounting records, objectives for maintaining cost uniformity, components of transportation costs, and treatme

0 views • 11 slides

Understanding the Concept of Return to Factor in Production Economics

Return to Factor is a key concept in production economics that explains the relationship between variable inputs like labor and total production output. The concept is based on the three stages of production - increasing returns, diminishing returns, and negative returns. By analyzing the behavior o

0 views • 7 slides

Comparing Logit and Probit Coefficients between Models

Richard Williams, with assistance from Cheng Wang, discusses the comparison of logit and probit coefficients in regression models. The essence of estimating models with continuous independent variables is explored, emphasizing the impact of adding explanatory variables on explained and residual vari

1 views • 43 slides

Grant Management Flexibility under Horizon 2020 During COVID-19

Grant management under Horizon 2020 during COVID-19 requires maximum flexibility with eligibility of costs incurred, force majeure clause usage, and flexibility in actual personnel costs. Teleworking costs are eligible, and personnel costs can be adjusted for exceptional circumstances. Travel costs

1 views • 12 slides

Understanding Administrative Costs in Grant Management

Administrative costs are essential for managing grants effectively. Learn about the difference between direct and indirect costs, and why tracking and reporting accurately is crucial to avoid disallowed costs. Explore the definition, classification, and significance of administrative costs in grant

0 views • 22 slides

Understanding Activities Delivery Costs and Program Administrative Costs in CDBG Programs

Exploring the allocation of staff costs between Activities Delivery Costs (ADCs) and Program Administrative Costs (PACs) in Community Development Block Grant (CDBG) programs. ADCs cover non-profit staff expenses for carrying out eligible activities, while PACs include costs for planning, general adm

1 views • 10 slides

Understanding the Costs of Inflation and Its Impact on Purchasing Power

Inflation is a crucial economic phenomenon with both winners and losers. While inflation itself doesn't necessarily reduce real purchasing power, it leads to various costs such as shoeleather costs, menu costs, and unit of account costs. These costs emerge due to the changing dynamics of prices, wag

0 views • 16 slides

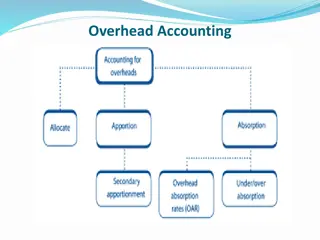

Understanding Overhead Accounting and Allocation Process

Overhead accounting involves allocating and apportioning overhead costs to different departments or cost centers in a company. This process includes dividing cost centers into production and service departments, assigning overhead costs accurately, and distributing common overhead costs proportionat

0 views • 18 slides

Understanding Costs for Defendants in Legal Proceedings

This article provides detailed information on the costs involved for defendants in legal cases, including the starting point for cost allocation, costs at different stages of the legal process, and considerations for recovery of costs. It covers aspects such as costs at the pre-action stage, costs a

2 views • 54 slides

Overview of New Civil Procedure Rules on Costs: CPR Parts 58 & 59

The new Civil Procedure Rules (CPR) Parts 58 & 59 introduce changes in the assessment and taxation of costs in legal proceedings. Detailed assessment replaces taxation, standard basis, fixed costs, and more defined, with new definitions and procedures outlined. Order 59 expands the powers to tax cos

0 views • 22 slides

Understanding Engineering Costs and Estimation Methods

This informative content delves into the concept of engineering costs and estimations, covering important aspects such as fixed costs, variable costs, semi-variable costs, total costs, average costs, marginal costs, and profit-loss breakeven charts. It provides clear explanations and examples to hel

0 views • 33 slides

Understanding Absorption and Marginal Costing in Accounting

Absorption costing, also known as full costing, encompasses all costs including fixed and variable related to production. It aids in determining income by considering direct costs and fixed factory overheads. Meanwhile, marginal costing focuses on only variable manufacturing costs and treats fixed f

0 views • 14 slides

Understanding Budget Basics for Comprehensive Budget Development

Components necessary for comprehensive budget development include categories of spending like direct costs, personnel costs, and facilities & administrative costs. Budget construction may vary by sponsor, but a detailed budget is required at submission. Personnel costs cover various types of employe

1 views • 19 slides

GAINS Calculations of Air Pollutant Control Costs and Cost-Effective Technologies

This document provides insights into the GAINS calculations of annual costs for emission control technologies, including investment costs, fixed and variable operation and maintenance costs. It outlines specific cost information for technologies like Flue Gas Desulphurization (FGD), considering fact

0 views • 9 slides

Understanding Costs in Business: Types and Significance

Costs in business play a crucial role in determining profitability and decision-making. This article explores various types of costs such as direct, indirect, fixed, and variable costs, along with their definitions, uses, and impact on business operations. Understanding these costs is essential for

0 views • 13 slides

Understanding Marginal Costing in Cost Accounting

Marginal Costing is a cost analysis technique that helps management control costs and make informed decisions. It involves dividing total costs into fixed and variable components, with fixed costs remaining constant and variable costs changing per unit of output. In Marginal Costing, only variable c

1 views • 7 slides

Ratio Method of Estimation in Statistics

The Ratio Method of Estimation in statistics involves using supplementary information related to the variable under study to improve the efficiency of estimators. This method uses a benchmark variable or auxiliary variable to create ratio estimators, which can provide more precise estimates of popul

0 views • 30 slides

2020 Company Confidential - Add-Ons and Variable Properties Guidelines

This document provides guidelines for add-ons and variable properties within the context of the 2020 Company Confidential data. It covers various aspects such as variable validations, logic return types, export/import considerations, and the handling of accessory items. The content emphasizes the pr

0 views • 39 slides

Break-Even Analysis Techniques and Examples

Break-even analysis is a valuable technique used to evaluate process and equipment alternatives by determining the point at which costs equal revenue. This analysis involves estimating fixed costs, variable costs, and revenue to find the break-even point in both dollars and units. The difference bet

1 views • 31 slides

How to Fill Out a Nursing Assistant Certification Reimbursement Request Form

Detailed instructions on filling out Form 06-123 for Nursing Assistant Certification (NAC) reimbursement requests. Sections covered include Provider Information, Direct Care Costs, Operating Costs, Total Costs, and Provider Authorization. The form requires manual entry of some totals and provides au

0 views • 16 slides

Analysis of 2021 Marginal Generation Costs for San Diego Gas & Electric

The analysis presents the 2021 Marginal Generation Costs methodology filed by San Diego Gas & Electric in April 2016 for the Time-of-Use (TOU) OIR Workshop. It includes forecasts for Marginal Energy Costs (MEC) and Marginal Generation Capacity Costs (MGCC) for the calendar year 2021, based on market

0 views • 6 slides

Understanding Overhead Costs and Their Importance in Business

Overhead costs play a crucial role in cost allocation and management within an organization. These costs, which include indirect expenses such as labor, materials, and services, cannot be directly linked to specific units of production. Instead, overhead costs are apportioned and absorbed using vari

0 views • 16 slides

Load Following by Nuclear Power Plants in Relation to Variable Renewable Energies' Development

The study explores the requirements of load following by nuclear power plants in the context of variable renewable energies' growth. It discusses the impact of renewable energy development on nuclear economic models and the need for dispatchable capacities. Benchmarks are set to test robustness of d

0 views • 11 slides

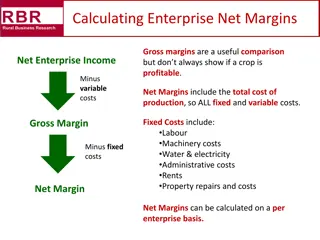

Understanding Winter Wheat Net Margins in England

Winter wheat net margins in England are calculated by subtracting total variable costs from total output to determine the gross margin. Fixed costs including labor, machinery, general costs, and property costs are then allocated to obtain the net margin. This analysis helps farmers assess the profit

0 views • 9 slides

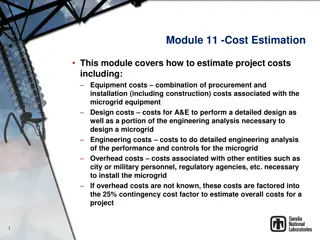

Project Cost Estimation for Microgrid Equipment and Installation

This module delves into estimating project costs for microgrid equipment, including procurement, installation, design, and engineering. It covers categories such as installation costs, design and engineering costs, overhead costs, and contingency costs, to provide a comprehensive understanding of es

0 views • 18 slides

Python Basics: Comments, Variable Names, Assignments, and More

Learn about the basics of Python programming, including the use of comments to explain code, defining variable names, type conversion, assignment operators, and general guidelines for coding practices. Explore how to effectively use comments to describe code functionality and understand the signific

0 views • 21 slides

Understanding Migration Costs in Low-skilled Labor Migration

This content delves into the work of KNOMAD and The World Bank in measuring migration costs for low-skilled labor migration. It outlines the objectives, phases, and methodologies used to assess various costs incurred throughout the migration cycle, such as compliance costs, transportation expenses,

1 views • 21 slides

Remediation Strategies for Part-Time and Variable Hourly Employees in Holiday Act Compliance

This case study delves into the challenges faced in managing leave liabilities for part-time and variable hourly employees under the Holidays Act 2003. It explores various working profiles such as split shifts, cycle shifts, variable shifts, and seasonal work, presenting issues in calculating leave

0 views • 18 slides

Guidelines on Allowable Costs and Related Parties in Long-term Debt Training

Explore guidelines on allowable costs and transactions with related parties in long-term debt training programs. Learn about costs paid to other agencies, examples of allowed costs, and costs not allowed. Gain insights into the XI-Q Bond Agency Guide and upcoming training sessions. Have questions? F

0 views • 6 slides

Resource Analysis Summary Report for Instructional Costs

This Resource Analysis Summary Report analyzes instructional costs for different campuses based on subject code and course level. It outlines how model costs used in the State Share of Instruction (SSI) are calculated by dividing the sum of unrestricted costs by Full-Time Equivalents (FTE). The repo

0 views • 9 slides

Understanding Endogeneity and Instrumental Variable Estimation Methods

Endogeneity in econometrics can create challenges such as omitted variables bias, measurement error, simultaneous causality, and using lagged values. This can affect the accuracy of models. One way to address this is through instrumental variable estimation methods. These methods help deal with endo

1 views • 42 slides

Understanding Cost Functions and Economic Planning with Aditi Arora

Explore the concept of cost functions in socio-economic planning with Aditi Arora, delving into the classification of costs, variable and fixed costs, opportunity costs, and more. Learn about total, average, and marginal costs, essential for making informed entrepreneurial decisions.

0 views • 17 slides

Understanding Cost Accounting Principles and Concepts

Explore the fundamentals of cost accounting through the 14th edition by Carter. Learn about cost concepts, production costing, job order costing, process costing, activity-based accounting, joint costing, and standard costing. Dive into assessments, activities, and classifications of costs related t

0 views • 28 slides

Understanding Tariff of Electricity and Principles of Calculation

Electrical energy production involves costs that are shared by consumers based on the amount and nature of electricity consumed. This includes fixed costs for setting up power plants and variable costs for generating electricity, which covers fuel expenses. The calculation of electricity costs is ba

0 views • 18 slides

Understanding Accounting for Borrowing Costs in Financial Management

Borrowing costs in financial management refer to interest and other expenses incurred when borrowing funds. These costs are crucial to account for correctly to ensure accurate financial reporting. Borrowing costs directly attributable to acquiring, constructing, or producing a qualifying asset are c

0 views • 8 slides

Sri Lanka Accounting Standards LKAS 23: Borrowing Cost Overview

This document provides an overview of Sri Lanka Accounting Standards LKAS 23 on borrowing costs, covering its introduction, scope, definition, and accounting treatment. It explains how borrowing costs are recognized, the scope of the standard, and the classification of borrowing costs. Additionally,

0 views • 12 slides

Financial Guidelines Overview for Collaborative Projects

Introduction to the financial framework for collaborative projects, including budget formats, budget lines, and principles of alignment in accordance with partner universities. Details on budget limits, implementation periods, activity year breakdown, and justification requirements are provided. Key

0 views • 27 slides

Analysis of Manufacturing Costs for Trunnion Speaker Production

This analysis breaks down the manufacturing costs for producing Trunnion Speakers, including variable costs, fixed costs, overhead costs, total costs, mark-up values, and break-even points. The detailed breakdown provides insight into cost per unit and helps in pricing decisions for achieving profit

0 views • 8 slides

Understanding Costs in Power Sector Decision-Making

Operational, decommissioning, and investment decisions in the power sector are influenced by different categories of costs. Operational decisions focus on variable costs like fuel and CO2 expenses, while decommissioning decisions consider both variable and fixed costs. Investment decisions require a

0 views • 6 slides

Understanding Relevant Revenues and Costs in Decision-Making

Explore the concepts of relevant revenues and costs in decision-making, including differential costs, avoidable costs, sunk costs, opportunity costs, and relevant costs. Learn how to analyze costs, make add or drop decisions, and apply these principles through an example scenario with Recovery Sanda

0 views • 16 slides