RE: ELECTORAL MATTERS AMENDMENT BILL [ B42-2023]

Background information on the CLSO's considerations of the Electoral Amendment Act and Electoral Matters Amendment Bill, addressing legal and constitutional issues raised in public submissions. Important clauses critiqued include Clause 3, 7, 9, 18, 26, 31, and 31B in various Acts. Public concerns o

1 views • 30 slides

Understanding Taxes: An Overview of Taxation Principles and Collection in Ireland

This content covers the fundamental aspects of taxation, including its definition, purpose, principles (fairness, certainty, efficiency, convenience), and tax collection in Ireland by the Revenue Commissioners. It explores key concepts related to taxation and aims to enhance understanding of tax sys

2 views • 26 slides

Accounting and Taxation of Securities Organized by Belgaum Branch of ICAI

Explore the accounting treatment and taxation of securities in a seminar organized by the Belgaum branch of ICAI. Learn about various types of securities, their accounting principles, taxation rules, and important points through case studies and insightful discussions led by CA Kinjal Shah. Gain val

4 views • 74 slides

UAE Taxation Laws for Free Zone Companies

The UAE has introduced various taxation laws for corporations and businesses in free zones, including corporate tax return filing requirements and conditions for qualifying as a Free Zone Person. The regulations cover aspects such as qualifying income, excluded activities, transfer pricing documenta

1 views • 26 slides

2023 Tax Legislation Overview

The presentation by National Treasury and SARS outlines the 2023 tax bills and legislative process. It covers adjustments in values, updates on tax rates, implementation of carbon tax, incentive reviews, and more. The content details various tax bills, including the Rates Bill, Revenue Laws Amendmen

2 views • 80 slides

Interpretation of Statutes and Articles: Taxation, Corporate Laws, Writ Remedies

Understanding the interpretation of statutes, articles of the Indian Constitution in relation to taxation, corporate laws for practicing members, and utilizing writ remedies before the High Court and Supreme Court. Exploring the scope of writs for enforcing fundamental rights, constitutional rights,

10 views • 38 slides

Stay Ahead in NRI Taxation in England with Bharat's Lower Tax Service

Stay ahead of the curve in NRI taxation in England with Bharat's Lower Tax Service. Our specialised solutions cater to the unique tax needs of Non-Resident Indians, ensuring compliance and maximising returns. With expert guidance and personalised strategies, navigate the complexities of cross-border

7 views • 3 slides

nritaxationbharat_blogspot_com_2024_05_nri_income_tax_return

Mastering NRI Taxation: Guidelines for Delhi Residents\" offers comprehensive insights into navigating the complexities of taxation for Non-Resident Indians (NRIs) residing in Delhi. This resource provides expert guidance on understanding tax laws, claiming exemptions, and optimizing deductions spec

3 views • 3 slides

Understanding the Purpose of Taxation: Financial, Social, Legal, and Ethical Perspectives

Taxation is a crucial method governments use to collect funds for public services. This chapter delves into the principles of a fair tax system, exploring how taxes should be related to income, predictable, cost-effective to collect, and convenient for taxpayers. It also discusses the redistribution

0 views • 19 slides

Understanding Principles of Taxation

Principles of taxation, including concepts such as public revenue, sources of revenue, types of taxes (direct and indirect), and non-tax revenue, are essential for students of commerce to grasp. Taxation serves as a means for the government to collect revenue for the common good through compulsory c

0 views • 12 slides

Recent Changes in Labour Laws and Code on Wages, 2019

The recent changes in labour laws involve the amalgamation of 44 laws into 4 codes, focusing on wages, occupational safety, industrial relations, and social security. The Code on Wages, 2019, aims to amend and consolidate laws related to wages and bonus, applicable to all employees in India. The Cod

1 views • 104 slides

National Environmental Management Laws Amendment Bill: Compliance and Enforcement Responses

The National Environmental Management Laws Amendment Bill includes revisions related to definitions, consequences of unlawful activity commencement, and more. Stakeholders have provided feedback on aspects such as consistency in terminology usage, inclusion of definitions aligned with existing acts,

3 views • 22 slides

Proposed Ratification of the Kigali Amendment to the Montreal Protocol

South Africa seeks Parliament's approval to ratify the Kigali Amendment to the Montreal Protocol, targeting the phase-down of hydrofluorocarbons (HFCs) to protect the ozone layer. The amendment requires new reporting on HFC production, imports, and exports, with different baselines for developing co

0 views • 10 slides

Exploring Taxation Acts and Their Impact on Revolutionary Sentiments

The provided content delves into historical taxation acts, including their specifics and potential implications on the onset of the American Revolution. It also draws parallels to modern-day examples of product taxation, prompting reflection on the fairness and consequences of such levies. The disco

4 views • 6 slides

Enhancing State Revenue Generation Through Effective Taxation Strategies

State governments rely on taxation to finance their expenditures, prioritizing revenue generation over borrowing. By engaging taxpayers in voluntary compliance, taxation strengthens government accountability and citizen participation in governance. Understanding the tax landscape, including federal,

0 views • 27 slides

Taxation Procedures and Authorities

Explore the principles and application of taxation laws, tax provisions, duties of tax authorities, and obligations during taxation procedures. Learn about the essential role of tax authorities in determining facts crucial for legitimate decision-making, benefiting taxpayers diligently, and conducti

0 views • 35 slides

Understanding the Impact of Debt Collection Laws in South Africa

The content discusses the implications of a proposed amendment to debt collection laws in South Africa, focusing on the financial impact on consumers. It provides background information on debt collection history, the role of the Council for Debt Collectors, and changes in regulations over the years

2 views • 21 slides

Understanding Gun Control and the Second Amendment Debate

The discussion on gun control and the Second Amendment is a contentious issue in the US, with frequent mass shootings leading to calls for stricter regulations. The Second Amendment guarantees the right to bear arms, but the high incidence of gun-related crimes raises concerns about public safety an

3 views • 31 slides

Brazilian Tax System and International Tax Treaties Overview

The Brazilian tax system follows guidelines set by the Federal Constitution, with taxation principles, authority, limitations, and revenue distribution. The country has various sources of tax law, including treaties, laws, and customs. Existing bilateral double taxation treaties with countries like

3 views • 9 slides

Impact of Taxation Laws Amendment on Real People Home Finance

The Taxation Laws Amendment Bill proposes changes affecting non-bank lenders like Real People Home Finance, limiting their doubtful debts allowance to 25% of the IFRS 9 provision. This would result in an inequitable treatment compared to banks, impacting the sustainability of non-bank lending busine

4 views • 8 slides

Windfall Profit Taxation: Past, Present, and Future

The presentation discusses windfall profit taxation measures in Europe, specifically in Italy, comparing the old Robin Hood tax with new contributions. It explores the aims, issues, tax rates, and bases of windfall profit taxation, highlighting its redistributive purposes and challenges in constitut

1 views • 14 slides

Electoral Laws Amendment Bill 2020 Overview

The Electoral Laws Amendment Bill 2020 aims to modify key legislation in preparation for upcoming general local government elections. It includes amendments to the Electoral Commission Act, Electoral Act, and Local Government: Municipal Electoral Act to streamline processes, update definitions, regi

2 views • 25 slides

Understanding Taxation in Macao SAR: A Comprehensive Overview

Delve into the intricacies of taxation in Macao SAR with a virtual seminar featuring prominent speakers. Explore topics such as tax administration, profits tax framework, and tax declaration processes. Gain insights into the role of the Financial Services Bureau in ensuring tax compliance and the va

1 views • 25 slides

Understanding the Fourteenth Amendment to the U.S. Constitution

The Fourteenth Amendment, ratified in 1868 after the Civil War, ensures citizenship for all persons born or naturalized in the United States. It prohibits states from making laws that violate citizens' privileges or deprive individuals of life, liberty, or property without due process. The amendment

0 views • 16 slides

Update on Agricultural Product Standards Amendment Bill Progress

The Agricultural Product Standards Amendment Bill is undergoing significant progress as of May 2023. The Bill has been adopted by the National Assembly and is now under consideration by the National Council of Provinces. Key deficiencies that led to the amendment include issues with definitions, aud

0 views • 20 slides

Understanding Fourth Amendment Protections: Balancing National Security and Privacy

This chapter delves into the Fourth Amendment protections against unreasonable searches and surveillance, emphasizing the importance of additional authority from Congress for such actions. It explores administrative searches, the cultural perceptions of searches pre and post-9/11, and the key princi

0 views • 77 slides

Understanding the Fourth Amendment: Search and Seizure Laws in the United States

The Fourth Amendment of the United States Constitution protects individuals from unreasonable searches and seizures by the government. It outlines the requirements for obtaining a search warrant, defines a reasonable expectation of privacy, and details the types of searches allowed without a warrant

0 views • 18 slides

Impact Analysis of New Corporate Taxation Regime Under Taxation Laws (Amendment) Ordinance, 2019

The new corporate taxation regime introduced through the Taxation Laws (Amendment) Ordinance, 2019 brings significant changes, including a lower tax rate for domestic companies. The regime allows companies to opt for a 22% tax rate, with implications on exemptions and deductions. Companies opting fo

0 views • 31 slides

Nevada Department of Taxation Guidelines for Repair and Reconditioning Services

Tax guidelines for repair and reconditioning services in Nevada provided by the Department of Taxation. Covers taxable repair labor, treatment of parts, repairmen as retailers or consumers, fabrication vs. refurbishing labor, painters, polishers, finishers, and replacement parts taxation.

0 views • 11 slides

Family Laws and Marriage Legalities in Pakistan

The legal system of Pakistan blends English common law and Islamic law, influencing various aspects such as commercial and personal laws. Family laws in Pakistan are a mix of codified and customary laws, with different laws applicable to different religious communities. Specific laws govern marriage

0 views • 21 slides

Understanding Newton's Laws of Motion

Dynamics is governed by Newton's three fundamental laws of motion. These laws, formulated by Newton, describe the behavior of objects in motion and at rest. Key terms such as mass, weight, momentum, force, and inertia are crucial in understanding these laws. Rigid bodies, which consist of fixed part

0 views • 22 slides

Understanding Taxation in Australia: Income Declaration and Assessment

Australian taxation laws require residents to declare worldwide income while non-residents are taxed on Australian-sourced income. The tax liability calculation involves taxable income, tax offsets, other liabilities such as Medicare levy, and PAYG credits. Assessable income includes various sources

0 views • 13 slides

Understanding Economic Porosity and Primitive Capital Accumulation in Mozambique

In this presentation by Carlos Nuno Castel-Branco, the concept of economic porosity and its consequences in Mozambique are examined. The discussion includes the historical rationale for economic porosity, magnitude of economic dynamics, taxation issues, investment patterns, capital flight, and publi

0 views • 36 slides

Overview of International Taxation in Italian Law

International taxation refers to rules governing tax laws in different countries, covering various aspects such as cross-border trade, investments, and taxation of individuals working abroad. Tax treaties play a crucial role in limiting the taxation power of treaty partners, with over 2,000 bilatera

0 views • 25 slides

Taxation Challenges for Cross-Border Teleworkers Post Covid-19

Challenges in international taxation arise for cross-border teleworkers post-Covid-19, especially regarding the taxation of income from employment under Article 15 of the OECD Model Tax Treaty. Issues such as physical presence, bilateral agreements during the pandemic, and future taxation scenarios

0 views • 7 slides

Understanding Taxation of Digital Goods and Tangible Personal Property in Alabama

Explore the taxation laws in Alabama regarding the digital delivery of tangible personal property and the classification of tangible personal property in sales tax cases. This content delves into specific court cases, definitions, and perspectives on the taxability of digital goods and software purc

0 views • 10 slides

Negative List Based Taxation of Services by S.B. Gabhawalla & Co.

This content delves into the conceptual framework of negative list based taxation of services, including the definition of service, elements such as service territory and value, and the framework dissecting the charge at 12%. It also explains what services are excluded from taxation and provides exa

0 views • 36 slides

Public Economics Course Summary - EHESS & Paris School of Economics

The Public Economics course at EHESS & Paris School of Economics offers an introduction to taxation history, government intervention theories, and policy incidence across developed and developing countries. The syllabus covers topics like welfare analysis, wealth taxation, and optimal taxation strat

0 views • 11 slides

The Case for Progressive Taxation: Ensuring Equality Through Fair Contributions

Progressive taxation involves higher tax rates for individuals with higher incomes or greater wealth, aiming to bridge economic and gender inequalities. This system can be achieved through well-designed tax scales, exemptions, and thresholds, ultimately contributing to fair distribution of contribut

0 views • 8 slides

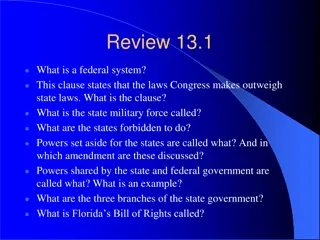

Overview of State Government and State Legislatures in Florida

A federal system is a political framework where power is divided between a central government and individual states. In this system, laws created by Congress take precedence over state laws. The supremacy clause enforces this hierarchy. States are prohibited from actions like declaring war or mintin

0 views • 12 slides

![RE: ELECTORAL MATTERS AMENDMENT BILL [ B42-2023]](/thumb/18837/re-electoral-matters-amendment-bill-b42-2023.jpg)