Facilities Improvement Fund (FIF): Tax Implications

Learn how Facilities Improvement Fund (FIF) grants impact taxable income for home-based child care providers in this informative webinar. Find out how to calculate taxable income and make informed financial decisions. Presenter: Margie Cangelosi, E.A.

0 views • 25 slides

Payroll Tax & Medical Centre Businesses

The intricacies of payroll tax in the context of medical businesses, including obligations, taxable wages, payments to contractors, and exemptions. Gain insights on how to register, provide voluntary disclosure, and navigate the Payroll Tax Act of 2011 effectively.

10 views • 23 slides

Exploring Nonlinear Relationships in Econometrics

Discover the complexities of nonlinear relationships through polynomials, dummy variables, and interactions between continuous variables in econometrics. Delve into cost and product curves, average and marginal cost curves, and their implications in economic analysis. Understand the application of d

1 views • 34 slides

Murray City School District FY25 Budget Overview

Murray City School District is preparing for the FY25 budget hearing in June 2024. The budget officer, usually the superintendent, must submit a tentative budget before June 1 each year. Legal requirements include holding a public hearing and publishing budget information for public inspection. The

0 views • 25 slides

Understanding Tax Tables, Worksheets, and Schedules for Federal Income Taxes

Explore the concept of tax tables, worksheets, and schedules for calculating federal income taxes. Learn how to express tax schedules algebraically and compute taxes using IRS resources. Examples featuring single and married taxpayers provide practical insights into determining taxable income and ca

0 views • 11 slides

Understanding Tax Reporting for Fellowship Grants at UC

This presentation addresses tax reporting issues associated with fellowship grants for UC graduate students. It explains the treatment of fellowship grants for income tax purposes, distinguishing between compensatory and non-compensatory grants. It also clarifies the taxable and nontaxable aspects o

0 views • 43 slides

Understanding Aggregate Supply in the Short and Long Run

Aggregate Supply in the short and long run is crucial in understanding the relationship between the economy's price level and the total quantity of goods and services produced. In the short run, sticky wages and production costs play key roles in determining supply levels, while in the long run, cha

0 views • 16 slides

Public Works Labor Compliance Vendor Workshop by Housing Authority of the City of Los Angeles

The Housing Authority of the City of Los Angeles conducted a workshop to assist contractors in understanding their Public Works labor compliance responsibilities. The workshop covered topics such as contractor responsibilities, registration with the state under SB854, federal and state labor laws, a

1 views • 26 slides

Understanding Labor and Wages: Education, Discrimination, and Workers

Explore the impact of education on wages and discrimination on income in this lesson. Identify terms like Labor Force, Glass Ceiling, and more. Learn about different types of workers and their skills. Discover how education level affects wages and the distinction between blue-collar and white-collar

1 views • 16 slides

Understanding Deductions in Taxation

Explore the essentials of tax deductions in Module 5, including how to calculate taxable income, lower taxable income plus income taxes, differentiate between Standard and Itemized Deductions, select the appropriate deduction for a client's return, and identify expenses covered by Itemized Deduction

0 views • 20 slides

Recent Changes in Labour Laws and Code on Wages, 2019

The recent changes in labour laws involve the amalgamation of 44 laws into 4 codes, focusing on wages, occupational safety, industrial relations, and social security. The Code on Wages, 2019, aims to amend and consolidate laws related to wages and bonus, applicable to all employees in India. The Cod

1 views • 104 slides

Rwanda Income Taxation and Transfer Mispricing Overview

Explore the taxation framework in Rwanda covering taxable presence, computation of business profits, deductable expenses, and base erosion with profit shifting measures. Understand how residents and non-residents are taxed on their incomes and the criteria for taxable presence in the country. Learn

0 views • 16 slides

Understanding Wage Principles in Economics

Compensation paid to employees for work is termed as wages and is typically based on an hourly basis. The relationship between real wages and money wages, as well as the concepts of nominal and real wages, are essential in understanding the dynamics of wages in economics.

1 views • 7 slides

Understanding Residuary Income and Taxable Sources

Residuary income, under section 56(1), includes all income not excluded from total income and subjected to income tax under "Income from other sources." Certain specific incomes listed in section 56(2) are taxable, such as dividends, winnings, employee contributions, interest on securities, and inco

0 views • 9 slides

Overview of Minimum Wages Act 1948 for Unorganized Workers

The Minimum Wages Act 1948 aims to protect the welfare of unorganized workers by setting minimum wage rates that ensure their subsistence and efficiency. The Act empowers the government to fix minimum wages in industries prone to exploitation. It includes provisions for fixing rates, procedure for r

3 views • 21 slides

May Trucking Co. v. ODOT - Ninth Circuit Case Analysis

May Trucking Company, an interstate motor carrier, challenged an assessment by the Oregon Department of Transportation (ODOT) for underpaid fuel taxes. The dispute centered on whether fuel consumed during idling should be taxable under the International Fuel Tax Agreement (IFTA). The Administrative

2 views • 9 slides

Directive on Adequate Minimum Wages in the EU Priorities

Priority 1 emphasizes protecting against unintended consequences and detrimental impact by amending definitions of collective bargaining, monitoring mechanisms, and promoting real improvements in national action plans. Priority 2 focuses on ensuring the Directive lives up to its aims by introducing

0 views • 4 slides

Challenges of Unpaid Wages in a Fissured Economy

Non-payment of wages, especially in cases of fissuring where subcontracting and dependence on intermediaries are prevalent, poses a significant issue in employment standards legislation. Better enforcement practices are essential, but the complex scenarios of fissuring make compliance challenging. T

0 views • 19 slides

Understanding Section 14(c) of the Fair Labor Standards Act

Section 14(c) of the Fair Labor Standards Act allows for the payment of subminimum wages to workers with disabilities when their productivity is impaired. The Wage and Hour Division of the U.S. Department of Labor oversees compliance with this provision, aiming for a vigorous and effective program.

0 views • 126 slides

Thomas Malthus and His Theory on Population Growth

Thomas Robert Malthus, an influential economist, proposed a theory on population growth in the 18th century. His theory suggested that population grows exponentially while food production increases at a slower rate, leading to inevitable food scarcity. Malthus also discussed the concept of preventiv

2 views • 19 slides

Understanding Taxable Scholarships at International Tax Informational Workshop

Explore the essentials of taxable scholarships at an informational workshop for international students and employees. Learn about compensatory payments, Forms W-2 and 1042-S, and how to differentiate between qualified and non-qualified education expenses to manage tax liabilities effectively.

0 views • 22 slides

Moving Expense Information and Eligibility Guidelines

Information on moving expense eligibility for non-taxable treatment, including distance requirements and time considerations. Details on taxable vs. non-taxable moving expenses, helpful hints for new employees, and guidelines for adequate accounting. IRS Publication 521 is referenced for additional

1 views • 6 slides

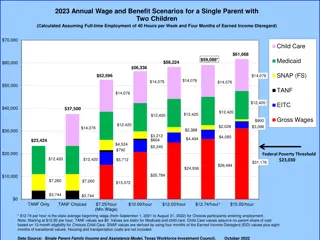

Comparison of Annual Wage and Benefit Scenarios for Single Parent with Two Children

Annual wage and benefit scenarios for a single parent with two children in 2019 and 2023, considering full-time employment with four months of earned income disregard. The analysis includes child care costs, Medicaid, SNAP (FS), TANF, EITC, gross wages, and federal poverty thresholds. Trends in wage

0 views • 6 slides

The Rise of Unions and Labor Conditions in the Late 19th Century

Labor conditions in the late 1800s were harsh, with long work weeks, low wages, and no benefits for workers. Deflation caused a rise in the value of money, leading to resentment among workers who organized into unions to demand better wages and working conditions. Craft workers and common laborers f

0 views • 17 slides

Stockholm Region Economy Report Q1 2022

The Stockholm Region Economy Report for Q1 2022 reveals a strong recovery post-Covid pandemic, with notable improvements in employment rates and total wages. Unemployment has decreased, while the number of people in employment has risen. Total wages in the private sector have increased, indicating a

0 views • 18 slides

Indiana INDemand Jobs and Labor Market Information

Indiana INDemand Jobs are determined based on future demand, percent change, wages, and real-time labor market data. The ranking methodology includes short-term and long-term projections, with a scoring system for each occupation. The Decile Ranking Method assigns scores from 1-10 in various categor

0 views • 14 slides

Understanding Collective Bargaining in School Districts

Collective bargaining in school districts involves negotiating over mandatory and permissive subjects such as wages, hours, and conditions of employment. School districts must differentiate between mandatory and permissive subjects, and disputes over mandatory subjects must be resolved through impas

0 views • 29 slides

Examining Socioeconomic Status of Childcare Workers in Illinois

Childcare workers in Illinois earn a median hourly wage of $10.5, ranking 35th in hourly wages among 730 occupations. The study aims to understand the flexibility and demographics of childcare workers compared to other occupations with similar wages. Assumptions suggest childcare work is predominant

0 views • 11 slides

Understanding Quarterly Census of Employment and Wages (QCEW) Program

The Quarterly Census of Employment and Wages (QCEW) is a collaborative program between federal and state entities that collects and disseminates employment and wage data at local levels. This program covers over 10 million establishments, offering valuable insights into employment trends and industr

0 views • 28 slides

Economic Disparities in the European Union: Insights from 2018 Meetings

The data presented showcases wage inequalities, compensation rates, minimum wages, monthly salaries, and low-paid workers' share in the EU, particularly focusing on Bulgaria. The figures indicate disparities among EU countries in terms of hourly wages, minimum wage levels, average monthly salaries,

0 views • 11 slides

Understanding W-2 Discrepancies and Pay Statement Variances

The W-2 form and pay statements may not always match due to differences in taxable wages, deductions, and withholdings. Understanding how to reconcile Box 1 wages, Box 2 federal income tax withheld, and Box 3 Social Security wages can help employees accurately report their income for tax purposes. T

0 views • 14 slides

Understanding U.S. Graduate Student Tax Reporting for Fellowships and Assistantships

U.S. Graduate Student Tax Information Session for U.S. students and resident aliens covers tax reporting rules for fellowships and assistantships. It discusses taxable and non-taxable aspects based on expenditure categories. Tips on accessing and utilizing tax-related documents are provided.

0 views • 63 slides

Tax Reporting Guidelines for Graduate Students in the US - March 2020

This document provides tax reporting guidelines for US citizens, permanent residents, and resident aliens who receive fellowship or assistantship payments. It explains the tax implications of these payments, detailing what is considered taxable and non-taxable income. The document also outlines the

0 views • 44 slides

Tax Information for US Resident Students and Scholars

Fellowship stipends for students and postdoctoral fellows, tax responsibilities, qualified expenses exclusion, taxable stipends for services like TA and RA assistantships, and guidelines for reporting taxable amounts on tax forms are discussed in detail in the provided information.

0 views • 17 slides

Global Trends in Garment Worker Wages: A Closer Look

Explore the dichotomy of garment workers' wages in the global industry, analyzing the race to the bottom versus the potential route out of poverty. Worker Rights Consortium's research sheds light on real wage trends and challenges faced by garment workers in leading exporting countries.

0 views • 34 slides

Understanding Taxable Scholarships for International Students

Explore the taxation implications of scholarships for international students at UNT System, including what constitutes taxable scholarships, qualified education expenses, and examples illustrating the calculation of taxable scholarship amounts. Gain insights into the importance of understanding thes

0 views • 24 slides

Impact of Proposed Labour Codes on Employers and Compliance Structure

This content discusses the impact and evolving compliance structure under the Code on Wages, 2019, focusing on clauses related to minimum wages, payment of wages, and payment of bonus. It outlines key aspects like wage fixation, deductions from wages, eligibility for bonus, and computation of profit

0 views • 23 slides

Evolution of the Code on Wages: A Comprehensive Overview

The Code on Wages, 2019 aims to streamline and modernize labor laws in India by consolidating various regulations into four codes. The journey of this code, from its inception to becoming law, is detailed along with the significance of the proposed changes. The evolution of labor laws and the implic

0 views • 17 slides

Understanding Income Tax Basics

Income tax is a fundamental part of contributing to a civilized society, with various taxes like sales tax, gas tax, and alcohol tax playing a role. This guide explains how income tax works, including taxable income calculations and refund processes. It also covers what amounts are taxable, such as

0 views • 14 slides

Overview of Ohio School District Taxable Property Values

Residential and agricultural properties make up a significant portion of Ohio's total taxable property values. The composition varies by district type, with suburban and urban districts experiencing the fastest growth since 2017. Public utility tangible personal property values have also seen rapid

0 views • 4 slides